baona/iStock via Getty Images

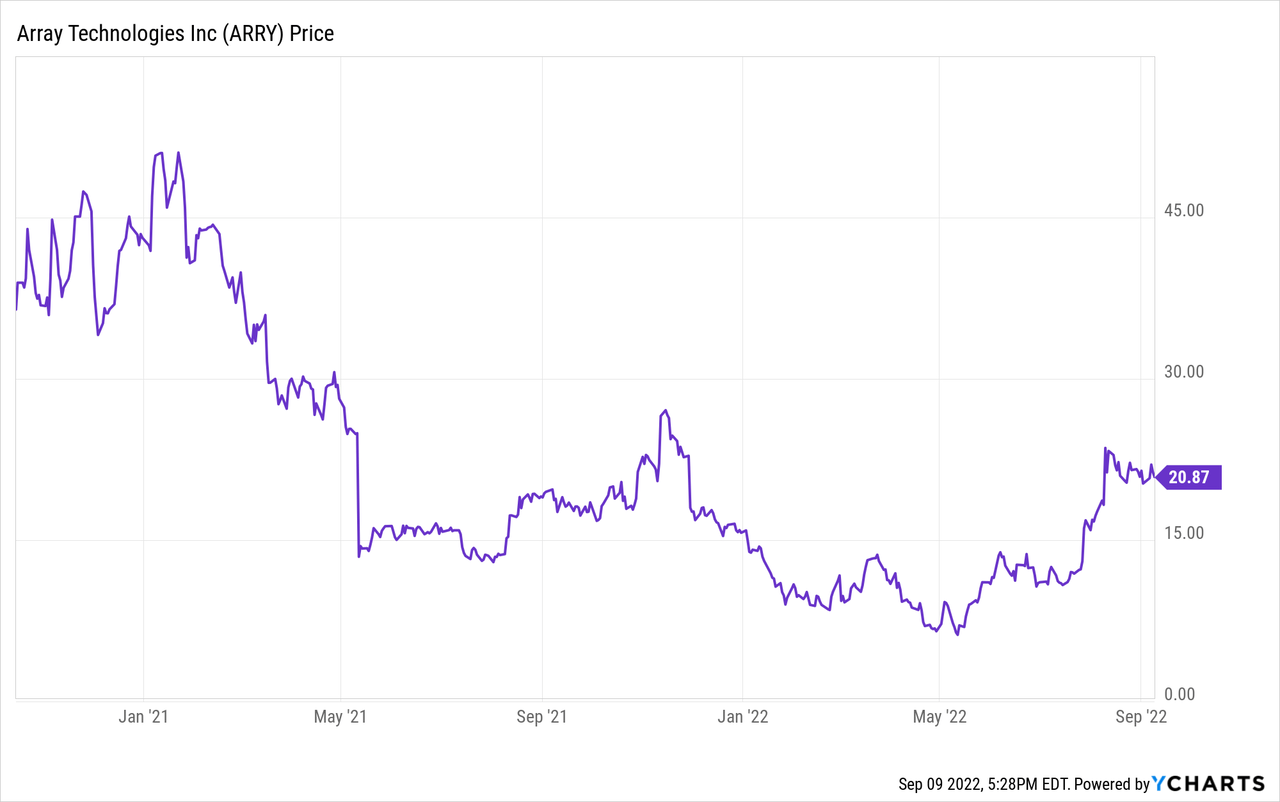

Array Technologies (NASDAQ:ARRY) went public and was immediately hit with a cascade of challenges, both macro and operational, that contributed to a collapse of its post-IPO stock price and seemingly placed its future at risk. The company would see its common shares trade as low as $5 per share, down from its IPO price of $22 per share. The zeitgeist during this fall was characterized by uncertainty, fear, and doubt on what was a clear long-term play on the rising demand for solar power in a world chasing decarbonization. The commons retracement also came in contrast to other pick-and-shovel plays on the growth of solar which would see their pandemic era runs continue to new highs.

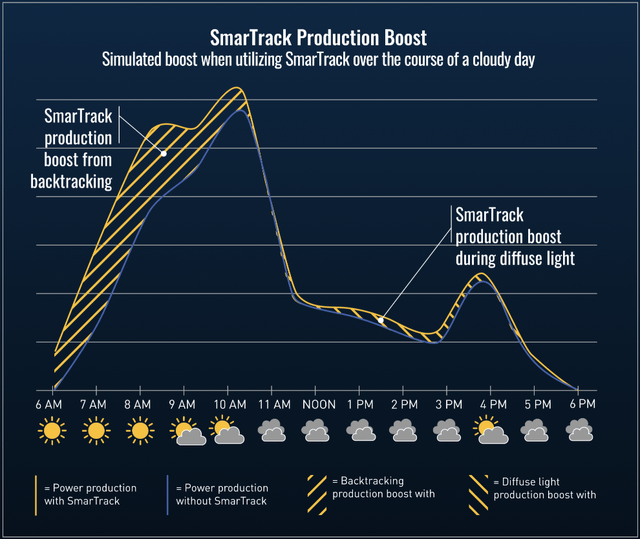

The picture now seems to be entirely flipped as steel prices fall precipitously and the recently signed Inflation Reduction Act sets the stage for a dramatic expansion of solar power. Array provides utility-scale solar tracking technology to solar projects with DuraTrack, a single-axis solar tracker, and SmarTrack, solar backtracking machine learning software that further boosts output.

The direction of the sun changes throughout the day and solar tracking technology from Array ensures the PV panels are constantly facing its direction. This maximises energy production and increases the returns profile of these solar projects. DuraTrack has been installed on more than 900 utility-scale projects worldwide which together account for around 22 GW of installed capacity.

Revenue Recovery Is Now Dramatic And Sustained

Steel has realized a sustained fall in prices over the last 12 months as the spectre of a global construction slowdown and full-blown recession dampens the near-term outlook for the commodity.

However, the extent to which these will be reflected in Array’s gross margins has been limited as the company is not buying steel at spot prices but is instead taking advantage of long-term fixed contracts that better protect them from the gyrations of the commodity. Hence, the collapse of steel prices will likely only start to be fully reflected in earnings from the later parts of fiscal 2023 going into 2024.

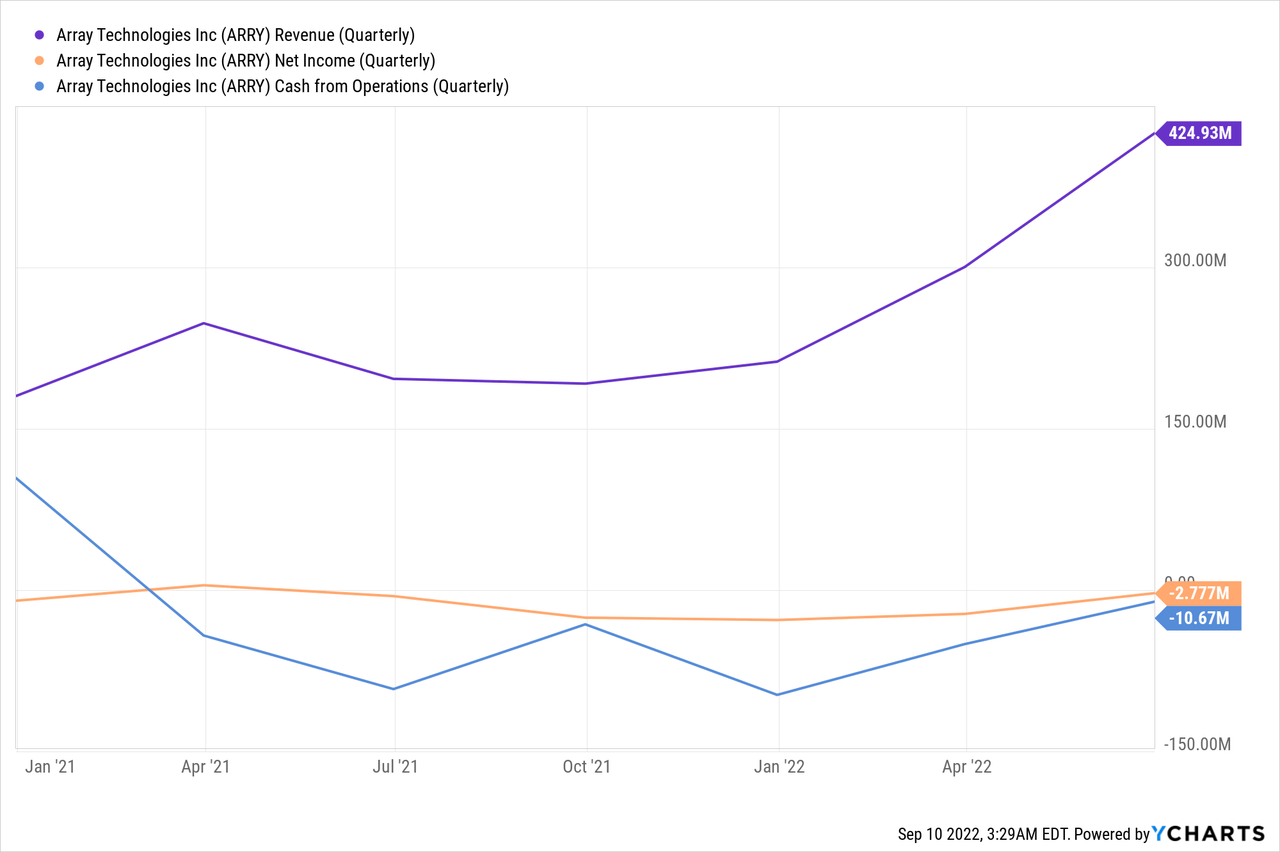

The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $424.9 million, up 116.2% from the year-ago quarter and a huge beat of $87.97 million on consensus estimates. Array has now realized three consecutive quarters of sustained revenue growth.

The company’s gross profit margins during the quarter at 11.15% was also a marginal increase from gross profit margins of 10.4% in the year-ago quarter. This meant overall profitability increased with adjusted EBITDA coming in at $25.9 million versus $9.9 million in the comparable year-ago quarter. However, both net income and cash from operations came in negative as negative free cash outflow totalled $12.2 million.

Trailing twelve-month cash burn at $196 million has exerted pressure on the company’s balance sheet. Cash and equivalents stood at $51 million as of the end of the last reported quarter. However, post-period end the company was awarded a $42.75 million legal settlement in relation to a suit against Nextracker for misappropriation of trade secrets. This is set against a $1.9 billion total order book that the company now moves towards fully realizing.

This high growth and potentially more profitable future for Array has been compounded by the Inflation Reduction Act. Described by Array’s management as the most impact legislation for the solar industry ever, it will allocate $370 billion over 10 years to decarbonization initiatives. The Act is set to offer investment tax credits to boost the rollout of solar power in the US and is set to bring forward the demand for solar, drastically changing the five-year outlook for the industry. Expectations are now for solar deployments to increase by 40%, around 62 GW, over pre-Inflation Reduction Act projections through 2027.

Hence, the contribution of solar power to the US electricity grid is about to increase markedly. This was just 3% of U.S. electricity generation from all sources in 2020 and is now set to rise to at least 10% by 2030. Important to note is that these projections were pre-Inflation Reduction Act.

U.S. Energy Information Administration

Utility Scale Solar Power: Growth Like Never Before

The Inflation Reduction Act will enshrine the role of solar power in US energy. Array stands to benefit from this rollout with its solar tracking technology. High steel prices, once a material headwind for the company now look to be a settled matter. The post-pandemic-led steel inflation now all but turned into a full crash.

While future growth as implied by Array’s management will be like nothing we’ve seen, a global economic recession would more than likely put on damper on common shares that have rallied strongly in recent weeks. A tapering of current investor enthusiasm could see shares move lower than their current highs. So whilst Array Technologies is a great company for those looking for a way to gain exposure to the ongoing solar boom, I’ll wait for a potentially better entry point.

Be the first to comment