Adam Smigielski/E+ via Getty Images

Investment thesis

Although Takeda Pharmaceutical (NYSE:TAK) is among the largest pharmaceutical companies in the world, the company has been collapsing unabated for 3 years now. The market is punishing this company heavily, but there is currently no good reason for such behavior. The pipeline does not have high growth prospects, especially following the patent expiration of VYVANSE; however, drugs such as ENTYVIO and TAKHZYRO are becoming increasingly popular worldwide and have double-digit growth rates. According to my assumptions, the possibility of getting a good capital gain from an investment in Takeda is very high considering that the company is undervalued by 71%. In addition, with a dividend yield of 5.26%, I expect to get excellent cash inflows already in the short term.

Unjustified negativity

Takeda Pharmaceutical is an internationally renowned Japanese multinational company. It is the largest pharmaceutical company in Asia and one of the top 20 in the world in terms of sales. Since the beginning of 2018, the price per share of this company has started to collapse relentlessly, and from $31.29 has reached the current $13.37. Such a drop is something resounding, as there were no extremely negative causes that caused it.

In order to understand the trigger of this crisis, it is necessary to understand what happened at the beginning of 2018, when Takeda began to collapse. In March 2018 it began to show interest in acquiring Shire Pharmaceuticals, a purchase that was later made official in January 2019 for $62 billion. An acquisition of such magnitude immediately caused consternation among investors, who, frightened by the sharp increase in Takeda’s debt, decided over the next 3 years to dump their shares. This behavior still astonishes me today, as the reasons for acquiring Shire were more than justified as far as I am concerned.

- To create a single company that could improve research and development.

- To acquire Shire’s portfolio, complementary regarding the gastroenterology and neuroscience segment, and integrative regarding the segment related to rare diseases.

- To increase through the acquisition of Shire the geographic exposure, especially to the U.S. The goal was for Takeda to become a company that operates worldwide, not just in Asia.

In light of this, I honestly cannot find any valid reason why Takeda has collapsed so much since that day. To date, the company has achieved its goals, in fact:

- Research and development costs have increased compared to the pre-acquisition period. In fiscal 2018 they were ¥325.44 billion, as of today (fiscal year ended March 2022) they have increased to ¥526.08 billion.

- International geographic exposure has changed significantly. According to the latest quarterly report, only 14.50% of revenues come from Japan, 51.50% from the U.S., and 21.10% from Europe and Canada. Specifically, from Q1 2021 to Q1 2022, revenue exposure to the U.S. increased by 8.10%. Just as expected, the acquisition of Shire is making this company more international.

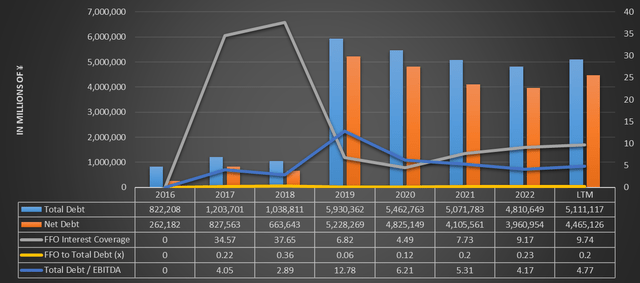

Finally, to conclude the topic related to the Shire acquisition, I attach a chart showing Takeda’s debt, one of the main problems according to investors.

Certainly, total debt and net debt had a huge increase at the time the acquisition took place; however, it is good to make further considerations and not just stop at nominal values. No debt is too high if the company can meet it through its profitability. A company’s debt should not only be compared with its previous values, but also with its income: only then we can understand whether it is sustainable.

- FFO/Interest coverage denotes a deterioration from 2018 values, however, 9.74x is still a sustainable value. The company through funds from operations manages to cover 9.74x the value of interest on debt.

- FFO/Total debt is lower than in 2018 but is very similar to 2017 values. Overall, this is not such a negative result, and especially the strong improvement over 2019 should be noted. The same reasoning can be applied to Total Debt/EBITDA.

- While it is true that the purchase of Shire resulted in a large increase in debt, it should be remembered that it also resulted in a large increase in profitability. In fiscal year 2018 Takeda’s revenues were ¥1.770 billion, in fiscal year 2021 they touched ¥3.569 billion.

Pipeline analysis

For a pharmaceutical company, the most relevant aspect is probably the quality of its pipeline, since it is from it that the company generates revenues. In this section I will show last quarter’s results related to Takeda’s pipeline, focusing mainly on the most relevant drugs in terms of revenue. Before I begin, however, it should be anticipated that the revenues will be calculated in yen; thus, a significant portion of the increase in revenues is due to the devaluation of the yen against major world currencies.

ENTYVIO

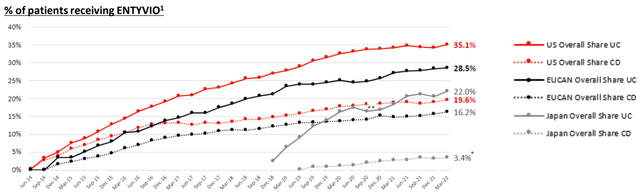

ENTYVIO is the most important drug in the entire gastroenterology portfolio as it has a weight of 62%. In absolute terms, this drug generates 17% of total revenues. Its goal is to treat intestinal disorders such as ulcerative colitis and Crohn’s disease by preventing the immune system from continuing to attack healthy tissues in the intestines. The popularity of this drug is growing quite rapidly, especially in the U.S.

In Q1 2021 revenues from ENTYVIO were ¥125.40 billion while in Q1 2022 they were ¥168.30, an increase of 34.20%. Much of this growth was driven mainly by sales in the U.S., up 40.9%. Regarding patent expiration, however, Takeda has patented various aspects of ENTYVIO until 2032. In terms of revenue, this drug is the most important for Takeda; therefore, seeing such rapid growth over the last year is certainly something to consider.

IMMUNOGLOBULIN

Immunoglobulin is the most important segment of the immunology-related portfolio as it has a weight of 78.70%. Compared to total revenues, the immunoglobulin segment has a weight of 11.40%. At its core, we find drugs that can improve the efficiency of antibodies such as GAMMAGARD LIQUID, KIOVIG, HYQVIA, CUVITRU. Compared to last year’s Q1, this segment also achieved strong revenue growth, from ¥81.60 billion to ¥111.80 billion. This strong 37% growth can be attributed to strong demand globally, especially in the U.S., where pandemic pressure is now easing.

VYVANSE

VYVANSE is the most important drug in the entire neuroscience portfolio as it has a weight of 70%. Compared to total revenues, this drug has a weight of 10.28%. It is a stimulant drug taken orally and mainly used to treat attention deficit hyperactivity disorder and uncontrolled eating disorder. Last Q1 2021 this drug generated ¥79.20 billion, while in the last quarter it generated ¥100 billion. The revenue growth was mainly due to the growth of ADHD in the U.S. adult population. Despite the great figures, this drug turns out to be Takeda’s biggest problem in terms of revenues, as its patent expires in 2023. According to CEO Christophe Weber this could lead to flat revenue growth in 2023.

TAKHZYRO

TAKHZYRO is the most important drug belonging to the rare disease portfolio and was acquired after the purchase of Shire. In Q2 2022, this drug generated revenues of ¥34 billion, a growth of 33.70% compared to last year’s Q1. TAKHZYRO is used to prevent recurrent attacks of hereditary angioedema, an uncommon disease that affects a small circle of people. Its revenues are expected to rise for the following reasons:

- There is a strong growing demand, especially in Europe and Canada. Compared to Q1 last year there was a 41% growth.

- Its use is expanding worldwide. It is currently available in 42 countries and is expected to be available in 11 more by the end of FY2022.

- TAKHZYRO can currently be used only by patients 12 years of age and older. However, in the last period, successful trials have also been conducted on children aged 2 to 12 years. We can expect this drug to be indicated for almost all ages in the future.

Overall, Takeda’s pipeline appears to be quite diversified and balanced. The biggest issue is definitely the patent expiration of VYVANSE in 2023 as it brings in about 10% of total revenues. With this in mind, we can expect that revenues can at least remain stable and not decrease next year, considering that ENTYVIO, TAKHZYRO and the IMMUNOGLOBULIN segment are experiencing strong growth. On the other hand, as for the drugs that were negatively impacted in this Q1 2022, none had revenues greater than ¥25 billion. In particular, it was the oncology portfolio that suffered the most, with VELCADE (-45.30%) and NINLARO (-2.60%). Total revenues for Q1 2022 were ¥972.50 billion, higher than the ¥949.60 of Q1 2021.

How much is Takeda worth?

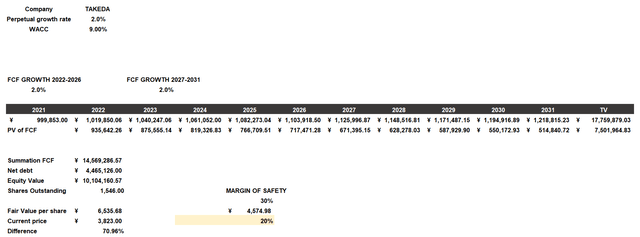

To understand Takeda’s fair value I will use a discounted cash flow. This model will be constructed as follows:

- The cost of equity will be 11% and includes a beta of 0.80, a risk-free rate of 3.50%, a country market risk premium of 4.90%, and additional risks of 3.50%. Being a Japanese company, I wanted to consider a higher cost of equity to remain as conservative as possible. The after-tax cost of debt is 6.08%.

- The capital structure considered will be 60% equity and 40% debt. The resulting WACC will be 9%.

- Free cash flow growth will be 2% per year and calculated from last fiscal year’s values. Since this is a Japanese company headquartered in Tokyo, I have preferred to include values in Japanese yen, thus avoiding a dollar conversion. The fair value will be related to the price of the shares listed on the Japanese stock exchange; in any case, the overall result on the company will also be considered similar for the shares listed on the NYSE.

According to these assumptions, the company is undervalued by almost 71%. Wanting to be even more conservative we can apply an additional arbitrary margin of safety of 30% and Takeda would still be undervalued by 20%. I think the market has punished this company too much in recent years and I expect a recovery in the coming months/years. It is true that the pipeline does not have much room for growth, but Takeda remains among the best pharmaceutical companies in the world and is doing what it can to reduce the debt achieved with the acquisition of Shire. Even with 0% growth Takeda would still be undervalued, so I consider this company a strong buy. Finally, I would like to emphasize that from an investment in Takeda I expect not only a capital gain, but also a dividend yield. Currently, the dividend yield is 5.26% and the free cash flow manages to cover 3.5 times the cost of dividends, so this is definitely a sustainable situation.

Be the first to comment