poba

With its shares delivering a total return of 235.1% since November of 2019, Catalyst Pharmaceuticals (NASDAQ: NASDAQ:CPRX) is positioned to continue beating the market for at least another two years. Thanks to favorable sales prospects for its therapy and a balance sheet that’s likely to keep getting stronger over time, this biotech has few obstacles in its way, and plenty of places to invest for growth. Plus, with burgeoning cash flows and little to worry about in terms of risk stemming from failures in clinical trials — more on that later — the company’s stock is an attractive purchase for a long-term hold.

Profitable scaling will continue as more Catalyst enters more international markets

Catalyst’s product is a drug called Firdapse (amifampridine), which is indicated to treat adults with Lambert-Eaton Myasthenic Syndrome (LEMS), a rare disease that’s characterized by muscle weakness, fatigue, and a high risk of developing cancer. So far, the medicine has seen success in the U.S., where it’s authorized for sale. In Q3, Firdapse sales grew by 59.3% year-over-year, bringing in $57.2 million. Its TTM diluted earnings per share is $0.48, and with its robust profit margin near 39.74% widening substantially in the last year, its net income is likely to continue to climb too, as little has recently changed about its operating and competitive environments.

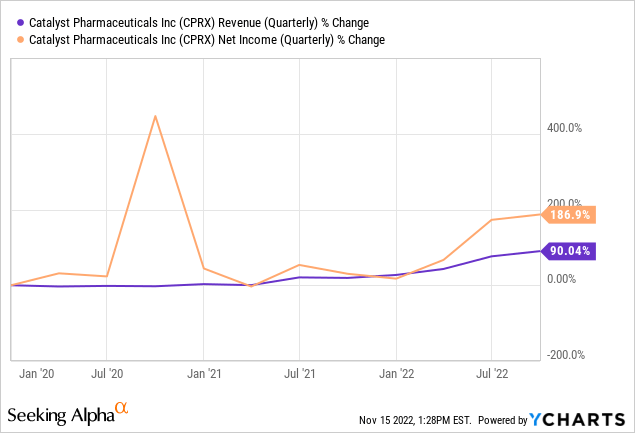

Expect it to perpetuate its strong three-year run of rising revenue and earnings, as shown below:

In the short-term, the bull thesis for Catalyst rests on the very high probability that Firdapse sales will keep rising, as there’s reason to believe that there’s plenty more room to grow within the LEMS therapy market. Per management’s estimate, of the 3,000 people in the U.S. with LEMS, roughly 1,600 people are properly diagnosed, with 800 undergoing treatment with Firdapse already and another 800 still awaiting treatment. Given that the medicine was approved for sale in November 2018, the therapy market is thus now more than half penetrated, which portends steady penetration for a while longer. As there aren’t any competing products that treat LEMS in the U.S., nor are any expected to hit the market anytime soon, there aren’t any major barriers standing between the company taking the rest of the market.

Read differently, that means the top line could ostensibly double in size over the next couple of years, potentially reaching as much as $340 million annually, as the remaining portion of the easily-accessible market starts treatment. And while there is a substantial portion of mis-diagnosed or undiagnosed patients, it’s reasonable to expect at least some of those people to get a proper diagnosis over time as a result of the company’s ongoing efforts to educate clinicians and patients.

Catalyst also plans to expand into Japan by getting Firdapse approved for sale, which will enable it to continue growing its top and bottom lines in the medium-term. Given that there are an estimated 1,300 people living with LEMS in Japan, three years after the drug’s launch there, the biotech could be treating as many as 650 individuals if its market penetration follows the same trajectory as it did in the U.S. If the medicine is priced similarly to in the U.S., treating that many people could imply revenue growth of around 81.12% compared to today.

It’ll also continue to penetrate the market in Canada, where the drug has been approved since 2020. Though neither the Canadian nor the Japanese market will be as large as the U.S., the two countries are likely stepping stones for the business to enter other major foreign markets like the E.U. and perhaps China. Furthermore, Catalyst aims to soon launch a program to expand the indications of its medicine to patients with both small-cell lung cancer (SCLC) and LEMS. So the bull thesis is stronger for the short-and-medium terms than it is for the long-term, when the company will need to succeed with its clinical trials while also penetrating international markets that may prove to be less friendly than at home.

A strong balance sheet portends well for the future

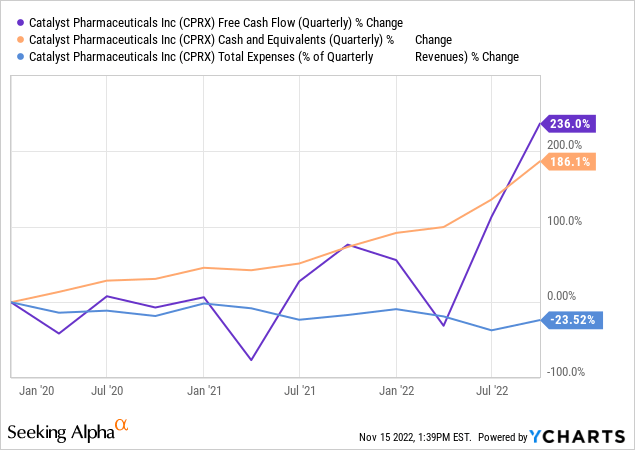

Catalyst’s TTM free cash flow (FCF) is $75.41 million, and it has more than $256 million in cash and equivalents on hand, with total debt of a scant $3.97 million. At the same time, its TTM research and development (R&D) expenses are only $16.86 million, and its selling, general, and administrative (SG&A) costs of $54.72 million are only 24.75% of its quarterly revenue. In sum, this means that it has plenty of money in the bank, with plenty more on the way relative to its current expenses.

Take a look at this chart:

At present it doesn’t need to borrow any money, which should insulate it from risks stemming from rising interest rates, but it could still afford to take out significant new debt if it’s needed for growth initiatives. Therefore, management has and will likely continue to have more than enough leeway to commercialize its drug in new markets or buy new pharmaceutical assets. It could also spend on acquiring promising smaller companies or initiating new pipeline programs, both of which will likely be necessary to succeed in management’s stated aim of creating a rare disease therapy portfolio. Hunting for places to spend excess cash is an enviable position for a biotech company to be in, and it’s also a major factor supporting the bullish thesis for the stock.

The price is right, for now

Regarding its valuation, Catalyst is in the middle of the road. Consider the below chart depicting its TTM price-to-earnings (P/E) ratio and its TTM enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio compared to its profitable peers in biotechnology with similar market caps:

|

Company |

Market Cap |

TTM P/E |

TTM EV / EBITDA |

|

Catalyst Pharmaceuticals |

$1.67 billion |

26.3 |

15.0 |

|

Corcept Therapeutics (NASDAQ: CORT) |

$2.84 billion |

28.2 |

18.4 |

|

Halozyme Therapeutics (NASDAQ: HALO) |

$7.28 billion |

36.1 |

29.3 |

|

Exelixis (NASDAQ: EXEL) |

$5.49 billion |

17.9 |

10.1 |

|

Dynavax (NASDAQ: DVAX) |

$1.64 billion |

3.2 |

3.6 |

Source: compiled by author with data from Ycharts.

As you can see, it’s a hair cheaper than its most-similar competitor, Corcept Therapeutics, which also has a single drug on the market, and it compares favorably with the others, even if it isn’t overtly priced at a discount. If Firdapse continues to sell well, and the company’s plans to expand its indications while entering new markets look like they’re coming to fruition, Catalyst’s valuation will likely become more pricey over the next few years.

But, without the announcement of fresh pipeline programs or new acquisition targets, rising earnings will continue to be the biggest driver of share price appreciation. So if earnings growth looks like it’s starting to level off, be aware that any dip that occurs will be a risky buying opportunity.

A minimal pipeline makes for few opportunities to de-risk

The biggest risk associated with Catalyst Pharmaceuticals stock is that its pipeline is threadbare compared to other biotechs of its size, even when considering those that don’t have a product on the market. Since the recent success of its attempt at expanding the indication of Firdapse to include children older than age six in the U.S., there’s only one publicly-disclosed project in progress, and it’s a phase 3 clinical trial required by Japanese regulators before they’ll approve Firdapse for sale there. No novel compounds are currently in clinical-stage testing with the company.

There are several associated risks to investors stemming from a sparse pipeline, starting with the risk of the Japan trial failing to deliver the efficacy results sufficient for commercialization. Aside from causing future revenue estimates to require correction, dragging the stock down in the process, that’d leave the biotech’s R&D capabilities and its clinical trial organization idle, which would be quite an inefficient use of resources. It might also call ease of commercializing Catalyst’s medicine elsewhere outside North America into question.

Assuming the trial goes as planned, the company will still need to invest in developing new programs (or advancing its preclinical programs into the clinic) if it wants to seed its future growth opportunities. The other associated risk is if management decides to initiate new pipeline programs or to buy new pharmaceutical assets for further development in fields that the market is pessimistic about. For example, if Catalyst purchased the rights to assets that had already been tested in third-party clinical trials and failed, investors may not consider buying those assets to be a good use of the company’s money from the perspective of generating shareholder value in the future.

With little in the way of communication from the company about potential acquisition targets or pipeline assets of interest, and with little in the pipeline, right now investors are almost guaranteed to be caught by surprise by whatever management ultimately chooses to invest in to sustain growth. It’s also true that the market could react positively to any new information from Catalyst. Still, the lack of a robust roadmap for continuing growth is a major impediment to the bull thesis for this stock, and it means that buying shares for the purpose of a long-term hold is only an appropriate move for those who can tolerate the risks associated with early-stage biotech companies.

Be the first to comment