elena_larina/iStock via Getty Images

Note:

I have covered Castor Maritime (NASDAQ:CTRM) previously, so investors should view this as an update to my earlier articles on the company.

Last month, junior Cyprus-based shipping company Castor Maritime reported anticipated, strong second-quarter results.

The company’s average daily time charter revenue (“TCE”) rate increased by more than 20% sequentially to $21,705 fueled by strong contributions from both the dry bulk and the recently acquired tanker segment.

In Q2, Castor Maritime generated almost $40 million in operating cash flow, a new record for the company thus causing cash and cash equivalents to increase to $115.3 million.

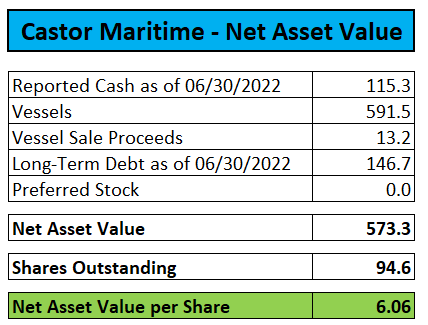

Net debt amounted to $31.4 million or just slightly above 5% of Castor Maritime’s estimated fleet value of $591.5 million.

Please note that the previously announced sale of the Aframax tanker Wonder Arcturus for $13.15 million closed after the end of the quarter. The transaction is expected to result in a $3.7 million capital gain before expenses in the current quarter.

Unfortunately, dry bulk charter rates have weakened substantially across all market segments in recent months due to a combination of rapidly easing port congestion and underwhelming demand from China.

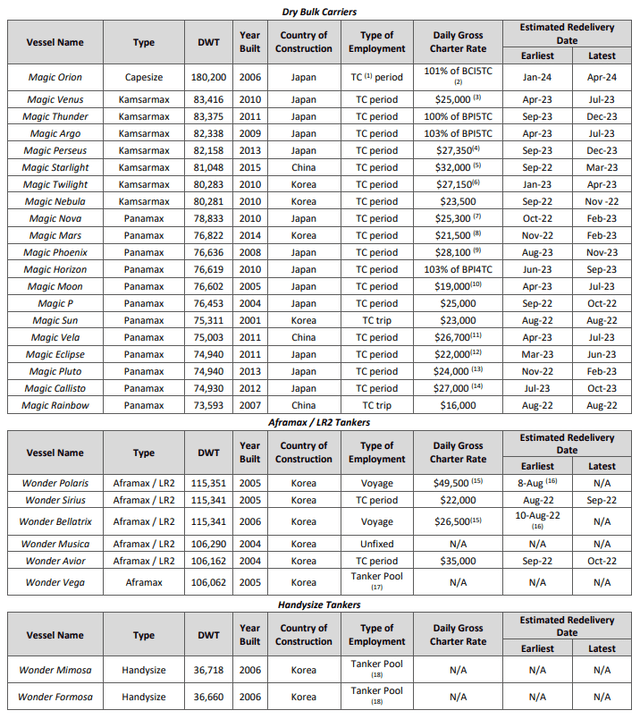

That said, the company’s latest fleet employment status (as of August 5) still points to another strong earnings report in November:

Company Press Release

The only negative development appears to be the “unfixed” status of the Aframax tanker Wonder Musica, which is somewhat perplexing in the current, strong tanker market as the vessel is not yet due for its 5-year special survey and doesn’t seem to have suffered any sort of damage as of late.

Please note that the company’s recently downsized at-the-market common stock offering program (“ATM program”) expired on June 15 without replacement.

Due to the company’s decent first half performance and strong secondhand vessel values, net asset value (“NAV”) per share has increased substantially quarter-over-quarter:

Company’s SEC Filings/Compass Maritime

Recent weakness in dry bulk charter rates and widespread fears of a global recession have caused the discount to NAV to increase to a record 82%. In addition, investors appear to remain mindful of a number of issues:

- Castor Maritime’s past involvement in capital raising schemes to the detriment of common shareholders very similar to smaller peers Globus Maritime (GLBS), Imperial Petroleum (IMPP, IMPPP), United Maritime (USEA) and OceanPal (OP).

- CEO, CFO and Chairman Petros Panagiotidis retaining full control of the company via supervoting preferred shares.

- A company controlled by the CEO’s sister remains responsible for the technical management of Castor Maritime’s fleet.

-

An entity controlled by the CEO is providing the commercial management for Castor Maritime.

In aggregate, the CEO and his sister managed to extract a whopping $13.2 million in management fees, charter hire commissions, administration fees and sale and purchase commissions during 2021.

While I recently downgraded peer Globus Maritime based on its newbuilding exposure and a perceived lack of near-term catalysts, I am hesitant to apply similar standards to Castor Maritime given the company’s outstanding financial condition, exposure to the red hot tanker markets and the recent removal of the long-standing ATM program overhang.

While I do not really expect major catalysts like share buybacks or a dividend initiation to emerge, I am reluctant to downgrade shares near-all-time lows with earnings and NAV at all-time highs.

In fact, I recently purchased a small trading position in the shares just in case last week’s recovery in dry bulk charter rates continues. Admittedly, this isn’t exactly a high-conviction trade but still worth a try after a number of brutal sessions for the general market and shipping stocks in particular.

Bottom Line

Castor Maritime reported strong second quarter results with an impressive cash flow performance. The company remains in outstanding financial condition with plenty of liquidity and negligible net debt.

Investors can reasonably expect Castor Maritime to report a strong Q3 in November with results boosted by the company’s tanker segment and a large one-time gain from the sale of the Wonder Arcturus.

As dry bulk charter market conditions have deteriorated in recent months, I would expect a weaker Q4 but even at current charter rates, the company should still generate decent operating cash flows.

At this point, I remain reluctant to downgrade shares near-all-time lows with earnings and NAV at all-time highs, particularly given recent removal of the long-standing ATM overhang and meaningful exposure to the red-hot tanker markets.

Be the first to comment