Andreas Rentz/Getty Images Entertainment

In this article, I’ll re-review one of my favorite companies – at least insofar as their products and portfolios go. We’re talking about CD Projekt (OTCPK:OTGLF), of course. And yes, it’s probably my favorite company from a pure product perspective – even if that isn’t true from a quality, valuation, RoR or upside perspective.

Something magical happens when interests and good valuation aligns – when you can invest in what you love, making money on what you know and like. It’s a rare thing – and it might be happening here as we move forward.

Let’s look at what CD Projekt can offer us, and if it’s time to “BUY” the company here.

Revisiting CD Projekt

We first described the company in full in my last article found here.

The recent set of results doesn’t exactly cause me to have renewed, long-term faith in the company. That hasn’t changed since my last article either, and that has to do with how results and profits flow in a gaming company.

I specified in my initial article that the company’s failure in Cyberpunk 2077 will have a far-reaching consumer confidence impact. As I see, this has been confirmed given how the company has acted since then.

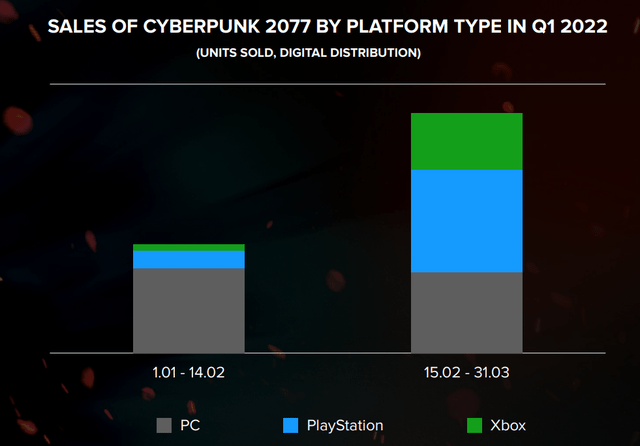

While I believe that CD Projekt has learned its lesson from the CP77 debacle, it will be years until we get more hard data on actual profits from the company’s new games and franchises. On the positive side, Cyberpunk sales have actually risen since the company released the next-gen versions. Things are looking good in terms of CP77 sales.

Cyberpunk Sales (CD projekt IR)

Aside from increased CP77 sales, the list of good news for the company in the first quarter is quite slim. Aside from this, the main thing to keep an eye on is other franchise sales and revenues. Witcher continues to perform like a beloved game out of its cycle – which means some sales, but not close to as much as during the highs. Aside from this, we’re looking at pipelines, and I don’t mean the gas/oil sort.

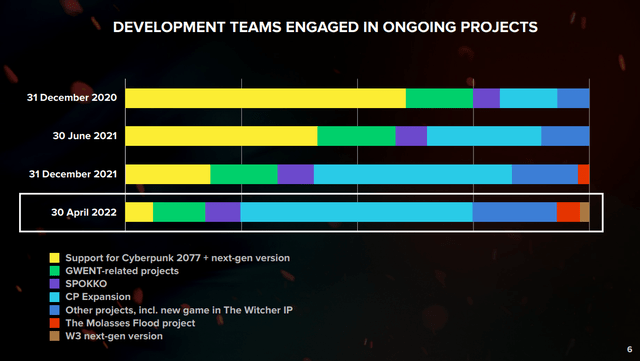

We’re talking development pipelines. Looking at the current pipeline, it’s clear that the company is shifting production teams toward the development of the next-gen witcher title. It’ll still be years before this comes to market – but we’re seeing that reallocation happening at this time.

CD projekt Presentation (CD Projekt IR)

Compare the team allocation to 2 years back, and you’ll see how little Cyberpunk is being pushed at this time, and how much resources, comparatively, are being allocated to the new project. While much of it is currently focusing on the so-called expansion plans for cyberpunk, I believe this to essentially be a bit of a dead-end for the company. Oh, it’ll be a bit of an income as people run to try it out – but due to reviews and game issues, I believe the response will be more along the lines of “underwhelming” when it comes to this. It will, in no way, be as big of a success as the expansions for W3, nor generate the sort of later profit the company may be expecting.

I cannot emphasize enough the importance of understanding and moderating your expectations when investing in a gaming company like CD Projekt. This isn’t EA (EA) or Ubisoft (OTCPK:UBSFY). This isn’t a company with 5 titles always in the fire, or a recurring title that generates revenue even if advancements aren’t what gamers are looking for, such as Assassin’s Creed, NHL, FIFA or NBA. Those titles, while not innovative, act as recurring cash generators for these companies, which make them far more stable than CD Projekt.

CD Projekt instead relies on a combination of expansion sales, legacy sales, in-game sales (limited) and smaller revenue streams. The business structure means that its windfalls will typically be maybe 1-3 years after a new blockbuster title is released. W3 was the first. CP77 was supposed to be the second, and while sales were excellent, the product quality was very bad when it came out. When your entire business model depends on delivering epic experiences to a demanding crowd, that’s not a good thing.

As I said, CD Projekt is trying to diversify its revenue streams to generate through-cycle profit levels. Its recurring Witcher incomes do a decent job of this. I don’t expect the CP77 anime series or the expansion to exactly cause the sort of excitement the company might be looking for.

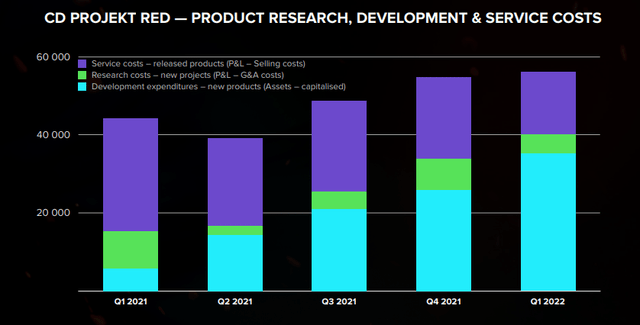

CD projekt Presentation (CD projekt IR)

We can also expect the development side of the company’s expenditures to ramp up significantly. The CapEx consumed by producing an entirely new set of games is nothing to underestimate. The company may be forced to tap leverage or equity during a time when rates go up, and when the company’s share price is already at relative lows. While company cash flows currently show no worrying situation with regards to this, we’ve not yet seen the more serious ramp-up of CapEx.

Cd Projekt Presentation (CD projekt IR)

The company does consider itself in a good enough shape to distribute a dividend for the year – and that dividend is at 1 PLN per share.

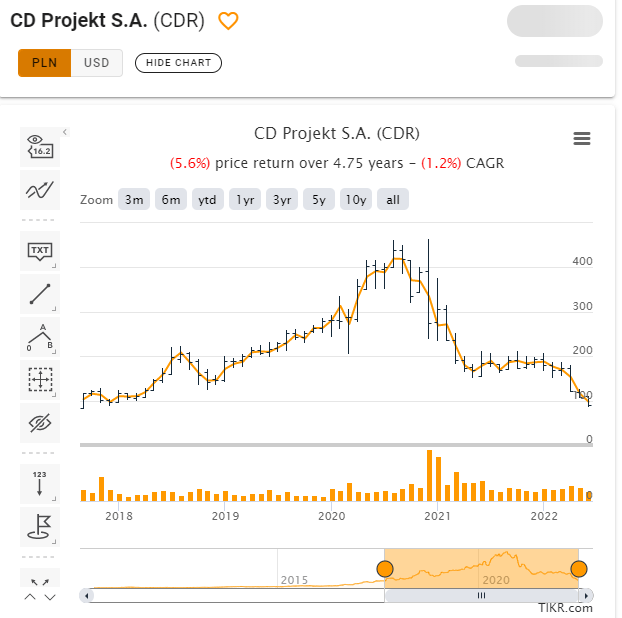

The entire return generated over the past 4.75 years is now gone, resulting in a net loss of 5.6% gross of FX and dividends during the time.

CD projekt red RoR (TIKR.com)

Oh, there are many investors that saw this company’s potential and invested prior to the company’s climb up – but I will argue that most investors did not have their eyes opened to the potential of the Witcher and what the company could do until way into 2019-2020, which means that if they’re holders, they’re likely in the negative at this point.

A sub-100 PLN price opens opportunities for investors though – but there are still issues that I am going to address very clearly in the valuation section of the article.

Let’s get through them.

CD Projekt – The Valuation

So, to answer my own question from the article title – I unfortunately do not believe that the company has been punished enough just yet. I base this stance on several clear opinions.

First of all, peers. CD Projekt is the weaker of its peers despite its product quality and portfolio, because it lacks the recurring revenue generators that these other companies do have. On a NTM P/E, EBITDA and Revenue basis, the company currently trades at forecast multiples well above peers like Activision Blizzard (ATVI), Netease (NTES), EA, Take-Two (TTWO) – all of which are cheaper and have an impressive set of game and product libraries on their own. Some of these peers do not have a yield, which puts the favor back to CD Projekt, but the simple fact is that despite the decline, the company’s earnings estimates for the foreseeable future precludes, in my mind, that the company should be trading at anything close to its peers. Yet it trades above it – quite significantly in some cases (Revenue, comparisons to EA)

Secondly, forward estimates. Let me remind you that the reason CD Projekt traded up as it did was a net profit increase of no less than 558% with a 54% Net profit margin during the fiscal of 2020. Why? Simple – they delivered a blockbuster game, even if it did turn out to have serious issues. The numbers a year after that? Net profit decline of 81.9%, with margin down to 23.5%.

I mention net profit as an example, but you can follow the same trends in EPS, both normalized and GAAP, as well as cash flows. The cyclicality of these numbers in a company like this are ridiculous, and they warrant a high degree of understanding when it comes to what you’re buying. Remember, that for the longest time, the company did not pay a dividend. That is a relatively new tradition that began in 2017. And anyone forecasting a dividend increase that would indicate a 9X dividend of the 2021 in 2026E (which yes, there are analysts from S&P Global doing just this), should be questioned as to what expertise they base this on. I don’t like speaking in absolutes, but I feel confident saying that no one can forecast the gaming industry 4 years from now.

When investing in Cd Projekt, you’re investing in a gaming company in the midst of a development cycle. What’s more, the company recently has behind it one of the most-awaited, but disappointing titles for gamers for several years. This might not be visible in the numbers, but believe me when I say that the company’s reputation took a massive hit.

They need to deliver on their next title – which is why they’re going back to old ways, existing engines, and existing successful titles.

CD Projekt needs a win.

I do wish them the best in this, but I have no interest in investing in a company based on the belief that they will deliver that win, unless it’s dirt-cheap.

In my previous article, I called for a 100-120 PLN per share target for the company. That was before the current full macro environment and the pace of rate increases we’re seeing now. While I believe you can see eventual alpha when the company delivers its new title from that price, I would discount it heavier today on the account of macro, peers and potential challenges presented by the current geopolitical and macro mix.

I’m cutting my target to 85 ZL/share, which would represent the upper end of the public comps in terms of revenue, P/E and EBITDA, as well as a 15-20% upside to 5-year averages if the company delivers a solid product.

Thesis

My thesis for CD Projekt is as follows:

- CD Projekt is an impressively-managed game company that produces some of the best games on earth. It’s also had a recent fizzle in the form of Cyberpunk 2077, and this will weigh on the company for some time yet.

- The company’s pipeline is weighted towards beyond 2023, which means that any investment in the company needs to be forward-looking with an at least 3-5-year timeframe.

- I believe you can make a credible case for a 100-200% RoR when the company’s next blockbuster title releases if you buy the company at below 85 ZL/share. The further below this, the better.

This forms the current basis of my thesis.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Be the first to comment