Mohammed Haneefa Nizamudeen

Investment summary

Having retained our hold call on SeaSpine Holdings Corporation (NASDAQ:SPNE) in September [Bottom Line Fundamentals Continue To Soften], we note to investors there’s been significant developments in the company’s growth engine. Back in October, the company. announced it had entered into a definitive agreement to combine in an all-stock merger of equals with Orthofix Medical Inc. (OFIX). The small-cap space is rife with potential M&A upside, so we are interested to see if this presents with an alpha opportunity.

OFIX is a medical device company with expertise in spine and orthopedics. It has a footprint in 60 countries, and both companies’ boards believe there is highly synergistic growth potential with the merger. In our last 2 publications on SPNE, we noted the company hadn’t met our investment criteria of high return on invested capital (“ROIC”) and that this was coupled with ongoing free cash outflows. We also advised that SPNE’s “operating performance continues to widen from top-bottom line on a sequential basis.” Hence, we seek to understand what delta could be made to this.

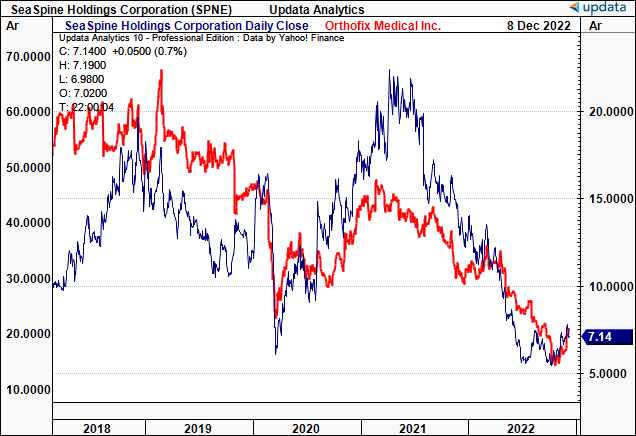

As you can see below [Exhibit 1], it hasn’t been the best of performances over the past 5 years. Both are trading around 5-year lows, and so a strategic maneuver is certainly justified in our opinion. In particular, there was key divergence from one company to the other over the years. Most recently, SPNE enjoyed a positive spread over OFIX, but this has tapered off. Nevertheless, the reasoning behind the merger is quite clear in our estimation.

Just a reminder, here are the key downside risks to the thesis:

- Failed merger would see a compression on SPNE’s share price in our estimation.

- This would be an overhang for some time, and, therefore, could nullify a buy thesis completely.

- Crowding in the pediatric section of the market, resulting in small market share gains.

- Issues with regulatory component.

- Market technicals could become wildly disconnected from fundamentals, and this could result in unpredictable volatility, with worse price visibility. We would move away from SeaSpine Holdings Corporation stock if that were the case.

- Investors should recognize these risks before considering anything.

Exhibit 1. SPNE vs. OFIX share price performance for the past 5-years. The reason to work together is certainly justified on this front. The question is, however, is it justified on an operational front?

Data: Updata

SPNE/OFIX merger breakdown – Pediatrics could be of value

The terms of the agreement, unanimously approved by the Boards of Directors of both companies, state that SeaSpine shareholders will receive 0.4163 shares of Orthofix common stock for each share of SeaSpine common stock owned.

The latest developments are that OFIX received an unsolicited takeover offer to $24 with interest from two P/E firms. It comes after the pair agreed to merge.

Upon the closing of the transaction, the ownership split will be ~56.5% of the OFIX and ~43.5% SPNE, respectively.

The combination of Orthofix’s and SeaSpine’s portfolios will combine a broad portfolio of offerings with interesting economics tied into the mix.

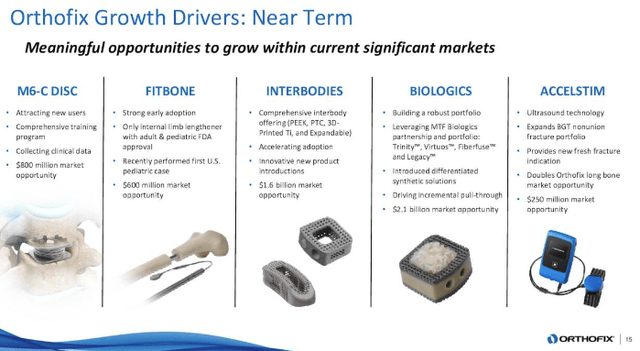

Exhibit 2. OFIX product offering, Q3 FY22 investor presentation

Data: OFIX Q3 Investor Presentation

The biologics and regenerative technology offerings are set to include the Virtuos Lyograft, Trinity Elite allograft, the OsteoStrand Plus and OsteoSurge 300 demineralized bone matrix (“DBM”) product line. It is hoped the combined portfolio will extend the company’s reach to penetrate more surgeon accounts.

However, in our opinion the merger has potential to create a premier offering in the pediatrics orthopedic market. This is broad-based and includes specialized spine, limb deformity, limb reconstruction, imaging solutions. This will enable them to service the full patient continuum of care for pediatric orthopedic surgeons. And here is where we believe the merged company could have a strong presence.

To understand why, our reasoning is as follows:

- The pediatric orthopedic implants market is expected to reach $3.4Bn by 2027. This represents a CAGR of 10.2% during the forecast period, outpacing the growth of the broader orthopedics industry.

- One of the key drivers of this growth is the increasing prevalence of bone and joint injuries and conditions in children. For example, according to John Hopkins Medicine, approximately $3mm children in the United States are diagnosed scoliosis each year, requiring specialized treatment and surgery. If you don’t know, scoliosis is a condition that affects the curvature of the spine. Normally, the spine is straight and has three natural curves. In individuals with scoliosis, the spine may have an abnormal “S” or “C” shaped curvature, which can cause the spine to twist and rotate. This can lead to misalignment of the vertebrae and displacement of the spinal cord and nerves. Orthopedic surgery is a gold standard in treatment of scoliosis in order to correct the curvature and prevent further progression of the condition. Treatment options can include spinal fusion and instrumentation, as well as other surgical and non-surgical methods.

- Additionally, the rising demand for minimally invasive surgical techniques, as well as the increasing availability of specialized training for pediatric orthopedic surgeons, is also contributing to the growth of this market.

- Furthermore, research has found hat the development of new and advanced implants designed specifically for pediatric patients is also driving growth. For example, recent innovations in the field have resulted in the creation of smaller, more flexible implants that are better suited to the unique anatomy and growth patterns of children. These advances have allowed for more successful surgical outcomes and have increased the demand for pediatric orthopedic implants.

Overall, our findings suggest that this may potentially offer significant opportunities for growth and innovation in the coming years, and this could be a tailwind for the merger. Hence, with both companies offering such a broad portfolio, this is where we identity the majority of the differentiated value.

In short

Our verdict is that the deal could be accretive to both companies, and figures provided are fair and reasonable by our estimation. Management also noted another $40mm in annualized cost savings as another positive, however, we’ll have to wait and see that play out. The key area we identify of potential value is within the pediatrics section of the orthopedics market.

However, with still some mild uncertainty on the deal’s completion, we are happy waiting on the sidelines for now, but are very trigger-heavy on SeaSpine Holdings Corporation, and OFIX, too, for that matter. We encourage investors to position for the same, and be ready for key announcements, and focus on the risks highlighted.

Be the first to comment