AlexSava

A few months ago, I wrote a cautious article on Barrick Gold Corporation (NYSE:GOLD). While I liked the company’s leverage to gold prices, I was concerned about cost structure inflation for miners.

Rising Tide Lifts All Boats

Since my article was published, I turned bullish on gold investments overall in late October, ahead of the November FOMC meeting. To me, the risks were to the upside as rumours of a ‘Fed Pivot’ began circulating.

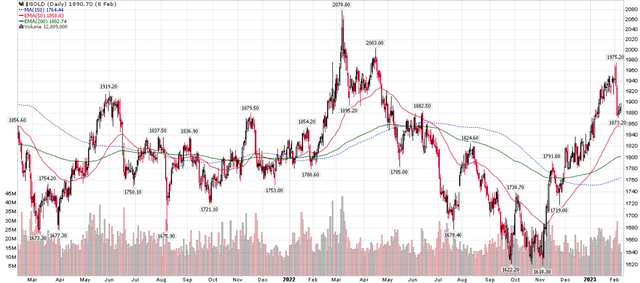

Sure enough, as the Fed hinted at reducing the pace of interest rate hikes, and then followed through with a reduction to 50 bps in December and 25 bps in February, gold prices staged an impressive 20%+ rally, from a late October low of $1620 / oz to a January high of $1975 / oz (Figure 1).

Figure 1 – Gold prices rallied since November (stockcharts.com)

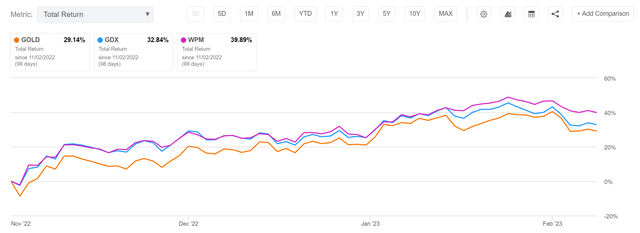

Barrick Gold, as a major gold producer, rallied on the back of rising gold prices. However, investors should note that since the FOMC meeting on November 2, 2022, Barrick has only delivered total returns of 29% vs. 33% for the peer group, as represented by the VanEck Gold Miners ETF (GDX), and Wheaton Precious Metals Corp. (WPM), my preferred large cap gold and precious metal producer, has returned 40% (Figure 2).

Figure 2 – GOLD has lagged peers and WPM (Seeking Alpha)

Reiterate Preference For WPM Over GOLD

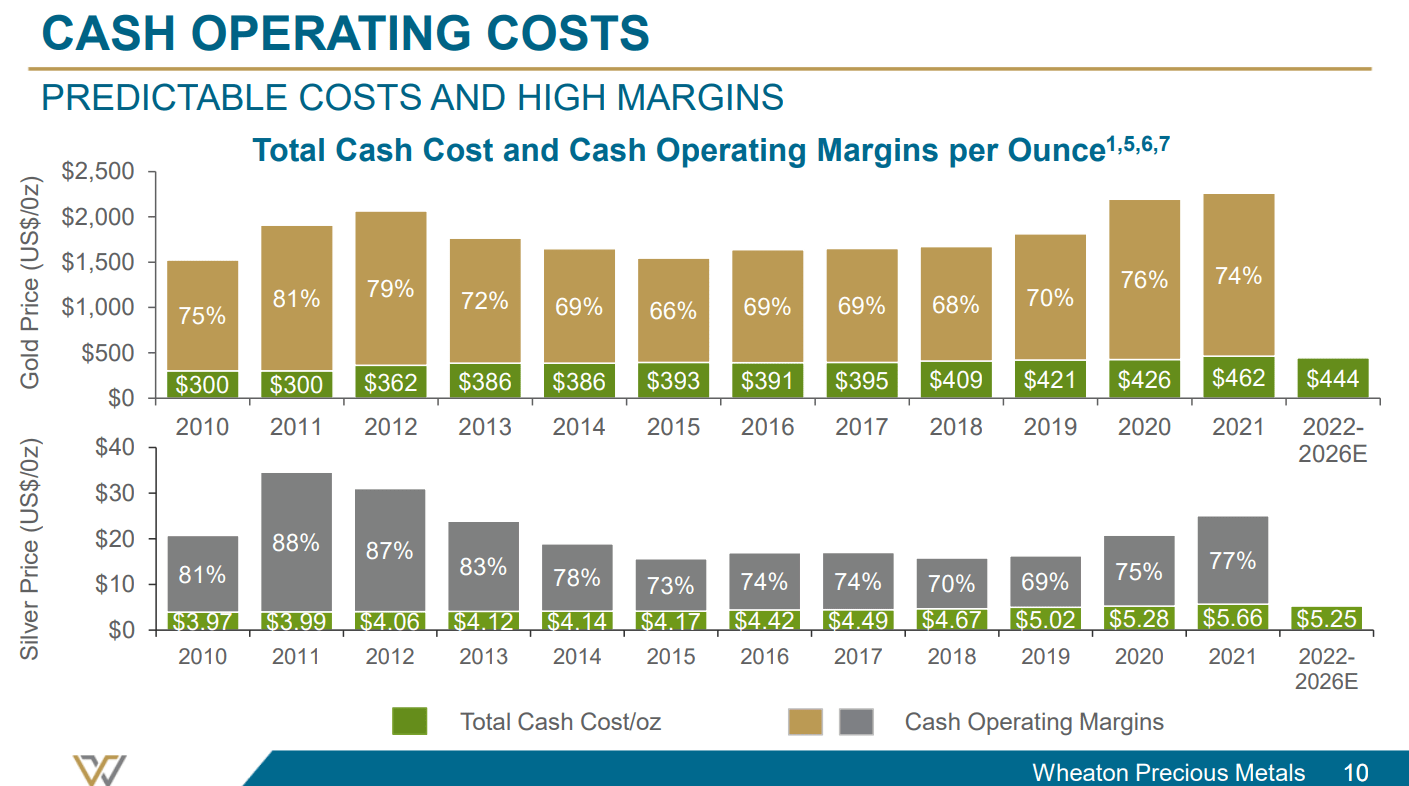

As I explained in my prior article, I prefer WPM’s royalty and streaming business model as WPM is able to consistently ‘produce’ gold and silver at first quartile cash costs due to the royalty and streaming agreements it has in place. Figure 3 shows WPM’s cash costs per oz, including forecasts for 2022 to 2026.

Figure 3 – WPM cash costs (WPM investor presentation)

Contrast that with Barrick’s costs, which includes sustaining capital costs that royalty and streaming companies do not have to pay, and one can appreciate the attractiveness of WPM’s business model (Figure 2).

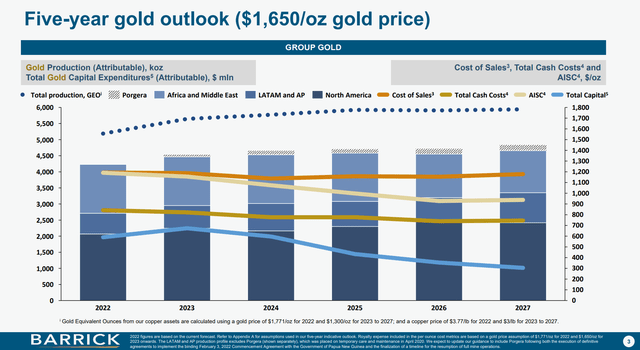

Figure 4 – GOLD cost estimates (GOLD investor day presentation)

Barrick Seeing Inflation Everywhere

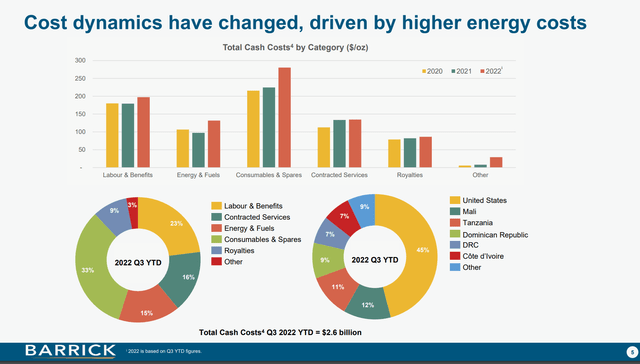

Importantly, if we look at a recent presentation from Barrick’s investor day, we can see Barrick is currently suffering from cost inflation in multiple categories including labour, energy, and consumables (Figure 5).

Figure 5 – GOLD cost inflation in multiple categories (GOLD investor day presentation)

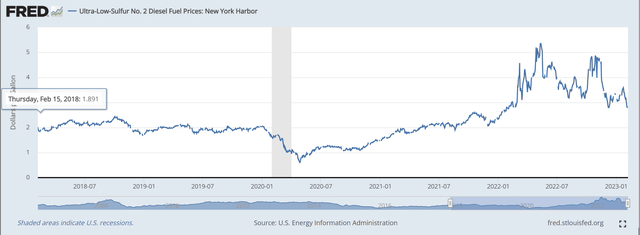

Fuel is the largest cost category for Barrick, accounting for 1/3 of Q3/2022 YTD costs. Although fuel prices, represented by diesel prices in figure 6 below, have eased in the last few months, they are still materially higher than 2021 levels. So Barrick is unlikely to see fuel inflation relief until later in 2023.

Figure 6 – Diesel prices are still elevated (St. Louis Fed)

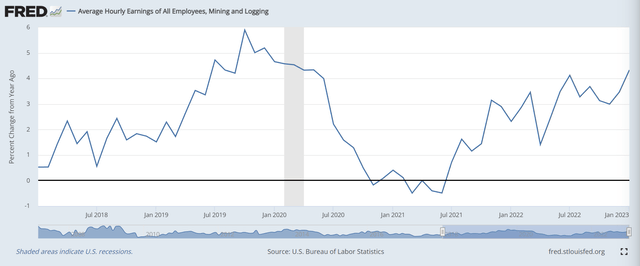

The second-largest cost for Barrick is labour and benefits at 23% of YTD costs. On this front, inflation appears to be worsening, judging by Average Hourly Earnings in the Mining and Logging sector, which just experienced a 4.3% YoY increase in January 2023 (Figure 7).

Figure 7 – Mining labour costs continue to rise (St. Louis Fed)

Granted, the data set above is from the St. Louis Fed and only covers American workers, but it does suggest continued labour pressures for Barrick.

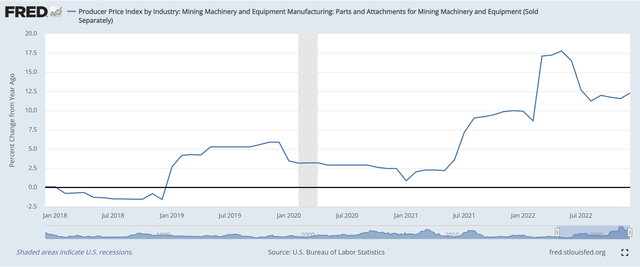

Finally, the 3rd biggest cost center for Barrick (aside from outsourced services) is consumables and spares. Again referring to St. Louis Fed data, we can see the Producer Price Index for Mining Machinery parts and attachments have been surging at double digit YoY inflation rates since 2021 with no signs of abating (Figure 8).

Figure 8 – Mining machinery parts and attachment inflation has been soaring (St. Louis Fed)

All in all, I believe inflation will continue to be a problem for miners like Barrick for at least a few more quarters.

M&A Heating Up

Another reason I prefer the royalty and streaming business model is there is less risk of the company pursuing value-destroying M&A transactions. In fact, Barrick Gold is famous for poor M&A restraint, having purchased Equinox Minerals, a copper producer, in 2011, at the peak of the commodity boom. In hindsight, the Equinox transaction was terribly overpriced, as Barrick had to write off $4.2 billion of the $7.3 billion transaction value.

Recently, we have seen M&A activity picking up in the gold mining sector. Within the largest gold miners in the world, as represented by the top 10 holdings of the GDX ETF, we have seen South Africa-based Gold Fields Ltd. (GFI) put itself in play by attempting to acquire Yamana Gold Inc. (AUY) in May of 2022 (Figure 9).

Figure 9 – GDX top 10 holdings (vaneck.com)

However, that deal was thwarted in late 2022 by Agnico Eagle Mines Ltd. (AEM), which partnered with Pan American Silver Corp. (PAAS) to take over Yamana.

Recently on February 5, 2023, we got another mega-merger in the gold space, with Newmont Corp. (NEM), the largest gold miner in the world, looking to acquire Newcrest Mining Ltd. (OTCPK:NCMGY), the 6th largest.

Looking at the top miners list, Barrick appears to be the only miner at the party without a dance partner. Given the company’s deal-focused history – Barrick famously tried to merge with Newmont in 2019 and acqui-hired its current CEO Mark Bristow by merging with Randgold in 2018, I doubt that Barrick would remain single for long.

Risks To Barrick

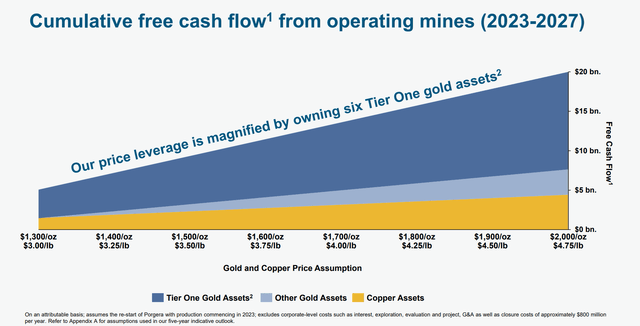

Barrick’s large production base gives it significant operating leverage to gold prices. According to company estimates, Barrick can generate over $20 billion in free cash flow (“FCF”) at $2,000 / oz gold and $5.0 / lb copper prices (Figure 10).

Figure 10 – GOLD FCF sensitivity to commodity prices (GOLD investor day presentation)

However, leverage works both ways, and Barrick’s financials could be negatively impacted by lower commodity prices.

Another risk to the company is continued inflation. We highlighted above that Barrick will likely continue to face inflation pressures in the coming quarters. However, if fuel prices start to rebound higher due to a re-opening China’s impact on energy supply/demand balance, then the inflation issue for Barrick could be longer-lasting and more pronounced.

Conclusion

Although Barrick has performed well in the past few months on the back of higher gold prices, I personally prefer investing in a royalty and streaming company like Wheaton Precious Metals, as there is less cost inflation risk with WPM’s business model. Furthermore, as the past few months have shown, even during a gold rally, WPM still outperforms Barrick by a mile. Finally, with M&A in the gold sector heating up, I worry that Barrick may be goaded into making a value-destroying transaction that the industry is known to do.

Be the first to comment