onurdongel

Master limited partnerships have historically been some of the favorite investments in the market for those that are seeking income. There are a few reasons for this including their generally stable cash flows, high yields, and tax advantages. However, they do have some problems such as being difficult to include in a tax-advantaged account like most retirement accounts. In addition, it can be quite difficult to put together a diversified portfolio of these assets without having access to an enormous amount of capital. One solution to both of these problems is to purchase shares of a closed-end fund that specializes in investing in the sector. These funds provide easy access to a diversified portfolio of assets that can in most cases deliver a higher yield than any of the underlying assets possesses. In this article, we will discuss the Center Coast Brookfield MLP & Energy Infrastructure Fund (NYSE:CEN), which is one fund that investors can use to add this asset class to their portfolios. Unfortunately, the distribution yield on this fund is a rather disappointing 5.05%, which is a substantial decline from the outsized levels that it had a few years ago. I have discussed this fund before but nearly three years have passed since that date so obviously a great many things have changed. This article will focus specifically on those changes and of course, provide an updated analysis of the fund’s financial performance. Therefore, let us investigate and see if this fund could be a good purchase today.

About The Fund

According to the fund’s webpage, the Center Coast Brookfield MLP & Energy Infrastructure Fund has the stated objective of providing its investors with a high level of total return. This is certainly not surprising since most infrastructure funds have the same objective. This is because infrastructure equities are total return entities by their very nature. These securities benefit from the growth of the issuing company, which should result in capital gains. In addition, most infrastructure companies and especially master limited partnerships pay out a substantial portion of their earnings as distributions to their shareholders. The reason why these companies tend to have very high yields is their low growth rates. As a result of the low growth rates, it is unlikely these companies will see their stock prices grow very quickly so they try to offset this by paying a lot of money out to the shareholders. In addition, the valuations of these firms tend to be low because of the low growth rates, resulting in high yields. We see this same dynamic across the utility sector and to a lesser degree real estate.

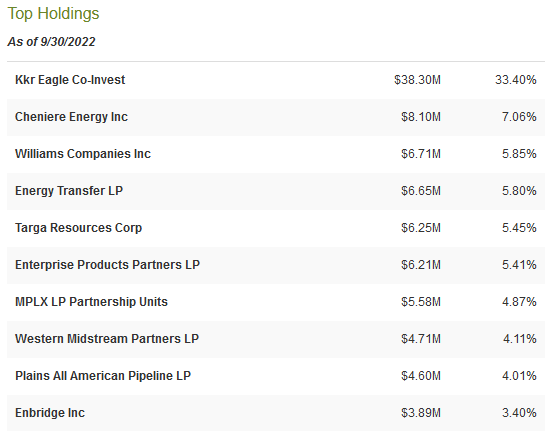

As the name of the fund implies, the fund aims to achieve its objective by investing in master limited partnerships and energy infrastructure companies. Interestingly, the fund does not state exactly how it defines an energy infrastructure company. Usually, an energy infrastructure company is a firm that transports energy from a producer to a consumer such as an electric utility and midstream company. That definition could also include shipping companies like Golar LNG (GLNG) or Teekay Tankers (TNK), but we rarely see those companies in infrastructure funds. A look at the largest positions in the fund reveals that the largest positions here are midstream companies, although there are a few other things here:

CEF Connect

As my regular readers are no doubt aware, I have devoted a great deal of time and effort toward discussing midstream companies here at Seeking Alpha over the years. As such, all of these companies should be at least somewhat familiar to most readers. In fact, the only company on this list that I have not discussed in this column is Western Midstream Partners (WES) but many of its fundamentals are the same as the other companies on this list. The most important fundamental possessed by all these companies is the stability of their cash flows. This is because of the business model that these firms use. In short, a midstream company will enter into a long-term contract with a customer for the transportation of natural gas, crude oil, or other hydrocarbon products through its infrastructure network. The customer compensates the midstream company based on the volume of resources that are transported, not on their value. This provides a great deal of insulation against changes in resource prices. The contracts in most cases specify a certain minimum volume of resources that must be transported, which provides protection against cash flow declines that might otherwise accompany a low-energy price environment that causes cutbacks in production. This overall stability is nice because it provides a great deal of support for the distributions that these companies pay out to the investors.

Many of these companies are the same as the last time that we looked at the fund, which is not surprising. There are not very many midstream companies that have sufficient size and volume to fit into a fund. With that said, Cheniere Energy (LNG) has a substantially larger position than it did the last time that we looked at the fund. This is certainly not a bad choice, though. I have pointed out in many previous articles that the future of liquefied natural gas is very strong due to countries all over the world seeking to increase their imports of the substance. Cheniere Energy is the second-largest producer of liquefied natural gas in the world and it is the largest publicly traded pure-play liquefied natural gas company globally. Thus, we can clearly see that the company is well-positioned for growth. I illustrated this in my last article on the company. Despite the company’s strong performance in the market over the last year, it still appears to be undervalued so its sizable position could position the fund’s shareholders for profits over the coming years.

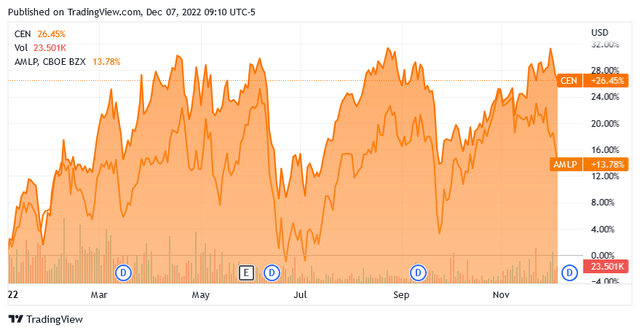

The fact that so few of the fund’s positions have changed significantly even over nearly three years makes it likely that most people would think that the fund has a remarkably low annual turnover. This is indeed the case as its 34.00% annual turnover is fairly low for an equity fund. This is nice because trading stocks or other assets costs money, which is billed to the fund’s shareholders. These added expenses create a drag on the fund’s performance and make it harder for the fund’s management to deliver a return that is acceptable to the investors. This is also one of the major reasons why most actively-managed funds fail to beat the general indices. The Center Coast Brookfield MLP & Energy Infrastructure Fund is one notable exception here though as it has significantly beaten the Alerian MLP Index (AMLP) year-to-date:

As we can see, the index has returned 13.78% year-to-date but the closed-end fund has delivered a much more impressive 26.45% gain. While the index does have a higher yield, the difference is not enough for the index to have delivered a higher total return over the period. The fact that this is also one of the few funds to have delivered a positive return this year is something that also might be appealing to many investors. The positive returns here could have easily offset poor performance elsewhere in your portfolio and while past performance is no guarantee of future returns, there are certainly some reasons to believe that the fund will continue to be a strong performer as we will see later in this article.

The most interesting thing that we see in the fund’s portfolio is its largest holding, KKR Eagle Co-Invest LP, which accounts for 33.40% of the fund’s assets. This is a private entity that cannot be purchased on any public exchange. The entity invests solely in Pembina Gas Infrastructure, Inc. but information about this entity is difficult to come by. Here is what the fund’s annual report says about it:

“As of September 30, 2022, the Fund’s largest investment, KKR Eagle Co-Invest LP, does not permit redemptions and invests solely in Pembina Gas Infrastructure, Inc., a new joint venture entity, created by combining Veresen Midstream LP and other natural gas processing assets (the “Private Investment”), represents 33.47% of the Fund’s Managed Assets. The Fund invests in the partnership through a holding company.”

It is important to note that Pembina Gas Infrastructure is not Pembina Pipeline (PBA), although the two are related. This entity appears to be a partnership with Pembina Pipeline which owns some of the assets that Pembina Pipeline acquired during the acquisition of Veresen Midstream a few years ago. As befits the notorious secrecy of KKR & Co. (KKR) though, there is no information about exactly how the ownership structure works. What we can determine though is that the fund is essentially a co-owner of some of Pembina Pipeline’s natural gas transportation and processing operations in Canada. Despite the secrecy, this should not be a problem for investors. Natural gas midstream companies are the strongest segment of the midstream industry as they generally have the best fundamentals over the next few decades and these are quality assets that the fund is invested. Overall, this position could be a real positive for investors going forward.

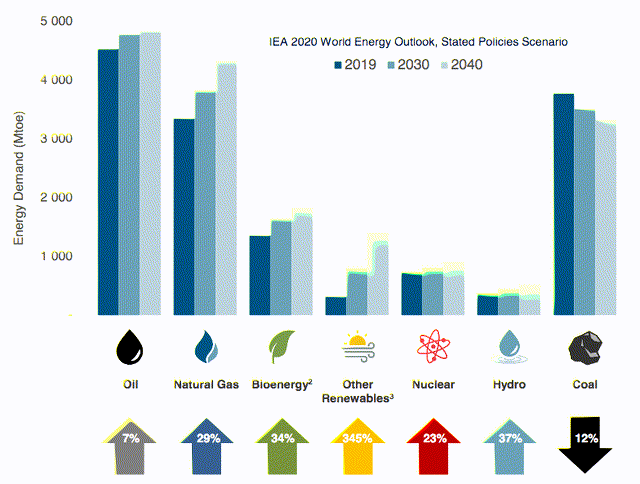

Fundamentals Of Midstream Companies

As just mentioned, the fundamentals for natural gas midstream companies are generally better than those for crude oil or other refined products. This is because the global demand for natural gas is expected to grow more than the global demand for crude oil. The fact that both of these products are expected to see demand growth at all is something that may be surprising to many investors. After all, we are seeing concerted attacks on traditional fossil fuel energy by governments, activists, and others around the world. However, according to the International Energy Agency, the global demand for natural gas will increase by 29% and the global demand for crude oil will increase by 7% over the next twenty years:

Pembina Pipeline/Data from IEA 2020 World Energy Outlook

Perhaps surprisingly, the demand growth for natural gas is being driven by concerns about climate change. As everyone reading this is no doubt well aware, these concerns have induced governments and other entities around the world to impose a variety of policies that are intended to reduce the carbon emissions of their respective nations. One common policy is to use various methods to encourage utilities to retire old coal-fired power plants and replace them with renewable energy sources, usually wind and solar. Unfortunately, wind and solar have a major problem with reliability. After all, wind power cannot generate electricity when the air is still and solar power does not work when the sun is not shining. A common solution to this problem is to supplement wind and solar generation facilities with natural gas turbines. This is because natural gas burns cleaner than any other fossil fuel and has the reliability to ensure the maintenance of the performance that we have come to expect from the modern electrical grid.

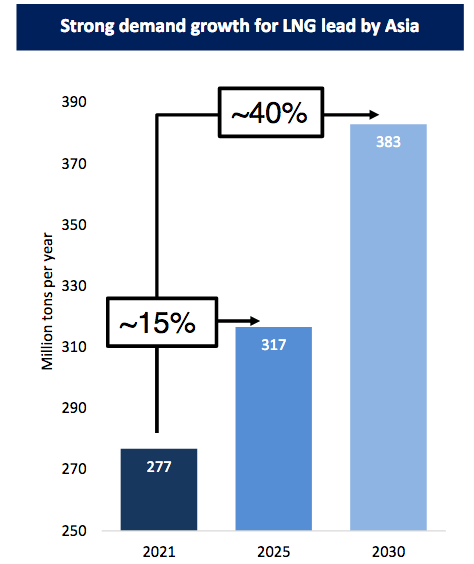

This growing demand for natural gas is causing a surge in the demand for liquefied natural gas. This is because natural gas will expand to fill any container that it is placed in natively. Thus, it needs to be converted into a liquid and shipped in specially designed vessels in order to be moved across large bodies of water, such as oceans. Between now and 2030, the demand for liquefied natural gas in Asia alone is expected to increase by 40%:

Golar LNG

We are also seeing rising demand from the European Union as the region attempts to reduce its reliance on Russian natural gas. This will clearly benefit companies like Cheniere Energy as they will be able to sell more products. It will also benefit natural gas midstream companies despite the fact that they do not produce natural gas. This is because someone will need to transport natural gas from the fields where it is produced to the various liquefaction plants and other users. This is exactly the business that midstream companies are in and, as we already discussed, midstream companies’ cash flows are directly correlated with volumes. As such, we should see rising cash flows across the midstream sector going forward, which should push up their share prices and distributions. This will benefit the holders of the Center Coast Brookfield MLP & Energy Infrastructure Fund.

Distribution Analysis

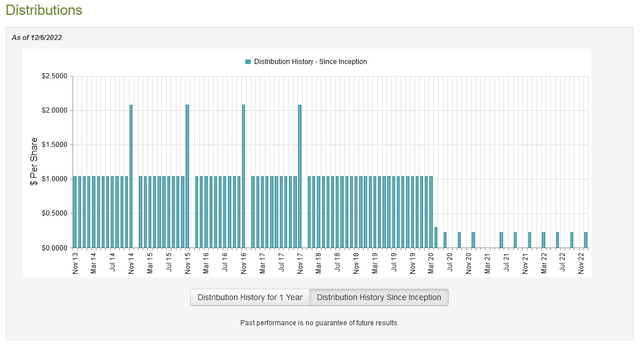

As mentioned in the introduction, midstream companies tend to have some of the highest yields available in the market. The fund invests in a portfolio of these companies so we can assume that it also likely has a high yield. This is certainly true as the fund pays a quarterly distribution of $0.2250 per share ($0.90 per share annually), which gives the fund a 5.05% yield at the current price. This is nowhere near as high as many other midstream closed-end funds yield but it is still quite a bit better than the 1.57% yield of the S&P 500 index (SPY). In addition to having a lower yield than peer funds, potential investors may also be turned off by the fund’s rather disappointing distribution history:

We see that the fund was fairly consistent with its distribution until 2020 when it cut twice. The fund’s distribution has been stable since that time, however. This is certainly not something that is unique to this fund as most midstream funds cut their distributions back in 2020. This is because the events of that year resulted in a great deal of uncertainty across the industry, prompting many midstream firms to cut their distributions and fortify their balance sheets. As the fund’s income decreased, as a result, the fund naturally had to cut its payouts to preserve its own capital. The fund’s past is not necessarily the most important thing for investors today though. This is because anyone purchasing the fund’s shares today will receive the current distribution at the current yield so the most important thing is the fund’s ability to maintain its current distribution.

Fortunately, we do have a very recent document that we can consult for this purpose. The fund’s most recent financial report (linked above) corresponds to the full-year period ending September 30, 2022. As such, it will give a pretty good idea of how well the fund performed during the fairly strong market for energy companies this year. During the full-year period, the fund received a total of $10,952,181 in dividends and distributions and another $22,532 in interest from the assets in its portfolio. Of these dividends and distributions, $3,044,625 is considered to be a return of capital and is thus not considered income to the fund. This gives the fund a total income of $7,930,088 during the period. It paid its expenses out of this amount, leaving it with $5,674,682 available for investors. This was more than enough to cover the $4,436,951 that the fund actually paid out during the period. As midstream companies tend to have reasonably stable cash flows and by extension distributions, we can assume that this distribution is almost certainly safe. The fund may even be able to increase it a bit in order to pass on the return of distributions that it received as well as its $5,869,944 net realized capital gains.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Center Coast Brookfield MLP & Energy Infrastructure Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the fund’s net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of December 6, 2022 (the most recent date for which data is available as of the time of writing), the Center Coast Brookfield MLP & Energy Infrastructure Fund had a net asset value of $21.65 per share but it only trades for $17.88 per share. This gives the shares a 17.41% discount to net asset value at the current price. This is a fairly substantial discount but it is nowhere near as attractive as the 19.18% discount that the shares have had on average over the past month. Although it may be possible to wait for a more attractive price, the current discount is such a good deal that it makes sense to buy today.

Conclusion

In conclusion, the Center Coast Brookfield MLP & Energy Infrastructure Fund looks like a very good way to invest in the midstream sector right now. The fund offers stellar year-to-date performance, a respectable yield, and exposure to the growing demand for natural gas. The fund also looks likely to raise its distribution in the near future. When we combine this all with an incredibly attractive purchase, this fund makes a lot of sense today.

Be the first to comment