JStuij

My articles on Chemours Company (NYSE:CC) is part of SA’s current sole coverage on the company. Very few contributors seem to be following this business, which can be considered a bit of a shame. My article 2 pieces ago specifically guided for a “HOLD” with a $25 PT. Imagine my surprise when only a few days later, my price alert went off and the company dropped below $25/share. I bought a few shares and kept an eye on the company.

There’s no doubt that Chemours remains a very volatile business. But as with other chemical businesses I invest in, this might eventually be enough to give us an upside here.

Let us see, therefore, what a 16%+ drop does to the appeal of Chemours Company.

Revisiting Chemours Company

Chemours will continue to be a play on volatile commodity pricing that’s influenced by macro as well as the overall uncertainty and pricing levels and impacts that we’re currently seeing.

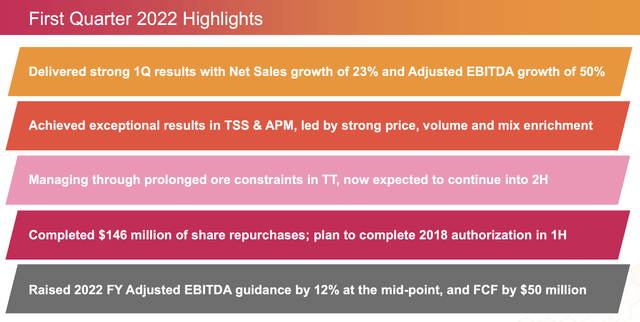

In my last article, I pointed out a recent price drop on Chemours, that would be followed by yet another price drop only a short time later. While 4Q21 results weren’t exactly bad, 1Q22 were actually fairly positive. These results saw sales increases and fundamental strength in the entire portfolio. With GAAP EPS more than doubling YoY, and EBITDA up 50%+ on an adjusted basis, investors could be excused for expecting Chemours to continue to outperform here.

I maintain my stance that for the most part, Chemours is positive here. There are risks to any company – CC included – but focusing on these comes at a cost of ignoring what is obviously a significant potential long-term positive in terms of demand.

Chemical companies have seen these sort of positive demand trends for over a year now. Companies, CC included, have been able to push price increases in order to retain their margins and offset the cost increases that we’re currently seeing across the entire market.

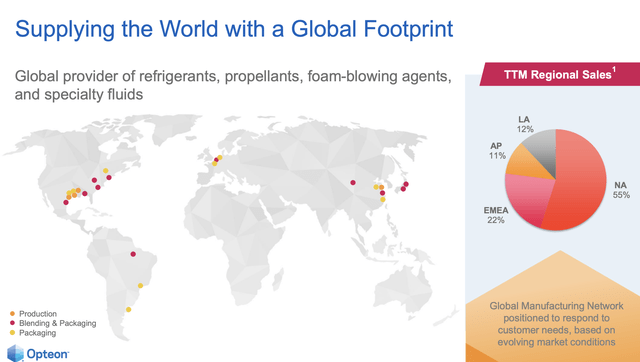

Chemours Opteon Applications (CC IR)

What has happened in Ukraine – but for CC, I see this as a net positive. Moving into a more pressured environment with more tightness on the availability side, companies like Chemours are like as not to see improved levels and trends here.

I believe that as we move into a higher rate and pressured environment, it’s companies like this that will shine.

The favorable pricing dynamic we’re seeing is one that I expect will continue going forward, and what we saw in terms of EBITDA will only continue. We could see this in the last quarter, with the current pricing momentum essentially meaning that Chemours dictates the pricing and can charge a hefty premium for what it sells. This fact continues to outweigh the higher variable input costs, hailing from a mix of feedstock price inflation, operating costs, labor costs, and logistical costs.

Chemours Opteon (CC IR)

The company also managed to greatly improve its net debt, which is now solidly below 2x in terms of TTM net leverage, and gross debt of around $2.6B, with an ending cash balance of $1.145B, and total liquidity inclusive of debt and revolvers at almost $2B. Chemours has no need to tap debt or equity in the near future from a cash point of view.

Chemours 1Q22 Highlights (CC IR)

The company saw excellent performance across the board from its various segments. We could point to its Titanium technologies segment, which saw an almost 30% YoY sales increase, but the true stars of the quarter were the thermal and specialized solutions segment.

Thermal and specialized solutions saw 40% net sales growth, with again, strong pricing and market dynamics and over 11% EBITDA margin increase despite feedstock pricing, energy pricing, and logistics. The company fully expects the upside to continue, with normal seasonal sales patterns for the business.

For Advanced performance materials, the company delivered record sales with double-digit sales increases and pricing pushes, similar trends to the other segments. Adjusted EBITDA margins rose by 6%, again despite headwinds, and these markets are expected to remain strong as well.

All of these trends were so good that the company bumped its guidance, to where the only way it comes in at the low end of the assumption range, is if the supply chain conditions materially continue to deteriorate across the board, or if we see even higher spiking energy costs for the company – or if China shutdowns last significantly longer.

If any of the upside assumptions, such as recovery, starts materializing, CC expects an EPS that trends slightly north of $5.5 and over half a billion in free cash flow with adjusted EBITDA of over $1.5B.

Chemours shareholder rewarding policy comes into focus here. Unfortunately, the company is not big on bumping its dividend. Instead, the majority of FCF goes to Shareholders in the form of buybacks up to $750M until 2025. The yield for the company, despite drops, is no higher than 2.95% here. This is low no matter how you slice it, given that there are EU chemical companies with better fundamentals that come higher than 5% here. That makes investing in a company with a lower yield a little tricky, despite Chemours being a “good” business.

Let’s look at some valuations and trends for this company and see what we want to get a decent upside going.

The Chemours Company – Valuation and target

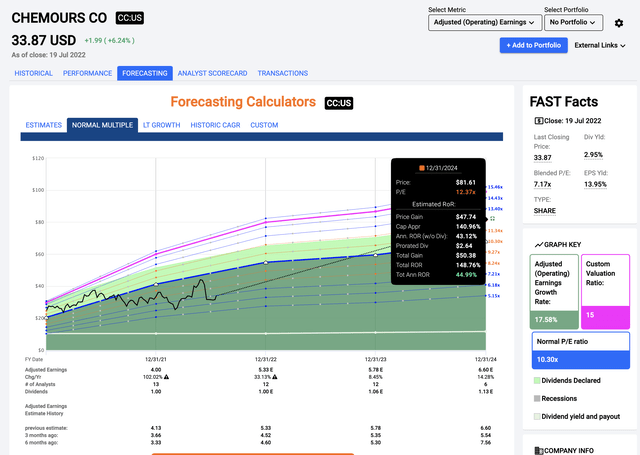

There is no doubt to my mind that there is plenty of upside to be had for Chemours. I haven’t had a heavy position in the company for many years, but at this valuation, which is now back down to less than 7.5X, it’s time to seriously start considering Chemours.

Some data.

If you invested during the COVID-19 crash, your current RoR for Chemours would be nearly 250%. That’s from the company trading at a P/E below 5X. Below 7.5X is therefore low, but not record-low as such. Still, the company isn’t expecting the sort of 2019-2020 earnings deterioration that caused the decline in share price.

Instead, forecasts and company guidance are expecting the company’s earnings to grow by almost 35% in this fiscal, followed by another 8% and 14% for 2023 and 2024E, respectively.

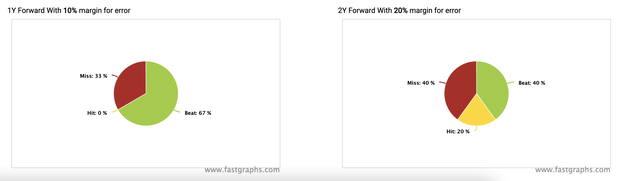

Add to this that Chemours, unlike what you might expect, actually has a decent trend of beating estimates.

Chemours Company Forecast Accuracy (FAST Graphs)

For this reason, I view it as plausible that the company might actually deliver much better results than we expect them to do. Even if they do not, and results are more moderated or towards the negative, you’ll still have bought one of the world’s more significant refrigeration gas/product companies at what can only be described as a significant discount.

The A-Z of it is that if the company delivers any sort of growth and sticks to its typical valuations of around 10-12X P/E, the upside at this particular time is no less than 35% annually, or 108% in 3 years, or all the way up to just south of 150% total RoR at a 12X P/E.

Chemours Upside (FAST Graphs)

Is such a development likely or in any way plausible? I would argue that yes, it most certainly is. The fact is, there are A-rated companies with higher upsides and almost 3x the yield available on the market today in exactly the same, or other sectors. But at this price, which is 15%+ below my last stance, with an expectation that now includes massive earnings growth, and a set of expectations that I actually consider quite plausible, I’m now finally ready to change my stance on the Chemours Company.

This is reason enough for this article, and this is why I’m writing this. Because as of now, I’m starting to expand my position in what I view as a great company, despite some of the potential downsides here.

S&P Global considers Chemours a “BUY” with a price target range of $32-$59, with an average of $42, currently seeing 5 “BUY” recommendations and 7 “HOLD”. I’m bumping my PT to $35/share, seeing improvements in valuation, forecasts, and better visibility for a potential alpha in the company.

I won’t sell my small stake here. Instead, I’ll start adding more.

Chemours, to me, is now a “BUY” with a $35/share PT, which is more conservative than most, but with a great potential upside in its books.

Current Thesis

My current thesis for Chemours Company is the following:

- The company is fundamentally appealing due to its chemical portfolio but is hounded by potential legal issues and risks – both future and historical, as well as an unappealing liability profile. This needs to be discounted for, but it’s entirely possible.

- Improved outlooks have proven my initial bearishness to be exaggerated. I change accordingly and give the company allowance for future outperformance. I bump my price target here.

- I give CC a “BUY” and “Bullish” rating, with an overall price target of $35, below the current analyst average, but considered fair on a peer and risk/reward comparison.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Chemours Company is currently a “BUY”.

Be the first to comment