DjordjeDjurdjevic/E+ via Getty Images

Investment Thesis

Celsius Holdings (NASDAQ:CELH) is a functional energy drinks company that has seen phenomenal growth over the past few years, with a primarily natural product that appeals to an ever more health-conscious consumer. Management has continually thumped analysts’ expectations, however, this is a company priced for further hypergrowth with a future that is unlikely to be plain sailing.

But does that make Celsius Holdings a good investment right now? I put it through my investing framework to find out.

Business Overview

Celsius is a fast-growing company specialising in functional energy drinks, with a broad portfolio of products offering clinically proven, innovative formulas that aim to embody a healthy lifestyle & help customers live a fit and active life. It has a number of different Celsius-branded product ranges, including Essential Energy, Sweetened with Stevia, and Heat just to name a few. It also acquired Func Food in October 2019, a supplier of beverages, protein bars, supplements and superfoods in the Nordic markets.

Celsius May 2022 Investor Presentation

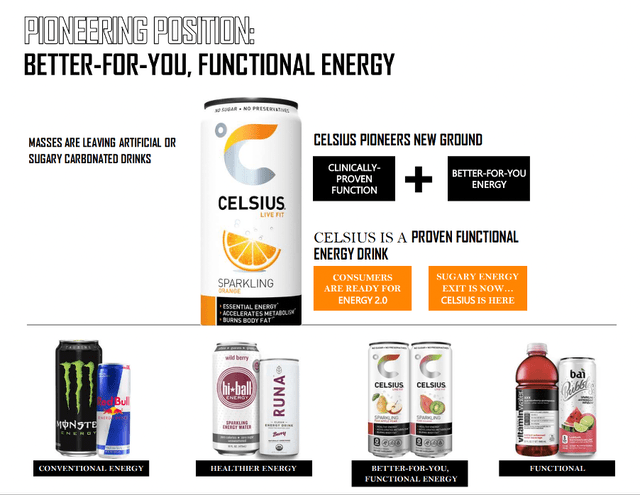

The core product ranges include pre- and post-workout functional energy drinks, but I guess the question is ‘what makes them functional?’.

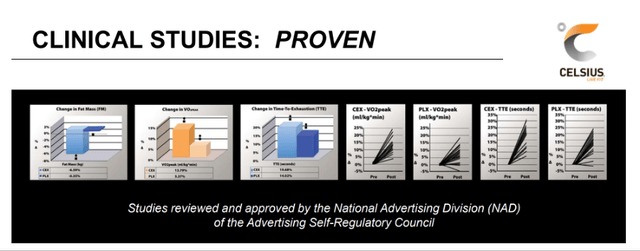

The core Celsius energy drink has been clinically proven to deliver health benefits by six self-funded studies published in various journals, which conclude that a single serving of Celsius burns 100-140 calories by increase a consumer’s resting metabolism by an average of 12%, while providing sustained energy for up to 3 hours.

The company also has a focus on trying to keep its products as natural as possible. Celsius’ proprietary MetaPlus formulation has been proven to accelerate metabolism and fat burn when combined with exercise, yet the ingredients within this formula are pretty natural: a blend of ginger root, guarana seed extract, chromium, vitamins, and green tea extract.

Celsius 2018 Investor Presentation

In terms of operations, Celsius manages the development, processing, marketing, sale, and distribution of its drinks. The products themselves are produced by third party beverage co-packers, which is a manufacturing plant that provides the service of filling bottles or cans for the brand owner. The ingredients and packaging materials themselves are purchased by Celsius, with the co-packing facility assembling the goods and charging a fee by the case. Whilst this gives Celsius a bit less control over its supply chain, it has enabled the company to focus on brand development and increase flexibility over its production facilities by not having to build a new plant wherever it wishes to expand.

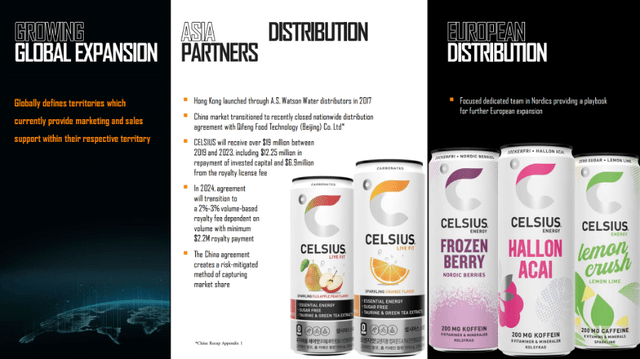

Celsius is sold throughout the US in multiple channels, including supermarkets, drug stores, convenience stores, nutritional stores, and mass merchants, as well as health clubs, spas, gyms, the military, and e-commerce websites – in fact, Celsius is the second largest energy drink by sales on Amazon (AMZN), with an 18.23% share of the category, only trailing Monster (MNST). It also has distribution plans globally, including a nationwide distribution agreement with Qifeng Food Technology in the China market.

Celsius May 2022 Investor Presentation

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

One economic moat possessed by Celsius is a form of counter-positioning combined with intellectual property, and I think this is the moat that gives it an advantage over the big players like Monster and Red Bull. The MetaPlus formulation (which has been clinically proven to accelerate metabolism & fat burn) is maintained as a trade secret, with no single member of the raw material supply chain or co-packers having access to the complete formula, apart from a company that is Celsius’ outsourced production manager. This means that if any company such as Monster or Red Bull want to create a similar product, they will have to come up with the formulation themselves – and then go through years of clinical research in order to prove the health benefits.

In addition, if we’re being honest, energy drinks aren’t easy to market as ‘healthy’. Red Bull and Monster don’t have a particularly health-conscious side to their brand, and there is a risk that venturing into creating a healthier energy drink could cannibalise sales of their existing products. Yet consumers are becoming more heath conscious, so perhaps this is a decision that they will have to make sooner rather than later – but if they do decide to pivot into healthier products, they will have to put in a lot of work to catch up with Celsius.

Celsius May 2022 Investor Presentation

I will also give the company some credit for its brand, as has been demonstrated in the company’s rapid growth & market share expansion over the past few years. In fact, on the Q1’22 earnings call, CEO John Fieldly highlighted the following data:

According to the trailing 4-week IRI MULO data as of April 17, 2022, Celsius is the number one brand driver of growth in the energy category compared to 2021. For the last 4-week dataset, the energy category grew $101 million. In that period, Celsius added $38 million of the growth accounting for 38% of the total. This is dollar share growth, eclipsing Monster by 1.4x, Alani Nu by 2.2x, Red Bull by 2.5x, Ghost by 3x and C4 by 4x.

During this period, Celsius increased to a $4.1 share and surpassed Rockstar for the number four position in the energy category. This growth has been driven across all channels, including those non-tracked with the two newest channels of club and the vending foodservice channels leading on a percentage growth metric and driving an incremental $25.2 million in revenue for the two channels alone compared to 2021 first quarter.

Not only has Celsius become the 4th largest player by market share, but it has done so whilst accounting for 38% of the total growth within the energy drink market over the 4-week period leading up to April 2022. So Celsius is both taking market share from competitors whilst successfully growing the overall energy drink market itself by appealing to broader audiences. In the same call, Fieldly highlighted:

And what we are seeing in our key customers is we are not cannibalizing the sales of other leading players. So, what – we are incremental. And when you look at the category growth, we brought in over that time period contributed about 38% of the growth during that period. So, we are bringing in a new consumer into the energy category. We are helping the category further expand. Our demo has been 50-50, male-female. So, very much incremental to the category. There is some cannibalization slightly that you are seeing. But the majority of it is all new to category is what we are really seeing with some of our data.

Again, this plays into the brand moat, and also the counter-positioning; Celsius is bringing in a new type of consumer, who previously would not have considered purchasing energy drinks – this is extremely impressive.

Leading on from this point, I would also give Celsius credit for switching costs. In creating this new category of functional energy drinks & by bringing in a new type of consumer, the number of alternative drinks to Celsius reduces. These new consumers who drink Celsius do so because of everything it offers (energy, metabolism acceleration, fat burn), and there is no real replacement – hence, high switching costs in a retail market that is generally famed for the opposite.

I was personally amazed by the number of economic moats that I could see within this business. Normally I’d expect brand & that’s about it, but Celsius has shown itself to be a powerful, category defining company.

Outlook

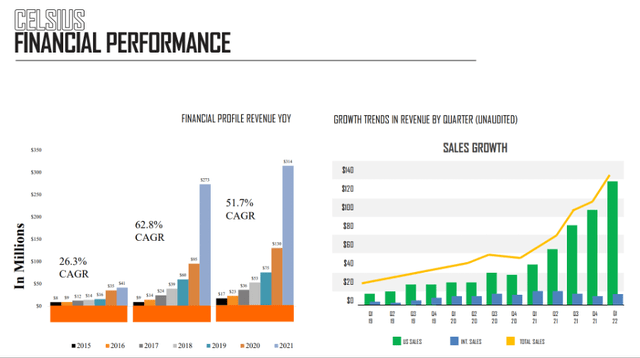

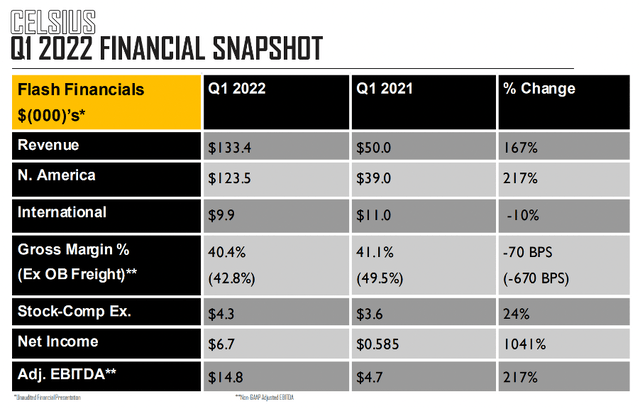

This company has been growing, and growing fast. A quick snapshot of its recent financial performance boggles my mind.

Celsius May 2022 Investor Presentation

But what is the outlook for this market as a whole? According to Investopedia, the global energy drink market is expected to grow from $53.1 billion in 2022 to $86.1 billion by 2027, representing a 7.1% CAGR over this period. Unsurprisingly, one of the most substantial trends changing the market is the shift to a more health-conscious consumer. According to Mordor Intelligence:

The manufacturers of energy drinks are focusing on expanding their product lines by introducing new flavors to encourage frequent consumption. Moreover, the increasing functionality of new age beverages to target health-conscious consumers is emerging as a trend among manufacturers. Companies are focusing on functionalities, such as nutrition, energy, muscle relaxation, alertness, virility, and potency, to make their products multifunctional and attract consumers, primarily for daily consumption.

Sounds pretty perfect for a company like Celsius to come in and take the market by storm, as it has done. But Celsius’ revenue of $398m over the past 12 months represents ~0.7% of the current $53.1 billion global market – so despite its incredible growth over the last few years, Celsius still has a huge opportunity ahead with tailwinds in its favour.

Management

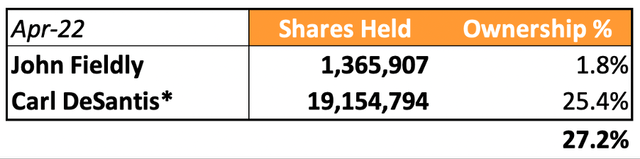

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. Unfortunately, we don’t have this with Celsius, a company founded in April 2004 & that has been successfully led by CEO John Fieldly since April 2018, although he was CFO for the 6 years prior. Whilst I struggle to find much detail on the founders themselves, a 2007 investment from entrepreneur Carl DeSantis helped to boost Celsius’ business, and he remains a principal shareholder & his son Damon sits on the Board of Directors.

I want to invest in companies where leadership has skin-in-the-game, and in truth I’m not too sure if I should give Celsius credit for this. Ownership of 1.8% for the CEO is low, but it’s actually fairly high for a non-founder led business – plus, there is the son of Carl DeSantis sitting on the board, and he will be eager to see that Celsius share price grow due to his family’s ~25% stake. It’s tough to judge, but I think there’s enough alignment of incentives between management and shareholders to make me happy.

Celsius 2022 Proxy Statement / Excel

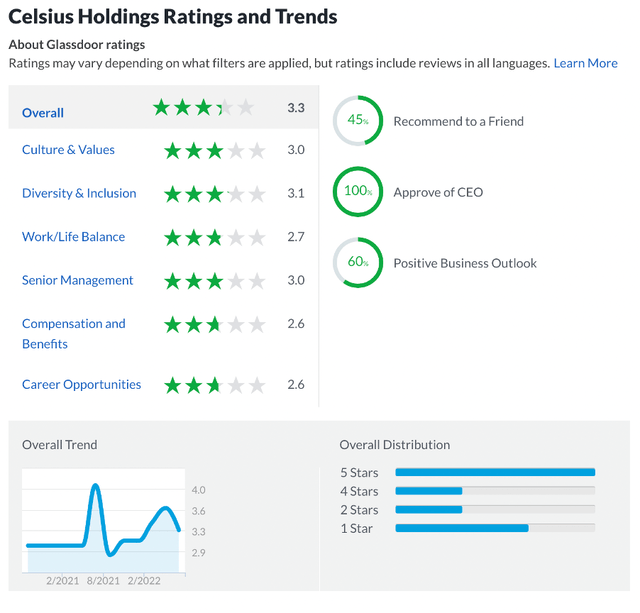

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, but this isn’t really possible for Celsius. It has some terrible scores, but it also only has eight reviews – so, there is nothing here that is useful as a gauge for the company’s culture.

Financials

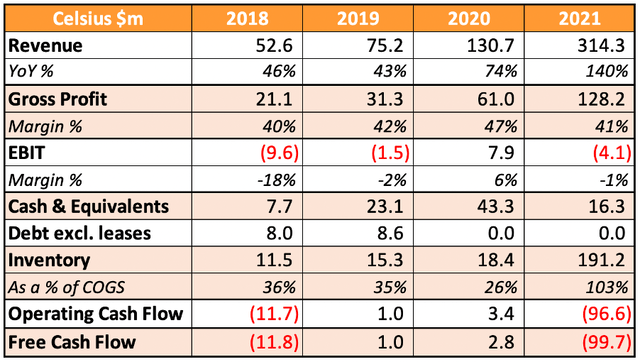

The standout feature in Celsius’ financial statements is its revenue growth. From 2018 through to 2021, the company grew revenues at an incredible 81% CAGR, from $52.6m to $314.3m. Perhaps more impressive is the fact that revenue growth actually accelerated substantially in 2020 and even more so in 2021, achieving 140% YoY growth. This momentum continued into Q1’22, with mind-boggling revenue growth of ~167% YoY.

Gross profit margins have been particularly squeezed in 2021 for all the reasons that you can probably guess; supply chain problems and increasing logistics costs. Gross margins were negatively impacted by an increase in costs for imported cans, higher raw material costs, ocean freights and transportation costs and repacking costs.

Perhaps the biggest surprise in these 2021 financials would be the sudden drop in operating cash flows, but this mainly relates to Celsius increasing its 2021 inventory substantially – and I mean substantially! Without this significant increase in inventory, cash flow from operations from 2021 would’ve totalled ~$84.3m according to management. The increase in inventory levels were due to management anticipating increased demand, potential supply chain inefficiencies and inconsistencies, and to support the company’s new six-orbit warehouse model. This inventory level did come down from $191m to $184m in Q1’22, but it remains high.

Yet I wouldn’t feel too concerned yet about inventory; these products have a long shelf life of 15-18 months, and the company has been growing exponentially & wouldn’t want to run the risk of rejecting orders on the basis of low stock. Plus, this company has zero debt, and would be very much free cash flow positive without this bump up in inventory, so I think investors can continue to sleep easily at night for now.

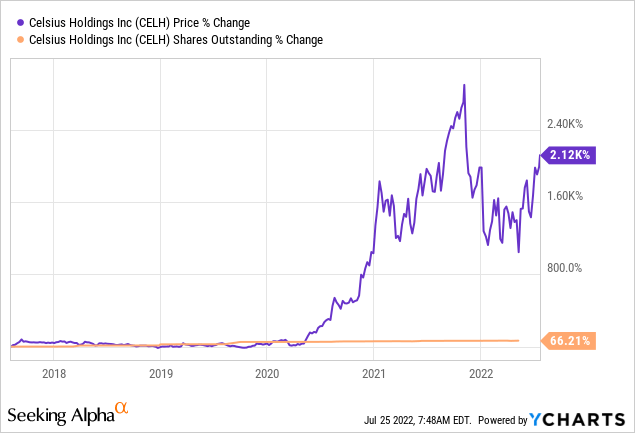

I’ll also highlight that shares outstanding have increased by 66% over the past five years. I’m not surprised; the company’s share price has gone through the roof, so I think it makes sense for management to take advantage of that. Yet I doubt shareholders are complaining, since the value of their shares have increased by over 2,100% despite this dilution. If the company continues to deliver for shareholders & continues to execute on its strategy, I don’t mind the dilution to help boost its growth.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Celsius is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

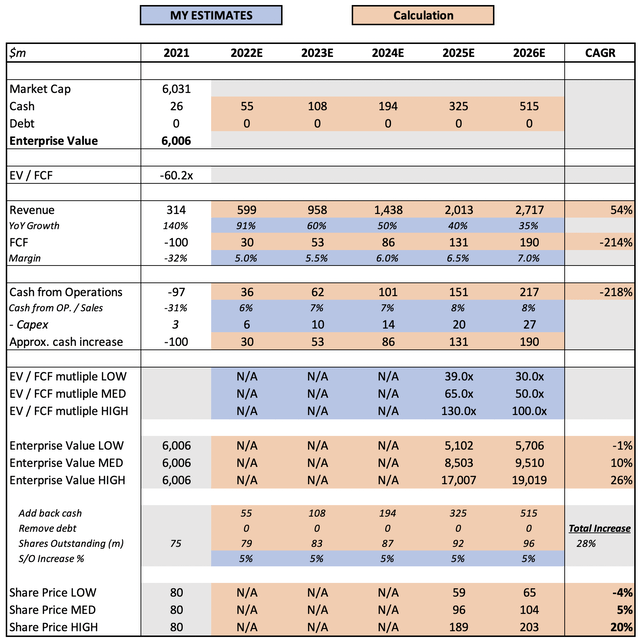

Unfortunately, management doesn’t provide much guidance for this company. As such, I have assumed substantial revenue growth of a 54% CAGR through to 2026, although I have conservatively assumed a slowdown over the time period. I have also assumed gradual margin expansion as the company continues to scale, and I assume that shareholders will continue to get diluted in order to help fund Celsius’ hyper growth. I also have used what I believe to be appropriate EV / FCF multiples for a company of Celsius’ growth profile.

Put all that together, and I can see Celsius shares achieving a 5% CAGR through to 2026 in my mid-range scenario.

Risks

When it comes to this company, there are a bunch of risks.

I think the first risk that comes to mind when you look at a business like this, which has experienced rapid growth for a consumer product, is the risk that it could be a fad. History is littered with products that soared in popularity for a period of time, only to come crashing down – is there a risk that Celsius could fall into this category? Absolutely.

But do I think it will? No, I don’t. This is a company that is riding quite a few tailwinds which are going nowhere, primarily the more health-conscious consumer that will appreciate all the benefits that come with Celsius’ products. So perhaps the greater risk is a slowdown in growth, and this is more difficult to predict for a company with triple-digital, accelerating growth rates.

Another risk is competition from the likes of Monster, Red Bull, PepsiCo (PEP) and Coca-Cola (KO). All huge companies with deep pockets & the ability to funnel funds into R&D, which could result in a drink that appeals even more than Celsius to the health-conscious consumer. Right now, it feels like Celsius doesn’t have much competition in its specific, growing segment of the market, but that could all change in the future.

There is also risk in its international expansion, and we can already see examples of how Celsius has failed to grow internationally at even half the levels it has reached in the US. As we can see below, despite revenue in North America growing by 217% YoY in Q1’22, revenue in the International segment actually fell by 10%. Brands like Monster and Red Bull are global, so if Celsius wants to be mentioned in the same breath, it must improve substantially on this international performance.

Celsius May 2022 Investor Presentation

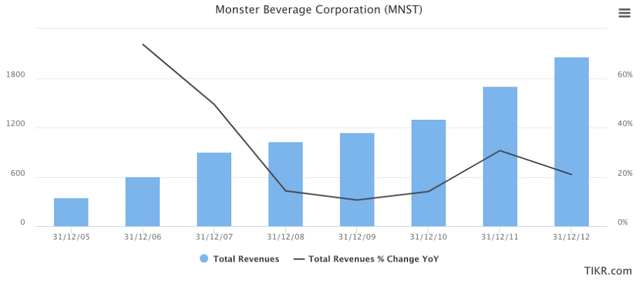

There is also the risk of a recession. Whilst I do feel that this product is fairly recession resistant, it may not necessarily be recession proof – particularly the sales through health clubs, gyms, and so on. The best proxy would probably be Monster Beverage, which saw a slowdown in revenue growth throughout the financial crisis in 2008/09, before recovering in 2010/11.

Summary

This is a difficult analysis to conclude on. Clearly there is a lot to like about this business, and I believe it has a number of enviable strengths that many industry peers would be jealous of.

Yet it’s priced for insane growth and has a substantial number of risks ahead of it – but, it has achieved insane growth thus far, all whilst navigating the majority of these risks apart from its poor performance internationally.

Taking everything into consideration, I would place a tentative buy rating on Celsius. If I were to add this company to my portfolio, it would only be a small starter position. I think investors will see substantial share price fluctuations, particularly if growth starts to slow down. On the flip side, I do think Celsius can greatly exceed the assumptions made in my valuation model & ride the tailwinds that are pushing it forward.

The appeal of this investment is huge, but I would certainly urge caution. This is a high-quality business with a bright future ahead, and one that I want in my portfolio, but it is not a screaming buy right now.

Be the first to comment