Khosrork/iStock via Getty Images

Introduction

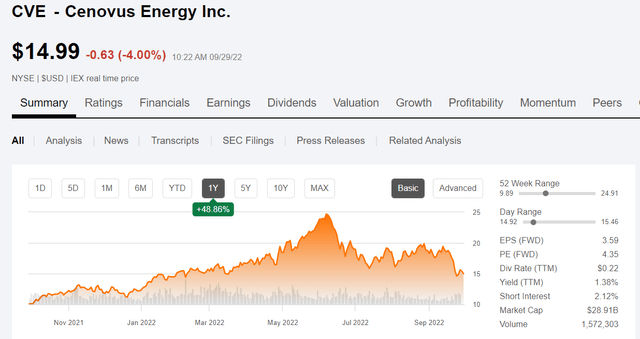

We first recognized Cenovus Energy Inc. (NYSE:CVE) as a potential star when it was trading around $5.00, back in January of 2021. It gained about 3X from there to February of 2022, and we endorsed again at $15.00 per share. It had some more gas in the tank and made it all the way to $25, before the current market jitters took 40% away from everything oil-related. Including CVE.

CVE price chart (Seeking Alpha)

The message here is nothing has fundamentally changed about the company and it deserves a much higher cash flow multiple than it current receives. As with many companies in the E&P space, you are being given a trip back in time to scoop up some shares. When the dust settles and the current narrative of recession (which is well founded but overblown as regards the oil market) disappears, we think CVE will push higher with oil prices and make new highs in the coming year.

We’re buying the dip!

The thesis for CVE

I am not going to do deep background on the company at this point. If you are new to my writing or the company, and you’d like to probe a little deeper, please read my two earlier articles. For now what you need to know is the company is a low cost producer of heavy oil that is needed for upgrading the light oil that comes from shale.

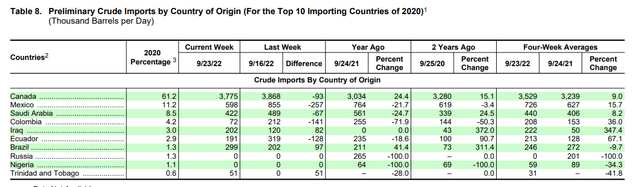

Our refineries were all built in the 1970’s and 80’s, when it looked as though we would always get boundless heavy oil supplies from Venezuela and Mexico. That isn’t the case any longer, and Canada has become our largest oil supplier, by a factor of 6X over their nearest rival, Mexico. Go back a few years and you would see Mexico at a much higher level. That country made a decision to keep more of its crude at home for their domestic supply as opposed to exporting it here.

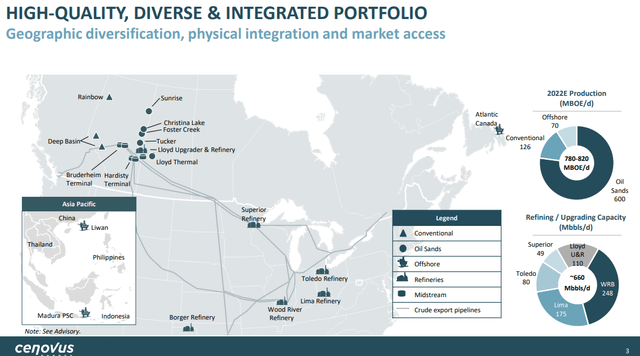

It is worth remembering the installed asset base of the company, much of which simply could not be built today. I harp on this a lot, I know, but you don’t have to go very far to find projects that people wish would get done, that also need to get done, that are simply stalled out in the morass of regulatory and political gamesmanship that dogs the industry. If you will forgive a trite analogy, “Forgiveness is easier to come by than permission.” Having it already on the ground, or in the ground amounts to forgiveness, and puts the company miles ahead of projects like Joe Manchin’s Mountain Valley Pipeline – which will never be built, in my estimation. I point this out to note the Husky Midstream, refining and storage assets that came with the CVE merger with Husky Oil that created the company as it now exists.

CVE is also a significant refiner and is doing a “land office” business in the U.S. market with its refining base spread across the middle of the country. CEO Alex Pourbaix commented on the refining sector in the Q-2 analyst call:

Clearly, the outlook for U.S. refining has changed drastically, and we are now seeing the benefit of the integrated model we put together with the Husky transaction. Our outlook for the financial performance of the U.S. refining business has dramatically increased.

So, in CVE you have an E&P producing ~800K BOEPD mostly from oilsands, with a strong refining and midstream complementary business. CVE is trading at a very low cash flow multiple at present of 2.8X, and also sports a low P/FB of ~27K per flowing barrel. A bargain like this isn’t going to stick around for long if the market develops this fall the way I think it will.

Q-2 recap and current events

CVE’s adjusted funds flow of $3.1 billion was the highest in the company’s history. Free Funds flow was $2.2 billion and excess free funds flow was also about $2 billion. Long term debt was below $9 billion and net debt was $4 billion at the end of Q2. CVE allocated about 50% of Q2 excess free funds flow towards shareholder returns, which is over and above their base dividend. Share buybacks came to over $1 bn in the second quarter.

Total operating margin was nearly $4.7 billion, compared with $3.5 billion in the first quarter. Upstream operating margin was more than $3.8 billion, compared with about $2.9 billion in the first quarter. Downstream operating margin rose to $847 million in the second quarter from $544 million in the first quarter. The increase was due to U.S. Manufacturing operating margin of $793 million in the quarter, compared with $423 million in the first quarter, driven mainly by strong market crack spreads, which more than doubled from the previous quarter

The company pays a rather paltry dividend, preferring share buybacks for variable returns. This makes a lot of sense when their least when their share price is at such low multiples. Most companies screw up buybacks, we think CVE is getting it right.

CVE increased its 2022 capital guidance adding about $400 million. This included about $120 million this year for the restart of the West White Rose project. They also added about $200 million in the oil sands. About half of that will go towards Sunrise (bought recently from BP in a fire sale), including the additional 50% interest once the acquisition closes.

CVE has a hurdle rate of cost of capital return at $45 per barrel WTI with even higher returns at today’s commodity prices, and plans for modest increases in output in 2023. Notably from Spruce Lake North production will also be coming online in the Lloyd Thermals, adding that 10,000 barrels a day. Once the Sunrise acquisition closes, the increased interest will represent about 25,000 barrels a day of incremental production.

Looking further down the road, Indonesia production will be increasing by about 10,000 BOE per day with the developments there as 2023 arrives.

Terra Nova is expected to begin producing again later this year, returning about 29K BOEPD to production in early 2023.

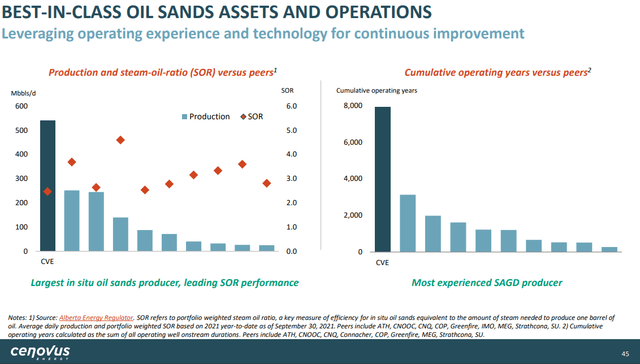

A potential catalyst

The BP Sunrise asset was under-invested over the past few years. As I discussed in a recent article, oil sands were just too “dirty” for the Euro Super Major’s taste, and capital was not allocated in that direction. Without getting too deep in the weeds on cost, the slide below is illustrative in that regard. Technology pays off in low steam/oil ratios-SOR, meaning lower inputs are required. This should deliver higher margins over time to CVE than those of competitors.

Owning 100% of Sunrise, with a production level of 50K BOPD, should add another 25K to CVE’s daily output from day one after the transaction closes later this year. CEO Pourbaix discussed plans for Sunrise:

We’re actually quite excited about the Sunrise asset. As we take over 100% kind of ownership of it, our development plans are unchanged. We are actually looking to continue to apply our Foster Creek and Christina Lake subsurface philosophies to the site. As we do expand the site, we’re actually seeing very good redrill opportunities. To date, the wells that we’ve been drilling are coming in slightly above our forecast, which is kind of reassuring.

And as we’ve actually studied the geology, we’re seeing a lot more opportunities. So the asset was really underinvested for a number of years. And what we are doing is reinvesting and getting it back to how we’d like it to operate. I’m confident we can actually get above the nameplate of 60,000 barrels a day, and I’ll take the next 24, 30 months to actually get there.

Adding 25K BOPD is another $730 mm in revenue per year at $80 per barrel. That probably pushes cash flow up another $450 mm, putting the total in the 10.4-10.6 bn range for 2023. That should be a boost to share prices all by itself.

Risks

Obviously, there’s a couple of risks worth documenting. The WCS differential has been higher by quite a bit recently, knocking on the door of $23, at a time when oil prices have been softer. Some of this is due to more production coming online and leading to reapportionment on some takeaway lines. Some of it is due to SPR releases, as previously noted. Alex Pourbaix commented along those lines:

We’re seeing kind of the light heavy spread in the U.S. Gulf Coast kind of wide note and numerous factors kind of contributing to that, one being kind of the strategic petroleum reserve release, which we’re anticipating that should lighten up in the August timeframe and currently forecasted to end in October.

Pourbaix led into the obvious – using rail, if production became restricted due to increased apportionment.

The fire at the BP refinery that is due to be taken over by CVE in Toledo, Ohio, appears to be taking it offline through the end of the year. When you add in the fact a couple of people died in the fire… risks abound, and can’t really be assessed at this point.

Your takeaway

CVE is off ~4% in this morning’s trading, along with everything else, oil-related and not. Fed fears and inflation seem to be ruling the narrative today, and wiping some of the gains made in the bull run yesterday. None of this impacts the fact that a quality company, with plans to grow its production, shrink its share count, and deleverage its already manageable balance sheet, is on sale.

That’s a dip worth buying. If you have a crystal ball and can pinpoint the day the market will turn, have at it.

Be the first to comment