Bruce Bennett

Generally speaking, I tend to stay away from companies in the retail space. I don’t like the highly competitive nature of this market and the low margins that often result from selling commoditized products. But one firm that I have been a fan of in recent years is Village Super Market (NASDAQ:VLGEA), a fairly small retailer that owns a portfolio of properties under the ShopRite, Fairway Markets, and Gourmet Garage brand names. According to the most recent data available, the company continues to grow nicely, with sales and profits rising even during these uncertain times. Compared to similar firms, the company looks to be trading on the cheap, plus it is cheap on an absolute basis as well. Given these data points, I do still believe that the company warrants a solid ‘buy’ rating despite seeing its share price rise relative to the broader market in recent months.

A great price

Back in June of this year, I wrote a follow-up article about Village Super Market to determine whether or not the company made for an attractive long-term prospect. In that article, I talked about how well the company had performed during what has already been a difficult year for companies across pretty much any industry. Even though shares had risen since my December 2021 article, I felt as though further upside was warranted. This led me to reiterate my ‘buy’ rating on the stock. Since then, things have gone pretty well. While the S&P 500 is up only 0.9%, shares of Village Super Market have generated upside of 5.1%. Relative to my December 2021 article, the picture is even more in favor of Village Super Market, with shares generating a return of 9% compared to the 13.5% decline the broader market has experienced.

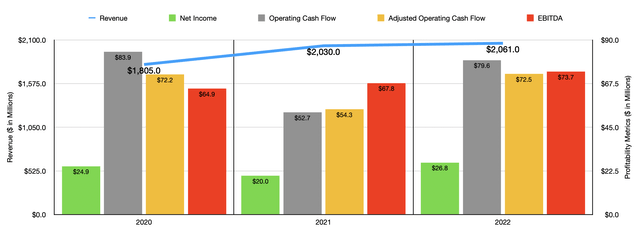

Author – SEC EDGAR Data

This return disparity has not been a fluke. To see what I mean, I would like to point you to the financial results covering the entirety of the company’s 2022 fiscal year. During that year, sales came in at $2.06 billion. That represents an increase of 1.5% over the $2.03 billion the company generated only one year earlier. In addition to benefiting from a 4.1% increase in same-store sales, the company also saw the number of stores in its portfolio increase from 37 to 38. With its rise in revenue, we also saw profitability improve. Net income increased from $20 million in 2021 to $26.8 million in 2022. In addition to this, operating cash flow rose nicely, climbing from $52.1 million to $79.6 million. If we adjust for changes in working capital, it would have gone from $54.3 million to $72.5 million. And over that same window of time, EBITDA increased from $67.8 million to $73.7 million.

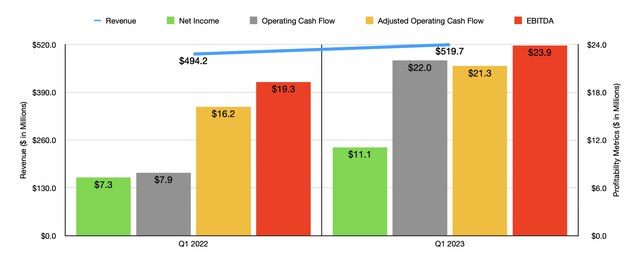

Since I last wrote about the company, it has also provided data for the first quarter of its 2023 fiscal year. The data there is just as encouraging, if not more so, than the data for 2022 as a whole. Revenue of $519.7 million translated to a 5.2% increase over the $494.2 million reported the same time last year. For the most part, a 4.3% increase in same-store sales aided on this front. It’s also great that profitability has followed sales higher. Net income of $11.1 million dwarfs the $7.3 million in profits generated the same time one year earlier. Operating cash flow fared even better, spiking from $7.9 million to $22 million. If we adjust for changes in working capital, it would have risen more modestly from $16.2 million to $21.3 million. And over that same window of time, EBITDA for the company increased from $19.3 million to $23.9 million.

Author – SEC EDGAR Data

When it comes to the 2023 fiscal year in its entirety, management has provided a bit of guidance. While they did not provide any meaningful data involving profitability, they did say that same-store sales should grow by between 1% and 3%. They should also benefit from continued investment in their stores, with two major remodels and three replacement stores planned, as well as other activities. No real guidance was given when it came to profitability metrics. But if we annualize results seen so far, we would anticipate net income of $40.8 million, adjusted operating cash flow of $95.3 million, and EBITDA of $91.3 million.

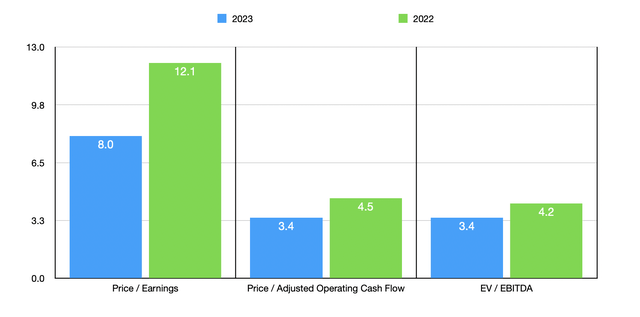

Author – SEC EDGAR Data

Using these figures, I calculated that the company is trading at a forward price-to-earnings multiple of 8. The forward price to adjusted operating cash flow multiple would be considerably lower at 3.4, while the EV to EBITDA multiple would come in at 3.4 as well. For context, if we were to use the data from the 2022 fiscal year, these multiples would be 12.1, 4.5, and 4.2, respectively. By pretty much every benchmark, these would be considered low multiples that place the company firmly in value territory. But of course, we should also value the company next to similar firms. In this case, I picked five companies in the retail space. And then I compared 2022 data from Village Super Market to their own figures. On a price-to-earnings basis, these companies ranged from a low of 10.3 to a high of 51.1. And when it comes to the EV to EBITDA approach, the range was from 3.8 to 19.3. In both cases, only one of the five companies was cheaper than our prospect. Meanwhile, using the price to operating cash flow approach, the range was from 5.5 to 17.4. In this case, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Village Super Market | 12.1 | 4.5 | 4.2 |

| Natural Grocers by Vitamin Cottage (NGVC) | 10.3 | 5.5 | 3.8 |

| The Kroger Co. (KR) | 14.7 | 7.3 | 6.3 |

| Grocery Outlet Holding Corp. (GO) | 51.1 | 17.4 | 19.3 |

| Sprouts Farmers Market (SFM) | 14.7 | 10.0 | 6.0 |

| Casey’s General Stores (CASY) | 24.7 | 11.2 | 11.7 |

Takeaway

With all the data we have in front of us, I do think that Village Super Market continues to fare well, and I suspect that this trend will continue for the foreseeable future. Of course, economic conditions could impact the company negatively in the near term if the state of the economy worsens considerably. But given the company’s historical track record and how cheap shares are today, not to mention the fact that cash exceeds debt to the tune of $12.6 million, granting the company tremendous flexibility, I do think it still makes for a solid ‘buy’ at this time.

Be the first to comment