HT Ganzo

Introduction

In this article, I want to do two things. First, we need to discuss very important developments in the aluminum industry. The industry is suffering from lower demand as a result of global growth slowing. However, the industry is also seeing an implosion in supply as a result of the ongoing energy crisis and very low global stockpiles. If demand starts to rebound again, we’re likely in for a very steep increase in aluminum prices again.

Hence, the second point of discussion is giving you a stock that benefits in such a scenario. US-based Century Aluminum (NASDAQ:CENX) is a producer of high-quality aluminum with long-term supply deals and relationships with established mining companies. Even better, the company does not only produce in the US, which has an energy-price benefit, but it also produces in Iceland, a country in Europe, which is immune to the energy crisis – at least to a big extent.

The company is extremely attractively valued, and I have little doubt that this stock will be one of the best performers during the next upswing of basic material stocks.

So, let’s look at the details!

The Aluminum Market

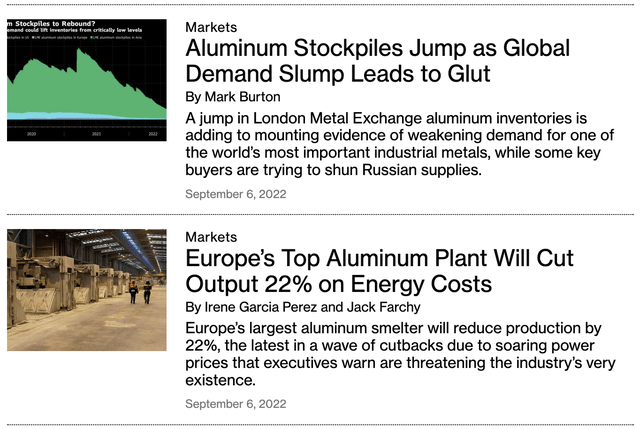

The beauty of the internet is that it offers information to confirm any bias. Especially in trading/investing, it’s easy to find both bullish and bearish arguments. The screenshot from Bloomberg is a good example. The first headline shows aluminum stockpiles jump as demand causes the industry to experience a glut. That’s pretty bearish, I would say.

The second headline shows that Europe’s top aluminum plant will cut output by 22% as energy costs hurt input prices. That seems bullish, or at least part of a bigger bull case.

It all depends on the time frame and the bigger picture – it always does, not just in this case.

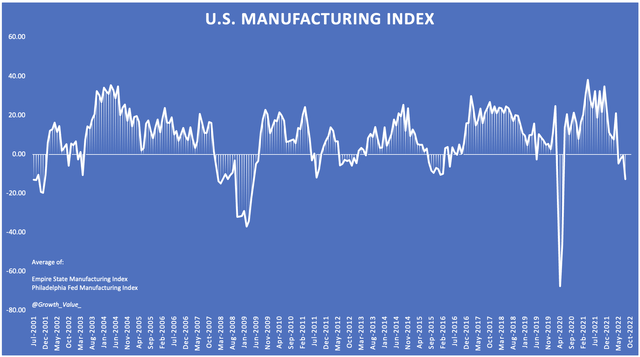

Essentially, demand is weakening as global growth is slowing down. China is battling self-inflicted weakness as a result of lockdowns and a severely weakening housing market. Europe is seeing imploding consumer sentiment due to high (energy) inflation, and in the US, manufacturing expectations are now pointing at contraction as the graph below shows.

I’m obviously just naming a few things pointing at weakness, but I think it’s fair to say that global growth is not in a good spot.

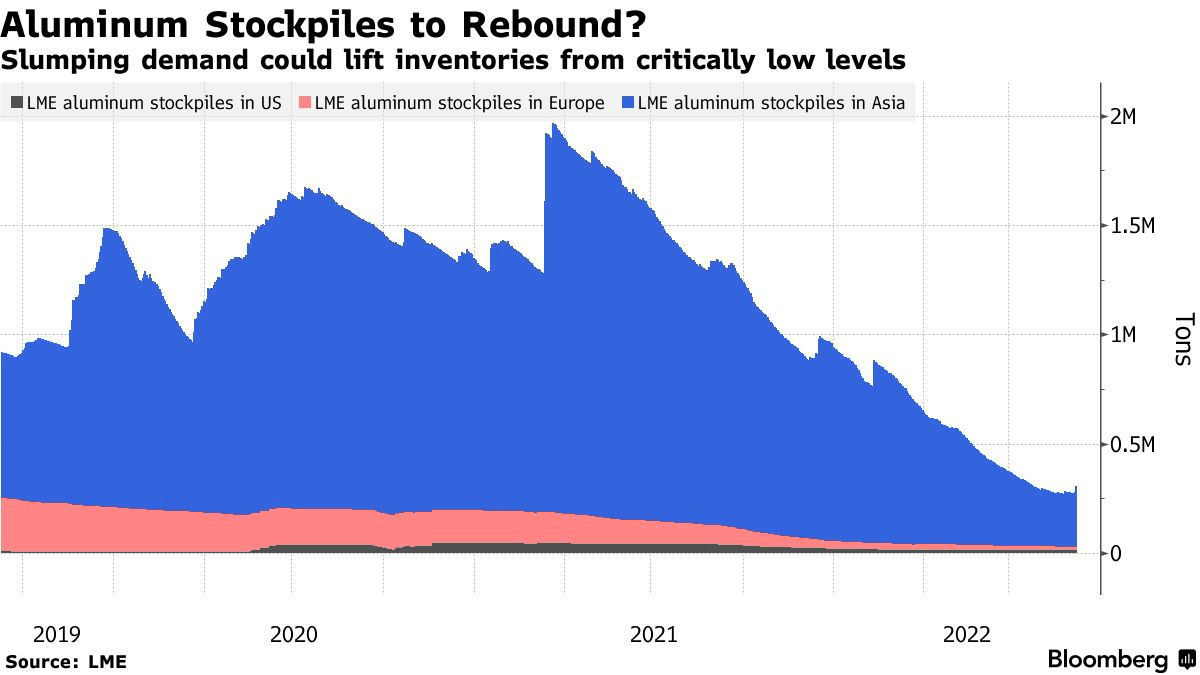

With that in mind, let’s look at the aforementioned inventories. Yes, slower growth is causing inventories to grow. However, inventories are at extremely low levels.

While Asia (mainly China) has always been the major driver of inventories, LMT inventories in Europe are pretty much at zero as a result of the energy crisis that started in 2021. Even Asian stockpiles have declined from roughly 1.5 million tons to roughly 250 thousand tons.

LME/Bloomberg

While slower demand has the potential to further increase inventories, supply won’t come back roaring.

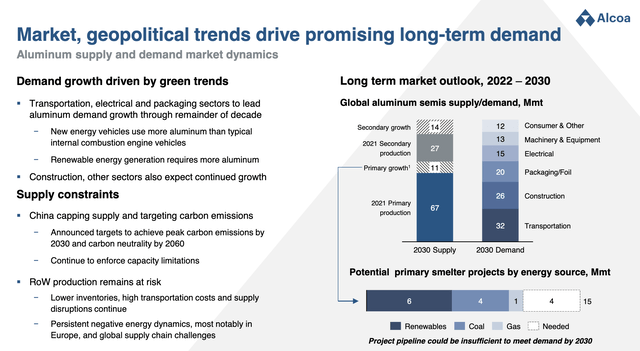

First of all, China is trying to fight pollution. They are not taking it as seriously as other nations, but at this point, it’s a serious health hazard in a lot of industrial regions. Alcoa (AA) estimates that supply in 2030 will see significant shortages, I assume these numbers do not take the current energy crisis into account. This energy crisis is hitting China as well, as fossil fuels become more expensive, making it harder to remain the world’s go-to place for cheap metals.

Alcoa 2022 Investor Presentation

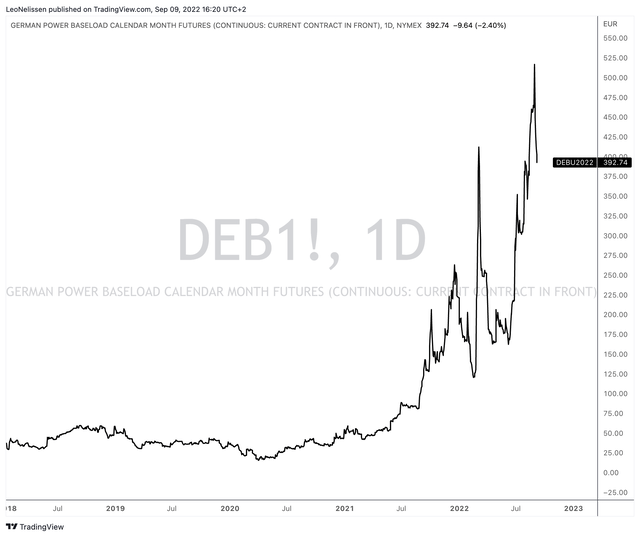

In Europe, the situation is worse. Politicians are trying to combine “net zero” and combat the energy crisis. This includes geopolitical issues as Putin has more or less shut down natural gas exports to Europe. As a result, baseload electricity prices are 600% above pre-pandemic levels.

TradingView (German Baseload Power Futures)

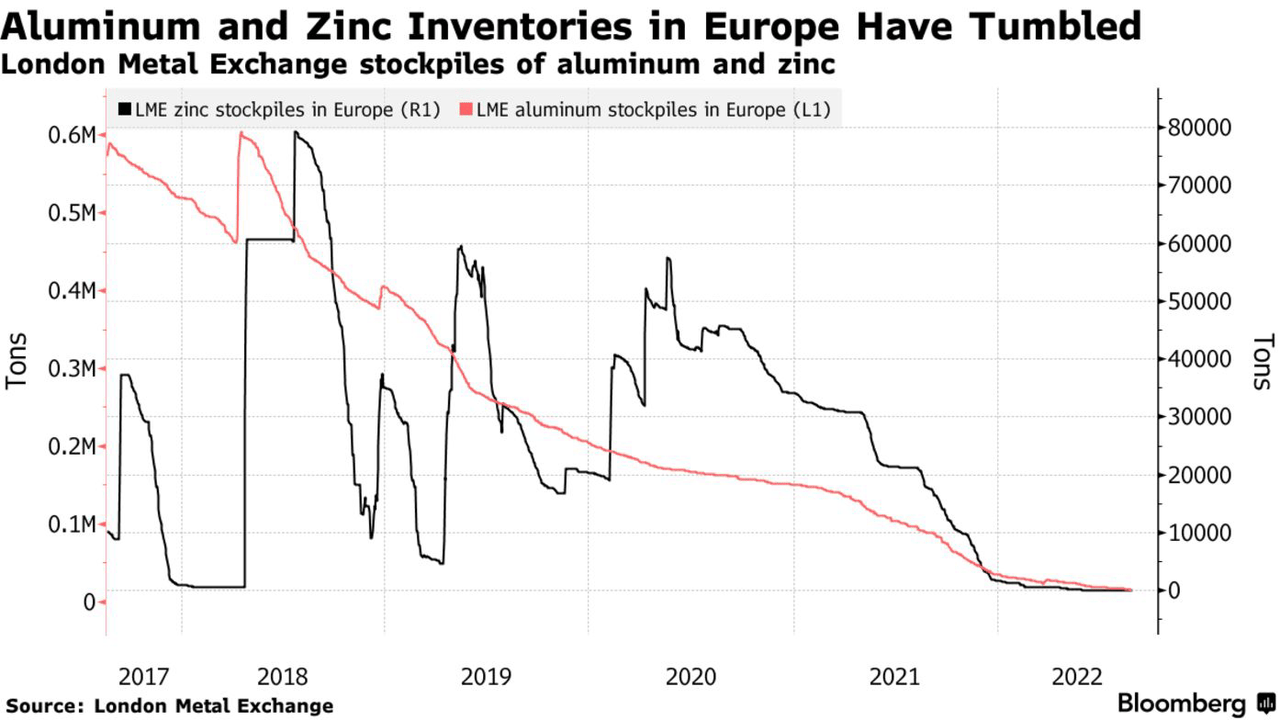

One can imagine what this trend does to the inventories of metals like aluminum. The chart below zooms in on European stockpiles (without including China).

I think the chart speaks for itself.

LME/Bloomberg

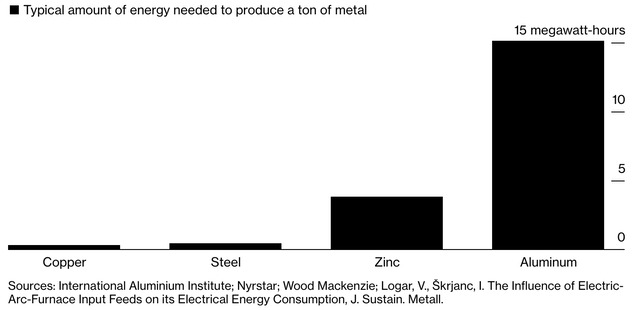

One of the main problems here is that Aluminum needs so much energy. In order to produce a ton of aluminum, more than 15-megawatt hours of energy are needed. This trumps any other major industrial metal.

So far, the regional aluminum and zinc production capacity has fallen about 50%. That’s before the latest cuts.

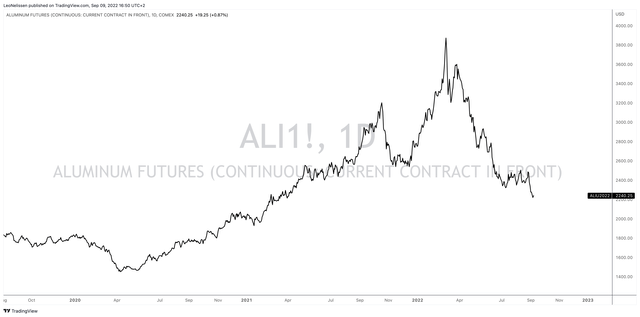

With everything mentioned so far, I believe that aluminum will be one of the winners if demand comes back. So far, COMEX aluminum prices have fallen to $2,240 per ton. While I am not sure where the bottom is, I believe we will see a steep surge well-beyond current levels as soon as we get the first signs of economic improvement.

Hence, I’m looking at Century Aluminum, which truly offers everything I’m looking for in an aluminum stock.

What Makes Century Aluminum So Special

Century Aluminum has a $740 million market cap, which makes it the smallest stock-listed aluminum producer in the United States. Century Aluminum is located in Chicago, Illinois, where it was incorporated in 1981.

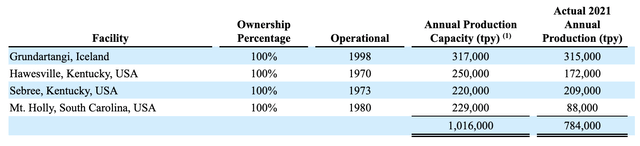

The company has the capacity to produce roughly 1.02 million tons of aluminum per year.

As the table below shows, the company produces in four wholly-owned facilities. Three of them are located in the US, which has access to affordable feedstock – compared to Europe. Moreover, the company has the ability to produce more than 310 thousand tons per year in Iceland.

Please note that operations at Hawesville are currently curtailed due to high energy prices. Hawesville’s smelting technology and the lack of value-added cast houses made it unattractive to continue operations.

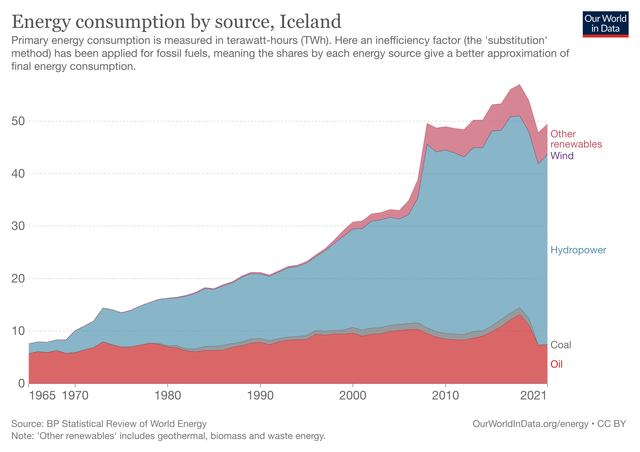

Iceland is technically in Europe, yet it is in a fantastic position because of affordable energy.

According to Statista (July 2021):

Compared to the EU average, Iceland’s electricity is significantly cheaper. For instance, the average price for households in Europe with a consumption between 2,500 and 5,000 KWh annually was 23.69 euro cents in the second half of 2021, around 10 cents more than in Iceland.

This is due to the country’s favorable geology, which allows it to produce cheap renewable energy. Located in the Mid-Atlantic Ridge, the country benefits from being in one of the most tectonically active places in the world.

In 2020 (prior to the energy crisis), the Fraunhofer Institute researched Iceland’s competitiveness. It found significant benefits over i.e., Germany, which is currently one of the biggest victims of the energy crisis.

Given the almost 100% carbon-free electricity generation and the high potential of natural energy resources, energy supply in Iceland is very cost-competitive85 compared to other, less resource-rich countries such as Germany. In addition, electricity generation costs in Iceland are not directly impacted by external factors such as fuel, carbon prices or adjacent power markets.

This allows the company to produce aluminum at competitive prices while still benefiting from full-pricing benefits. In the case of CENX, its pricing is based on three factors. First on the benchmark price, which is the LME aluminum price. Second, regional premiums like the Midwest premium for metal sold in the United States. Third value-added premiums for certain aluminum products. After all, not all aluminum products are created equal.

When it comes to its customers, the company sells roughly 60% of its products to the mining and commodity giant Glencore (OTCPK:GLCNF), which owns 42.9% of CENX’s outstanding stock (46.4% on a fully diluted basis).

14% of sales go towards the Southwire Company, which means that close to 80% of sales are under long-term contracts with reliable buyers.

Century Aluminum also has long-term supply contracts with Glencore, which supplies a big part of its alumina needed to produce aluminum. These contracts are LME-linked with the remaining supply coming from Concord Resources Ltd.

The company has also hedged a big part of production costs. According to CENX:

[…] only about 1/3 of our Icelandic energy contracts are paid to the Nord Pool price, with the remaining 2/3 provided under long-term LME-linked power contracts. We have hedged a little over 60% of our remaining 2022 Nord Pool exposure at an average price of EUR 24. For 2023, we have hedged 80% of our Nord Pool exposure at an average price of EUR 30. From 2024 onwards, we do not have any Nord Pool exposure.

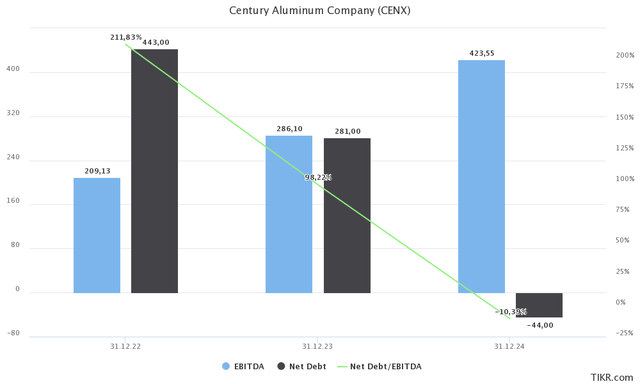

Despite closures, CENX is on pace to do $209 million in adjusted EBITDA this year. That’s better than 2017 when it did $164 million. That was one year prior to the 2018 global growth peak. In the years ahead, EBITDA is expected to consistently grow to more than $420 million. This is expected to come with $60 million, $193 million, and $307 million in free cash flow in 2022, 2023, and 2024, respectively.

As the graph below shows, this could push net debt into negative territory in 2024, meaning more cash than gross debt on the CENX balance sheet.

Lower debt is important as CENX is borrowing against high rates. As of June 30, the company has $427.6 million in gross debt. $246.2 million of this consists of 7.5% senior secured notes due April 1, 2028. These notes were sold in April of 2021.

That’s a high rate, which is why it is important that the company focuses on financial stability. The company is set to lower the net leverage ratio to less than 1.0x in 2023, which is great news.

It also helps the valuation. Using 2023 EBITDA expectations of $290 million, CENX is trading at a 4.0x multiple based on its $1.16 billion enterprise value. This value consists of its $760 million market cap, $280 million in 2023E net debt, and $116 million in pension-related obligations.

This valuation is very attractive and it does not at all incorporate the main scenario where demand comes back. The company could do more than $400 million in EBITDA with negative net debt. That would lower the valuation to roughly 2x EBITDA.

In other words, I have no doubt that CENX will be trading close to $25 again when demand rebounds, causing investors to shift money to cyclical industries again. The problem is getting there. As economic growth is weakening while the Federal Reserve is aggressively hiking, we could see a volatile sideways move until the Fed pivots, which I believe could happen in 2023 when inflation is dragged down by weakening economic growth.

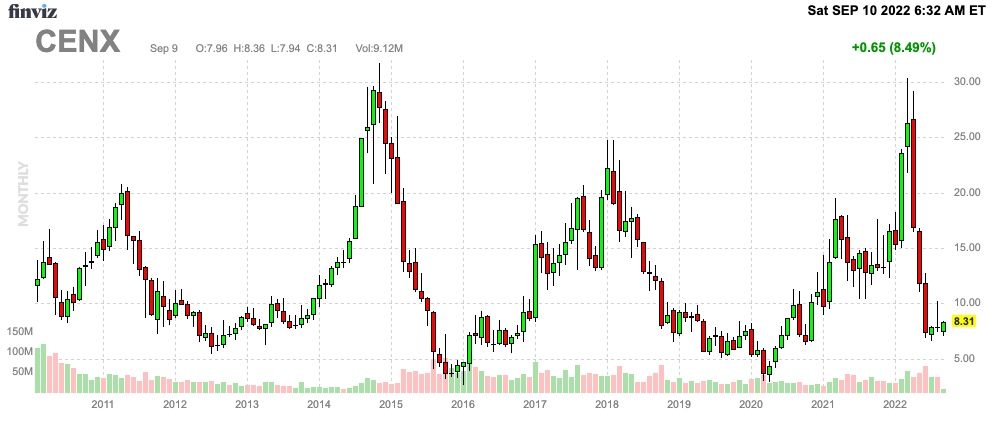

FINVIZ

Takeaway

Global aluminum markets have become a total mess. The only reason why aluminum prices are falling is that demand destruction is causing inventories to rise. The problem is that inventories are at extremely low levels. Even China has massively reduced aluminum production due to environmental issues and the price of energy. These impacts are even bigger in Europe where smelter capacity has come down more than 50% – and it’s still falling.

We’re creating a situation where aluminum prices are bound to explode again as soon as demand improves again.

This benefits Century Aluminum. While the company shut down its Kentucky plant to deal with high energy costs, it remains in a rather favorable competitive position. It has cheap production in Iceland, partially hedged costs, and long-term contracts with both suppliers and buyers.

While CENX is small and prone to high borrowing costs, it has significantly reduced the net leverage ratio while its low implied valuation provides tremendous long-term upside.

However, as economic challenges remain and CENX is extremely volatile, I only recommend investors buy very small exposure. This is a long-term investment idea (2-4 years) and I do not rule out another move lower as economic growth could weaken further in the months ahead. So please bear that in mind.

Other than that, I think we’re dealing with one of the stocks that will be a major beneficiary when demand expectations improve.

(Dis)agree? Let me know in the comments!

Be the first to comment