Sundry Photography

While CrowdStrike Holdings (NASDAQ:CRWD) has fallen substantially from the peak in 2021, the typical shareholder hasn’t felt any real pain. The stock regularly traded in the $50s after the IPO at the end of 2019, so any initial investor has made a ton of money up into this earnings report. My investment thesis is slightly Bearish on the stock, with the negative trend still unfolding.

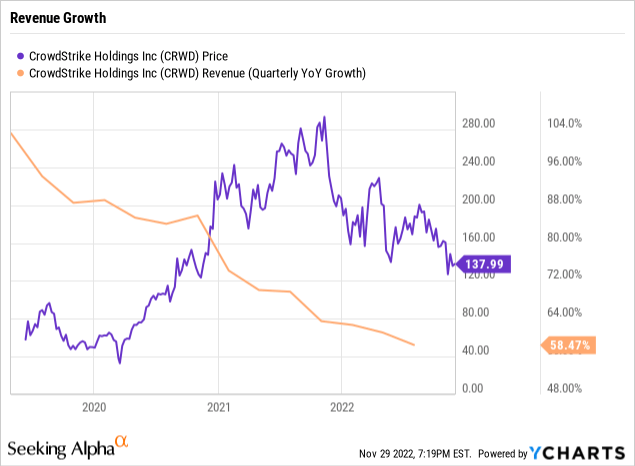

Decelerating Growth

After the close, CrowdStrike reported FQ3’23 revenues beat estimates by nearly $6 million. The cybersecurity company reported revenues grew 53% during the quarter ending in October.

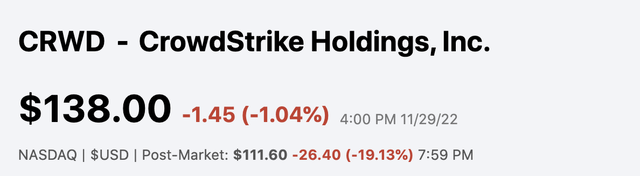

The stock crashed after-hours due to disappointing guidance and signs of major deceleration ahead. CrowdStrike still guided to FQ4’23 revenues of $624 million, but the numbers missed analyst estimates by ~$10 million.

The issue here is as much the company guiding below analyst estimates, as much as the decelerating growth rate. CrowdStrike guided towards revenue growth of ~45% following the 52% in the last quarter and nearly 59% growth back in FQ2.

Up until the last few quarters, growth was slowly trickling down from mid-80% to more sustainable growth in the 50% range. Now, CrowdStrike is clearly signaling that macro headwinds and the size of the company will make excessive growth rates difficult going forward.

The market struggles to value stocks in deceleration mode, with a preference for consistent growth in the 20% to 30% range over 50% growth decelerating. The key here is that CrowdStrike has big signals revenue growth will hit those lower levels soon enough.

For FQ3’23, net new ARR only grew 17% YoY to $198 million. The elongated sales cycles due to extra scrutiny are set to crush the ARR growth rates in the year ahead. Once this happens, most corporations find momentum tough to regain.

On the FQ3’23 earnings call, CFO Burt Podbere guided to very weak ARR growth going forward:

As George mentioned, even though we entered Q3 with a record pipeline, we are expecting the elongated sales cycles due to macro concerns to continue, and we are not expecting to see the typical Q4 budget flush given the increased scrutiny on budgets. While we do not provide net new ARR guidance given the current macro uncertainty, we believe it is prudent to assume that Q4 net new ARR will be below Q3 by up to 10%.

Looking into FY 2024, assuming an approximately 10% year-over-year headwind in the first half of the year on net new ARR, and for the full year, net new ARR would be roughly flat, to modestly up year-over-year. This would imply a low 30s ending ARR growth rate and a subscription revenue growth rate in the low to mid-30s for FY 2024.

Assuming net new ARR dips 10% sequentially, CrowdStrike will only add $180 million during FQ4 after adding $217 million last year. The cybersecurity specialist would end FY23 with an ARR balance of $2,518 million for 45% growth, down from the 54% growth rate in FQ3.

The company is guiding to substantial weakness to start FY24. In order to reach the 30% annual growth rate outlined by the CFO, CrowdStrike will need to regain momentum in the 2H of the year. With so many covid pull forwards in the tech sector, investors need to carefully follow the ARR trend, knowing just about every other tech stock saw an initial slowdown that led to further weakness not initially predicted by the management team.

Lower Path

When the stock traded around $50 back in 2019, CrowdStrike traded at around 17x sales estimates. The stock had a market cap of ~$12 billion, with sales over the next year at $700+ million.

Analysts have revenue growth at 37% for FY24, but the company won’t likely meet this growth target, with ARR only reaching a 30% growth rate for FY24 based on a rebound in the 2H.

The stock fell nearly 20% in after-hours to $111 pushing the market cap down to $27 billion. In the best-case scenario, CrowdStrike would deliver FY24 revenues of ~$3 billion. The stock still trades at 9x forward sales estimates.

CrowdStrike traded up to $100 quickly following the IPO probably providing possible support. The stock only traded at $60 pre-covid, so CrowdStrike still hasn’t come close yet to giving up all of the gains. Remember, though, the cybersecurity stock traded at a high premium valuation out of the gate that won’t likely repeat again when revenues reach the $3 billion level.

Takeaway

The key investor takeaway is that investors have to fear CrowdStrike growth decelerating even further than management predictions. Other covid tech stocks like DocuSign (DOCU) and Twilio (TWLO) failed to maintain excessive growth rates.

The bottom for CrowdStrike is difficult to predict, but the path of the stock still appears lower.

Be the first to comment