felixmizioznikov/iStock Editorial via Getty Images

Summary

I recommend a buy rating on Cavco Industries (NASDAQ:CVCO). It operates in an industry that is set to enjoy several tailwinds moving forward, and CVCO’s advantage in scale should allow it to ride on this tailwind to grow. The current macroenvironment is relatively favourable as it is much more affordable than a typical on-site home. I believe CVCO’s valuation has been beaten down to an unjustified level, which represents an attractive entry point.

Company overview

CVCO builds manufactured homes on an assembly line, with each module or floor section completed in stages. The company distributes its products to customers in 48 states and Canada via a network of independent distribution points and 45 company-owned retail stores. On September 24, 2021, CVCO acquired from Commodore certain manufactured housing assets, including six manufacturing facilities and two retail locations that were wholly owned by Commodore. With the purchase of Commodore, CVCO was able to reach more customers in the Northeast and strengthen its position in the Midwest and Southeast.

Secular tailwinds for manufactured home

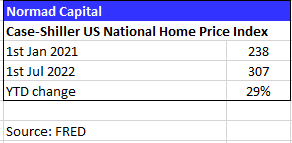

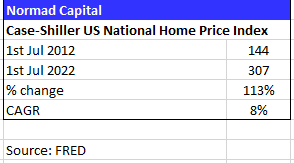

The most significant factor in the widespread use of manufactured houses is their low cost. Buyers, especially those from lower-income households, are feeling the effects of the persistent increase in home prices, rental costs, and mortgage rates. As of early 2021, home prices across the country had risen by 30%, while rents had risen by 15% to 20% on average. The situation was exacerbated by the federal government’s sudden wave of rising interest rates to contain inflation, which led to a 350bps increase in the US mortgage rate. As a result, this has a negative effect on the housing market.

Normad Capital, Fred

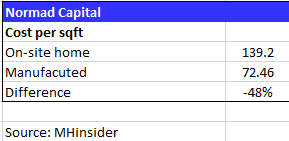

Many low-income families can benefit greatly from the fact that manufactured homes are, on average, 48% cheaper than site-built homes. Manufactured homes can be constructed quickly and cheaply due to the factory-building method. Most manufactured homes are constructed indoors in a controlled environment using conventional building supplies. Assemblage line methods and a controlled work environment mitigate issues like weather, theft, vandalism, damaged building products and materials, and incompetent labor that plague conventional home construction. Workers in a factory benefit from better management and training than their counterparts in the site-built housing industry.

Normad Capital, MHinsider

The quality of manufactured homes has increased greatly over the years, not just the price. There has been an improvement in both the variety and quality of manufactured homes on the market. Modern innovations in the construction industry have made it possible to create modular homes that look just like conventional houses from the outside, so they can appeal to a broad range of buyers and fit in with virtually any community. The innovation of factory construction has resulted in many new types of housing, including two-story attached homes and single-family attached homes. (See here for some examples of the choices available.)

In the long run, I anticipate that manufactured home prices will rise to reflect the increased perceived quality of these dwellings. The increase in detached single-family homes is also good for manufactured home prices because it acts as a floor. Home prices in the United States have increased at a CAGR of 8% annually over the past decade. Manufactured homes can expect to see price increases of 8% per year if the price gap between manufactured and site-built homes continues to hover around 40%.

Normad Capital, FRED

In addition to the aforementioned tailwinds, which will continue to help the manufactured home industry in the future. As I see it, the current housing shortage is a positive near-term factor. Homebuyers are being effectively pushed to consider manufactured homes as an affordable option due to rising rents. The Biden administration is also working to make up for the lack of homes by doing things like increasing the number of manufactured homes that are built and sold.

Scale is a major competitive advantage

The market share of the industry is strongly held by the top 3 players (over 75% held), and CVCO is the third-largest player in the manufactured home industry with ~13% market share. The remaining market share is split between many fragmented and subscale players.

One of the key advantages of scale is the procurement of raw materials, where the economies of scale are realized. As with other assembly-line operations, manufactured home factories can save money by purchasing supplies, furniture, and appliances in bulk. Manufactured home manufacturers negotiate and pass on to the consumer discounts on a variety of building materials. In the case of a manufactured home, scale also refers to reach. Manufactured home delivery is a challenging process, so the availability of a reliable delivery system and close proximity to the intended location are essential. In order to be competitive on a national scale, it is essential to have production facilities in different parts of the country. Delivery network, procurement ability, and supply chain bottlenecks will enable superior operators to gain market share from inferior suppliers in the local market.

Also, the majority of people are unaware of the importance of relationships formed with local distributors and retailers. These sellers have a significant effect on customer acquisition and are essential for achieving local economies of scale. As a result, first-mover advantage (which leads to scale) is frequently a game-changer, as it is essential to build strong and long-lasting relationships with key stakeholders.

Strong history of operational excellence

The best evidence of a business concept and management’s ability to execute it is history. CVCO’s ten-year performance has been stellar in a number of ways. Over the past five years, the company’s top line, EBITDA, and EPS have all increased at annual compound rates of 13%, 24%, and 31%, respectively. Management has been optimizing the business and avoiding irrational expansion, as evidenced by the margin profiles. While EBITDA margin grew from 2.65% in FY2011 to 13.69% in FY22, gross margin increased from 14% to 21.5% over the same time period. What’s more impressive is that management did all of this without using balance sheet leverage; the business has been cash flow positive every year since 2011. With interest rates on the rise, a strong balance sheet is essential for making bargain-priced purchases (high interest rates reduce asset value due to the rising cost of capital).

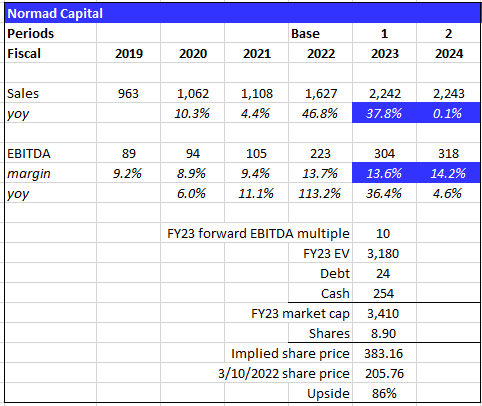

Valuation

At the current stock price of $205.76 and 8.9 million shares, the market cap is ~$1.8 billion. I believe the stock price should be worth $383.16, or 86% higher than it is today. Using consensus figures, SPGI will make $2.2 billion in sales and $318 million in EBITDA in FY24. This is on the back of expanding margins and a huge growth in FY23, both of which I believe will happen as discussed in my thesis above.

Assumptions:

- Sales: to grow according to consensus estimates over the near-term until FY24 supported by short-term housing supply issues, rising housing prices, and mortgage rates

- EBITDA: to follow consensus estimates until FY25 which suggest margin expansion due to incremental margin from rising manufactured home prices and fixed cost leverage. I believe the margin could expand higher, as seen from the jump from FY21 to FY22 (~430 bps of expansion), but to be conservative, I used consensus figures.

- Valuation: to be valued using a slight discount from the past 10-year average EBITDA multiple of 10x in light of the rising rates environment as equity risk premium rises.

Normad Capital

Risk

Integration of Commodore

CVCO recently completed the $153 million acquisition of Commodore. In comparison to previous acquisitions, this is a relatively large one. Even though CVCO has grown through acquisitions in the past, any delays or mistakes in putting the businesses together would hurt performance.

Deep recession

In spite of the fact that CVCO is less susceptible to the typical housing cycle due to its affordability, it is still vulnerable to the economic cycle. During the subprime crisis, CVCO was severely impacted (FY07 to FY09). EBITDA and EPS both dropped by over 95%, while revenue dropped by 40%.

Poor acquisitions moving forward

CVCO has historically grown through acquisitions. Given the barriers erected by incumbents in the region, acquisitions are critical in this industry (recall the importance of local relationships with stakeholders). As a result, acquiring a subscale player and quickly gaining a foothold is easier than starting a new brand and slogging it out for years. The issue with the acquisition is that it could be a major flop, affecting CVCO’s growth.

Conclusion

CVCO operates in an industry with several tailwinds, such as affordability of manufactured homes, housing supply issues, and quality of manufactured homes. This sets the stage for CVCO to continue growing and capturing market share from housing starts. CVCO is currently trading at its trough-multiple (ETBIDA 5.1x), which I think is a good entry point that should give investors a huge return based on growing earnings and a re-rating to previous average levels (with a slight discount).

Be the first to comment