piranka/iStock via Getty Images

“Show me the heroes that the youth of your country look up to, and I will tell you the future of your country.” – Idowu Koyenikan

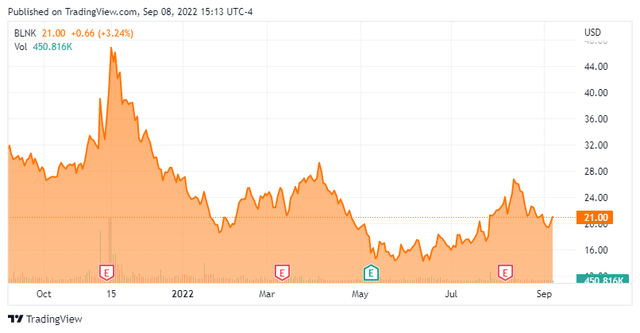

Today, we put Blink Charging Co. (NASDAQ:BLNK) in the spotlight for the first time. The company is in a key niche in the fast-growing electric vehicle (“EV”) industry and is located an hour south of me here in Delray Beach, Florida. The stock has a large short position, but insiders aren’t bailing despite what has been a volatile ride for shareholders over the past year. Who’s right? We attempt to answer that question via the analysis below.

Company Overview:

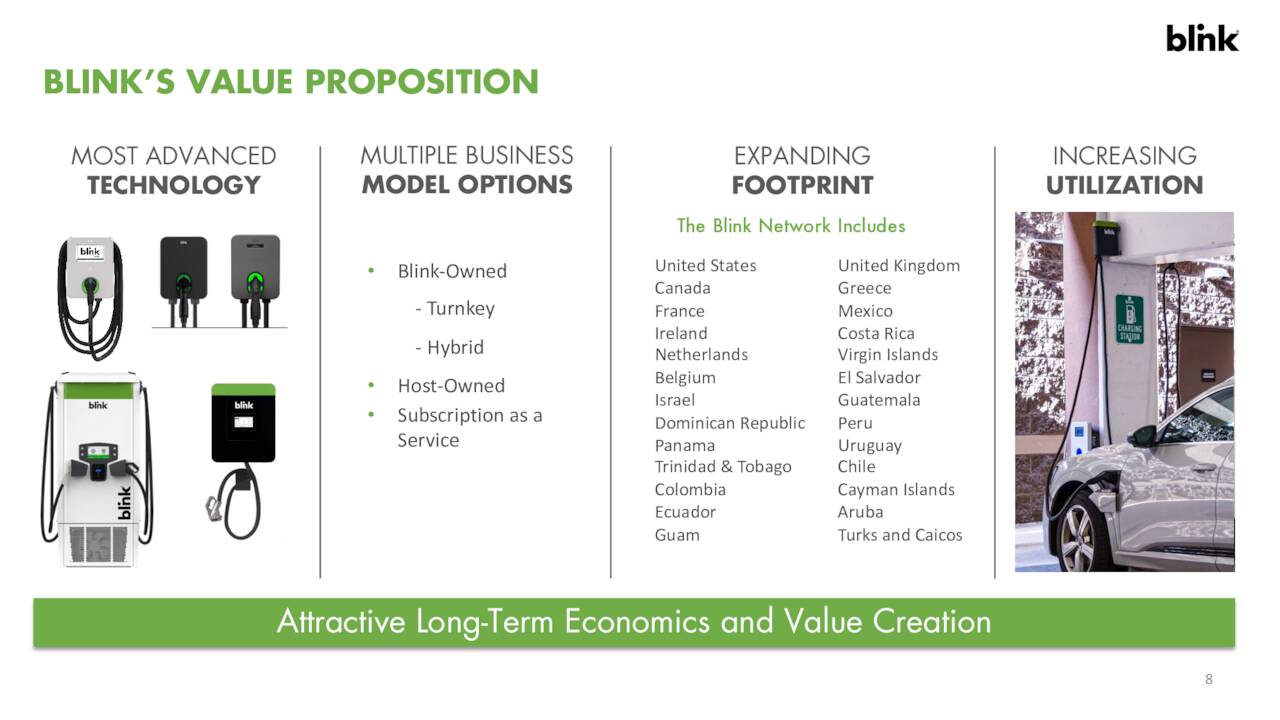

August Company Presentation

Blink Charging Co. is headquartered in Miami Beach, Florida. The company owns, operates, and provides electric vehicle charging equipment and networked EV charging services in the United States and internationally. The stock currently trades at around $21.00 a share and has an approximate market cap of just over $1 billion.

August Company Presentation

The company generates revenues both through charging fees (which it shares with property owners) and product sales. In addition, Blink generates network fees from their hosts as well as warranty payments, grant and rebate income and some minor miscellaneous sales. Currently, Blink Charging is the only current EV charging company to offer complete vertical integration from research & development and manufacturing to EV charger ownership and operations.

Second Quarter Results:

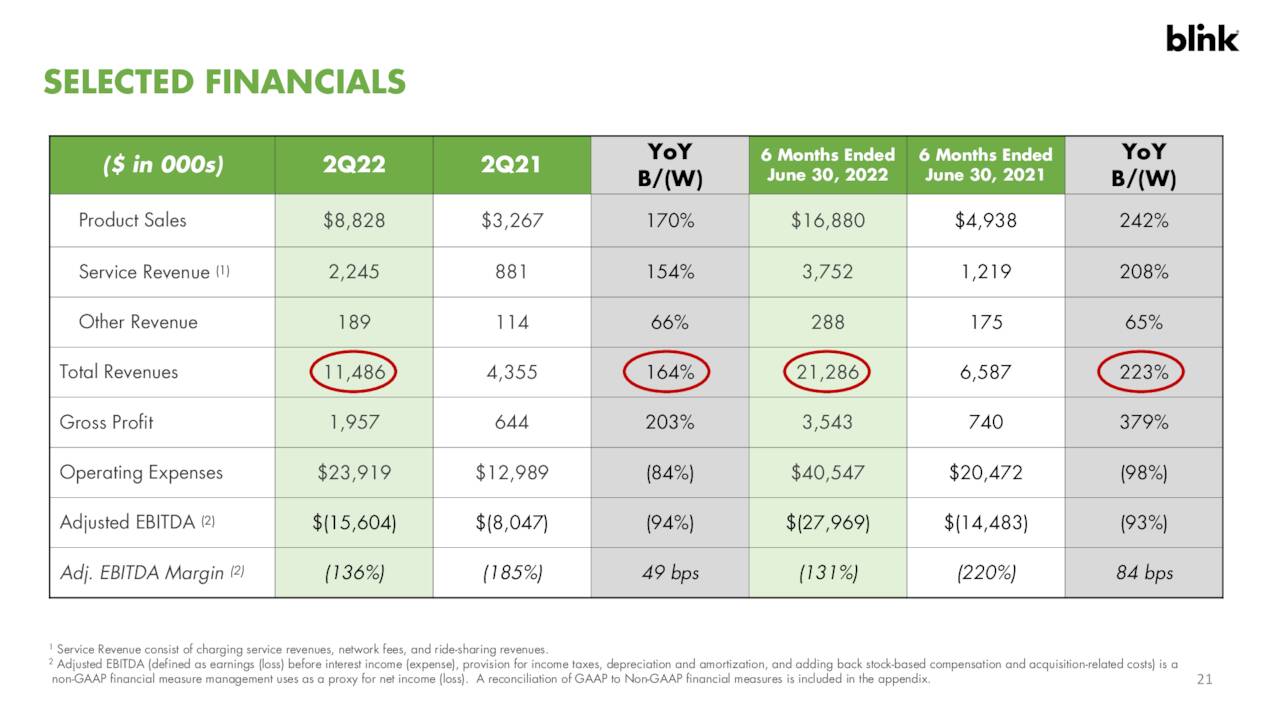

On August 8th, the company posted second quarter numbers. Blink Charging had a net loss of 41 cents a share as revenues rose more than 160% on a year-over-year basis to $11.5 million. Excluding recent acquisitions, revenues still doubled in the quarter from the same period a year ago.

August Company Presentation

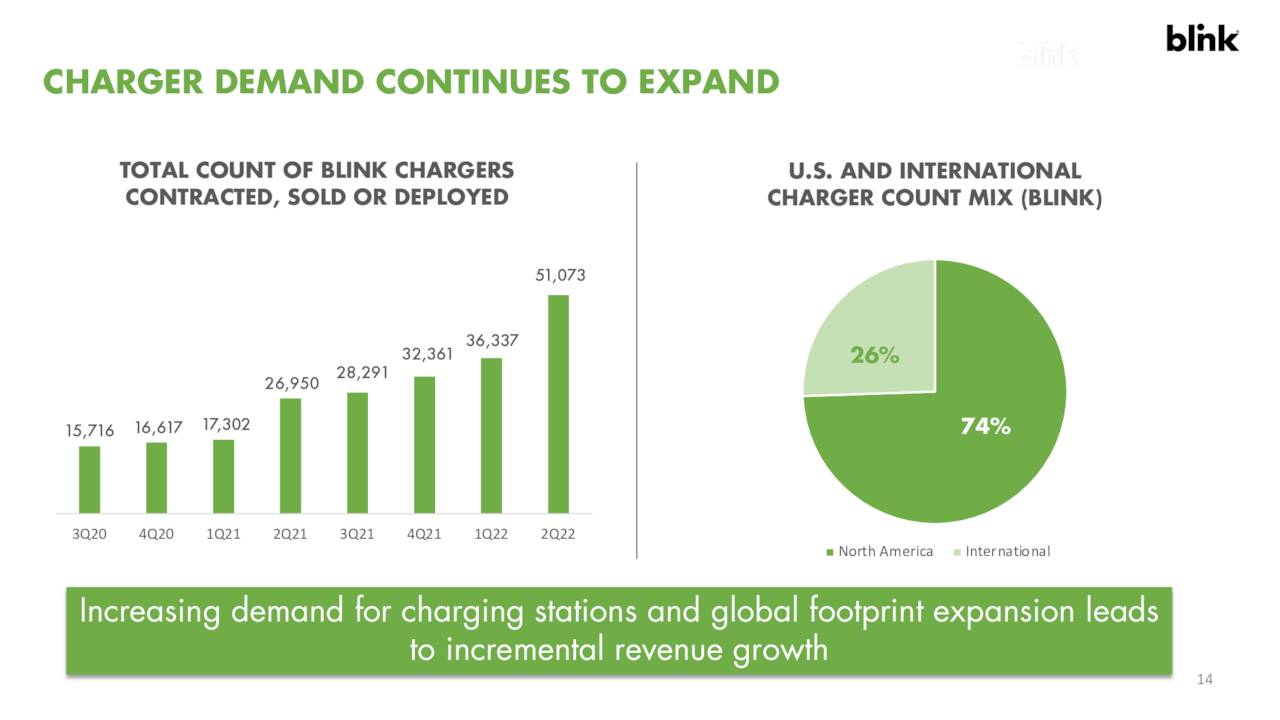

The June acquisition of SemaConnect should also greatly enhance manufacturing capabilities. The company paid some $200 million in cash and stock to purchase SemaConnect which brought with it some 13,000 EV chargers to Blink’s existing footprint, an additional 3.800 site host locations, and 150K+ registered EV driver members. The acquisition should also aid the development of a national EV charging network that provides interoperability among different charging companies.

August Company Presentation

During the quarter, the company had 5,631 charging stations contracted, deployed or sold, which was a 73% increase from the same period a year ago. Services revenues rose 154% from 2Q21 to $2.2 million.

August Company Presentation

Analyst Commentary & Balance Sheet:

Just over one out of every four shares in the stock is currently held short. A director bought nearly $110,000 worth of shares on June 24th. That is the only insider activity in the shares this year as insiders don’t seem to be budging and cashing in any of their stakes. After posing a net loss of $22.6 million in the second quarter, the company ended the first half of 2022 with approximately $85 million in cash and marketable securities on its balance sheet against no long-term debt.

The analyst community is mixed on Blink’s prospects at the moment. Since second quarter results posted, both Stifel Nicolaus ($23 price target, up from $19 previously) and D.A. Davidson ($19 price target, up from $17 previous) have reissued Hold ratings while Needham ($27 price target) and H.C. Wainwright ($50 price target) have maintained Buy ratings.

Verdict:

The current analyst firm consensus has the company losing just under two bucks a share in FY2022 even as revenues rise over 150% to just north of $53 million. The analyst community is expecting similar losses in FY2023 even as they project sales to rise another 75% during the year.

August Company Presentation

The company is showing consistent growth in a fast-growing market. Blink Charging Co. faces increasing competition from the likes of Tesla (TSLA), ChargePoint Holdings, Inc. (CHPT), and others as one would expect given the potential size of this growing market. The current administration recently extended the $7,500 per electric vehicle tax credit as the result of recently passed legislation. Unfortunately, most of that will be eaten up by price hikes the likes of Ford (F) announced almost immediately after passage to cover the increasing costs of building these vehicles given the current inflationary environment.

August Company Presentation

There is also the big question of whether the electric grid is close to ready to handle the increased needs from a growing electric vehicle population. California recently asked EV owners to not charge their vehicles to deal with the rolling blackouts the state is facing. Ironically, this came a few days after California banned gas-powered vehicles in the state produced after 2035.

My main concern is company specific and has to do with the company’s burn rate in relation to its balance sheet. It is apparent the company is going to have to do another capital raise in the near future to support its growth. With losses in FY2023 projected to be on par with this year, it may not be the last raise Blink Charging Co. will have to do in the foreseeable future.

August Company Presentation

There is a lot to like about this company as they seem to be executing well and continue to add new big-name clients. However, until the company is closer to breakeven status, I will probably avoid the shares as I will most others in the industry as well for now.

“All battles are first won or lost, in the mind” – Joan of Arc

Be the first to comment