hapabapa

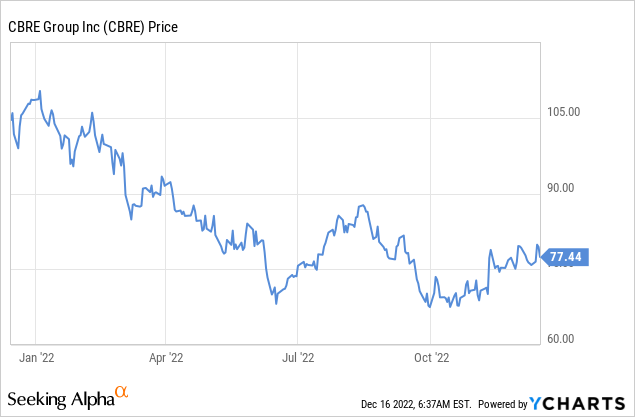

Global commercial real estate services and investment firm CBRE Group (NYSE:CBRE) has seen its share price come under severe pressure the past year, with shares losing about a quarter of their value during this time. Some of it was merited, as shares had gotten a little expensive and several headwinds arrived. We believe, however, that shares have now over-corrected and are now trading at a very attractive valuation. We believe some of the headwinds might start to dissipate in the second half of 2023. As a result, we believe that now is a great time to buy CBRE shares.

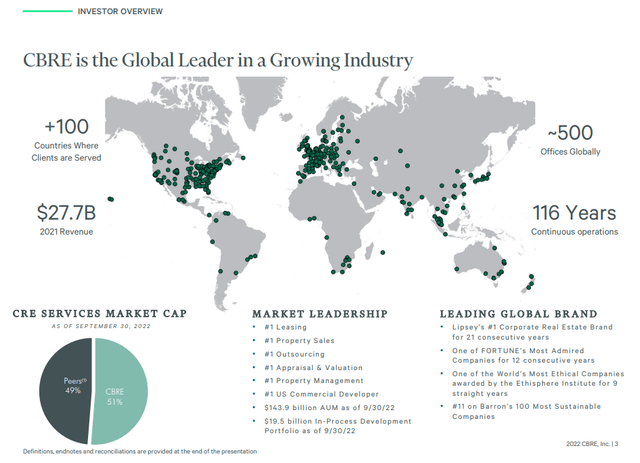

As a reminder, CBRE offers a wide range of services, including property sales and leasing, project management, property management, facility management, and valuation and advisory services. CBRE operates in more than 100 countries, serving a diverse range of clients including corporations, government agencies, and individual investors. CBRE is the global leader in its industry, and its main competitors include Jones Lang LaSalle (JLL), Cushman & Wakefield (CWK), and Colliers International (CIGI).

Structural Tailwinds

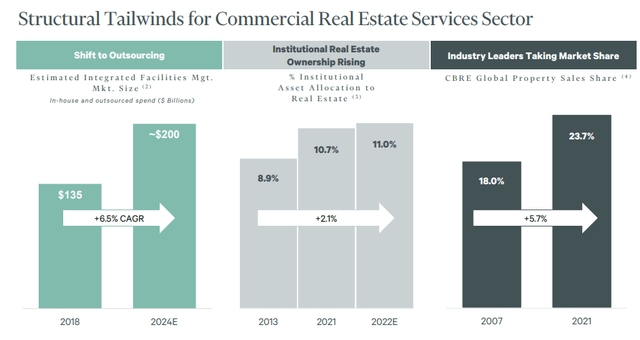

While there are some cyclical headwinds with a rising interest rate environment and a weakening economy, it is important to remember that CBRE has some secular tailwinds in its favor. We believe these structural tailwinds will prove more important than the short/medium term headwinds the company is currently facing.

These tailwinds include a very significant shift to outsourcing facilities management, institutional investors increasing their allocations to real estate, and CBRE taking market share from competitors. Clients are coalescing around market leaders, with CBRE being the most significant beneficiary. Increasing institutional ownership of commercial real estate is driving demand for institutional quality services, such as those provided by CBRE. Big clients are also attracted to CBRE’s broad line of services and geographies in which it can operate, helping the company get an even bigger share of business.

Strong financial performance

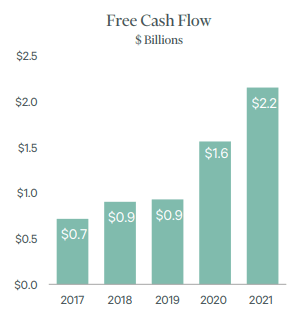

CBRE has consistently delivered solid financial results, with revenues, free cash flow, and earnings growing over time. As can be seen in the graph below, free cash flow has exploded in the last few years, going from ~$700 million in 2017 to $2.2 billion in 2021.

CBRE Investor Presentation

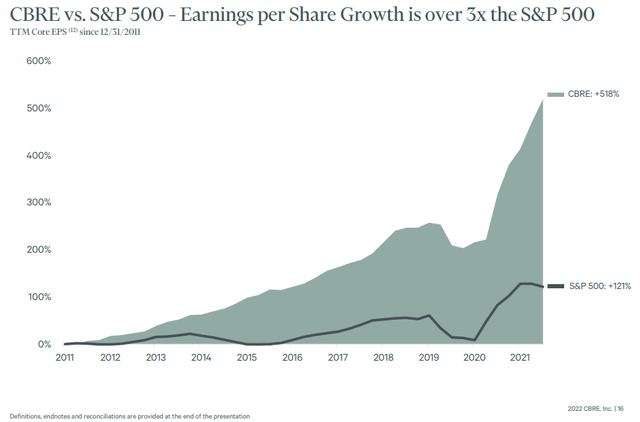

Similarly, CBRE earnings have grown much more quickly than those of the S&P 500 (SPY). In recent years earnings growth has even accelerated, being particularly strong in the post-pandemic period.

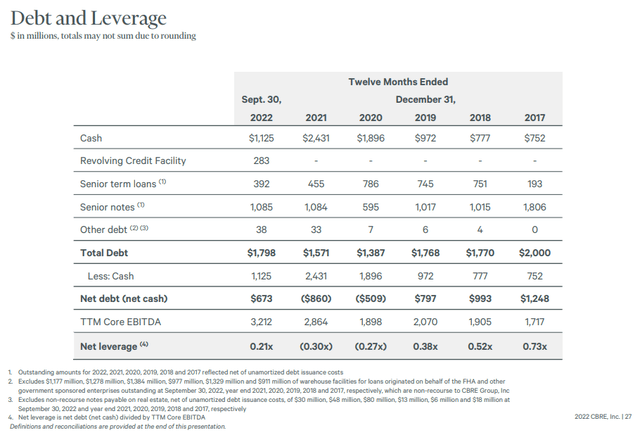

This earnings growth was not the result of the company leveraging its balance sheet. Actually, it has been quite the contrary, with the company reducing its leverage. As of the end of the last quarter net leverage was only 0.21x, compared to 0.73x in 2017.

Growing resiliency

We believe the biggest reason shares are trading at an attractive valuation right now is that many investors are afraid a recession will arrive next year. While this is entirely possible, and commercial real estate is a sector usually significantly affected, we believe the company is well positioned to weather the potential downturn.

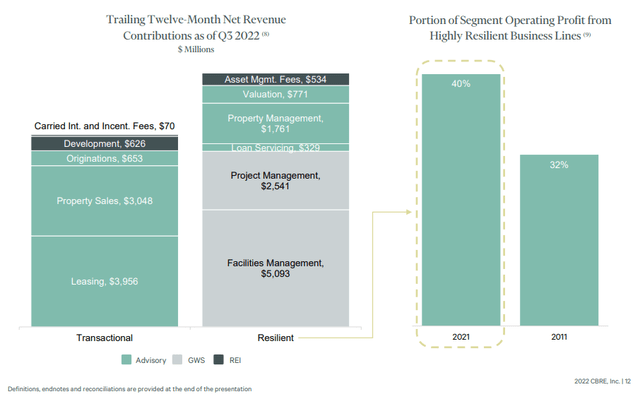

In addition to having a very solid balance, the company has become more resilient over the years. With a bigger percentage of its operating profit coming from business lines that are less cyclical and more resilient. Some of these lines of business, which now make ~40% of the business, include facilities management, project management, asset management, property management, and loan servicing.

Another thing making the company resilient is its highly variable cost structure, with 42% of costs being pass-through and 42% tied to revenue. Its operating expenditures also have flexible components, such as bonuses, equity compensation, travel, and promotion. Only ~$2.7 billion of total costs, or 10% of the total, are more fixed in nature.

Potential for future growth

CBRE has made a number of strategic acquisitions in recent years, which may help drive future growth for the company. Additionally, the company has a strong presence in emerging markets, which may offer added opportunities for expansion.

We like the types of acquisitions CBRE is doing, many of which are focused on recurring services. An example is the recent acquisition of Full Spectrum Group, a provider of technical support services for high-end laboratory systems.

Attractive Valuation

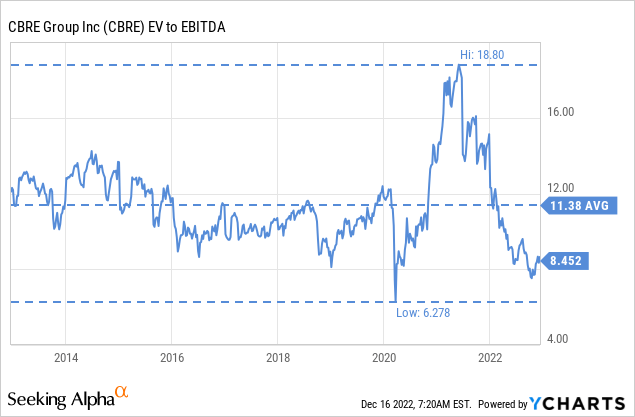

The biggest reason, however, why we believe this is an excellent time to buy shares is the attractive valuation. EV/EBITDA is almost three turns lower compared to its ten year average.

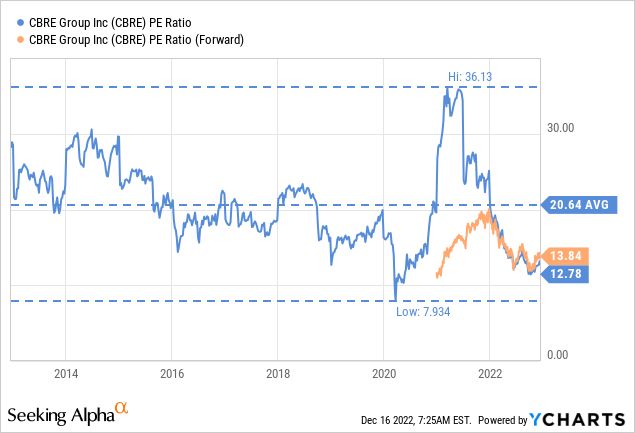

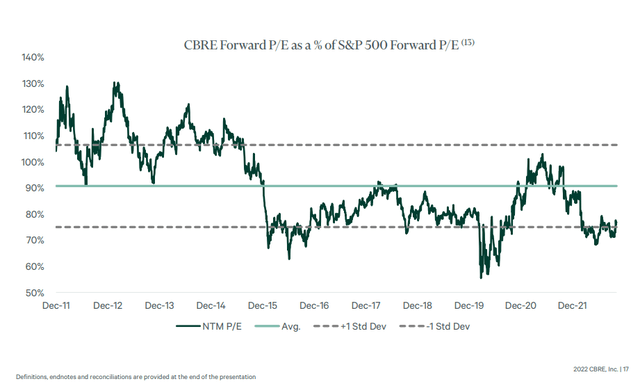

The price/earnings ratio, both the trailing twelve months and the forward p/e are considerably below the ten-year average as well. Given the global leadership of the company, the fact that it is gaining market share, and its strong balance sheet, we believe ~13x is a very undemanding multiple for the shares.

In its most recent investor presentation, the company shares a slide we found particularly interesting. In it the company shows how shares are trading roughly 1 standard deviation below the average CBRE forward p/e as a percentage of the S&P 500 forward p/e. Historically the company has traded at ~90% of the S&P 500’s forward p/e, but right now it is closer to 75%. It therefore appears that shares are undervalued not only with respect to its own history, but also when compared to its historical valuation in relation to the market.

Risks

There are certainly a number of risks worth considering with CBRE, including the potential for a recession in 2023. While the percentage of profits coming from more resilient businesses has been increasing, the company still has ~60% of its profits coming from transactional businesses. These transactional businesses are the ones that tend to be most affected during recessions and weak economic environments. Something else to consider is the effect that the work-from-home will have in the office sector. Given the significant exposure to the office market, it can have a big impact on CBRE’s results.

Conclusion

We believe now is a great time to buy CBRE shares given the very attractive valuation and solid financial position of the company. While there is a risk that a recession might arrive in 2023, we believe the potential negative effect on the share price would be temporary, and we see shares performing well over the long term. Mitigating the recession risk are a solid balance sheet, a highly variable cost structure, and a high percentage of profits coming from resilient business lines. Importantly, there are a number of structural tailwinds which are benefiting the company.

Be the first to comment