cokada/E+ via Getty Images

Investment Thesis

It is becoming apparent to many investors that NVIDIA’s (NASDAQ:NVDA) hyper-growth could be finally ending after two years of bull run. The deceleration of its revenue growth is also a long time in the making, given the pull-forward growth during the pandemic. Nonetheless, we believe that the pessimism has already been baked into NVDA’s valuations and stock price, given the drastic correction in November 2021. As a result, though a slight retracement could still be possible, we do not expect a similar harsh decline as in the past six months.

Nonetheless, a quick recovery would not be possible, given the ongoing macro issues, significantly worsened by the Ukraine war and China’s Zero COVID Policy. Those looking for a rally back to pandemic highs would be disappointed as well, since it is basically a once-in-a-lifetime occurrence. In addition, with the overly bearish market sentiments, intermediate-term sideways action could be entirely possible. Therefore, investors should be patient and avoid any incoming bear and bull traps moving forward.

NVDA Reported Excellent FQ1’23 With Robust Operating Metrics

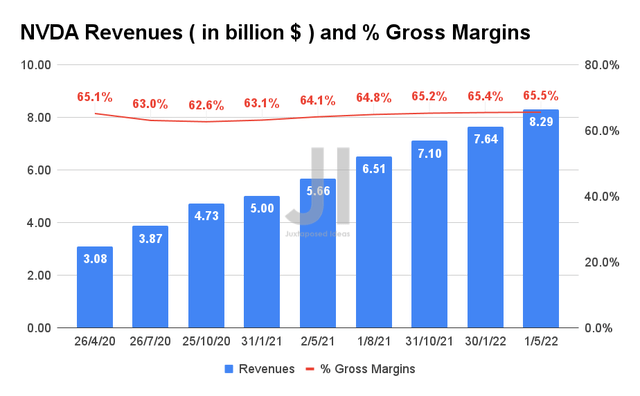

NVDA Revenue and Gross Income (S&P Capital IQ)

In FQ1’23, NVDA reported revenues of $8.39B, representing revenue growth of 8.5% QoQ and 46.4% YoY. It is also apparent that the company had managed to sustain its elevated gross margins over time despite the global supply chain issues, while reporting gross margins of 65.5% for the latest quarter, representing an increase of 1.4 percentage points YoY.

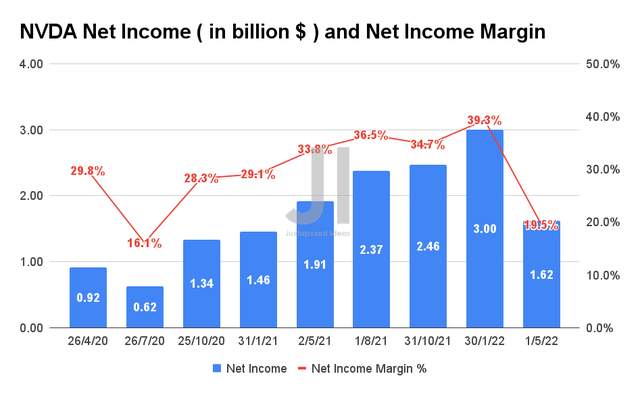

NVDA Net Income and Net Income Margin (S&P Capital IQ)

Though the drop in NVDA’s net income in FQ1’23 may look alarming, it is essential to note that it is attributed to the $1.35B termination charge in the ARM acquisition. Thereby, the adjusted net income of $2.97B would have been a more favorable comparison, since it represents an impressive 55.4% YoY growth, though only in line sequentially. Nonetheless, with adj. EPS of $1.36, NVDA easily surpassed consensus estimates’ EPS of $1.29 again, emphasizing its stellar performance in the past 14 quarters.

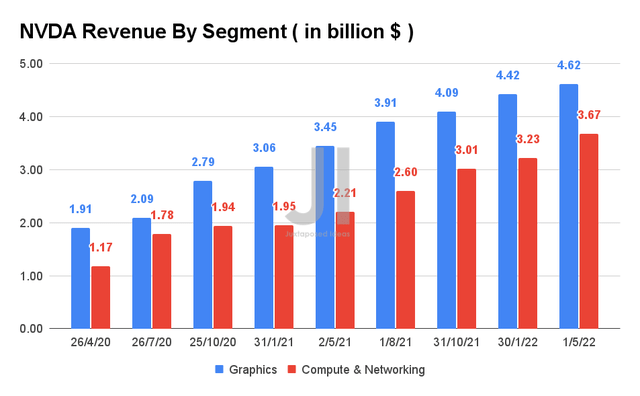

NVDA Revenue By Segment (S&P Capital IQ)

It is also evident that demand for NVDA’s products has been stellar so far, with continuous growth YoY. The GPU segment took the lead at $4.62B, accounting for 55.72% of its revenue in FQ1’23. The company reported a further breakdown of $3.62B in gaming-related sales with a 31% increase YoY, professional visualization sales at $622M with a 67% increase YoY, and automotive sales at $138M with a decline of 10% YoY. The decline for the latter is partly attributed to the global supply crunch for semiconductors, further exacerbated by reduced auto production from China’s Zero COVID Policy. Nonetheless, investors need not worry since the auto pipeline now exceeds $11B for the next six years, representing a 37.5% YoY growth.

In contrast, NVDA’s data center segment reported record revenue at $3.67B in FQ1’23, representing 83% growth YoY, thereby highlighting the growing demand from the hyperscale customers and vertical industries. Jensen Huang, founder, and CEO of NVIDIA, said:

We delivered record results in Data Center and Gaming against the backdrop of a challenging macro environment. The effectiveness of deep learning to automate intelligence is driving companies across industries to adopt NVIDIA for AI computing. Data Center has become our largest platform, even as Gaming achieved a record quarter. (Seeking Alpha)

BTC Historical Prices and Crashes (Coinbase)

However, given the recent crypto crash, there is a likelihood of slower demand for gaming and mining GPUs in the next few quarters, thereby further impacting its stock valuations then. Nonetheless, we do not expect the headwinds to be permanent, since the cryptocurrency market will rebound again as it did after the great crypto crash in December 2017 and May 2020.

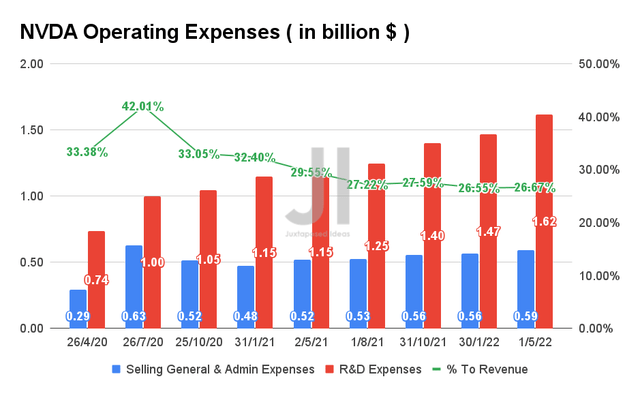

NVDA Operating Expense (S&P Capital IQ)

It is evident that NVDA continues to reinvest into the business with growing R&D expenses at a CAGR of 31.45% in the past five years. Nonetheless, the company has also shown much restraint in its operating expenditure, since it has remained relatively flat compared to its revenues in the past four quarters. By FQ1’23, NVDA only spent 26.67% of its revenues on operating expenses, compared to 29.55% in FQ1’22. Due to the company’s excellent management team and calculated growth strategies, we are confident of its excellent gross margins moving forward.

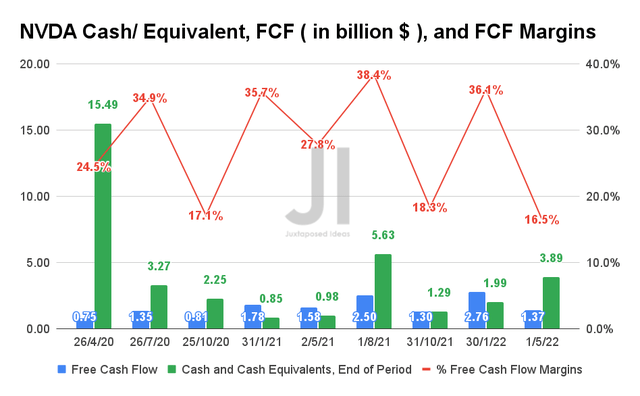

NVDA Cash/ Equivalents, FCF, and FCF Margins (S&P Capital IQ)

For FQ1’23, NVDA reported Free Cash Flow (FCF) of $1.37B with FCF margin of 16.5%, indicating a poorer performance YoY in comparison to FQ1’22 at FCF of $1.58B and FCF margins of $27.8%. Again, these are attributed to the ARM termination charge, which would have otherwise brought its adj. FCF to $2.72B. Nonetheless, we are not concerned, given that it is a one-time expense and that company retains robust cash and equivalents of $3.89B on its balance sheet.

However, NVDA’s Performance In FQ2’23 Is The Real Question

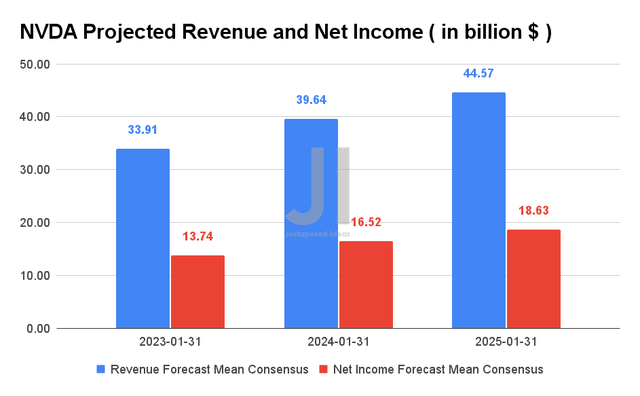

NVDA Projected Revenue and Net Income (S&P Capital IQ)

Over the next three years, NVDA is expected to report revenue growth at a CAGR of 18.32% and net income at a CAGR of 24.09%. However, while its projected revenue growth had remained constant from our previous analysis in May 2022, it is apparent that its profitability has been downgraded by -7.1% since then. Furthermore, consensus estimates have also reduced their projection for FY2022 revenues by -2.6% and net income by -3.9% since May 2022. These were probably attributed to NVDA lowering its FQ2’23 guidance to $8.1B of revenues with gross margins of 65.1% against consensus estimates of $8.44B, due to a $500M reduction from the Ukraine war and China’s Zero COVID Policy.

Nonetheless, we are of the opinion that the decline is nominal and temporary at best, since it is mainly attributed to the macro issues instead of consumer demand. In addition, we expect a more robust H2’22 performance from NVDA, potentially leading to an upwards rerating of its revenue and net income growth then, assuming more favorable macro conditions. Jensen Huang, founder, and CEO of NVIDIA, said:

We are gearing up for the largest wave of new products in our history with new GPU, CPU, DPU and robotics processors ramping in the second half. Our new chips and systems will greatly advance AI, graphics, Omniverse, self-driving cars and robotics, as well as the many industries these technologies impact. (Seeking Alpha)

In the meantime, we encourage you to read our previous articles on NVDA, which would help you better understand its position and market opportunities.

- Nvidia: Ridiculous Times Indeed

- Nvidia: Serving $100 Trillion Industries – Time To Buy The Market Leader

So, Is NVDA Stock A Buy, Sell, or Hold?

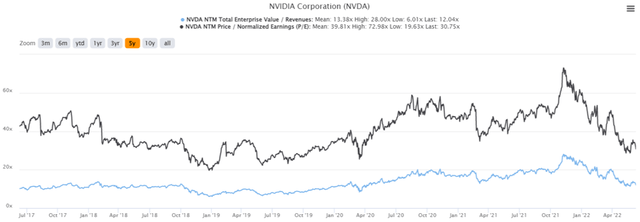

NVDA 5Y EV/Revenue and P/E Valuations (S&P Capital IQ)

NVDA is currently trading at an EV/NTM Revenue of 12.04x and NTM P/E of 30.75x, lower than its 5Y mean of 13.38x and 39.81x, respectively. The stock is also trading at $169.74 on 10 June 2022, down 51% from its 52-week high of $346.47, nearing its 52-week low of $155.67. It is apparent that the stock has had ambiguous sideways action in the past month, given the softer FQ2’23 guidance.

Despite the strong buy rating from consensus estimates with a price target of $277, we recommend patience for those looking to add more as the NVDA stock will likely remain in a rut for a while longer. In addition, despite the strong industry demand for NVDA’s A100 GPU, we expect temporary headwinds in the form of slowing demand from the crypto market. Nonetheless, with the contribution of the new DGX H100 AI supercomputing system by H2’22 and Grace Data Center CPU Superchip by H1’23, we may potentially see a stock recovery by then. We shall see.

In the meantime, it is entirely possible that the stock may continue its sideways action for some time, before recovering upon a positive catalyst.

Therefore, we rate NVDA stock as a Hold for now.

Be the first to comment