Just_Super/E+ via Getty Images

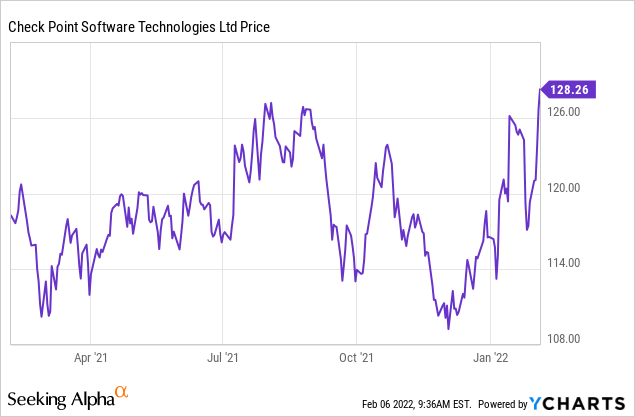

Check Point Software (CHKP) reported a better than expected earnings with subscription revenue growing an impressive 14% yoy. Gross margins remained quite strong despite some headwinds from the supply chain disruption and higher cloud usage.

Management also provided 2022 revenue guidance that implies a little acceleration at the midpoint compared to 2021 revenue growth. However, commentary around increasing their salesforce by 25% will cause margin pressure throughout the year, thus resulting in another year of sub-par EPS growth with guidance of 2-3% yoy growth at the midpoint.

Yes, I believe the company’s growth metrics have improved in recent quarters as the company appears to be on track for acceleration, though I continue to remain on the sidelines for now.

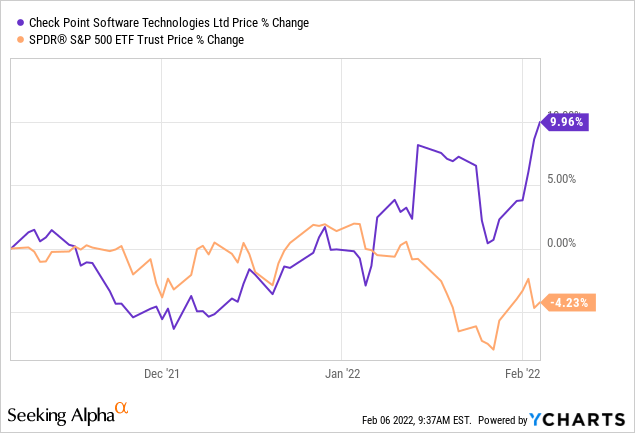

The second chart above does a great job depicting how CHKP has been able to outperform the market during this transition out of growth stocks. Given CHKP’s growth metrics and valuations, investors were not fleeing out of the stock, thus enabling CHKP to drive some nice outperformance over recent months.

However, management’s guidance, in my opinion, outlines only some improved growth for 2022 on top of another year of sub-par EPS growth. With valuation already around the high-end of historical levels, it seems difficult for investors to get much more than 10-15% upside even in a best case scenario.

For now, I am remaining on the sidelines given valuation is not overly attractive after considering the 2022 growth potential. I believe there will be opportunities to buy the stock on pullbacks throughout the year, though at current levels, I remain cautious.

Q4 Earnings and Guidance

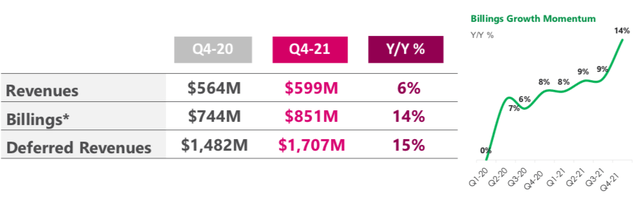

Check Point reported a strong quarter to end the year, reporting revenue growth of 6% yoy to $599 million, beating expectations by ~$13 million. Subscription revenue, which represents around 33% of total revenue, was the main driver and grew 14% yoy to $204 million.

Gross margin continues to remain strong at 87.5% despite some increased costs related to supply chain contains and increased cloud costs relating to their Harmony and CloudGuard solutions.

Nevertheless, the company’s trends in billings seem to have turned a corner. From Q2-2020 through Q3-2021, the company reported billings growth between 6% and 9% yoy, however, Q4-2021 billings growth accelerated to an impressive 14%. With $851 million in billings, it appears the company’s pivot towards more subscription-based revenue has been paying off.

On the company’s earnings call, management remained confident in double-digit billings growth, driven by growing subscription revenue.

I think I already stated that some of the assumptions that we have during the projections, we feel that our billing can keep growing, growing in a nice rate. Our internal projections are definitely for — our internal goals are definitely for double-digit growth. Not all of that will translate immediately into revenues, partly because we are growing the subscription part of our business and the deferred revenues, partly because there’s risks associated with the supply chain and others that may slow us down on some things, even the introduction of Quantum Lightspeed, which is great because it can enable us to capture new markets and new market share has some risks in it.

Another interesting tidbit is management’s tone on share repurchase. During Q4, the company reported it bought back 2.8 million shares worth $325 million. This compares to cash flow from operations of $294 million, meaning the company was willing to spend over 100% of their cash flow on share repurchases.

Just last quarter, the company announced an expanded repurchase authorization of $2 billion with the ability to repurchase up to $325 million per quarter. Clearly, management repurchased the full $325 million during Q4 and it would not be surprising to see this trend continue.

In fact, the company has just under $4 billion of cash/marketing securities and I believe they will continue to repurchase shares at the $325 million per quarter rate. This helps lower the company’s share count, thus helping with EPS growth.

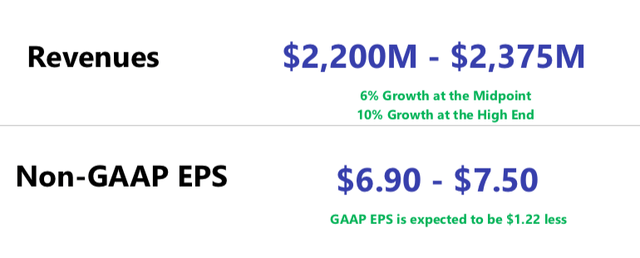

Management also provided guidance for the full year, which includes revenue of $2,200-2,375 million, representing 2-10% yoy growth. In 2021, the company grew revenue 5% yoy and management’s guidance implies revenue growth accelerating at the midpoint.

One of management’s goals for 2022 is to expand their workforce by 25%, giving them increased capacity to sell their products/services. Management noted:

Last but not least, growing, continuing and growing our investment in our frontline sales force. Our internal goal, which I hope we’ll be able to make is grow the frontline salespeople by 25%, supporting more customers, reaching more customers and, of course, delivering growth this year. And mainly, actually, this investment will translate into results, hopefully, by the end of 2022 and in 2023.

So while the increased investment may place some pressure on margins during 2022, management is hopeful the increased salesforce will have an impact on revenue/billings growth in late-2022 and into 2023.

Thus, the company provided 2022 EPS guidance of $6.90-7.50, representing growth of ~2-3% at the midpoint. This compares to EPS growth of 4% in 2021, though given the above commentary around increased investments in 2022, I believe management provided guidance that is highly achievable.

Valuation

While the company’s stock was only up ~1% after earnings, Check Point has done a fairly good job avoiding the massive rotation out of growth stocks. Part of this has been driven by the company’s somewhat muted revenue growth in recent quarters and years.

However, management has confidence that revenue growth can accelerate next year, driven by strong billings acceleration. While EPS growth will likely remain muted given the company’s increased investments in their salesforce, I believe the tone of growth has shifted to a positive stance.

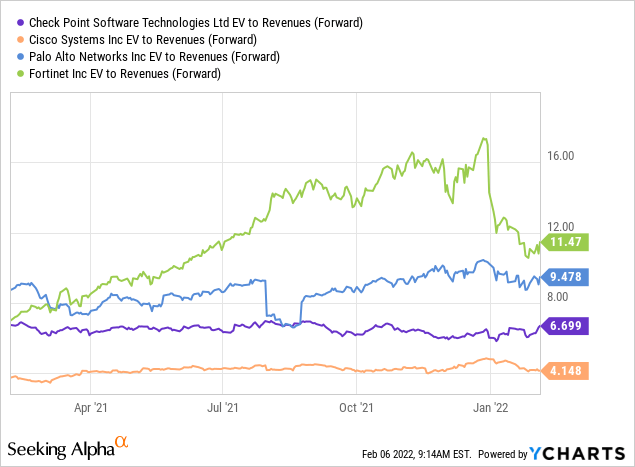

Nevertheless, even if the company were to accelerate revenue to 10%, which would be the top-end of management’s 2022 guidance range, this would remain well below some of the faster-growth peers in the security landscape. Add on some margin pressure throughout 2022, and EPS growth, while improving, is still only expected to be under 10%.

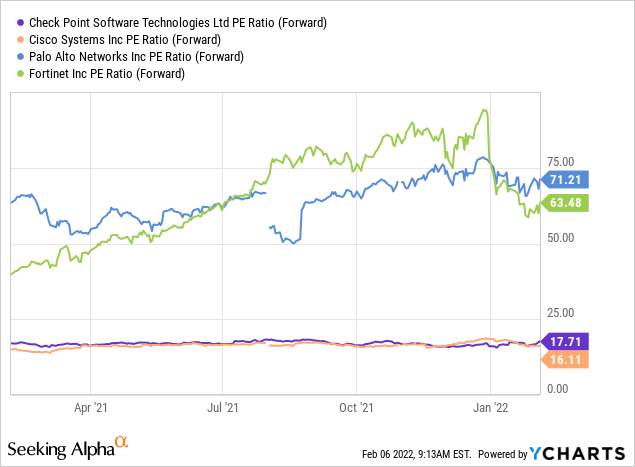

Check Point currently trades at just under 18x forward P/E, which remains well below the fast-growth peers of Palo Alto (PANW) and Fortinet (FTNT), though remains slightly above Cisco (CSCO). When looking at Check Point’s EPS growth guidance of ~2-3% at the midpoint, it seems like there could be better options in the security landscape to get a better return.

When looking at management’s EPS guidance of $6.90-7.50, it appears that valuation is somewhat full. For example, if we assume EPS comes in at the high-end of guidance and trades at a ~20x multiple, which would be above the historical valuation level, this would imply a $150 stock price, or ~15% above the current price. Yes, this is good upside, but this would require EPS to be at the high-end of guidance and for valuation to exceed historical levels.

Assuming an 18x forward P/E multiple on $7.50 EPS, this yields a stock price of $135, or only a few dollars above the current level.

Let’s consider valuation metrics of a potential 2023 EPS. Assuming 2022 comes in at the high-end and 2023 EPS grows an impressive 10%, this could imply $8.25 EPS in 2023. At the stock’s current level, this implies a ~15.5x multiple.

Assuming CHKP holds an ~18x multiple throughout 2022, then by the end of the year, we could see the stock at ~$148 (using 18x a 2023 EPS of $8.25). Even in this analysis, it appears a best-case scenario would yield ~15% return for the year. While it’s definitely not a bad return, I believe there are many other faster-growth security disruptors that have potential for amplified returns.

For now, I am remaining on the sidelines and believe the stock’s near-20% run since early December was largely a shield from rotation out of growth. When looking at current valuation metrics, it appears the stock is pricing in a successful 2022, which could limit the absolute multiple over time.

Be the first to comment