Thomas Barwick

Intro

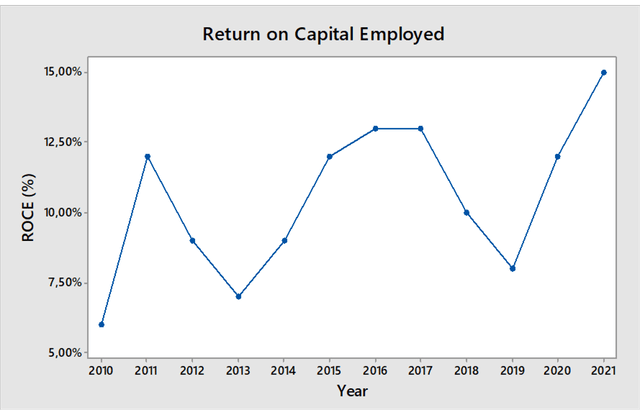

Tessenderlo (OTCPK:TSDOF) is my favorite value pick for 2023. The company offers great value for investors seeking alpha as it is overlooked by most institutional investments and is hardly followed by analysts. The company also checks all my boxes for a long-term investment position in my portfolio: qualitative management, secular growth tailwinds, extremely cheap valuation multiples (P/E of 6.5x, EV/EBITDA of 3.1x, EV/EBIT of 4.8x …), recurrent insider share purchases and very descent returns on capital (ROCE ~ 12% and rising).

Despite the long-term bull case, I also expect record results for FY 2022 following record H1 results published earlier this year. The company is experiencing a strong tailwind due to high food commodity prices and thus high fertilizer prices. Fertilizer prices have soared last year due to supply chain disruptions reaching record highs. Although fertilizer prices will likely soften in the near term, they are expected to remain at very high levels throughout 2023 and beyond.

Tessenderlo’s primary listing is on Euronext Brussels where it’s trading with TESSB as its ticker symbol. Buying shares through its primary listing is preferable above the OTC listing.

Tessenderlo group’s activities

Tessenderlo Group’s activities are subdivided into four operating segments:

The Agro segment combines activities in the production, trading and marketing of crop nutrition (liquid crop fertilizers and potassium sulfate fertilizers based on sulfur) as well as crop protection products.

The Bio-valorization segment contains activities in animal by-product processing. This consists of PB Leiner (the production, trading and sales of gelatins and collagen peptides) and Akiolis (the rendering, production and sales of proteins and fats).

The Industrial Solutions segment includes products, systems and solutions for the processing and treatment of water, including flocculation and precipitation (DYKA group). After the fusion with Picanol is completed, this division will also contain Picanol’s industrial weaving machines’ operations.

The T-Power segment includes a 425 MW CCGT electricity power plant (Combined Cycle Gas Turbine), which is located in Tessenderlo Belgium. The power plant is flexible and is designed to supply electricity when other energy sources (Nuclear, renewable, etc.) are insufficient to meet demand. This division is generating a steady income through a subsidized capacity remuneration mechanism (CRM).

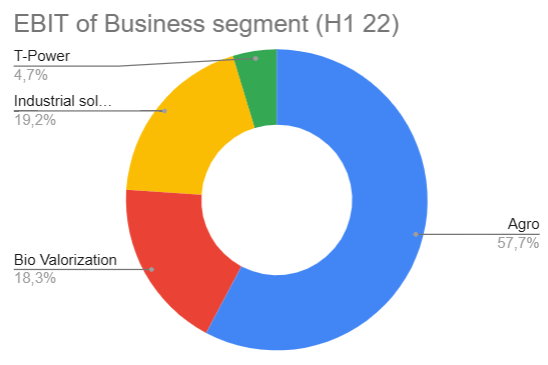

EBIT per business segment (Company press release – H1 Results)

Booming fertilizer prices causing record results

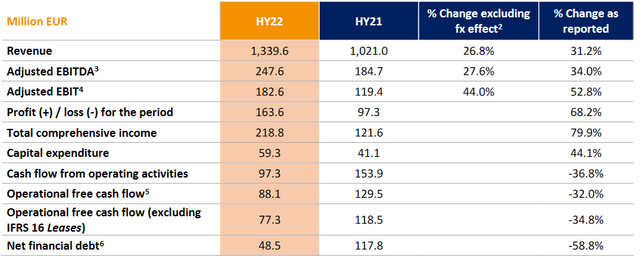

Tessenderlo started 2022 with a very conservative outlook predicting earnings to be either flat or softly declining. But things quickly changed for the better and Tessenderlo could not keep silent until the first half-year results. In June the company released a positive profit warning stating a 10% EBITDA increase for FY 2022. This was a strong hint towards very strong H1 results which later occurred.

H1 topline results & key figures (Company press release – H1 Results)

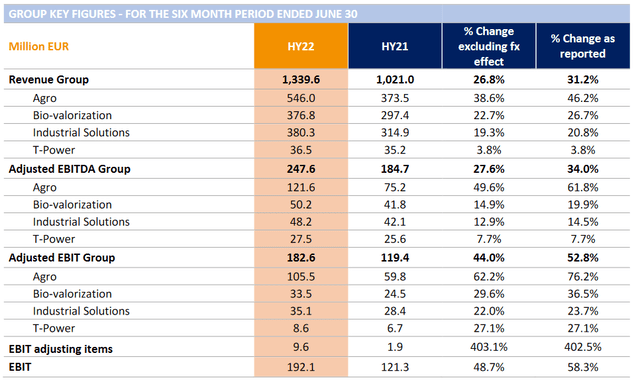

All divisions surprisingly reported strong increases in profitability (+44% increase in EBIT). Especially the Agro segment stood out (+61% increase in EBIT) reflecting the highest fertilizer prices since 2008 and a strong dollar as a large part of their offset market is located in the US.

H1 topline results & key figures per business segment (Company press release – H1 Results)

Evolution of the Agro Segment

In terms of profitability the agro segment accounts for more than half of the profit. The evolution of this segment is therefore discussed in this section.

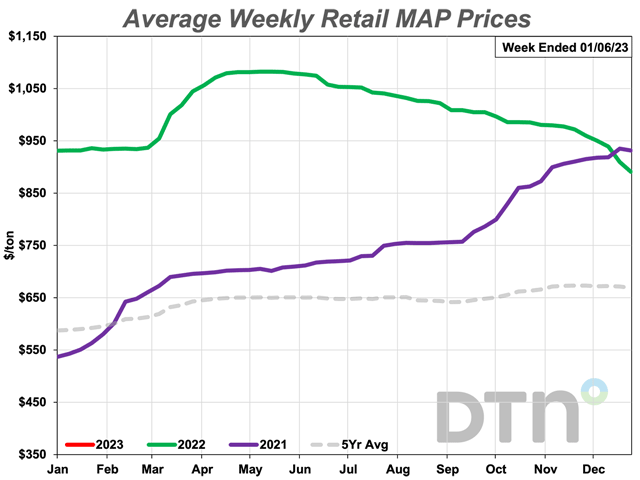

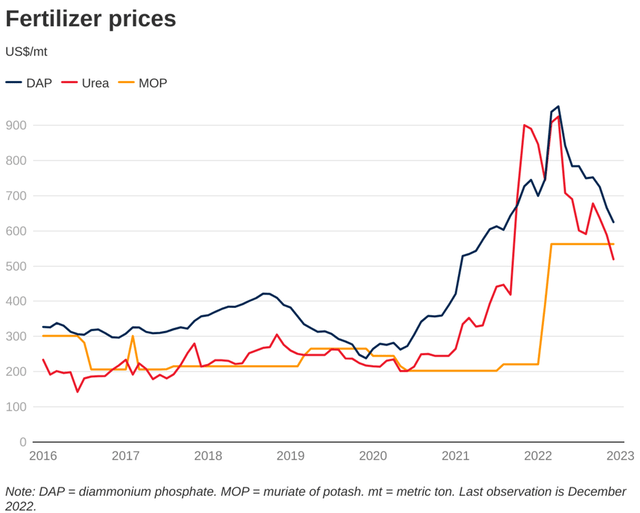

Agricultural prices reached new records in Q2 2022 as grain and fertilizer prices reached record highs following the war in Ukraine. Both Russia and Ukraine are important global crop producers. Remarkably, that fertilizer prices have been on the lift since the start of 2021. This is because agricultural commodity prices have been on the rise even before the war.

Graph shows average retail price evolution for fertilizers (DTN Retail Fertilizer Trends)

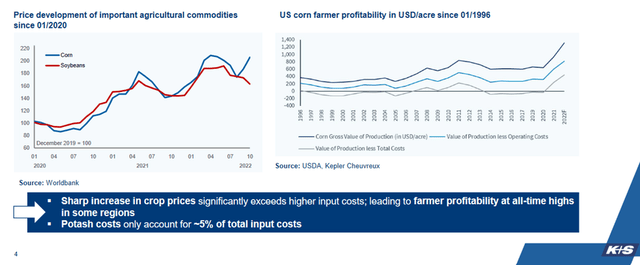

On the demand side high fertilizer prices are supported by high agricultural commodity prices and high farmer profitability.

Global stock-to-use ratio & Global fertilizer inventories – Profitability of acres (K+S Investors presentation)

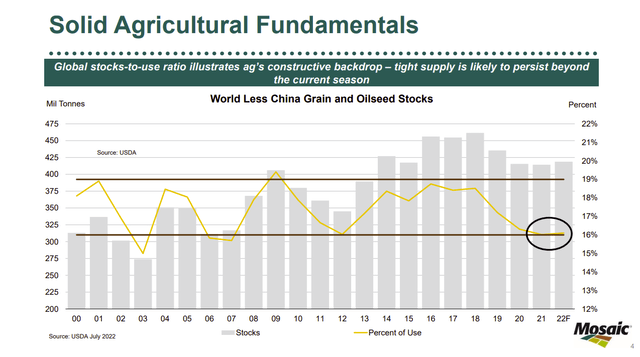

On the supply side high fertilizer prices are supported by the lowest inventories in the last 10 years and a surge in raw material prices.

Global stock-to-use ratio – Global fertilizer inventories (Mosaic’s Q2 Investor presentation)

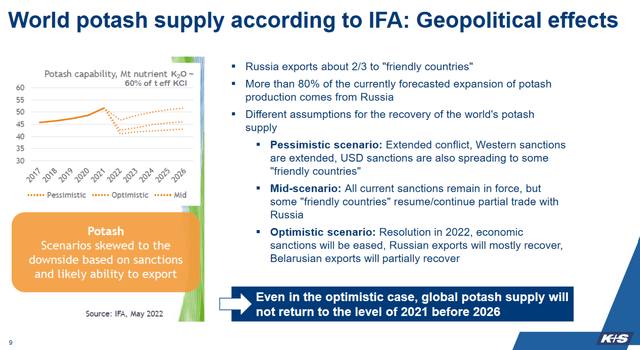

It is expected that potassium-based fertilizer prices will remain historically high due to the disrupted supply chain in raw materials. Muriate Of Potash or MOP is Tessenderlo’s most important raw material.

Fertilizer Raw Material Prices (Bloomberg World Bank)

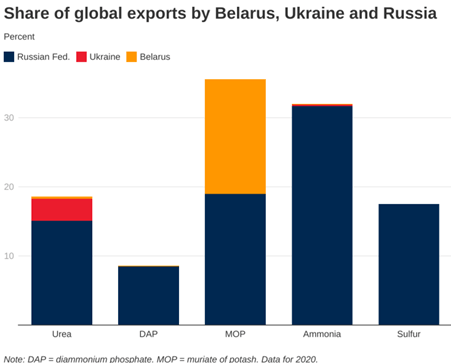

The supply chain of raw materials is heavily disrupted as Belarus/Russia is providing around 40% of the world’s MOP.

Raw materials of fertilizers versus country of sourcing (UNComtrade – World Bank)

At the release of the 2021 annual report in March ’22, Tessenderlo stated that they are sourcing potash in Russia and Belarus for their European factories which have been restricted by EU sanctions against Russia/Belarus. In response they were forced to look for alternative sourcing starting from H2. Final results should further clarify their future MOP sourcing for their European operations and impact on cost/margins. For their US operations there is no impact expected.

World potash supply in different scenarios (K+S investor’s presentation / IFA)

For the full year of 2022, I expect that the good performance of H1 is continued although at a slightly softer pace. For 2023 and beyond it is likely that retail prices will normalize but remain way above historical levels through structural rising demand and continued tight supply/inventories.

The fertilizer segment remains an attractive business with solid long-term prospects as commodity prices for corn and soybeans and profitability for farmers are at high levels. The use of fertilizers is essential to ensure high crop yields and provide for the world’s rising demand for basic food commodities. Investors of Tessenderlo are advised to closely follow up results and outlook of competitors such as Mosaic (MOS) and K+S (OTCQX:KPLUY) to gain leading insights into Tessenderlo’s results/outlook.

CEO and main shareholder Luc Tack

The current owner and CEO, Luck Tack, is a very respectable entrepreneur and disciplined investor. He has a reputation for acquiring mismanaged businesses at very low prices. Subsequently, he invests his own blood, sweat and tears to successfully turn around these businesses by rigorously cutting SG&A costs and applying a buy-and-build strategy. In 2009 he bought a lion’s share (around 90%) in Picanol, a small-cap enterprise on the verge of bankruptcy. Together with his business partner, Stefaan Haspeslagh (CFO), he transformed Picanol into a staggering cash machine in the years after. This transformation was not unnoticed by other Belgian entrepreneurs and earned him the glorious title of ‘Trends manager of the year‘ in 2014.

With the cash that was stacked up in Picanol, he decided in 2013 to expand his entrepreneurial footprint and Picanol acquired a large stake of 28% in Tessenderlo from the French government. Over the years both Picanol (90% owned by Tack) and Luck Tack himself have been consistently buying shares of Tessenderlo on the open market bringing Picanol’s share of ownership to around 50% and Luck Tack’s ownership to around 6%.

At the time Tack acquired his initial stake in Tessenderlo, the company’s balance sheet and profitability were weak. Under the reign of the French government, Tessenderlo was heavily mismanaged for years through an unsustainable dividend policy while cutting back on investments year after year.

In the years following the acquisition a cleanup followed. Since then there was a strong focus on cost controlling, disciplined capex investments and free cash flow. The quality of management is reflected in steadily increasing capital efficiency ratios and year-after-year increases in net profits. Tessenderlo’s industrial segments are cyclical in nature. Yet capital efficiency (ROCE %) has been steadily increasing making a successful turn-around more visible year after year.

Evolution of Return on Capital Employed (Tessenderlo’s Annual Reports – Own Graph)

Note: 2019 was a negative outlier caused by high losses on foreign currencies. Corrected for these effects ROCE was actually around 13% in 2019.

Valuation multiples suggest a bargain price

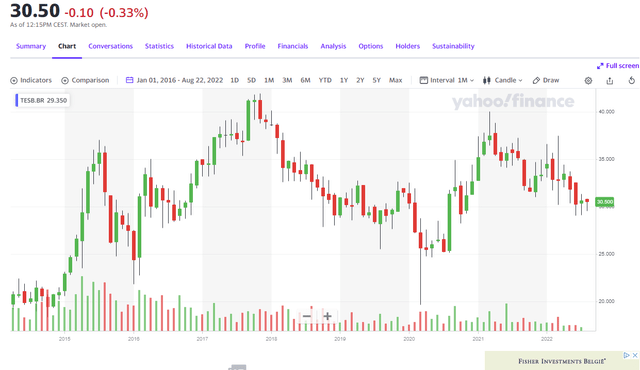

If you had been invested in Tessenderlo for the last 5 years you would not have been rewarded for your patience. The stock price is almost exactly at the same level as 5 years ago.

Share price evolution of Tessenderlo (Yahoo Finance)

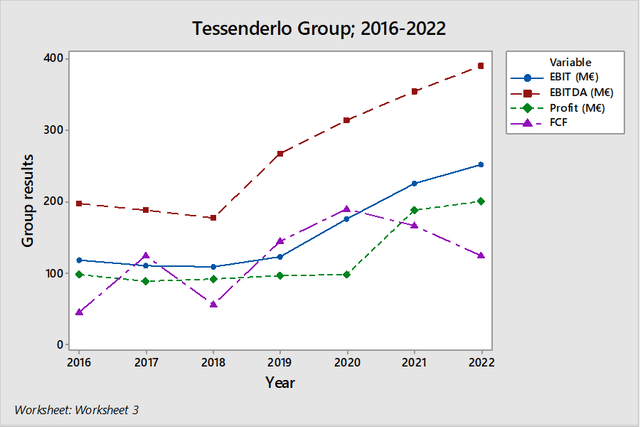

The share price evolution does however not reflect the good performance in all divisions of the business. There is progress in all underlying profitability indicators (adj. EBITDA, EBIT and net profit). Free cash flows are typically more fluctuant and heavily dependent on CAPEX investment decisions. Still, free cash flows are also systemically trending up.

Evolution EBITDA, EBIT, net profit & Free Cash Flow (Tessenderlo’s annual reports – Own Graph. Note: 2022 estimates are based on the company’s reviewed outlook)

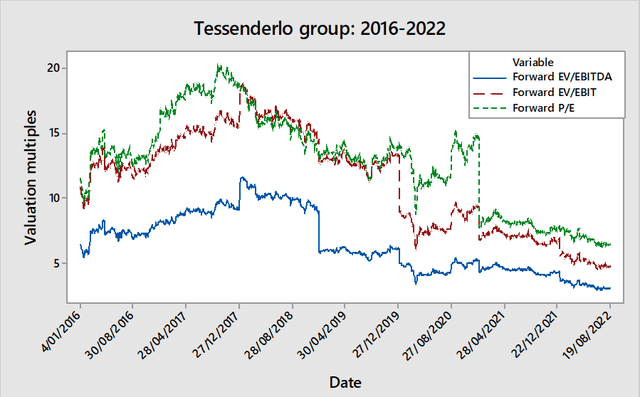

Yet this is not reflected in the share price which is trading at record-low historical multiples (P/E of 6.5x, EV/EBITDA of 3.1x, EV/EBIT of 4.8x). Conclusively valuation multiples are extremely low versus their historical levels. This is while the fundamentals and long-term prospects are solid and underlying businesses are growing at a steady pace. Investors that are getting in today are buying in at 50c on the dollar. And this does not account for an obvious outperformance versus their conservative 2022 outlook.

Evolution of valuation multiples (Tessenderlo’s Annual Reports – Own Calculations)

Near term catalysts

A dirt-cheap valuation does not necessarily guarantee that the share price will go up in the short term. Luckily there are several near-term catalysts that will allow investors to reinitiate their interest in the company:

- A successful merger between Picanol and Tessenderlo

- Reinitiating dividend

- Increased analyst coverage

- Increased free float

- Return of institutional investors

The Tessenderlo-Picanol merger saga

Despite the fact that no one will contest that the corporation is in far better form than it was ten years ago, there have been some worries over corporate governance.

Tack attempted to combine Picanol and Tessenderlo in 2015. The transaction was set up as a takeover offer by Picanol on Tessenderlo through a share-swap agreement, valuing both companies on very similar multiples. Investors and analysts opposed the merger claiming the offer was not to the benefit of Tessenderlo’s shareholders. They failed to see synergies between the two companies and also argued that the deal was structured so Tack wouldn’t be paying a premium on Tessenderlo. Thus, the bid price was deemed to be too low. After analysts and institutional investors univocally shot down the terms of the deal Tack pulled back his offer and declared the deal dead and buried. After this event, the relation between Tack and investors & analysts has cooled down significantly. Consequently, institutional investors and funds sold off their holdings one by one, while Tack on the other hand consistently has been increasing his stake and the number of voting rights.

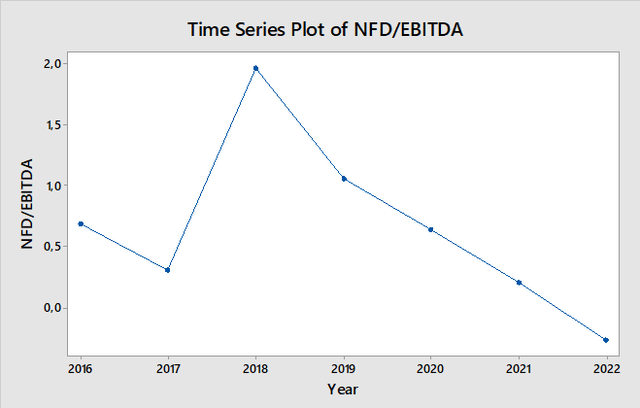

Another reason for the long-lasting exit of institutional investors and funds has been the absence of a dividend payout since 2013. While the balance sheet was fully loaded in 2013 there has been an ongoing deleveraging since Tack entered Tessenderlo. Since his entrance into the capital, the focus of the group was always oriented toward generating free cash flows and disciplined capital allocation (also through acquisitions).

Evolution of Net Financial Debt (NFD) over EBITDA. Note: The peak in net debt in 2018 was due to the large acquisition of T-power (328 M. €). (Tessenderlo’s Annual Reports – Own calculations)

Currently, the balance sheet is rock solid carrying a small net cash position. Investors on the other hand are disappointed in the absence of a dividend while there is plenty of room for a reasonable payout. It certainly did not help that CFO Haspeslagh reacted as if he was stung by a wasp every time questions were raised at the annual shareholder meeting around reinitiating dividends.

But it was obvious Tack would reattempt to merge both entities as he kept buying shares of Tessenderlo rigorously until his share in the voting rights surpassed the 70% benchmark. At that point there was very little that could stop Tack’s merger plans. In July 2022 it then finally happened. 7 years after the first attempt to merge the two Tessenderlo launched a share-swap offer on Picanol. As a deal sweetener, Tessenderlo also promised to reinitiate the dividend after the merger is complete.

Following the exchange offer, the Board of Directors will propose a dividend policy to the shareholders, taking into account the sustainable growth that is being pursued”

After more than 99% of shareholders have already accepted the merger seems a done deal. The final closure will take place in March. My expectations are that this event will set a positive chain reaction in motion causing rediscovering of the stock. First of all, the merger will have a positive impact on the absolute free float (combining the free float of Picanol and Tessenderlo). In combination with its renewed dividend policy, the return of institutional investors and funds is therefore expected. In addition, I also believe a dividend will add to fading corporate governance concerns. This in turn will allow financial analysts to reinitiate coverage of the company.

Takeaway message

Buying into Tessenderlo now is buying into a group with attractive growth perspectives at a very attractive price. My expectation is that the closing of a long-anticipated merger between Tessenderlo and Picanol will cause the rediscovering of the company over the course of 2023. A revaluation of the stock is therefore extremely likely.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment