Kukurund

Introduction

It’s time to talk about the world’s largest producer of construction and mining equipment. Caterpillar (NYSE:CAT) has been a part of my dividend growth portfolio since 2020 when I bought the stock because it was criminally undervalued – on top of the company’s qualities as a dividend growth stock, which I will discuss in this article. However, I’m not just going to dive into the company’s finances, I’m also going to elaborate on a secular economic development that I believe will be a driver of headlines for years, if not decades to come. The mining industry will become more important than “ever” due to the global rush for renewable technologies and applications. Moreover, I will discuss the current economic environment and my own strategy when it comes to owning Caterpillar in an industrial-heavy portfolio.

In other words, we have a lot to discuss!

A Challenging Macro Environment

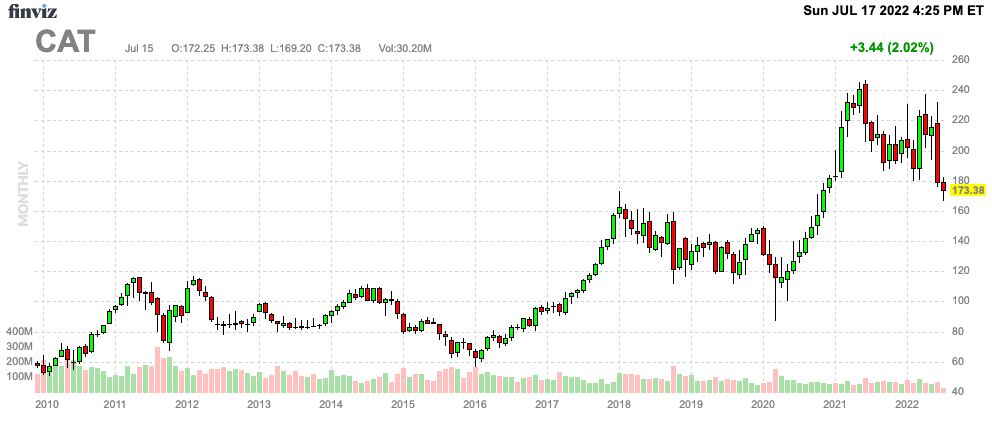

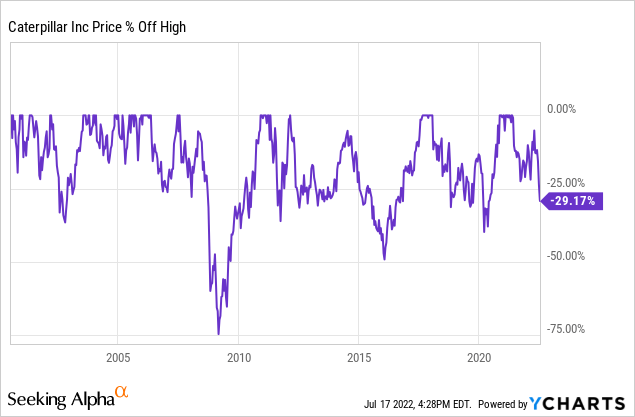

The soon-to-be Texas-based machinery company is down roughly 30% from its all-time high reached in the first half of 2021.

FINVIZ

Once again, Caterpillar finds itself in a nasty drawdown. However, as bad as this one is – so far – it’s nothing compared to what investors had to stomach during the 2014/2015 manufacturing recession or the Great Financial Crisis, which erased close to 75% of the company’s market cap.

In a recent article, I discussed my view on industrial stocks, which includes Caterpillar. We’re dealing with a mix of related issues like (but not limited to):

- Supply chain issues in almost every single industry

- An energy crisis (it’s worse in Europe than in the US)

- Geopolitical tensions in Ukraine and to a lesser extent in Asia

- High inflation

- Low consumer sentiment

- An aggressive Federal Reserve, which is determined to suppress inflation

The worst part is that, unlike prior cycles, the Federal Reserve is hiking and determined to fight inflation. As the central bank cannot influence supply chains directly (i.e., it cannot print oil, wheat, affordable labor, or make China quit its zero-COVID policy), it is determined to use the demand side to lower inflation. This means hurting demand to balance supply and demand. That’s one of the reasons why stock market sentiment is far from great – to put it mildly.

While industrial production is still growing at 4%, new, leading data is painting a darker picture. As I explained in the article I just mentioned, new orders in manufacturing are expected to contract while a lot of commodities remain in short supply. That’s bad news for companies as it not only prevents them from quickly turning their backlog into actual sales but also slows backlog growth considerably.

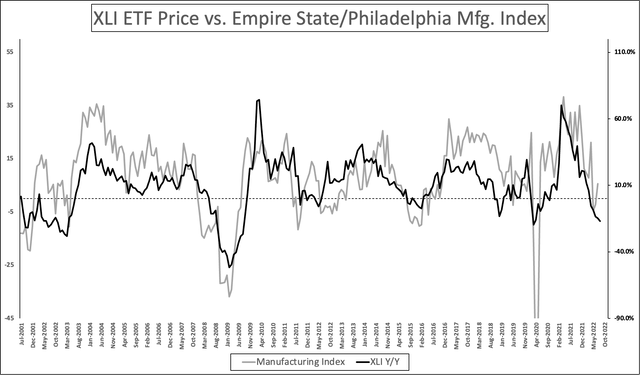

The good news is that a lot has been priced in. This is the chart I used comparing industrial stocks (XLI) to leading manufacturing expectations.

Author

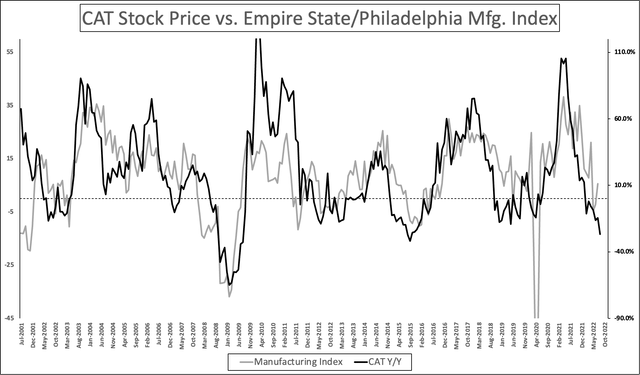

This is the chart when comparing this data to Caterpillar:

Author

While it is hard/impossible to call for a bottom, I do like the risk/reward in a lot of industrial (and related) stocks, which is why I have been adding to some of them recently. After all, when I invest on a long-term basis, I believe it’s more important to buy stocks at prices that seem very attractive instead of aiming for the perfect bottom, which often leads to not buying any stocks at all.

With that said, let’s discuss a trend that both I and Caterpillar highlighted in recent weeks and months: secular commodity growth.

Secular Commodity Growth

On June 21, I wrote an article covering metals and mining ETF (XME). My focus was on secular growth causing severe (expected) commodity supply shortages.

Seeking Alpha

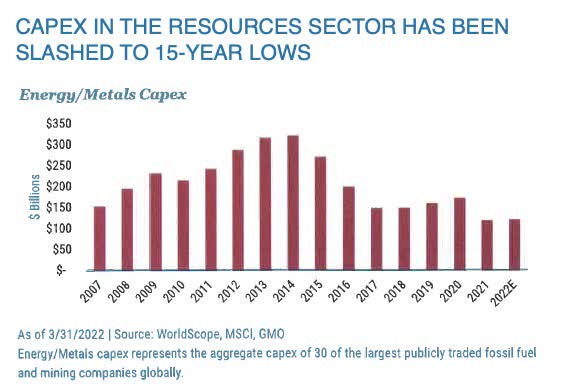

One of the issues facing the global demand for commodities is the fact that supply isn’t keeping up. It’s not just the energy supply that is suffering from subdued capital expenditures, it also impacts metals.

Mining.com

According to Mining.com,

Underinvestment in supply in recent years will impact production for at least the next decade. Over most of the last decade, commodity prices have been falling or low. Commodity producers, reacting to low prices and criticism that they had overinvested during the China-driven commodity supercycle, slashed capex significantly.

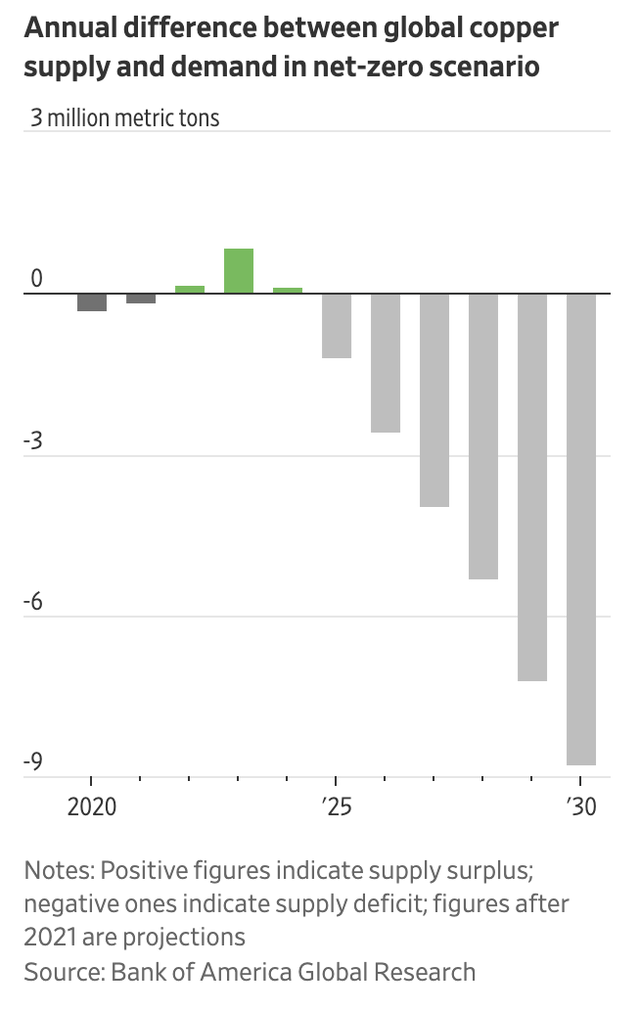

The Wall Street Journal had similar findings with regard to the need for metals tied to renewable technologies (net zero):

Producers have taken some steps to increase the supply of specialty materials such as lithium and cobalt that are crucial ingredients in batteries, but not enough to fill expected shortages.

Despite seeing some of their highest profits in a decade, many mining executives are cautious because of rising costs for fuel and equipment, higher interest rates and challenges developing deposits in emerging markets that are seeking a greater share of industry earnings.

If we use copper as an example, it is estimated that global copper supply will not even be anywhere close to expected demand in a net-zero scenario.

Wall Street Journal

Kitco News reports that the mining industry needs to spend $81 billion annually to 2030 just to avoid shortages to achieve net zero.

Moreover, these expectations do not include any estimates of rising demand from consumers in high-growth economies – and one can imagine what a rising middle-class in emerging markets means for metals demand.

According to Kitco:

“The UN estimates the adaption costs at $140-300BN pa by 2030 in developing countries alone. Based on the mining CAPEX required to achieve Net Zero, although this may simplify it a bit, the return on that investment could be somewhere between +94-317%,” the authors of the report said.

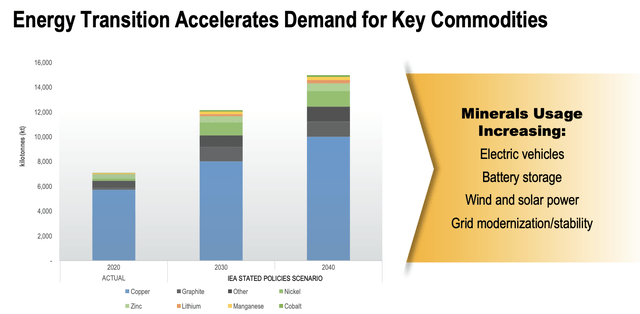

With all of this in mind, the start of this article – Caterpillar – also commented on these issues in its 2022 investor day presentation.

For example, in 2020, key commodity demand was roughly 7,000 kilotons. This number could rise to 12,000 in 2030 and 15,000 in 2040.

Caterpillar Inc.

Electric vehicles alone need 6x more metals than a conventional car. These numbers are truly mind-blowing.

On a side note, Caterpillar expects that residential construction spending will also double by 2040. The same goes for “traditional” infrastructure spending.

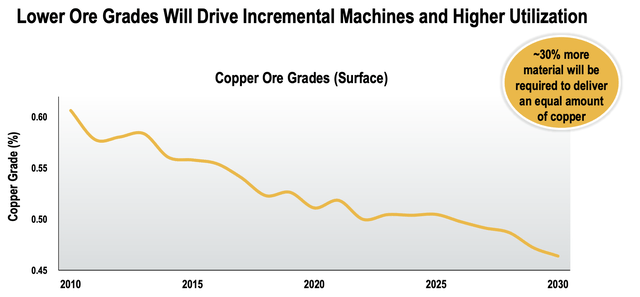

Moreover, additional growth opportunities for Caterpillar will come from the fact that – according to the company – it will take 30% more material in 2030 to deliver the same amount of copper that mines produce now. That’s a huge number. And, bear in mind that copper is one of the most important energy transition commodities.

Caterpillar Inc.

It also helps that the average age of mining machinery is 11.7 years, opening up mid-term opportunities for miners to replace old equipment in an environment of high commodity prices.

So far, the company has the benefit of long-term high commodity demand as well as a favorable risk/reward thanks to recent stock price weakness and slower mid-term economic growth expectations.

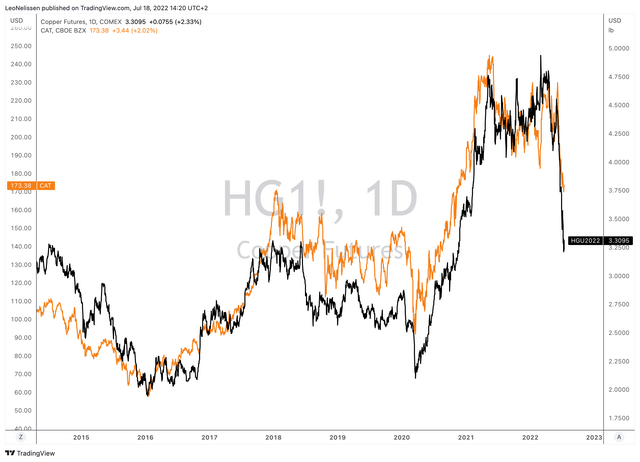

I also believe that the dollar will start to weaken as soon as the Fed starts to sound more dovish. That could reverse the decline in copper (that dragged down Caterpillar) – especially when economic growth expectations.

TradingView (Black = Copper, Orange = CAT)

With all of this said, Caterpillar is more than just a cyclical stock. It has the ability to deliver significant long-term value.

The Dividend Stock CAT

Caterpillar is extremely cyclical. With a market cap of $92.5 billion, it’s the world’s largest producer of construction and mining equipment and a major producer of off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives.

The company has four reportable segments. Three of them are in the ME&T category, which one frequently encounters in Caterpillar’s reports and presentations. It stands for machinery, energy, and transportation and it includes every single tangible product that Caterpillar produces. The fourth segment is financial products. This segment makes money from financing and insurance services.

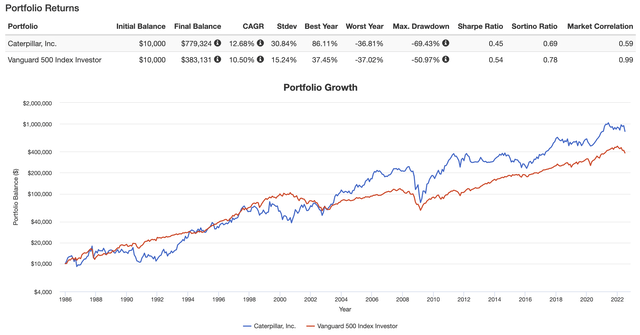

Despite its cyclical behavior, Caterpillar gains more during bull markets than it loses during bear markets – a lot more. Since 1985, Caterpillar has returned 12.7% per year, turning $10,000 into almost $780,000. This beats the S&P 500 by almost 200 basis points per year. The issue is that this comes with a 30.8% standard deviation, which is double the standard deviation of the S&P 500.

Portfolio Visualizer

Outperforming the market is hard, and it’s even harder when operating in industries that are as cyclical as the industries Caterpillar operates in.

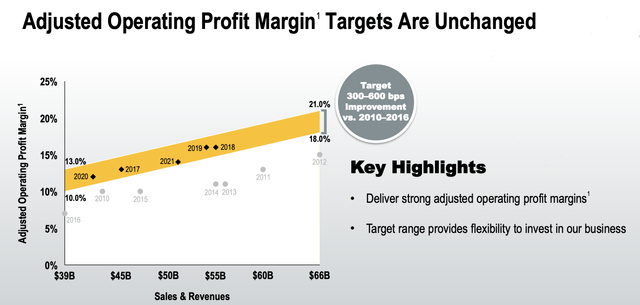

Caterpillar’s success is basically caused by its quality product portfolio that not only quality products, but also future technologies like full remote control, automation, EV applications, and connectivity. The company is able to sell these products while raising its margins. The company targets at least 300 basis points higher operating margins compared to the 2010-2016 period (this was a slow period with low commodity prices). So far, this is working out as expected.

Caterpillar Inc.

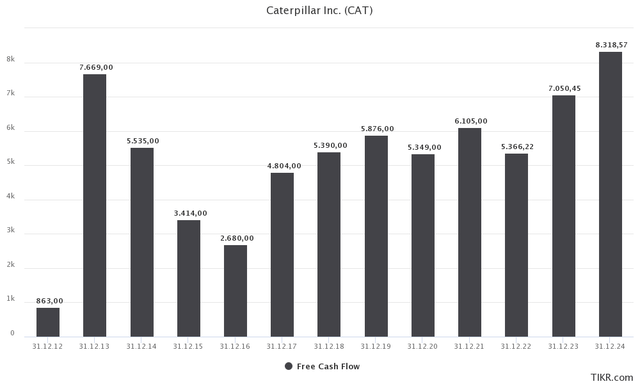

Thanks to higher margins, the company is consistently generating high free cash flow. In 2021, Caterpillar did $6.1 billion in free cash flow. That’s 6.6% of the current market cap. As free cash flow is net income adjusted for non-cash operating items minus capital expenditures, it’s cash a company can spend on buybacks, dividends, and debt reduction.

TIKR.com

During the past 12 years, net debt has slowly, but gradually declined. This year, the company is expected to end up with $28.9 billion in net debt. Next year, that number could be $28.0 billion thanks to $7.0 billion in expected free cash flow.

$7.0 billion in FCF implies an FCF yield of 7.6%, which is a lot.

What do I mean by “a lot”?

It’s enough to support strong dividend growth, buybacks, and debt reduction.

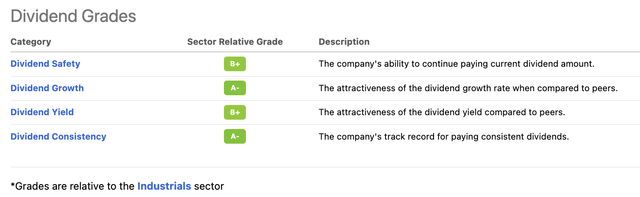

When it comes to dividends, Caterpillar has one of the best Seeking Alpha scorecards I’ve seen in a long time. It scores high on everything, especially dividend growth, and consistency.

Seeking Alpha

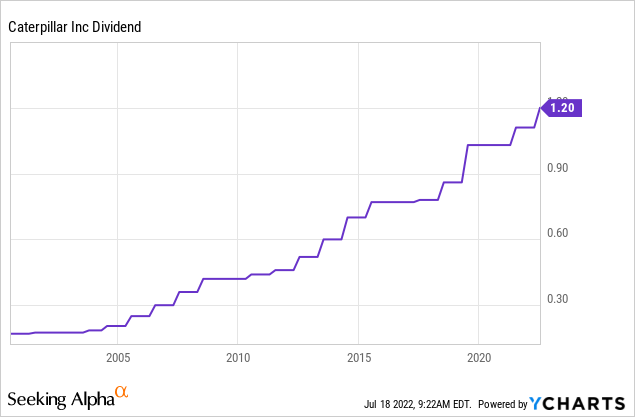

On June 8, Caterpillar hiked its dividend by 8.1% to $1.20 per share. This implies a 2.8% dividend yield. The 10-year average annual dividend growth rate is 9.2%, which is more than decent for a stock that is as mature and cyclical as Caterpillar. Also, 9% per year on a current yield of 2.8% is a big deal that quickly turns 2.8% into a yield on cost that even high-yield-seeking investors will appreciate.

On top of that, the company is aggressively buying back shares. This has two reasons. First, it allows a company to return cash without making a big commitment like a dividend. Second, Caterpillar wants to return a lot of cash.

This is what CEO Umpleby said in a recent presentation (he also said he’s positive for the future, so I kept that in the quote):

investors look increasingly to companies that return capital to shareholders through dividends or share repurchases or a dividend aristocrat, we’ve returned over the last three years, 101% of our free cash flow to shareholders. We’ve done what we said we’re going to do and we believe our total addressable market is increasing. So we’re very excited about the future. And in my 42 years with the company, I’ve never been more excited about our future as I am right now.

In the first quarter alone, buybacks were $800 million. Earlier this year, the company approved a new $15 billion long-term buyback program. That’s more than 16% of shares outstanding.

Between 2017 and 2021, the company has bought back roughly 50 million shares, or 8.1% of its shares outstanding (net buybacks).

In other words, if my long-term bull case turns out to be correct, investors are in a terrific spot to benefit from a high total return.

Caterpillar Stock Valuation

A part of the valuation is the risk/reward that I already discussed in this article. The stock is down roughly a third from its all-time high, which is now offering new opportunities.

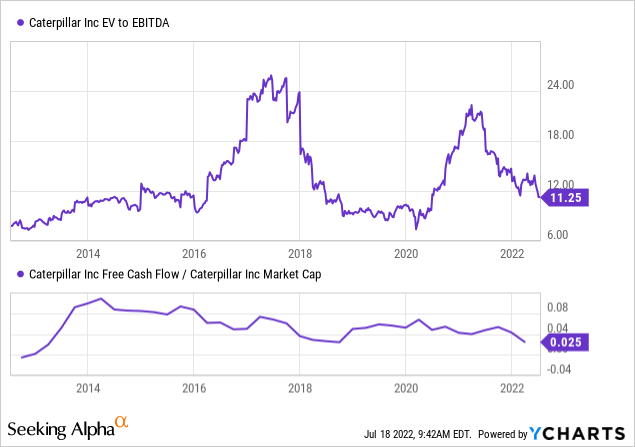

To give you a few numbers, let’s look at the EV/EBITDA valuation. For that, we need the company’s $92.5 billion market cap, $28.0 billion in expected 2023 net debt, (just 2.5x EBITDA), and $5.4 billion in pension-related liabilities. This gives the company an enterprise value of $125.9 billion. That’s 11.2x next year’s expected EBITDA of $11.2 billion.

That’s a more than decent valuation. The same goes for the company’s implied FCF yield of close to 8%. That would imply one of the highest yields since the commodity crash in 2014/2015. Or to put it differently, investors are not overpaying to get access to what matters most: the company’s cash flow.

Personally, I’m not changing a thing. I have more than 40% industrial exposure. CAT is a core part of that since 2020.

Takeaway

Caterpillar isn’t just a cyclical machinery company; it has been a great source of wealth for decades. And that isn’t about to change. The company benefits from secular growth tailwinds in mining and high expected growth in construction. By 2040, we will see demand for metals more than double while the quality of mining operations deteriorates, increasing the need for quality equipment.

On top of that, the risk/reward has gotten a lot better. Caterpillar is trading at an attractive level, the implied free cash flow yield is high, and investors have priced in a lot of weakness in manufacturing sentiment.

I also discussed the company’s qualities as a dividend growth stock. Its yield is now close to 3.0%, dividend growth is high, and buybacks are used to distribute additional cash to shareholders.

The only thing investors need to be aware of is that Caterpillar is very cyclical and prone to regular (steep) downturns.

Once investors keep that in mind, there’s not a lot more to it besides buying and waiting for the expected total return to do its work.

(Dis)agree? Let me know in the comments!

Be the first to comment