yuelan/iStock Editorial via Getty Images

Today, we are back to comment on Novartis’s latest development (including its Q3 update) thanks to our participation in the Credit Suisse Global Healthcare Conference (NYSE:NYSE:NVS, OTCPK:NVSEF). During the year, we decided to downgrade Novartis mainly for a lower Sum-of-the-Parts valuation with a discount on Sandoz and 2) the company’s limited growth catalyst in the short/medium term horizon with important losses of exclusivity.

Q3 results implication and the latest conference

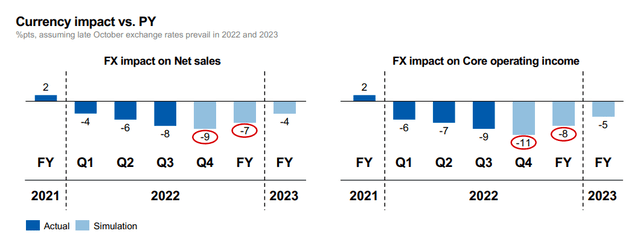

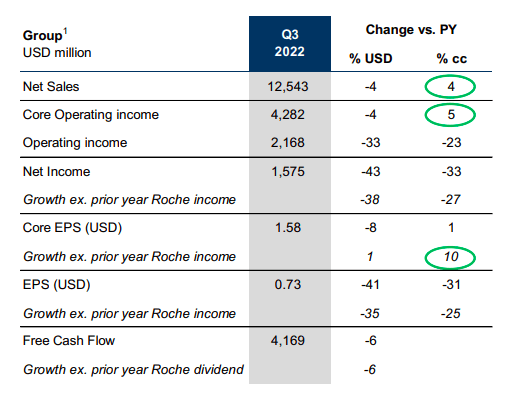

Looking at the Q3 results, Novartis’ performances were mixed and reflect our main thesis. Indeed, the company missed sales by 2% and recorded negative sales growth at minus 4% compared to the last year-end quarter. However, the group’s operating profit was in line, but missed on its EBIT pharmaceutical core sector. Numbers in hand, it was negatively impacted by currency development with a minus 8% and 9% in top-line sales and EBIT respectively.

Novartis FX impact

Source: Novartis Q3 results presentation

More important to note and key to our forecast number is the fact that the company expects a drop of 4% in sales and also a drop of 5% in its core operating profit in 2023. Looking at the company’s main products on Wall Street expectations, key misses were Cosentyx, Pluvicto, and Leqvio. Negative to Novartis’ future performance is the generic launch of Gilenya which could add near-term pressure on the company accounts. For the above reason, here at the Lab, we are not making any changes to our 2022 numbers and we decided to lower our EPS by 1% for the higher competition in the US generic new entries.

Novartis Q3 performance

Source: Novartis Q3 results presentation

Concerning the Healthcare conference, our main take is that Novartis is reorganizing its internal structure. Haematology and oncology are going to be the next important area where the company would like to focus. There was more clarity on geographic footprint and R&D development with a focus on Germany and also in the US. Limiting the scope and expanding the commercial structure will provide an upside in the long term. However, there were no positive indications of new drug development. Another negative aspect that was covered was the IRA implication. The Inflation Reduction Act was signed by the Biden administration to reduce drug prices for people (and consequently reduce Government spending). It is not easy to estimate an impact on Novartis accounts, but we hope that the company will lobby the US Government to reach an agreement on the activity of the small molecules and also expand its years of exclusivity to avoid repercussions on price development.

Conclusion and Valuation

The company’s limited growth potential limited our rating, so we reiterate our neutral valuation. Last time, we arrived a target price of CHF 80 based on 13x P/E 2023 estimates. The company is trading at 12.7x P/E and is now in line with our target price. In addition, Novartis is at a 13% discount compared to its closest peers, and we believe this is justified. Q3 was mixed and the negative 2023 outlook was broadly in line, with no major changes, we confirm our previous valuation.

Be the first to comment