J. Michael Jones/iStock Editorial via Getty Images

Introduction

It’s been a while since I wrote about Synchrony Financial (NYSE:SYF), so a little review of operations is in order before I explain why the company’s valuation of 6.2 times earnings is a good value and not a value trap. Synchrony is a consumer lender through credit cards and installment loans across a diverse set of sectors from home improvement and auto repair to medical, dental, and veterinary care, to power sports equipment just to name a few.

Synchrony partners with retailers and providers in these sectors to offer credit cards and financing programs. The company earns higher rates of interest this way compared to general purpose credit cards but is also subject to higher costs from loyalty programs and retailer share arrangements. These loans are also subject to higher default risk than general purpose credit cards, but Synchrony has historically earned attractive returns even after these costs and charge-offs. Synchrony has been diversifying its portfolio with about 1/4 of the loan receivables now on dual or co-branded cards that can be used anywhere. Still, the majority of the loan portfolio is based on traditional store credit accounts.

The market always seems to have a reason to value Synchrony at a mid-single digit P/E in spite of a safe and steady business. During the pandemic, there were worries about widespread customer defaults, which quickly turned out to be unfounded thanks to government stimulus programs. Then, the stimulus programs themselves created concerns about consumers paying off their cards and buying new purchases with cash rather than credit. Now, there are worries about inflation or an upcoming recession cramping consumer spending. Through all this, the market was also worried about loss of big partner accounts like Walmart (WMT) and Gap (GPS) despite the company forming new partnerships with the likes of Verizon (VZ) and PayPal (PYPL).

While loan receivables value has had its ups and downs over the last few years, the consumer has been more resilient than expected. Synchrony has been able to return cash to shareholders through dividends but mostly massive buybacks. The share count has declined from around 800 million shares in 2017 to a little over 500 million today to around 450 by mid-2023 based on the current buyback authorization. This grows EPS and book value per share even without big net income growth. Based on company guidance in the 1Q 2022 earnings call and presentation, my estimate of Synchrony’s 2022 EPS is $6.40 per share, making the stock a buy at a P/E of only 6.2 times.

The Worries Are Unfounded

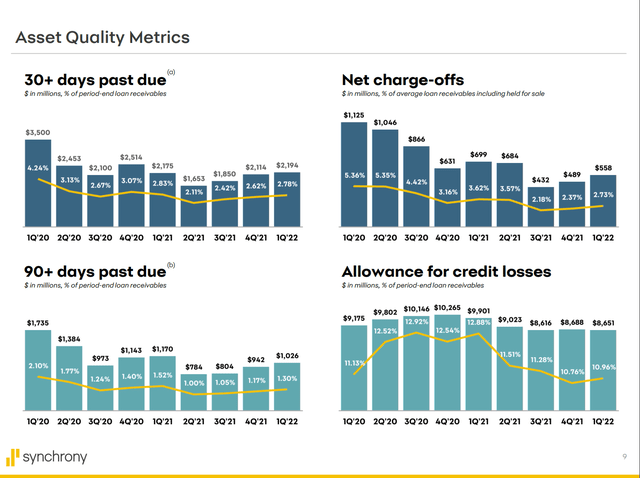

The credit quality of Synchrony’s loans has been a worry which never materialized. Looking at the chart below, the 1Q 2020 delinquency and charge-off metrics are fairly typical of the bank’s loans pre-pandemic. At that time, everyone was concerned about consumers not paying their bills, causing the bank to make large increases in its provision for credit losses. As government stimulus programs were rolled out, consumers not only paid their accounts on time, but many paid them off completely. As a result, Synchrony released a large amount of loan loss reserves in 2021 and now reserves are stable around 10%-11% of loan receivables.

While the delinquencies and charge-offs may have bottomed in mid-2021, the slow climb since then leaves them well below pre-pandemic levels. Synchrony now expects charge-offs to average 3.5% of loans this year and not reach their mid-cycle expectation of 5.5% until mid-2024. This outlook is based on macro assumptions of continued low unemployment. Inflation does not seem to be negatively impacting the consumer due to their higher level of savings coming into this period. If anything, inflation is increasing purchase volume in some categories like gasoline and apparel.

The customer is really starting at a point of strength. They absolutely have excess liquidity, and we demonstrated that or at least indicated that with higher savings rates. Our credit delinquency and how it sits today, average balances, all are in great shape when they have it, and you have low unemployment. So we look at the customer today. When you look at purchase behavior pattern, we see small evidences of inflation inside of our book, but not really significant.

Source: CEO Brian Wenzel, Synchrony 1Q 2022 Earnings Call

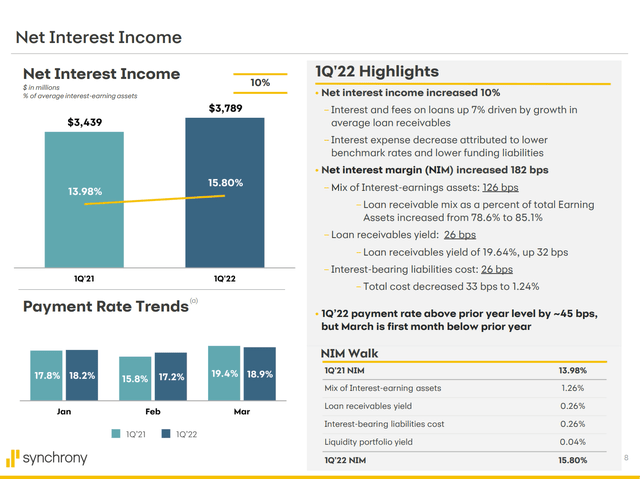

One downside of a stronger consumer for Synchrony is that they tend to pay off their cards sooner resulting in lower loan balances outstanding. This was an issue in 2021 as I wrote in some of my previous articles. As of March 2022 however, customers are finally starting to pay less of their balance compared to last year. The growing loan receivables balance helps net interest margin even if rates on deposits and loans move up in parallel. Simply the higher percentage of loans relative to cash within interest earning assets makes a significant difference.

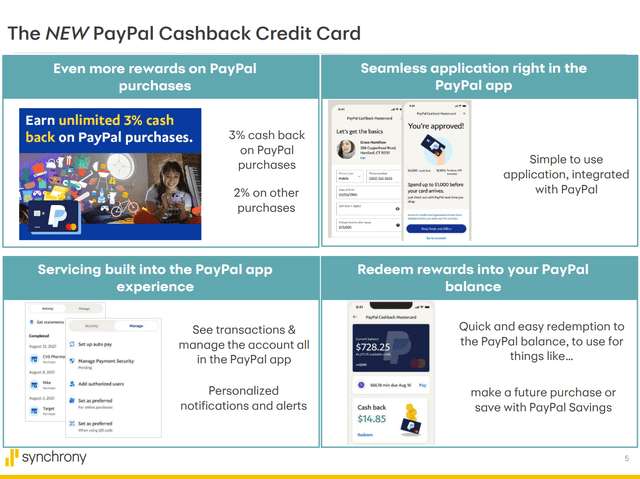

The churn in some of Synchrony’s major partnerships has also been a worry in the past few years, starting with the loss of the Walmart card in 2019. Currently, the bank also has two major card portfolios held for sale which are expected to be off the balance sheet by the end of the year: Gap and BP (BP), totaling about $4 billion of loan receivables. I do not see this as a big negative because it means Synchrony is being disciplined about not renewing partnerships where costs for retailer share arrangements and loyalty programs become too high. Synchrony has signed up many new retail partners, two of the most significant being Verizon and PayPal. The PayPal card recently launched, and in addition to the loan portfolio it provides, also gives Synchrony more experience building the app-based interface desired by younger consumers.

With growing purchase volumes from continued consumer strength and new card partnerships, Synchrony expects to grow loan receivables by 10% this year. Given modest increases in charge-offs and operating costs, Synchrony should be able to return $3.05 billion of capital via buybacks by 2Q 2023 as stated in the earnings release. That is enough to retire about 77 million shares, or about 15% of shares currently outstanding. That would be after already retiring about 75 million shares in the last 4 quarters.

For those who like dividend growth, that has been more modest, and is only going up by $0.01 per share to $0.23 quarterly starting in 3Q 2022. That represents a dividend yield of around 2.3%.

Putting The Numbers Together

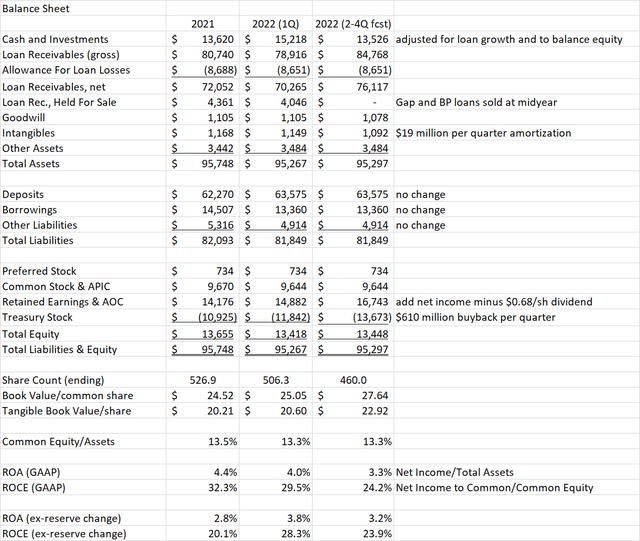

Those who have read my earlier Synchrony articles will be familiar with my financial model for the company. Starting with the balance sheet, I am assuming Synchrony can grow loan receivables by 10% in 2021 not including assets held for sale. The bank will remain well-capitalized with Common Equity / Assets at 13.3%, in line with current levels. Equity increases by retained earnings, which is net income minus dividends, and buybacks this year are $1.83 billion, or 60% of the $3.05 billion planned by 2Q 2023. The resulting book value per share increases from $24.52 at the end of 1Q 2022 to $27.64/share at the end of 2022. Return on assets and Return on common equity are still attractive at 3.3% and 24.2% by the end of 2022, but down from current levels as loan loss provisions return to a more normal run rate. Excluding the change in reserves, ROA and ROCE would improve from 2021 levels.

Author Spreadsheet (Data Source: Synchrony Earnings Release and Guidance)

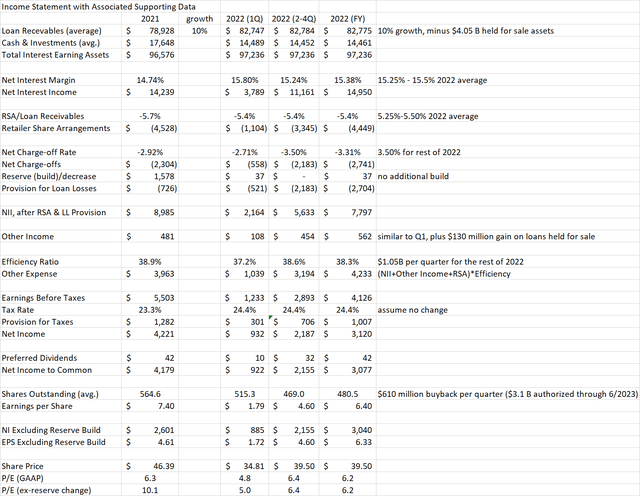

On the income statement, I am using company guidance of 15.25%-15.50% net interest margin on the loan receivables mentioned above. The bank also provided the guidance of 5.25%-5.50% retailer share arrangement costs and 3.5% charge-offs as a percent of loans, and $1.05 billion per quarter of operating expenses. Buybacks are as described above, resulting in the 480.5 million average share count for 2022 and EPS of $6.40. This is lower than 2021 due to the more normal loan loss provisions this year compared to big reserve releases last year. Excluding reserve builds, EPS would be up 37%.

Author Spreadsheet (Data Source: Synchrony Earnings Release and Guidance)

Conclusion

SYF share price is down about 23% from its highs in October 2021, probably due to worries about higher interest rates and inflation having an impact on consumer spending. In the 1Q 2022 earnings release, we see that the consumer is still paying their bills on time better than they were before the pandemic, even as they are buying more and starting to carry a higher balance. This actually helps Synchrony’s net interest margins. This organic growth in loan receivables combined with new programs like the PayPal card more than offsets the lost interest income from the loan portfolios to be sold this year. Inflation does not seem to be impacting the consumer yet either, as they had a cushion of savings headed into this period enabling them to spend more and carry a higher balance.

The loan receivables growth is the main driver of earnings, which is enabling Synchrony to continue buying back large quantities of shares, helping EPS and book value per share. The bank should earn $6.40 per share this year which puts the P/E at an extremely cheap 6.2 times 2022 earnings. While the market always seems to have worries about the stock, a move back to 2021 highs of around $52 seems warranted which would represent a P/E of 8.1, more in line with the average over the past 3 years. After rating SYF a hold near the 2021 highs back in June, I now consider it a Buy.

Be the first to comment