JStuij/iStock via Getty Images

Dear readers/followers,

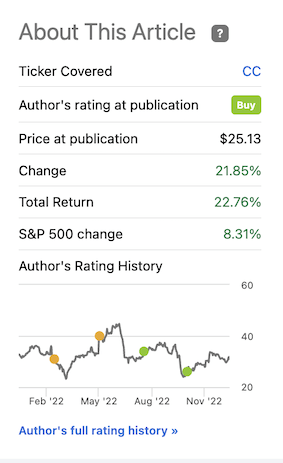

For the past year and more, I’ve been covering Chemours (NYSE:CC), and we’ve seen the company decline more and more – only to recently bounce back up. This resulted in some impressive rates of return for the short term, at least when looking at the results based on my most recent article.

Seeking Alpha, Chemours Article (Seeking Alpha)

In this article, I’m going to revisit my overall positive thesis here, which you can see has started to reach the price targets and valuations where I then traditionally held a more neutral stance on the business.

So is it time to revisit that neutral stance?

An update on Chemours Company

Chemours has been on an absolute tear. From a very negative return from my first bullish article, this recent one more or less recovered parts of those losses. Not many other contributors still cover this company – even if there has been at least one article about it as of late. I can understand the reasoning behind this. This is a risky company. This is a company that doesn’t exactly fulfill my demands in the context of fundamentals and historical safety.

Still, let’s wrap here for a second – because Chemours is interesting – both to you and to me, and the fact is that at this time, the total long-term RoR since my first article back almost a year ago, has outperformed the S&P 500 by almost 20%, even if I was neutral back in the beginning.

Chemours is an interesting business. It does Titanium Tech, Thermal & Specialized solutions, Performance materials and Chemical solutions. Competition does exist in almost every company segment – including peers such as INEOS AG, Tronox (TROX), Honeywell (HON), Daikin Industries (OTCPK:DKILF)(OTCPK:DKILY), 3M (MMM), Cyanco Corp, and many others, depending on what segment you’re looking at.

The company is still junk-rated. No improvement there at all – it’s BB-rated – although the improvement we can see from at least a year ago is that the business has managed to remove the negative mark, from BB- to BB. A slight improvement, but still ways to go before IG-rating.

To be absolutely clear here, seasonality and volatility are expressed in the company’s share price, where investors since 2015 have been treated generally to market-beating returns, but with a lot of volatility in between – and frankly, would have been better off selling at overvaluation.

But at the same time, there is a lot to like about this company. Sales are highly specialized products and services to industrial customers, with very few middlemen. The company does operate a distributor network for specific product lines and geographies, and sales are made either through one-time buys/spot buys or long-term contracts.

Also, dividend growth has been good, with double-digit CAGR growth over the past few years, and the company still pass less than 50% of its earnings in dividends under current levels.

End markets for key segments are very attractive…

CC IR (CC IR)

…and furthermore, the company’s products are used by virtually every segment of customers on the planet, making for an appealing sort of fundamentals.

We have 3Q22 which came out in November as the recent set of results – and these results are really what pushed the company upward as much as we’ve seen over the past few weeks and months, generating double digit returns. Despite tracking below its guidance range in terms of adjusted EBITDA and FCF, the company’s operational stability is impressive – despite uncertain market demand due to macro outlooks.

4Q seasonality remains a thing – and we should expect for 4Q22 to really be more volatile. The company is also taking cost actions to mitigate the more serious volatility we might be experiencing here.

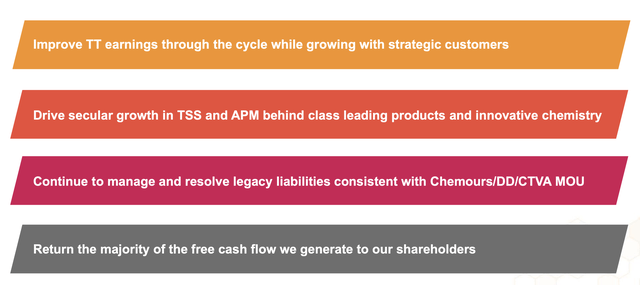

The company’s goals remain clear.

At its heart, CC even in 2022-2023 and forward remains a play on Titanium Dioxide. The company’s foam, refrigerant and fluoropolymers are together less than 50% of the overall revenue. Over 51% of the company’s annual sales comes from various forms of Titanium Dioxide and other minerals, with a geographic tilt towards NA with 42% of company sales. Company EBITDA results were really rather negative for most of the company, but again, there are reasons for this that the company really can’t control.

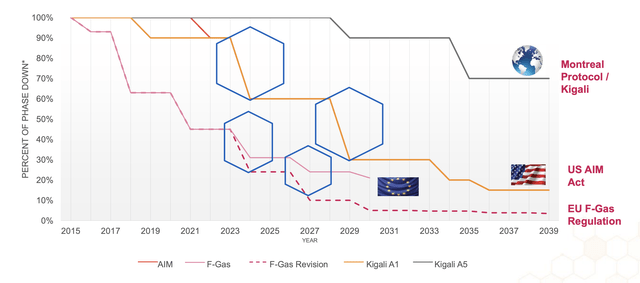

At its heart though, this company remains a solid sort of business, and a leading provider of the product it works with. Despite being smaller in terms of sales of refrigerants, the company is amongst the world-leading companies in refrigerants, and is a category leader with its next-gen low GWP technology and co-developed HFO tech. Regulatory trends remain fully in favor of Opteon adoption.

And there is a global TAM that is many times as large as the company is currently working with – so plenty of room to grow here.

Demand trends for Chemours remain, despite some issues in macro here, relatively solid. Chemical companies have seen these sorts of positive demand trends for over a year now.

Companies, which also include Chemours, have been able to push price increases in order to retain their margins and offset the cost increases that we’re currently seeing across the entire market.

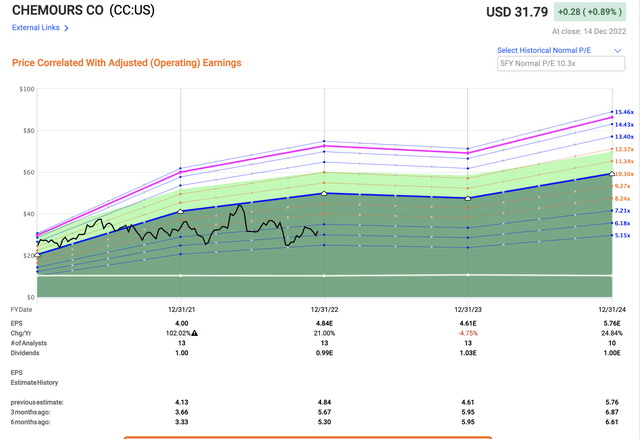

These trends remain, and these trends are why the analysts following the company are expecting an adjusted EPS growth for 2022 of 21% YoY, despite a 102% EPS growth in 2021. So despite these forecasts being noted down by about 10-15% over the past few months, the overall expected trends are still positive.

The company’s primary challenges remain macro-focused. And macro isn’t something Chemours can really influence. What we can say for the next couple of years is that earnings will likely see more growth in 2024, but that 2023 will likely remain somewhat impacted – slightly negative or flat compared to 2022.

These recent quarterlies mark what I believe to be a “new normal” for the company in terms of EPS from which I don’t believe we’ll see a massive near-term decline here. 1Q22, 2Q22, and 3Q22 all delivered results that call for EPS to grow in 2022.

The company is doing this on the back of Opteon expansion, net sales increase, and its raising FCF guidance to $575M+ for the year – or more.

The risk at this time that should be looked at, to give a fair picture of the company, is the overall impact of the sales slowdown. The company had a TiO2 slowdown back in 2019 as well, and the impact in the following years on EPS was brutal – however, the difference from back then is that the company’s business and contracts were structured differently. The company also characterizes 2019 as more of a share loss, due to the company implementing processes at the time, and since then, Chemours has regained most of the lost market share.

As we said early in the year, about 80% or so of our business was contracted. And so we expect that ratio to stay roughly in line. It varies from quarter-to-quarter. But our contracted business is good. And obviously, the value proposition with TVS is we respond to the market demand signals of our customers, and we’re seeing that across the portfolio. As we said in our guide in September, we’re already seeing this more so in Europe and in Asia, specifically in Mainland China. And volumes and demand continue to do well in the Americas, North America and Latin America.

(Source: Mark Newman, 3Q22 Earnings Call)

So, it’s not exactly the same story as back then. CC is responding this time by dialing down production where needed. My own recommendation here is rather than looking at the P&Ls of the quarterlies, I would look at the TTM numbers, as these somewhat more non-seasonal trends tend to give a fairer perspective on the company’s results.

Over to valuation.

Chemours Valuation

Despite some improvement, Chemours remains a very conservatively valued business at a low multiple. We’re currently trading the company at a blended P/E of around 6.62x – no higher than that, despite the recovery. This is significantly below the average of around 9.5x. The company now yields 3.15%, and Chemours remains a close-to-$5B market cap chemical company with plenty of products and trends going in its favor.

Also, the company remains to trade in a position that’s very unfavorable, and completely opposed to where the next few years of trends are expected to go.

F.A.S.T. Graphs Chemours Upside (F.A.S.T. Graphs)

Even trading flat at no more than 6.18x, the upside for this company is still there. At such results you would be RoR’ing about 9% annually, or close to 20% until 2024E – and gain, that’s lower than the company is currently trading in terms of P/E-multiples.

I won’t be calculating the company at 10x – the average is 9.5x, and at such a volatile sort of pattern, I want to stay conservative. So at 9.27x forward P/E, the potential RoR for Chemours is still 31.22% per year, or close to 75% until 2024E.

That’s a very high sort of upside, bought at a very low valuation, for a company that despite BB isn’t really going anywhere. That’s how I see it.

Analyst valuation for this business remains mostly positive. Street targets here are lower due to the impacted 3Q22 demand situation – but we’re still at close to $34/share, which is an upside of at least 6-7% here at this price, and I view this target to be somewhat too conservative from the 12 analysts following the business as things currently stand. The fact is, 8 analysts considered the company a “BUY” when it traded at 33.56 a year back, but that number is down to 3 now, despite the company being cheaper.

Chemours has not become less qualitative in the time – the market has changed. Well, I invest beyond market cycles and for the long term. For that reason, I remain with my Chemours targets at this time, and this is my current thesis for Chemours.

Current Thesis

My current thesis for Chemours Company is the following:

- The company is fundamentally appealing due to its chemical portfolio but is hounded by potential legal issues and risks – both future and historical, as well as an unappealing liability profile. This needs to be discounted for, but it’s entirely possible to do so – just keep your targets below 11-13x P/E and a share price of $40/share.

- Improved outlooks have proven my initial bearishness to be exaggerated. I change accordingly and give the company allowance for future outperformance. I bump my price target here.

- I keep CC as a “BUY” and “Bullish” rating, with an overall price target of $35, below the current analyst average, but considered fair on a peer and risk/reward comparison.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

As things stand now, the company is still a “BUY”, and it fulfills every criteria that I have except one – the quality, due to its non-IG-rating.

Be the first to comment