Tatiana Sviridova/iStock via Getty Images

Ceapro (OTCQX:CRPOF) (TSXV:CZO:CA) is involved in extracting from plants active ingredients that have beneficial properties. The company’s main products are oat extracts, which are sold to major cosmetic and personal care companies. My investment thesis is that Ceapro has built a profitable cash machine from its base cosmetic business and is now expanding into potentially more lucrative adjacent markets such as pharmaceuticals.

Business model

In 2011, the company brought on new CEO Gilles Gagnon, a former manager at the Sandoz division of Atrium, a supplier of active ingredients to the cosmetic industry. Mr. Gagnon, who has an MBA and a Ph.D. in pharmacology, oversaw the acquisition of 11 companies during his tenure at Sandoz. He passed on acquiring Ceapro due to its lack of progress but accepted the role of Ceapro CEO after retiring from Sandoz.

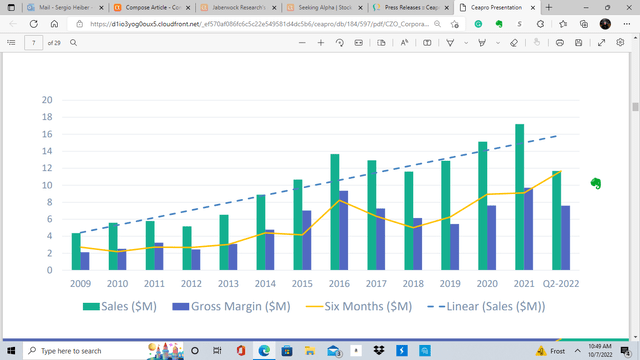

Under Mr. Gagnon’s leadership, Ceapro’s focus has been on developing the core business by investing revenues back into the company. Production capacity has increased by 10X. Scaling production was instrumental in not only increasing revenues but also resulting in margin expansion and profitability.

REVENUE AND MARGINS (Ceapro website)

The improved results have provided the funding for the company’s efforts to develop new technologies and to expand into nutraceutical and pharmaceutical ingredients markets.

The numbers

Insiders own about 8% of the 77.6 million shares. The market cap is $38 million. The company has no debt and $10 million in cash resulting in an EV of $28 million.

For the most recent reported quarter, the company recorded record sales of $11.7 million, a 28% increase over the prior year. The underlying valuations are modest for a company growing at an almost 30% pace. The PE is only 9, while the EV/S is 2X.

The company has about $0.12 per share in cash. At the current stock price of $0.50, you get the $1 million being generated in free cash flow per quarter plus the company technology and product pipeline for $0.38/share. There are several catalysts in place to accelerate the stock price to a higher valuation as the company executes its business plan.

The core business

Ceapro’s two main products are beta glucan and avenanthramides extracted from oats, sold to major cosmetic and personal care companies such as Neutrogena, Gold Bond, Dove, Dollar Shave Club, and Burt’s Bees. Beta-glucan is sold by a variety of companies but Ceapro is the only commercial source of avenanthramides from oats. The company’s last report indicated that beta-glucan sales are growing at a 75% rate while avenanthramides sales grew by 23%.

Oat beta-glucan is used to improve skin conditions by moisturizing, decreasing wrinkles, and enhancing wound healing. Oat beta-glucan is a natural anti-oxidant with known effectiveness in reducing inflammation and irritation that is used for improving the body’s immunity system, weight management, and promoting heart health.

Technology

The company’s proprietary extraction technology, which is offered to third parties either through licensing or contract manufacturing, is also a portion of the company’s core business. Oats are extremely sensitive to heat, which makes the extraction process complex. The extraction process uses heated water and ethanol to separate and maintain the qualities of the desired ingredients in liquid form that meets standardized qualifications.

Ceapro’s technology is a major moat for potential competitors to overcome and the reason I wanted to include it in this piece. I offer the reader a simplification of how it works. More detailed information can be found on the company’s website.

Pipeline

Ceapro is also developing Pressurised Gas Expanded technology (“PGX”) used to dry extracted materials. This technology allows for the conversion of extracted materials from liquid form to other forms such as a spray or a powder and to increase the concentration of the active ingredients beyond what is otherwise possible.

The PGX technology is the company’s gateway into expansion into adjacent markets as it leads to the creation of many different products from cosmetics to functional foods, nutraceuticals, and pharmaceuticals. While the company continues to improve its patented PGX technology, it has a pipeline of various products in the early development stages including:

- a functional drink

- beta-glucan as a nutraceutical for immune system boosting

- PGX technology for the formulation of new substances

- a pharmaceutical for treating inflammation

- drug delivery and potential treatment for lung fibrotic disease

Management is pursuing and considering collaborations for product development and licensing opportunities for its PGX technology.

Risks

The company is dependent on one distributor, Symrise for the majority of its sales. Oat quality is highly dependent on high humidity during planting season, which is a factor that cannot be controlled. The company’s beta-glucan products compete directly with other beta-glucan suppliers while the avenanthramides products compete indirectly with other cosmetic, nutraceutical, and pharmaceutical products that are directed at similar issues.

Conclusion

Ceapro’s management has built a company that is demonstrating strong growth and has built relationships with cosmetic industry household names. Revenues have been pumped back into the business to develop a new technology that offers the opportunity to create new products in forms and in qualities that were previously unavailable. The company has a strong balance sheet and is in a solid position to develop new business relationships and new products.

Be the first to comment