piranka

Information technology is incredibly important in the modern era. Having said that, it’s not an area that most companies specialize in. This means that, instead of relying on solving information technology-related problems in-house, many companies seek out the assistance of firms that are specialized in this area. One player in this space that deserves some special attention is CDW Corporation (NASDAQ:CDW).

In recent years, this industry giant has done well to grow both its top and bottom lines. Long term, I fully suspect that the company will go on to create additional value for its shareholders. But at present, shares are a bit pricey compared to similar players and they look to be more or less fairly valued, at best, on an absolute basis. Because of that, I’ve decided to rate the business a ‘hold’, reflecting my belief that its returns will more or less mirror the broader market returns for the foreseeable future.

A play on IT

As I mentioned already, CDW Corporation focuses on providing information technology solutions to its customers. These customers are all across the spectrum, ranging from small to medium and even to large businesses. The company also services the government, education providers, and the health care industry. Operations are largely focused around the U.S. market. But the company also does have a presence in the United Kingdom and in Canada.

In all, the company provides a solutions portfolio that includes over 100,000 products and services from more than 1,000 different brands. These products can be delivered in physical form, virtual form, and even cloud-based environments. The company has also described itself as a leading sales channel partner for OEMs, software publishers, cloud providers, and other types of firms.

The best way to really conceptualize the company is to imagine it as a distributor of and advisor for the technology solutions that it provides. Examples on the hardware side include notebooks and mobile devices, network communications, desktop computers, video monitors, enterprise and data storage products, and more. On the software side of things, the company provides application suites, security, virtualization, operating systems, and other types of offerings.

And on the service side, the company focuses on advisory activities, as well as design, software development, implementation, managed services, and it even provides warranties. At the end of the day, the company believes that one of its strongest selling points is that it serves as a solutions provider that helps to integrate the technology products and services that their customers purchase, instead of the customer viewing the technology it acquires as discrete products and services.

In terms of overall sales concentration, much of the company’s revenue comes from the notebooks and mobile devices category. 32% of all of its revenue came from that category in 2021. Next in line was the ‘other hardware’ category that comprised all other miscellaneous hardware products that were not otherwise sorted into a different category. Those made up 20.9% of revenue. Meanwhile, software came in third at 13.5%.

It would also be helpful for us to look at the company’s operations through the lens of the segments that it has. The first of these is the Corporate segment, which is comprised mostly of the private sector business customers with more than 250 employees in the U.S. market that the company services. Last year, these customers accounted for 39.3% of the firm’s revenue and for 43.9% of its profits. Next in line, we had the Small Business segment. This comprises all of the same sorts of activities that the Corporate segment does, except that it focuses on smaller employers. 9% of its revenue came from that segment last year while 10.6% of its profits did.

We also have the Public segment, which involves all of the government agencies, education, and health care institutions that the company services. 39.3% of its revenue and 38.2% of its profits came from there last year. And finally, we have the Other segment, which focuses on the company’s operations in the UK and Canada. 12.4% of its revenue and 7.3% of its profits came from there last year.

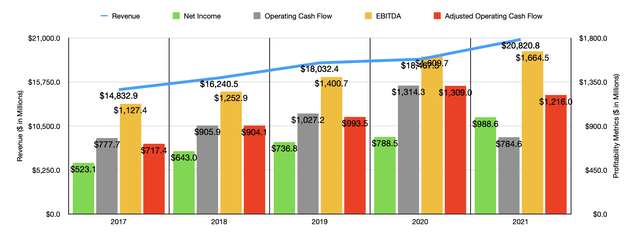

Author – SEC EDGAR Data

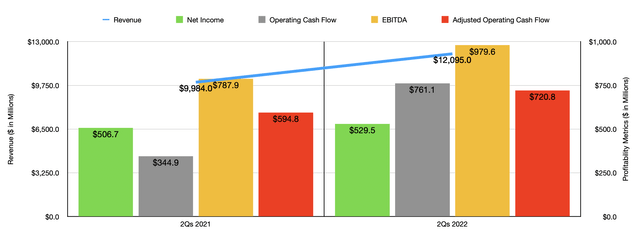

Over the past few years, the management team at CDW Corporation has done a really good job growing the company’s top and bottom lines. Between 2017 and 2021, sales rose year after year, climbing from $14.83 billion to $20.82 billion. That growth has continued into the 2022 fiscal year, with revenue jumping by 21.1% from $9.98 billion to $12.10 billion in the first half of the year. The greatest strength for the company in 2022 has come from the Corporate segment, with sales jumping by 39.6% year over year. This, in turn, was driven in part by the company’s acquisition of Sirius. However, it was also attributable to high demand from its customers when it came to digital transformation and to a continued focus on a hybrid work model.

Author – SEC EDGAR Data

As revenue has risen, profitability has followed suit. Net income rose from $523.1 million in 2017 to $988.6 million last year. Operating cash flow has also generally risen, climbing from $777.7 million in 2017 to $1.31 billion in 2020. But then, in 2021, cash flow dropped to just $784.6 million. Even if we adjust for changes in working capital, it would have fallen some, declining from $1.31 billion to $1.22 billion.

Meanwhile, EBITDA for the company is also mostly improved over the years, climbing from $1.13 billion in 2017 to $1.66 billion last year. Just as has been the case with revenue, profitability for the company has continued to increase this year. Net income of $529.5 million beat out the $506.7 million reported in the first half of the firm’s 2021 fiscal year. Operating cash flow skyrocketed from $344.9 million to $761.1 million, while the adjusted reading for this rose from $594.8 million to $720.8 million.

And finally, we have EBITDA, with the metric rising from $787.9 million in the first half of 2021 to $979.6 million the same time this year. It should be said that the company has made good use of its strong and growing cash flows over the years. Last year alone, for instance, management brought back $1.5 billion worth of shares. Moving forward, I expect this trend to continue.

When it comes to the 2022 fiscal year as a whole, management has not provided very much valuable guidance. Perhaps the most important thing they said was that the non-GAAP earnings per share for the enterprise should climb at a rate that places it in the mid-teens. If we take this quite literally to imply 15%, and don’t factor in additional share repurchases, then we should anticipate net income this year of roughly $1.10 billion. Applying that same growth to other profitability metrics would translate to adjusted operating cash flow of $1.35 billion and EBITDA of roughly $1.84 billion.

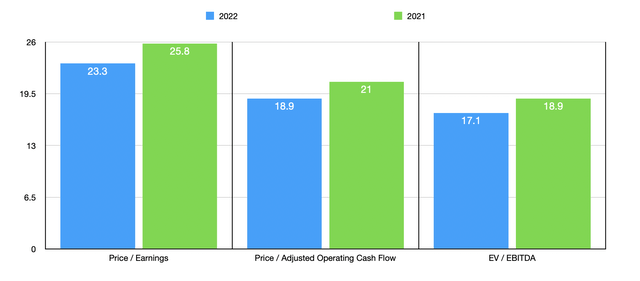

Author – SEC EDGAR Data

If we use these estimates, shares of the business are still looking a bit lofty. The forward price to earnings multiple, for instance, should come in at 23.3. That’s down from the 25.8 reading we get using 2021 results. The price to adjusted operating cash flow multiple should drop from 21 to 18.9, while the EV to EBITDA multiple should drop from 18.9 to 17.1. To put this in perspective, I compared the company to five similar firms.

Using 2021 figures, these companies are trading at a price-to-earnings multiple of between 5.6 and 18. And when it comes to the EV to EBITDA approach, the range is between 4.9 and 10.4. In both cases, CDW Corporation was the most expensive of the group. And when it comes to the price to operating cash flow approach, the range was from 9.9 to 45.3. In this scenario, two of the five firms are cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| CDW Corporation | 25.8 | 21.0 | 18.9 |

| TD SYNNEX Corporation (SNX) | 18.0 | 45.3 | 10.4 |

| Arrow Electronics (ARW) | 5.6 | 17.9 | 4.9 |

| Avnet (AVT) | 6.5 | 9.9 | 5.5 |

| Insight Enterprises (NSIT) | 13.5 | 42.0 | 10.2 |

| ePlus (PLUS) | 13.7 | N/A | 9.2 |

Takeaway

All things considered, CDW Corporation seems to be a solid company with a bright future. Between organic growth and acquisitions, the company has continued to expand and profitability looks robust. Management is actively buying back shares and it operates in a space that should only see increased demand for the long haul. Having said that, shares do look a bit lofty, including relative to similar firms. So because of that, I’ve decided to rate the business a ‘hold’ for now.

Be the first to comment