undefined undefined

Investment Summary

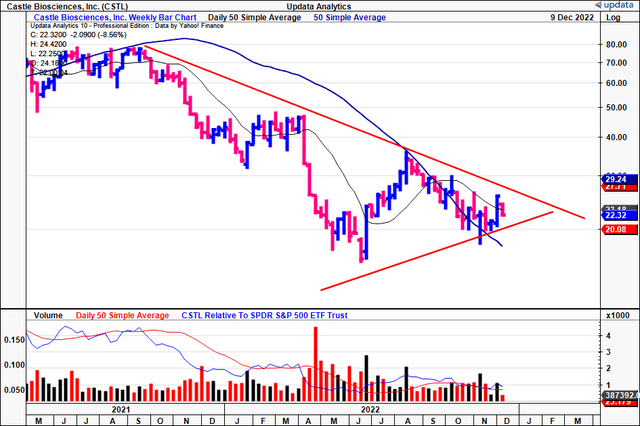

We have noticed Castle Biosciences, Inc (NASDAQ:CSTL) in our broad oncology coverage as a niche operator in the dermatological cancer pocket of the market. Seeking to diversify exposure to the broad segment, we investigated the investment credentials of CSTL using our rigorous investment process. We’re back today to discuss our key findings. Whilst CSTL offers compelling opportunity down the line, right now, we rate the stock a speculative buy based on our calculations discussed. Here we’ll discuss the market opportunity and where we see the value. You can see the stock’s ascending price action off a double bottom in the chart below, so we are interested to see where it goes from here.

Before reading, please wrap your head around the key risks to the investment thesis. These include:

1. Regulatory Risk, beings subject to the regulations of the FDA and other government agencies which could impact its operations and financial results.

2. The company relies on its proprietary technologies which may not be robust enough to meet customer needs or competitive threats.

3. Moreover, CSTL is a relatively new company and its products and services may not be widely accepted by a larger market, leading to lower demand for its offerings and potentially lower revenues.

Exhibit 1. CSTL 24-month price evolution, ascending wedge off double bottom.

CSTL: Fair view of fundamentals

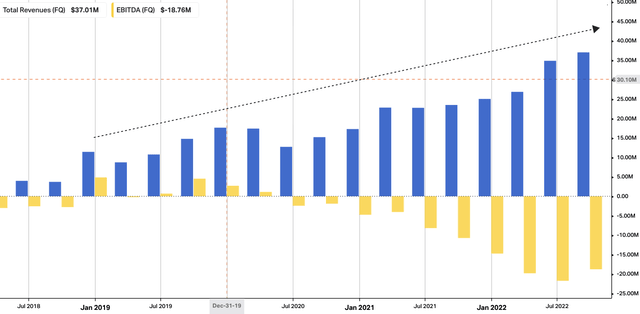

The most articulate way we can convey the company’s fundamentals is analysis of its short and long-term growth percentages. CSTL’s longer-term quarterly operating performance is seen in Exhibit 2.

During the third quarter of 2022, the company saw a significant increase in both revenue and test report volume. Revenue increased by 58%, while test report volume increased by 57%. These strong results have led the company to increase its full year 2022 guidance to between $132mm and $137mm, representing anticipated growth of at least 40% from 2021 total revenue.

The company’s skin cancer test saw a 34% increase in test reports over the third quarter of 2021 and a 4% increase over the second quarter of 2022. Overall, the company estimates that its third quarter 2022 test report volume for this test represents a market penetration of approximately 4%.

For the YTD, the company saw approximately 1,801 new ordering clinicians and approximately 6,763 total ordering clinicians for dermatologic tests combined. In terms of specific tests, the DecisionDx-Melanoma test saw a 34% increase in test reports over year.

Exhibit 2. CSTL sequential operating performance since FY18, with ongoing revenue upsides. Core EBITDA loss widening, however.

During the first quarter of 2022, Novitas completed a medical review of the company’s DecisionDx-SCC test and subsequently priced the test at a rate of $3,873 per test. Apparently this is the usual and customary rate for risk stratification or prognostic gene expression profile tests. Novitas also released a broad track LCD entitled dl-39-365, genetic testing for oncology earlier this year.

In September, CMS released the draft 2023 Clinical Lab fee schedule pricing update for tests with corresponding new codes. Both the DecisionDx-SCC and DiffDx-Melanoma tests were given new PLA codes earlier in the year, thus were included in the Draft 2023 CLFS. The DiffDx Melanoma test was cross-walked to MyPath Melanoma, appropriate for a diagnostic support test for the segment. However, CMS also proposed cross-walking the DecisionDx-SCC test to MyPath Melanoma, against the majority and minority recommendations of the CDLT advisory panel. A final determination on the 2023 rate is expected to be communicated by CMS in Q4.

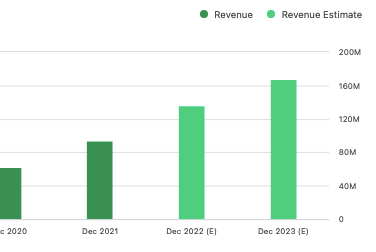

Exhibit 3. CSTL revenue forecasts, FY22 and FY23. We note this trend is in-line with longer-term growth averages.

Data: Seeking Alpha, CSTL

Market opportunity: Dermatological/Skin cancer treatment market

As with all our investment theses, we perform a wide macroeconomic review of the data as the first part of a top-down review. It’s important we convey this to you so you know where we stand in our thesis.

Dermatological cancer, also known as skin cancer, is the uncontrolled growth of abnormal cells in the skin. It is the most common type of cancer, with over 3.5mm cases in the United States each year. There are several different types of dermatological cancer, including basal cell carcinoma, squamous cell carcinoma, and melanoma.

Basal cell carcinoma is the most common type of skin cancer, accounting for about 80% of all cases. It typically develops on areas of the skin exposed to the sun, such as the face, neck, and hands. It is slow growing and rarely spreads to other parts of the body.

Squamous cell carcinoma is the second most common type of skin cancer, accounting for about 20% of cases. It typically develops on areas of the skin exposed to the sun, such as the face, ears, and hands. It can spread to other parts of the body, but this is rare.

Melanoma is the most aggressive and dangerous type of skin cancer. It develops in the cells that produce melanin, the pigment that gives skin its color. It is most common in people with fair skin, but can also occur in people with various skin tones. Melanoma can spread to other parts of the body, making it more difficult to treat.

There are a number of studies that demonstrate the importance of early detection and diagnosis in improving patient outcomes. One study, for example, found that early detection of melanoma through regular skin examinations by a healthcare provider was associated with a significant decrease in the risk of death from the disease. Another study found that the use of diagnostic tests such as dermoscopy, a non-invasive imaging technique that allows for the visualization of pigmented lesions on the skin, can improve the accuracy of melanoma diagnosis and lead to earlier intervention.

In addition to improving patient outcomes, the use of diagnostic testing can also help to reduce the cost of care by enabling the use of less invasive and less expensive treatments when melanoma is detected at an early stage. For example, dermoscopy and total body photography, which allows for the documentation of all visible skin lesions, can help to identify early stage melanomas that can be treated with local excision rather than more extensive surgical procedures. This can not only improve patient outcomes, but can also result in significant cost savings for the healthcare system.

Turning to the market opportunity, we’d note the skin cancer treatment market is driven by various factors, including the increasing prevalence of skin cancer, growing awareness about skin cancer, and advances in treatment options. According to a study published in the Journal of the American Academy of Dermatology, the prevalence of skin cancer has been increasing in recent years, with an estimated 5.4mm cases of non-melanoma skin cancer and nearly 100,000–200,000 cases of melanoma estimated to be diagnosed in the United States in 2022.

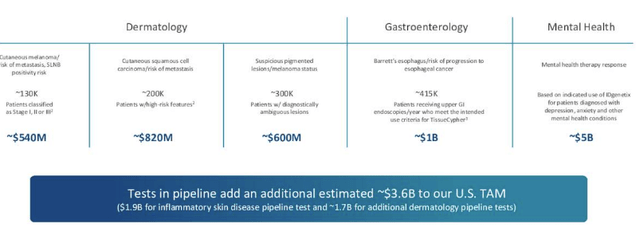

The global skin cancer treatment market is estimated to reach $14.5Bn by 2031, growing at a CAGR of 7.3% over the next 10 years. Furthermore, advances in treatment options for skin cancer have also contributed to the growth of the skin cancer treatment market. You can see a bit more of CSTL’s dermatology addressable market below.

Therefore, as you can see, it is a wise choice to uncover underexploited names within this corner of the healthcare market.

Exhibit 4. CSTL Dermatology market

Image: CSTL Q3 FY22 investor presentation

Valuation and conclusion

The stock is rated lowly at present, at 2.5x forward EV/sales and 1.4x book value. Taking management’s guidance of $330mm in revenue for FY22, and applying the 2.5x multiple, we see an upside target to $31. This is supported by our point and figure analysis below. Hence, we rate the stock a speculative buy to these ranges.

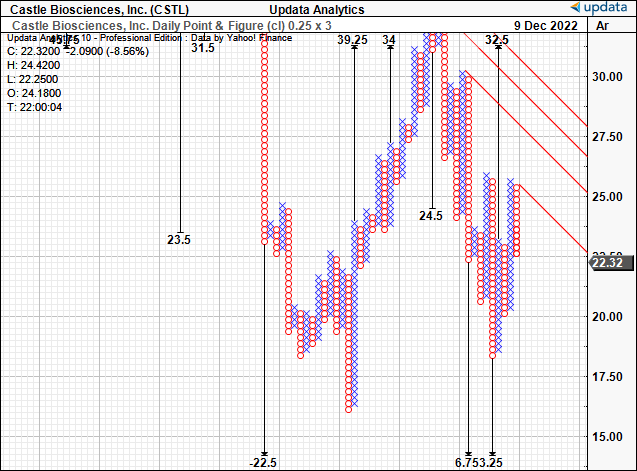

Exhibit 5. Upside targets to $32.5

Data: Updata

Be the first to comment