Jose Luis Pelaez Inc

Specials thanks to Cappuccino Finance who helped me write this article.

The last time I wrote one of these, I got in trouble. So the fact that I’m writing one again probably makes me a sucker for punishment.

But as long as it doesn’t make me a sucker for yield, I think I can handle the consequences – whatever they might be.

For my first “I’m Rooting for a Recession” article, the consequences were some unhappy comments. Which I’ll get to in a moment. First though, here were the summary bullet points it began with:

- I do look forward to weakness in the stock market because I love buying blue-chip equities when they’re trading in the bargain barrel.

- Therefore, I do a lot of work [that] helps to prepare me for an eventual downturn in the market.

- So, you see, I don’t fear this likely “garden-style” recession. And, in fact, I’m rooting for it.”

Between the title and that last sentence reiterating the title, you can probably guess what the criticism was. Maybe you were even one of the following:

“Recessions are a part of life. It is an opportunity to purchase assets as discount prices and build passive income. But I wouldn’t cheerfully root for a recession. People lose jobs, savings, homes and, worst of all, hope.” – pberardi

Or:

“I am not rooting for a recession. Because recessions are not something you wish for.” – nickfrancois

Or maybe you were one of the commenters who got much more passionate than that.

I “Get” Recessionary Fears, Believe It or Not

I won’t include the harshest responses to my original article – which got a whopping 390 comments altogether – but here’s a special mention nonetheless:

“The author missed that people don’t pay rent during recessions. That’s what happens when businesses close, people get laid off, and times get bad. Which is what the author apparently is hoping to happen. Because he’s part of the 1% hoping to profit off of people getting their lives destroyed.” – Tim Apple

That would be painful if it were true. But I’m happy to say I work hard to build up people’s lives. (And perhaps less happy to say I’m not “part of the 1%.”)

As my regular readers know, I suffered enormous financial losses during the Great Recession. Losing my business… wondering how I was going to provide for my family… seeing the stress they were all under…

It isn’t something I’d wish on anyone. I even got into stock analysis in no small part to help steer others away from that kind of fallout.

For anyone who’s forgotten, let me quote Bryan M. Kuderna, author of Millennial Millionaire,

“Since the S&P500 was created in 1957, there have been 10 recessions. Aside from the Covid-19 recession of 2020, which only lasted two months, the other nine recessions were preceded by high inflation and triggered by the Fed raising interest rates. Each recession ended as the Fed began lowering interest rates, loosening monetary policy, and often coincided with increased government spending, known as fiscal expansion…

“Looking purely at S&P 500 calendar year returns, 2008 was the most severe market correction…”

To which I’ll say, tell me about it.

Been there. Done that. Lost it all. And came back stronger as a result.

But still… tell me about it.

What in the World Are We in For?

I do have to wonder how much of the actual original article my worst critics read.

I’m not even trying to accuse anyone of being intentionally misrepresentative. Perhaps the title got them so worked up that they couldn’t think clearly past it.

Yet if they had been able to, they would have noticed how the eighth paragraph down read:

“At this point, most reports from credible analysts/firms that I’ve read are calling for a relatively tame, short, and shallow recession (due largely to the relative strength of the labor market). I tend to agree, but that doesn’t change the fact that, to most investors, the word ‘recession’ is a scary one.”

In that case, the key word I want to point out is “shallow.” I and most analysts out there were expecting something mild.

In which case, nope! I wasn’t going to object to something that sent the stock market down a bit, opening up some great entry price points.

These days though? Well, I might have to change that mindset.

Because a “garden-variety recession” is admittedly looking less likely based on everything we’re seeing these last few months. Consider how:

- The Federal Reserve is becoming increasingly aggressive.

- The markets are increasingly understanding that.

- More and more individual experts and institutions are coming out with predictions of a much more substantial downturn.

In which case, despite the title of this article, I’m still rooting for a recession, recognizing that if we’re going to have one, we might as well make the best of it. In which case, let’s talk about some real estate investment trusts (“REITs”) that should make it through just fine.

Top 10 REITs for Gen X

In case you missed it, I recently put together a list of the Top 10 REITs to Buy for the following:

Did I miss anyone?

Answer: Yes

I intentionally left off my age group, Gen X. That’s my generation, born between the mid-1960s and the early-1980s. According to Investopedia,

“Gen X numbers around 65 million, while the baby boomers and the millennials each have around 72 million members. Gen X is also sometimes referred to as the “latchkey generation” as they were often left unsupervised at home after school until their parents came home from work.”

That explains why I grew up on TV dinners and episodes of Star Trek.

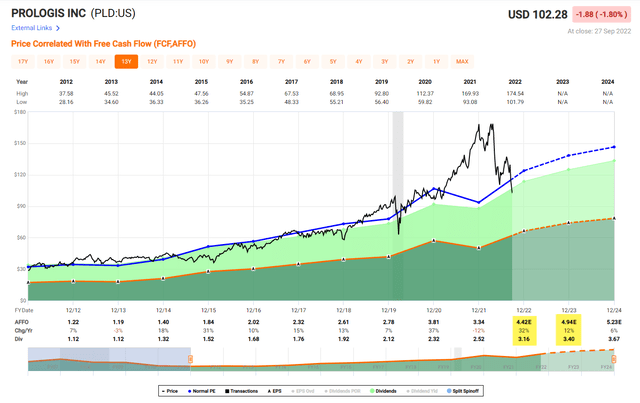

Gen X Pick #1: Prologis, Inc. (PLD)

Prologis focuses on real estate that is necessary for business logistics. As many of us are aware at this point, demand for warehouses and logistic-related facilities is growing rapidly.

People are getting increasingly attached to the convenience of last-mile delivery, so this demand will only increase. After all, who can resist the urge to sit in their living room and get everything he/she needs delivered directly to the door? Prologis’ top customers include Amazon (AMZN), FedEx (FDX), and Home Depot (HD), so this trend has been spurring on Prologis’ growth.

An additional attractive feature is that this space has a high barrier to the entry. These warehouses and logistic facilities are huge, and the equipment and machines within the buildings are very high tech. This makes it difficult for new companies to enter the market and creates a large economic moat for Prologis, who already enjoys economies of scale and a network effect due to their large footprint.

They just had a great 2Q 2022, and I expect them to continue to grow in the long run. Currently, they have a total of $5.2 B in available liquidity, and long-term debt to EBITDA ratio is at 4.7x. Their fundamentals are very strong, and they have significant capacity to execute value-added development opportunities.

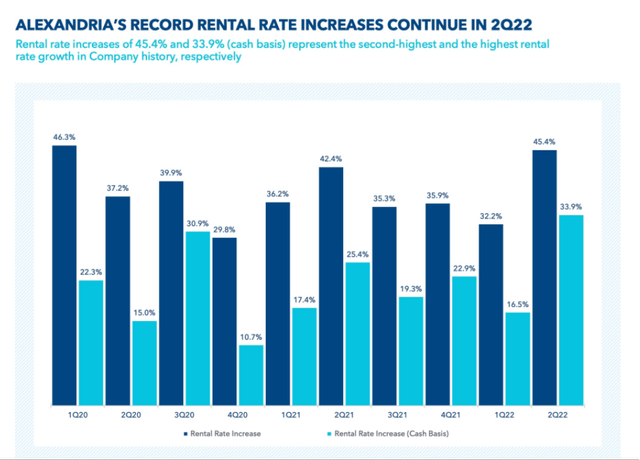

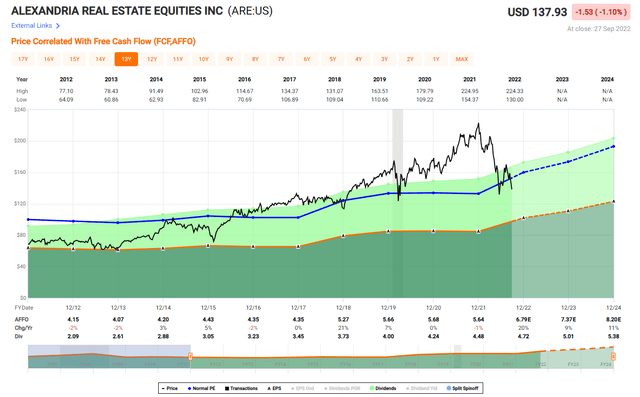

Gen X Pick #2: Alexandria Real Estate Equities, Inc. (ARE)

Alexandria Real Estate is an urban office REIT that focuses on life science, agtech, and technology campuses. They develop energetic urban cluster campuses with a highly collaborative culture that appeals to young talent in these high tech industries. Given the booming life science, agtech, and technology spaces, the demand for Alexandria’s real estate just keeps increasing.

Alexandria has a healthy pipeline of project to drive their growth in the future. They have 5.9 M RSF projects under construction and expect 1.9 M RSF of key projects to be completed in the next six months. Reflecting this strong growth, Alexandria has been raising their dividend consistently (6.8% per year, average of last 10 years).

To drive this growth, it’s critical to maintain a strong balance sheet, and Alexandria is doing a great job. With $5.5 B in liquidity and less than 5.1x of Net Debt and Preferred Stock to Adjusted EBITDA ratio, they have a very strong balance sheet. It is not surprising to see their high credit rating (Baa1 on Moody’s and BBB+ for S&P Global). I expect Alexandria to continue its strong growth into the future.

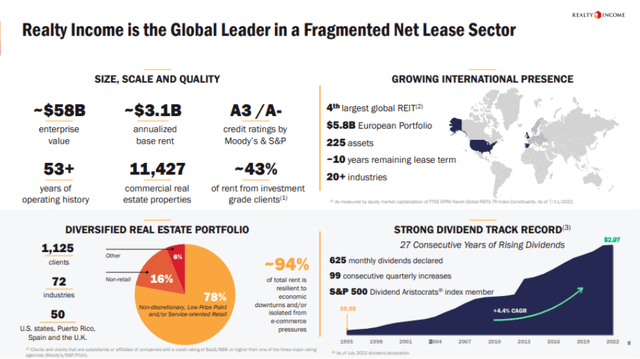

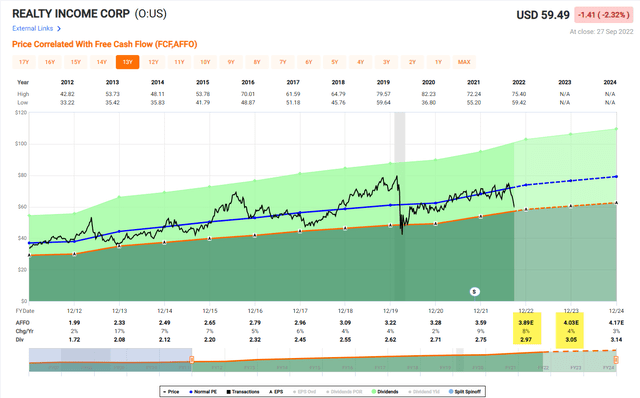

Gen X Pick #3: Realty Income Corporation (O)

Realty Income is a REIT that acquires and manages freestanding commercial properties that generates rental revenue under long-term net leases. They are one of the Top 10 global REITs, with 15.1% shareholder return (CAGR since 1994) and 4.4% annual dividend growth (CAGR since 1994).

Realty Income has over 1,000 clients spread across 72 industries. With $58 B of enterprise value, their portfolio and operational record are the example of stable growth. Given their diversified portfolio and strong growth prospects, I expect them to continue their 27-year streak of increasing dividends.

Their current valuation (P/AFFO of 16.66x and P/FFO of 19.9x) is significantly lower than historic levels. According to iREIT Alpha’s rating table, the margin of safety for their stock is 15%. It’s presenting a great opportunity for investors to grab their stock at a bargain price while also enjoying a solid dividend yield of 4.8%.

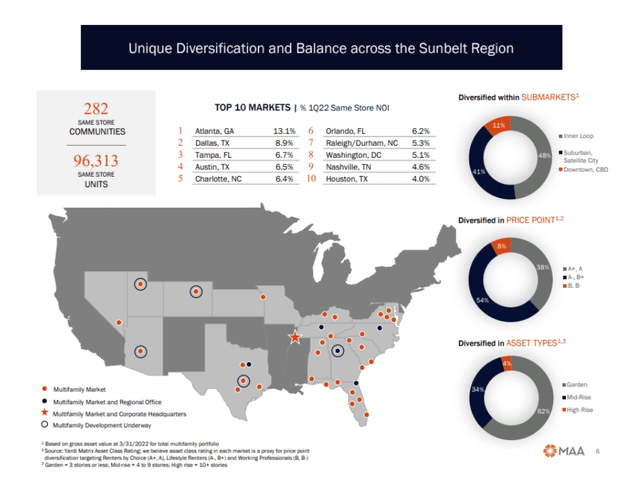

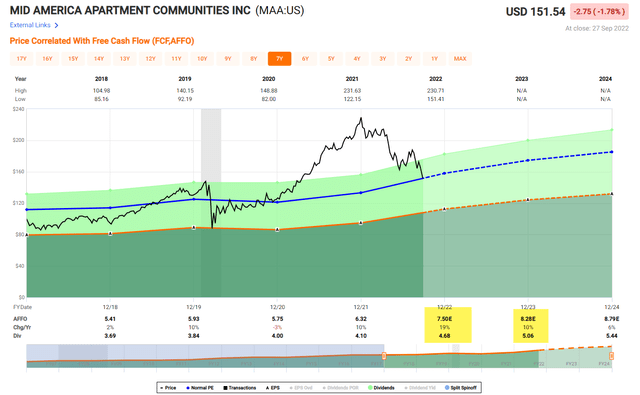

Gen X Pick #4: Mid-America Apartment Communities, Inc. (MAA)

Mid-America Apartment Community is a multifamily-focused REIT. They own, operate, acquire, and develop apartment communities in Southeast, Southwest, and Mid-Atlantic regions of the U.S.

They have been generating sustainable, stable, and increasing cash flow by diversifying their portfolio across markets, utilizing technology to provide desirable services to residents, and operating their existing properties effectively.

As their pipeline includes approximately $1 B in development and lease-up by the end of 2022, I expect their stable growth trajectory will continue for the foreseeable future. Also, they have a total of 13 K units of redevelopment opportunities within their assets that can also add value and contribute to their growth.

Mid-America also has a very favorable debt maturity schedule and strong balance sheet. They have nicely spread out their debt over the next several years with no significant maturity in the next 12-15 months, and they have $1 B of credit facilities and $480 M of commercial paper program available.

Mid-America’s credit ratings are at BBB+ (S&P), Baa1 (Moody’s), and A- (Fitch). With this strong balance sheet, they won’t have any problem supporting their growth.

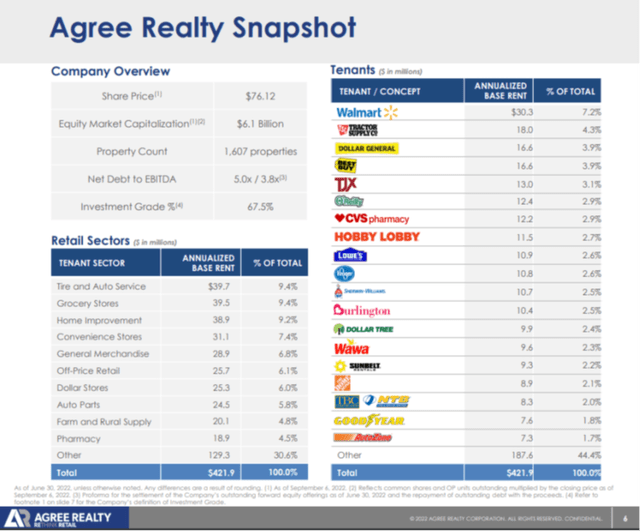

Gen X Pick #5: Agree Realty Corporation (ADC)

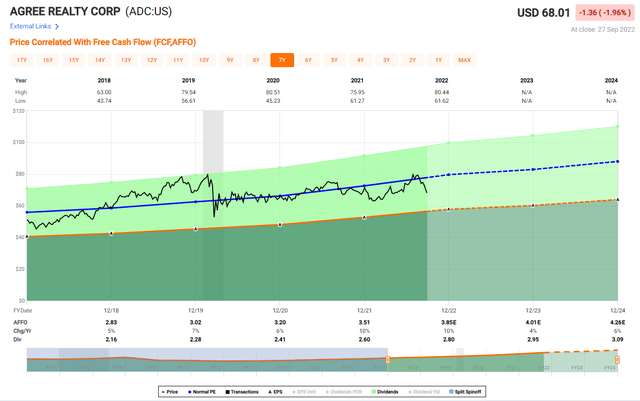

Agree Realty is a REIT that focuses on acquiring, owning, developing, and managing retail properties that are net leased to prime tenants. Their top tenants include household names like Walmart (WMT), Best Buy (BBY), CVS Health (CVS), and Hobby Lobby.

Agree Realty maintains a strong and diversified portfolio by choosing tenants that are resistant to e-commerce (matured and omni-channel structured tenants) and recession, and also have a strong balance sheet.

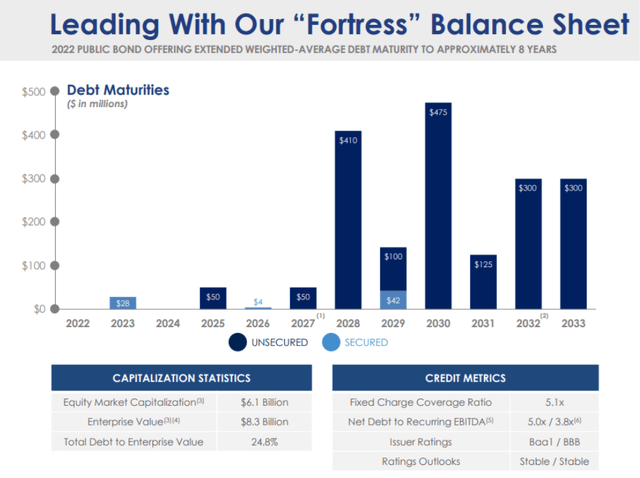

Agree Realty has a very strong balance sheet and favorable debt maturity schedule. They do not have significant debt maturity until 2028, and it is well spread-out afterwards. Their Net Debt to Recurring EBITDA ratio is at 5.0x, securing a solid credit rating (Baa1 and BBB with stable outlooks).

Their current valuation (P/AFFO of 19.66x and P/FFO of 19.0x) is lower than their historic numbers. I believe their stock is undervalued at this point. With their fortress balance sheet and base of premier tenants, I believe their stock will rise nicely, and the dividend will continue to grow.

Gen X Pick #6: Regency Centers Corporation (REG)

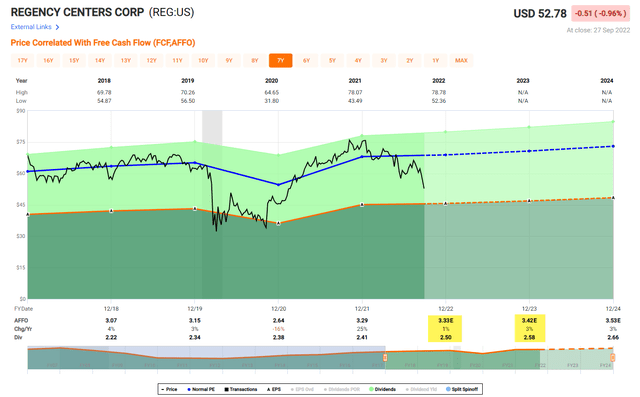

Regency Centers Corporation develops, owns, and operates income-producing retail real estate located in top markets within the U.S. They lease their assets to necessity, service, convenience, and value retailers. Regency has ownership of more than 400 properties, primarily anchored by major grocery stores with large floor space.

They have been expanding nicely with a well-managed and diversified portfolio. Their 400+ properties with 54M+ sq ft are occupied by more than 8,000 tenants, and their dividend has been growing at 3.6% per year since 2014. Regency’s business of targeting high quality open-air shopping centers, maintaining a strong value adding pipeline, and leasing to premier tenants has certainly been paying off.

Regency Centers has a very strong balance sheet to support their growth. Their debt maturity schedule is distributed over the next several years. At most, only 15% of total debt will mature in any given year. The weighted average interest rate of 3.8% is also very manageable, and the weighted average time to maturity is 8+ years. Their net debt-to EBITDA ratio is at 5.0x.

Reflecting fears about an upcoming recession, their stock price dropped more than 20% in the past 12 months. I believe this is a mistake by the market, and their stock price is clearly undervalued, supported by their lower P/AFFO (16.11x) and P/FFO (12.81). I expect shareholders will be rewarded handsomely in the future.

Gen X Pick #7: Simon Property Group, Inc. (SPG)

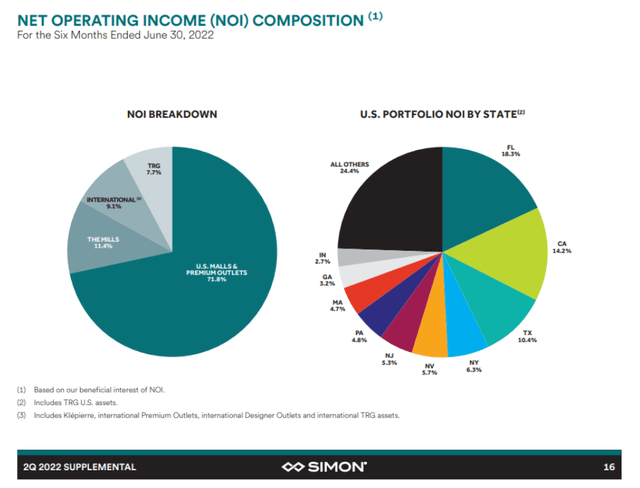

Simon Property Group owns, develops, and manages premier shopping, dining, entertainment, and mixed-use buildings. They have a geographically very well diversified portfolio that is spread across Florida, California, Texas, and New York.

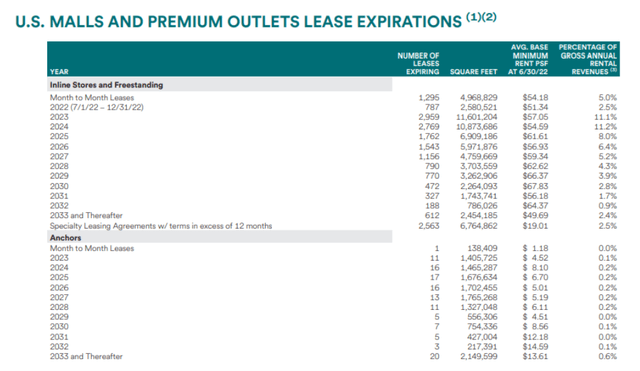

Also, Simon Property has been doing a great job at managing the lease expiration schedule with their tenants. It’s very well spread out over the next several years. They did an exceptional job at capturing growth from expiring leases, while not putting too much pressure on any given year.

To drive growth, it is critically important to maintain a strong development portfolio, and Simon Property has been doing a great job in this area. They have $184 M invested in the first half of the year, and an additional $236 M will be invested throughout the year.

Additionally, they already have $152 M worth of investment expected for 2023. With this strong development pipeline, I expect Simon Property to steadily grow in the future.

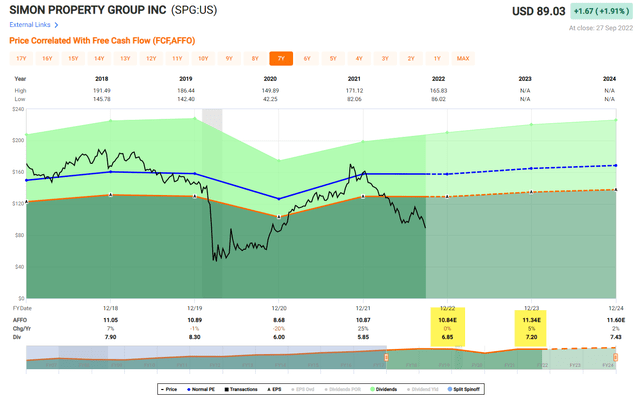

Looking at the current stock price ($89.09, 9/27/2022), they are undervalued by 23%, based on iREIT Alpha’s ratings table. Their low valuation figures (9.33x of P/AFFO and 7.46x of P/FFO) also show that their stock price is undervalued at this point.

Gen X Pick #8: Digital Realty Trust, Inc. (DLR)

Digital Realty Trust is a leading global provider for data centers. They own, acquire, develop, and operate data centers around the world. Digital Realty provides global coverage, capacity, and connectivity solutions to corporations and small businesses.

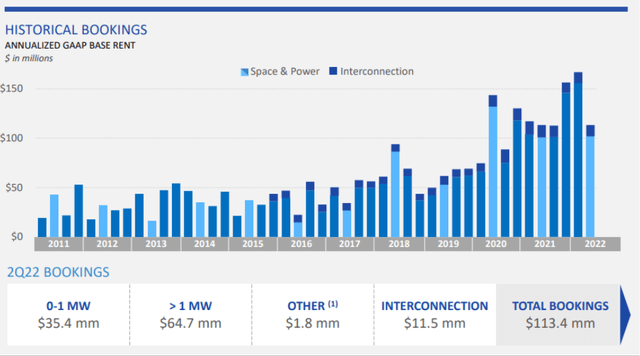

Reflecting the increasing demand for data centers, Digital Realty Trust has been growing rapidly in the past decade. Looking at the booking trend, their growth has been steady since 2011. As more and more companies leverage data to increase their sales and analyze customer habits, I expect the demand for data centers to keep increasing. Digital Realty Trust is in a prime position to take advantage of the trend.

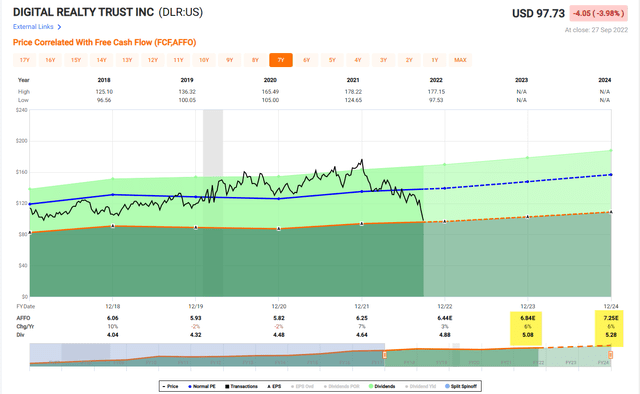

Their stock price is clearly lower than its current valuation. Their P/AFFO ratio of 15.64x and P/FFO of 14.97x are nearly 25% below historical values. The dividend yield of 4.5% is very attractive as well. The investor should take advantage of the chance to grab an undervalued stock with strong prospects.

Gen X Pick #9: American Tower Corporation (AMT)

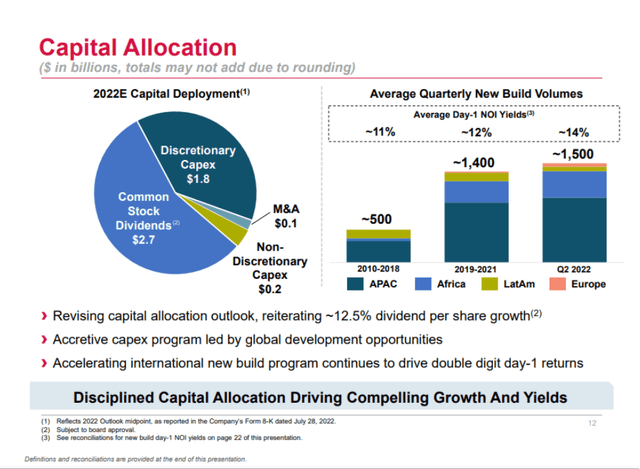

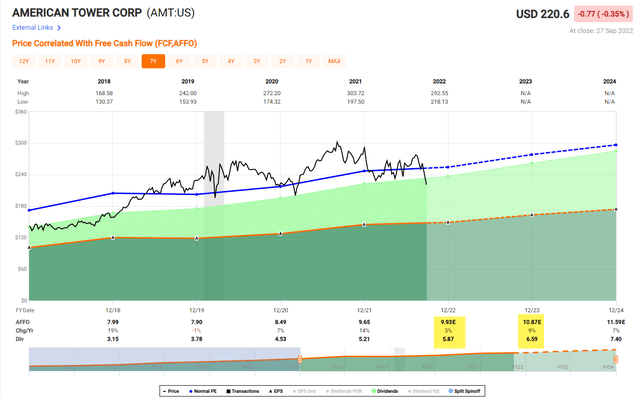

American Tower is one of the largest global REITs and primarily leases space on communication sites to wireless service providers, radio, and television broadcast companies. Since their inception, they have been doing a great job at growing their portfolio through acquisitions, long-term lease arrangements, and site development.

American Tower’s revenue has been growing at more than 10% per year for the past 5 years, and AFFO has been growing at a similar rate as well. Looking at their consistent and opportunistic capital deployment, it’s not surprising to see such growth. Their average quarterly new build volume has been consistently increasing in the past decade, and I expect the trend to continue.

With ever-increasing demand for more data and mobile advancement, I expect demand for communication sites will continue to grow. American Tower is in a great position to take advantage of that.

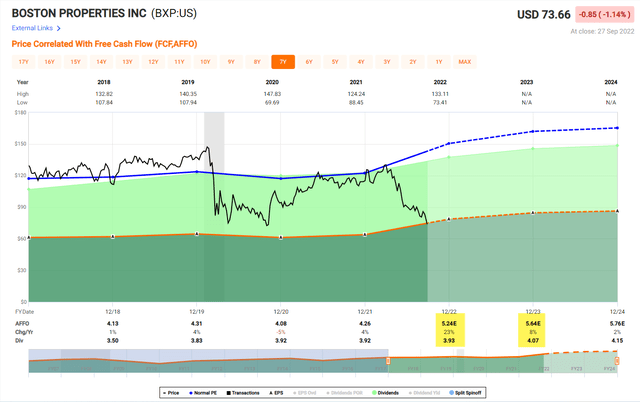

Gen X Pick #10: Boston Properties, Inc. (BXP)

Boston Properties is a REIT that develops, owns, and manages Class A office properties concentrated in six premier markets: Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, D.C. Their asset portfolio includes over 190 properties with 53.7 million square feet, making them one of the largest publicly traded office REITs.

Their business has been consistently growing (3% per year revenue growth, 5-year CAGR) following a cycle of acquiring desirable new properties, strategically disposing of a portion of assets, and redeveloping other assets. They have a solid pipeline of acquisitions and development projects in the works, so I expect the trend will continue in the future.

Based on iREIT Alpha’s price target ($100 to $120), Boston Properties’ is being traded 26% below the target range. Given their strong portfolio, solid balance sheet, and growth prospects, I believe the market is clearly making a mistake.

The current valuation also suggests that they are undervalued. The current P/FFO ratio of 11.23x and P/AFFO ratio of 17.37x are nearly 20% below the historical level. Also, this lower stock price pushed up the dividend yield above 5%, which is a huge bonus for investors.

Takeaways

As some of Gen X are already in retirement, and others are close to retirement, it’s critically important to preserve the nest egg.

With the portfolio of stocks in this article, you can expect to sleep well through the night, while collecting a nice dividend in the meantime.

Also, some of the stocks are undervalued at this point, and are presenting a great value play. Therefore, these 10 REITs provide the best of both world: stability and growth potential.

Fears about a looming recession fear may keep the stock market struggling for a while. However, it’s not all bad news.

The bear market is a great opportunity for investors to pick up shares of their favorite company at a discount!

And to be perfectly clear: I’m not actually rooting for a recession, in the sense that there will be job losses. However, the real reason I’m doubling down on the fear is to insist on focusing on high quality stocks. As I wrote in my “Cash is King” article, “now is not the time to be too cute.”

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” Warren Buffett

Be the first to comment