imaginima

Energy Transfer (NYSE:ET) reported strong 3Q 2022 financial results. The company’s adjusted EBITDA increased by 20% YoY; however, decreased by 4% QoQ. As oil and natural gas production in the Permian, Eagle Ford, Bakken, and Anadarko regions increase, ET’s transportation and storage volumes go up. Recently, ET’s mainline construction on the Gulf Run Pipeline finished and the project is expected to be completed by year-end. Moreover, in September 2022, Energy Transfer completed the acquisition of Woodford Express for approximately $485 million. Woodford Express owns a Mid-Continent gas gathering and processing system, which has 450 MMcf per day of cryogenic gas processing and treating capacity and over 200 miles of gathering and transportation lines, which are connected to Energy Transfer’s pipeline network. Also, oil and natural gas prices in 4Q 2022 and 2023 will remain higher than in 2021. I expect ET to continue reporting strong financial results in the upcoming quarters. The stock is a buy.

Quarterly results

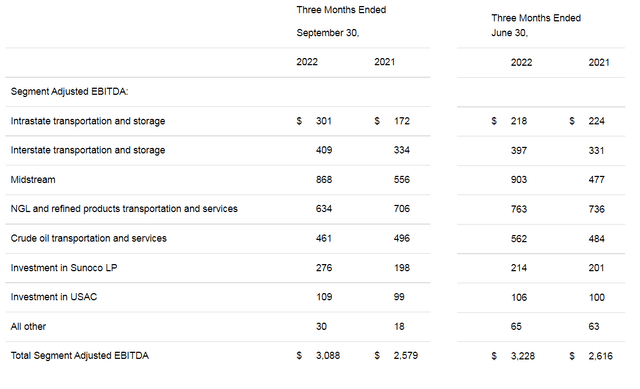

In its 3Q 2022 financial results, ET reported net income attributable to partners of $1.01 billion, up $371 million YoY. In 3Q 2022, ET’s net income increased by 24% QoQ. The company’s adjusted EBITDA increased from $2.58 billion in 3Q 2021 to $3.09 billion in 3Q 2022. Compared with 2Q 2022, ET’s adjusted EBITDA decreased by 4% QoQ. “In the third quarter of 2022, the Partnership experienced a $126 million charge in the crude oil transportation and services segment related to a legal matter. Energy Transfer’s third quarter 2022 results were impacted by an approximately $130 million negative adjustment related to hedged inventory in the NGL and refined products transportation and services segment. These two items impacted third quarter 2022 Adjusted EBITDA by approximately $260 million in the aggregate,” the company explained.

In 3Q 2022, the company’s revenues and cost of products sold increased by 38% YoY and 40% YoY, respectively. Compared with 2Q 2022, ET’s third-quarter revenues and cost of products sold decreased by 12% QoQ and 14% QoQ, respectively.

According to Figure 1, compared with 3Q 2021, ET’s adjusted EBITDA in 3Q 2022 increased in intrastate & interstates transportation and storage segments, midstream segment, investment in Sunoco LP segment, and investment in USAC segment; however, decreased in NGL and refined product transportation services segment and crude oil transportation and services segment. Also, compared with 2Q 2022, ET’s adjusted EBITDA increased in intrastate & interstate transportation and storage segments and investment in Sunoco LP segment; however, decreased in other segments.

“Energy Transfer’s base business continues to execute well with performance ahead of expectations, driven by continued strong demand across Energy Transfer’s network,” the company stated. ET expects its 2022 Adjusted EBITDA to be between $12.8 billion and $13.0 billion (previously $12.6 billion to $12.8 billion). Also, the company expects its 2022 growth capital expenditures to be between $1.8 billion and $2.1 billion.

Figure 1 – ET’s segment adjusted EBITDA

The market outlook

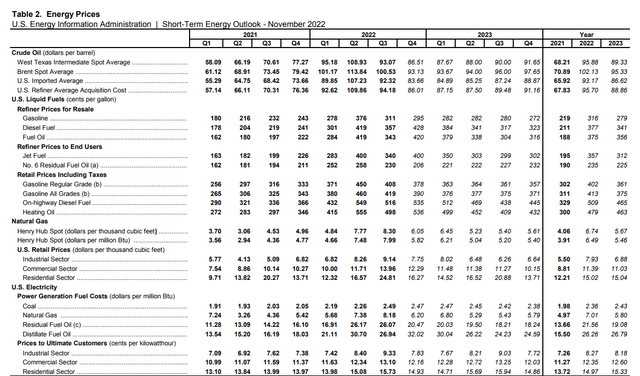

According to EIA’s short-term energy outlook (released on 8 November 2022), due to higher heating oil prices and consumption as a result of colder temperatures during winter (October 2022 to March 2023), the average U.S. home expenditures on heating oil will be by 45% more than in last winter. EIA has increased its average U.S. home forecasted heating oil expenditures by 1800 bps. Moreover, EIA expects Henry Hub natural gas spot price to be $5.82/MMBtu in 4Q 2022 and $6.21/MMBtu in 1Q 2023 (see Figure 2). On its October release, EIA expected Henry Hub natural gas spot price to be 7.41/MMBtu in 4Q 2022 and $7.12/MMBtu in 1Q 2023. Due to higher-than-expected storage levels heading into winter, and increasing natural gas inventories, natural gas prices will not be as high as a few months ago.

Figure 2 – Energy prices

Compared with the first ten months of 2021, Russian natural gas pipelines to European Union decreased by 50% in the first ten months of 2022 and will decrease further until the end of the year. As European Union was able to import 30 Bcm of Russian gas supply in the summer of 2022 and due to China’s COVID-19 restrictions that decreased its LNG imports, EU gas storage sites are now 95% full. However, Russian gas pipelines to the EU could cease completely and China’s COVID-19 lockdowns will eventually finish. Thus, the EU will need to increase its natural gas imports from the United States. “Europe could face a gap of as much as 30 billion cubic meters of natural gas during the key summer period for refilling its gas storage sites in 2023,” IEA explained. Thus, according to the LNG prices and LNG demand outlook in 2023 and due to its IPM agreement, CQP is well-positioned to make huge profits shortly.

In the past two weeks, Brent crude oil price increased to $98 per barrel due to the news about China easing COVID-19 restrictions. However, China dashed hopes there would be a relaxation of the COVID-19 restrictions. Thus, for now, China’s oil demand is not expected to increase and won’t have a positive effect on oil prices. However, the OPEC+ production cut of 2 mb/d (which is the largest cut since the pandemic started) and the European Union ban on Russian crude that will come into effect in December 2022, combined with continuing Iranian oil sanctions, support oil prices.

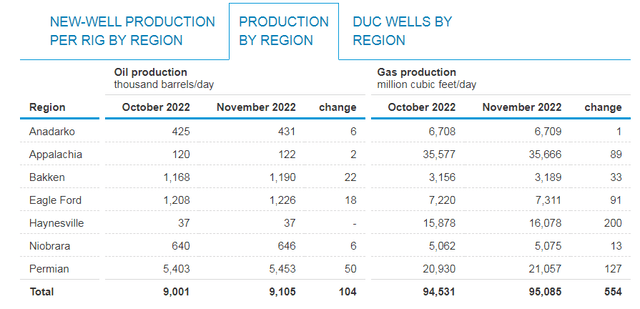

ET’s adjusted EBITDA in the crude oil segment has significant connectivity to the Permian, Bakken, and Midcon Basins. Also, ET’s adjusted EBITDA in the midstream segment has strong connectivity to the company’s operations in Permian, Eagle Ford, Anadarko, and Marcellus/Utica Basins. “Over 90 percent of Energy Transfer’s growth capital spending is comprised of projects that are already on-line or expected to be on-line and contributing cash flow at very attractive returns before the end of 2023. The project backlog includes Gulf Run Pipeline in Louisiana, Grey Wolf and Bear processing plants in the Permian Basin, Fractionator VIII in Mont Belvieu and LPG facilities projects at Energy Transfer’s Nederland Terminal,” the company said.

Figure 3 shows that oil production in Permian Basin is expected to increase by 50 thousand barrels per day to 5453 thousand barrels per day in November 2022. Also, oil production in the Bakken region is expected to increase from 1168 thousand barrels per day in October 2022 to 1190 thousand barrels per day in November 2022. Moreover, natural gas production in Permian Basin is expected to increase by 127 million cubic feet per day in November 2022. In November 2022, Natural gas production in Eagle Ford and Anadarko is expected to increase by 91 and 1 million cubic feet per day, respectively.

Thus, I expect ET’s intrastate & interstate transportation and storage, midstream, NGL, and refined products transportation and services, and crude oil transportation and services segments’ adjusted EBITDA in the winter of 2022-2023 to be higher than winter of 2021-2022. However, the company’s 4Q 2022 and 1Q 2023 results will not be as strong as in 2Q 2022 and 3Q 2022.

Figure 3 – Oil and natural gas production by region in October and November 2022

Performance outlook

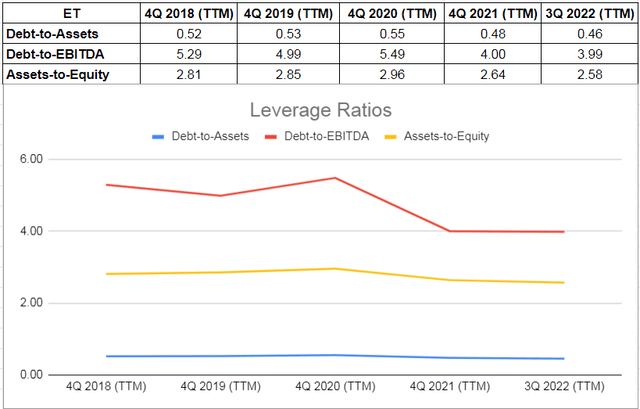

In this detailed analysis, I have investigated Energy Transfer performance across the board of leverage and coverage ratios. Leverage ratios could be very insightful to show how the company is financing its assets and business operations. In other words, does it use debt or equity financing for most of its operations? In this analysis, I used some common leverage ratios that have significant comparability to its debt. The ratios are calculated in comparison with previous years to be more helpful.

The debt-to-assets ratio is one of the significant calculations that measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. Thereby, the higher the ratio, the greater the degree of leverage and financial risks. It is observable that the debt-to-asset ratio of Energy Transfer decreased from 0.55 at the end of 2020 to 0.48 at the end of 2021, and to 0.46 on 30 September 2022. Moreover, ET’s debt-to-EBITDA ratio, which determines the probability of defaulting on debt, decreased from 5.49 at the end of 2020 to 4.00 at the end of 2021, and to 3.99 on 30 September 2022. Finally, Energy Transfer’s asset-to-equity ratio has been on a downward path continuously during recent years and sat at 2.58 on 30 September 2022, compared with its level of 2.96 at the end of 2020 and 2.64 at the end of 2021. The decreasing assets-to-equity ratio indicates that the company uses lower debt to finance its assets. As a result, the leverage ratios of Energy Transfer indicate the company’s solvency and its ability to meet its current and future obligations (see Figure 4). I expect ET’s leverage ratios at the end of 2022 to remain lower than 2020 and 2021. Due to higher volumes across all of its core segments and the impacts of the recent acquisition of Enable Midstream, the company’s 2022 results will be significantly stronger than in previous years.

Figure 4 – ET’s leverage ratios

Summary

In terms of the market condition, oil and natural gas prices will remain high and due to the increasing production levels, ET’s financial results this winter will be better than the winter of 2021-2022. In terms of financial health, ET will be capable of covering its financial obligations in the upcoming quarters. The stock is a buy.

Be the first to comment