Nirian/E+ via Getty Images

If anyone needed impetus to buy the stock of equipment rental company Ashtead (OTCPK:ASHTF), this week provided it. It posted strong financials, which is notable at a time when cyclical industries are expected to be dragged down by macro challenges. This article looks at the company’s latest numbers in the context of these economic trends, which make a strong case to buy the stock for the long-term. Though by some valuation comparisons, it is still pricey.

No sign of slowdown

For the April-July quarter (Q1, 2022-23) of its financial year, Ashtead’s revenues grew by 25% to $2.3 billion from Q1, 2021-22. Significantly, its revenues from the US market which makes up for 84% of its total sales, grew by 30%. This is encouraging at a time when the US economy is in a technical recession, having reported shrinking economic output for two straight quarters.

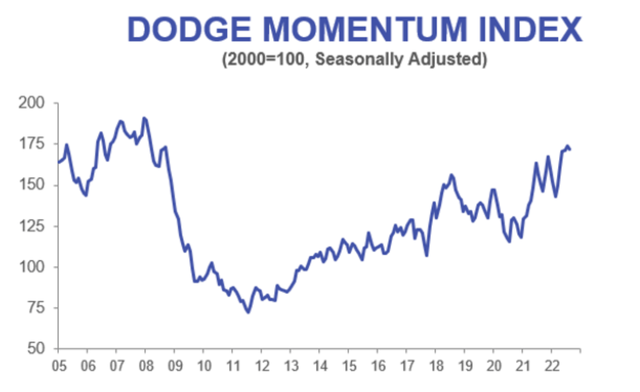

It would be logical to expect the construction industry, its largest market with a share of 40% in revenues from the US, to slow down at this time. But post-pandemic demand stays strong. And it is likely to continue to do so, going by the Dodge Momentum Index, a leading indicator for nonresidential construction spending in the US by a year. Its latest figures for August, show some correction, but the index remains close to 14-year highs.

Source: (Dodge Data and Analytics)

This is also reflected in Ashtead’s outlook for 2022-23. It has upgraded its guidance for rental revenue, which makes up for the bulk of the total. It now expects the segment to grow by 15-17% from its expectations of 12-14% earlier. Industry-related spending is expected to rise significantly in the US because of the government’s push for infrastructure creation and clean energy production, which bodes well too.

Strong margins reflect pricing power

A spurt in demand, however, is a double-edged sword right now, when inflation is already at multi-decade highs. Rising prices can hurt companies’ bottom lines and Ashtead has flagged it too, in its recent earnings release. The company says, “In common with many businesses, we face inflationary pressures across most cost lines…While our strong performance on rate, combined with our scale, has enabled us to navigate this inflationary environment, driving strong revenue and profit growth, it is a drag on drop through and margins.”

A small drag is indeed visible on its EBITDA margins, which dropped to 46% in Q1, 2022-23, from 46.4% in Q1, 2021-22. But the decline seems too small right now to be any sort of red flag. Moreover, its operating profit margins, are actually up at 27.5% in the latest quarter from 26.9% in Q1, 2021-22, which shows that the company is still in a strong position to pass on higher costs.

In fact, its operating profit is actually ahead of Ashtead’s expectations, up by 26% and its EPS is up by 33% from Q1, 2021-22. Its outlook on earnings also remains stable, which is another positive, with adjusted pre-tax profit expected to stay in line with previous expectations.

Rising interest payments, but under control

The only reason that the company has kept its profit projections unchanged, despite the better-than-expected numbers in Q1, 2022-23 is because of rising interest costs. Its interest expense is up by over 11% for the latest quarter annually. This was to be expected since its net debt is up by 23% from Q1, 2021-22. It doesn’t help that the current aggressive monetary tightening cycle is increasing interest rates too. Going forward, high-interest costs could be a particular challenge for indebted companies.

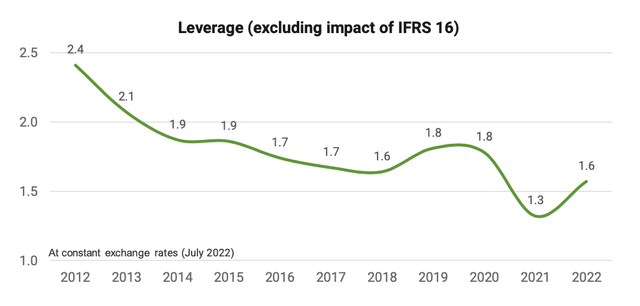

Source: (Ashtead First Quarter Results, 2022)

So far though, Ashtead’s net debt is in check. It has a net debt-to-EBITDA ratio of 1.6x, which the company says is at the lower end of its target range of 1.5-2x and is also lesser than it has generally been over the past years. Also, despite the increase in interest expense, interestingly, its interest coverage ratio has actually improved to 9.1x from 8.2x in the first quarter of 2021-22. So even if the combination of higher debt and interest payments, keeps earnings from outperforming, by themselves these numbers are not a big matter of concern.

Overvalued..or not?

In stark contrast to its robust performance, however, the Ashtead stock has dropped by more than 37% this year. The answer can be found in its market valuations compared to peers. Here we compare it with United Rentals (URI), which is its closest peer in terms of market capitalisation, at over $20 billion, and a share of the US market, of over 10%. It trades at a price-to-earnings (P/E) of 13x right now, compared to a little under 17x for Ashtead. This means that Ashtead’s price would have to decline by around 30% to be at the same P/E as United Rentals, which translates into a price of just below $40 from the last closing price of almost $51.

There is a catch here though. Both stocks are trading below the industry average, a sense of which is gauged from the P/Es for the S&P 500 sector indices for Construction Materials and Construction & Engineering, which are at 17x and 35x respectively. Even considering the broader Industrials segment, because Ashtead supplies equipment beyond construction, has a P/E of 26x right now. These indicate that the Ashtead stock is actually undervalued.

Conclusion

In sum, it is clear that Ashtead’s financials are strong and supported by big expected spending in its biggest market, the US. This expenditure can also give a fillip to the sagging US economy, which could feed into a virtuous cycle of growth for the construction industry, its largest business segment.

At the same time, since the start of the year, the Ashtead stock has been largely on a firm downtrend. That it is still trading at a valuation higher than its closest peer, United Rentals, is not comforting either. That this is happening in the context of weak stock markets, is hard to overlook as well. Keeping this in mind, there could be some more downside to the stock in the short term.

This is just one way of looking at the P/E though. S&P 500 construction segment P/Es actually indicate an upside to the stock. It has also returned 128% to investors over the past five years and 845% over the past decade. Its current fundamentals and projections indicate that it can continue to do so in the future too. Ashtead is a long-term buy.

Be the first to comment