onurdongel

Warehouse automation is more of a necessity these days as e-commerce kicks off. Symbotic (NASDAQ:SYM) is another interesting warehouse automation play as it helps the largest companies in retail, wholesale and food & beverage modernize their warehouses to make them more efficient and smarter.

Investment thesis

Symbotic does seem well positioned to modernize the warehouses of today as it provides an end-to-end solution to its customers to help improve efficiency in their supply chain and utilize technology to improve the processes of today. Symbotic does have a clear plan and pathway to tackling the different total addressable market that it has set out to conquer. The total addressable market is huge and provides a long-term runway for growth. It has multiple levers to pull for growth as it can expand on existing relationships, move into new verticals and new geographies as well as rolling out new products. Symbotic already has success in attracting large, strategic customers and has amassed an impressive backlog. All in all, Symbotic looks to be a contender in the warehouse automation space as it continues to execute well on its strategy and have a long growth opportunity ahead of it.

Overview

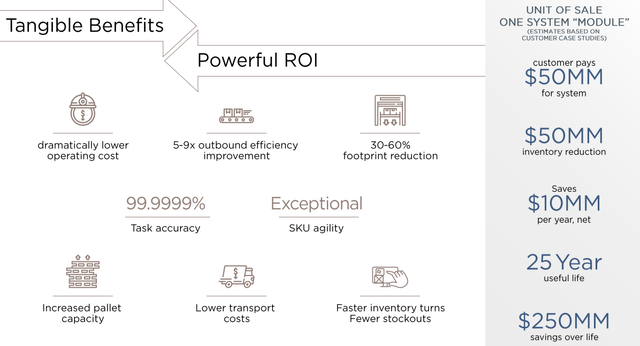

Symbotic provides end-to-end solutions to enhance efficiency in the supply chain by using autonomous robots and artificial intelligence enabled system software to help modernize warehouses of today. The end result of their autonomous, end-to-end system is to improve the accuracy of fulfillment and increase agility and supply chain efficiency while lowering the overall inventory costs as well as operating costs. As can be seen below, Symbotic outlines the powerful return on investment for using one system module which leads to substantial cost savings, efficiency improvements, accuracy increases as well as reduction in footprint, amongst others.

Tangible benefits of Symbotic offerings (Symbotic IR slides)

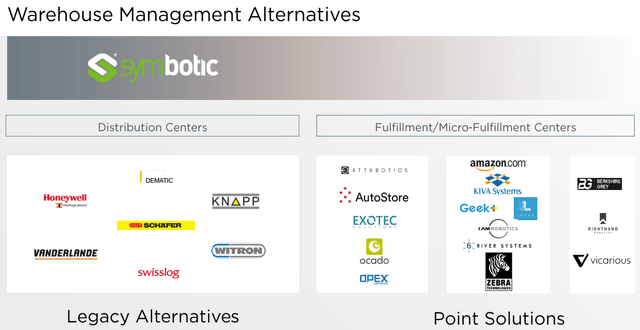

I have written on another warehouse automation player called Berkshire Grey (BGRY) and the article can be found here. While both Berkshire Grey and Symbotic do seem rather similar, I think Symbotic offers a complete, end-to-end solutions to customers while Berkshire Grey is more of a point solution focused on fulfillment centers, selling robotic fulfillment systems for robotic picking, robotic movement and mobility and system orchestration.

Warehouse Management Alternatives (Symbotic Capital Management slides)

Symbotic has 3 segments, the largest being its systems segment. This segment is where Symbotic does the assembly and installation of the hardware systems as well as the configuration for customers. The systems segment assembles and installs the hardware systems and configures applicable software on behalf of customers. Symbotic’s software maintenance and support segment includes their artificial intelligence enabled software as well as the support services that provide software support and upgrades. Lastly, the operation services segment includes services that helps customers with the operating system and the user experience.

Tackling huge strategic markets, one at a time

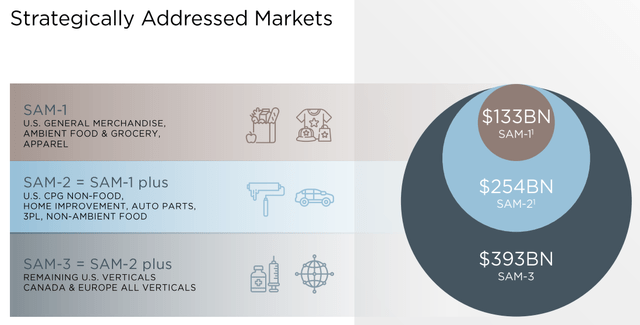

I think that the Symbotic management have clearly outlined their market opportunity. While we can expect management to focus on near-term opportunities, the total market opportunity looks to be rather attractive at $393 billion.

As can be seen below, the primary strategic markets that Symbotic will take on today comes from the United States general merchandise, ambient food and grocery and retail, which it calls SAM-1. SAM-2 includes more secondary verticals like home improvement, auto parts, non-ambient food and 3PL, increasing the market size to $254 billion. Lastly, for SAM-3, Symbotic will look to expand into Canada and Europe, as well as other remaining verticals like healthcare and pharmaceuticals, bring the total addressable market in SAM-3 to be $393 billion.

Strategic market opportunity (Symbotic IR slides)

Large customers and backlog

One thing that I really like about Symbotic is the massive backlog it has as a rather small company with only $700 million in market capitalization. Symbotic is interestingly selective on the customers it wishes to bring on board as it wants to focus on only customers it deems strategic. As a result, Symbotic’s largest customer is Walmart (WMT), which makes up a majority of the $11.4 billion in backlog that the company currently has. In addition, Walmart recently announced that they will be installing Symbotic systems in all of Walmart’s 42 regional distribution centers. As a result, this has resulted in customer concentration as Walmart takes up 67% of the revenues for FY20221 and a majority of the $11.4 billion backlog Symbotic has. The Walmart win as well as large order from the company does signal that large customers see the value add that Symbotic brings into their supply chain.

The remaining 33% of its FY2021 revenues comes from several customers like Target (TGT), Giant Tiger and C&S Wholesale Grocers. The backlogs are based on contracts with cost-plus fixed models that enables additional incurred input costs to be passed on to the customer and ensure Symbotic is able to maintain gross profit margin. I am of the view that we will likely see more large, strategic customer wins like the Walmart win, thereby bringing further growth in backlog and momentum to the business.

With 6% of the $11.3 billion in backlogs beginning to be recognized in the next 12 months, this implies $678 million to be recognized in the next year.

Long-term expansion strategy

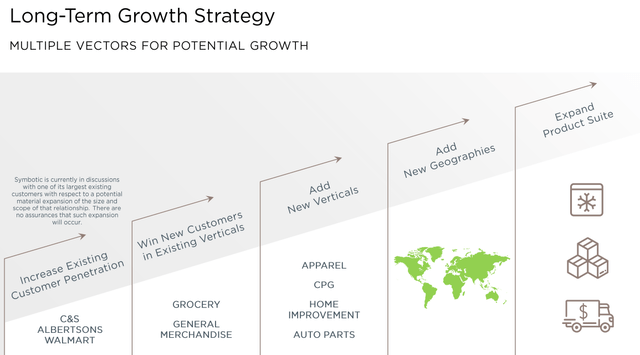

The company has multiple levers to pull for long-term growth. The near-term focus will be to increase penetration in existing customers and to win new customers in existing verticals. Subsequently, Symbotic will look to expand into new verticals and new geographies, and eventually, expand its portfolio of products.

Long-term expansion strategy (Symbotic IR slides)

Financials

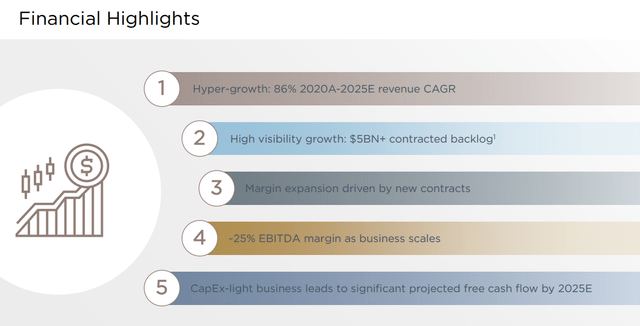

While Berkshire Grey still has negative gross profit margins, Symbotic already has positive 17% gross profit margins as of the latest quarter. Furthermore, when looking at Symbotic longer term goals, they expect hyper growth of 86% revenue CAGR from 2020 to 2025F, with 25% EBITDA margins as the business scales and significant free cashflows by 2025F.

While it remains to be seen whether these goals can be met, the robust and expanding backlog that the company has, and the current solid execution gives investors’ confidence in its ability to achieve these targets.

Financial goals (Symbotic IR slides)

Valuation

I value Symbotic based on a mix of 2025F EV/Sales and 2025F P/E.

Currently, the company is trading at 6x 2023F EV/S multiple and 4x 2024F EV/S. Furthermore, the company is expected to be profitable by 2024F, and it is currently trading at 31x 2024F P/E multiple.

I assume a 2025F EV/S multiple of 3.8x for Symbotic, taking into account the faster than average growth rates in the near-term. Revenues expected to grow at 64% CAGR from 2022 to 2025.

I assume a 2025F P/E multiple of 40x for Symbotic, given the rapid earnings ramp up in the following years to come as earnings accelerate.

Discounting both the 2025F EV/S valuation and the 2025F P/E valuation, and giving equal weights to both methodologies, my 1-year target price for Symbotic is $18, implying 67% upside from current levels.

Risks

Execution risk

As Symbotic has secured substantial backlog in the magnitude of $11.4 billion, the risk then will be that they are unable to execute well, scale up fast enough and deliver the product as required by their customers.

Supply chain risks

As an extension to the above risks, apart from their need to execute and ramp up well, Symbotic faces the risk of disruptions in the supply chain or increasing logistics costs.

Customer concentration risk

As highlighted above, the customer concentration from Walmart does pose a risk to Symbotic. If the company is unable to diversify its customer base and show competence in getting a wide variety of customers, investors may put a lower multiple on the company given the huge concentration risk on one company.

Incremental customers risk

As there are long wait times as a result of the $11.4 billion backlog, this may deter other potential customers other than Walmart to want to do business with Symbotic given that the company may not have near-term capacity to fulfill their operational needs.

Conclusion

I think that we will likely see Symbotic as a much larger player in the warehouse and supply chain automation space in a few years’ time. It is well positioned in the industry as an end-to-end solution provider that brings a suite of products and services to its customers. In addition, it has a large opportunity in front of it as it looks to focus on its $393 billion in total addressable market. While this will certainly happen in stages, the markets Symbotic intend to target in the future are rather complementary and synergistic to what it is currently doing and will likely drive growth and efficiencies in the future as the business scales up. In addition, Symbotic does have a rather clear expansion strategy, in my view, and well communicated to investors. Some of the levers that it can pull to drive near-term growth includes expanding on existing customer relationships, obtaining new customers, and entering new verticals.

In addition, I think that Symbotic has had a rather impressive start with the large $11.4 billion in backlog that it has, as well as being able to win over Walmart as a strategic customer. This speaks volumes about the confidence that Walmart has in Symbotic and its products and looks set to be a leading indicator for more strategic customer wins in the future. I think that Symbotic looks great at the moment as a future leader in the warehouse and supply chain automation space and my 1-year target price for Symbotic is $18, implying 67% upside from current levels.

Be the first to comment