ArtMarie/E+ via Getty Images

Our memory is a more perfect world than the universe: it gives back life to those who no longer exist.” ― Guy de Maupassant

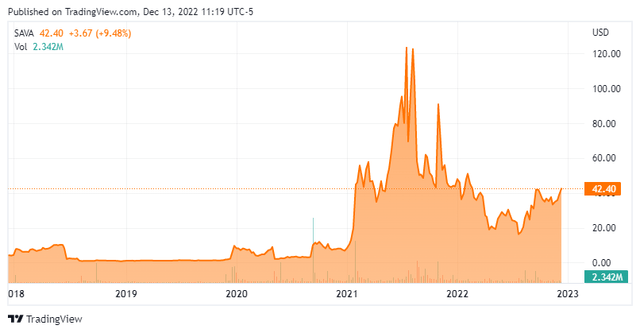

Today, we put Cassava Sciences, Inc. (NASDAQ:SAVA) in the spotlight for the first time. As can be seen below, the stock of this Alzheimer’s focused developmental concern has been extremely volatile over the past two years.

Company Overview:

Cassava Sciences is a clinical stage biotechnology company based in Austin, TX that is focused on developing drugs for neurodegenerative diseases. The company was known as Pain Therapeutics up until 2019 when the company changed its name to Cassava Sciences. It should be noted that Pain Therapeutics’ pursuit of a gel formulation of oxycodone resulted in a failure despite multiple marketing applications. Cassava Sciences’ stated mission is to detect and treat Alzheimer’s disease. Currently, the stock trades just north of forty bucks a share and sports an approximate market capitalization of $1.75 billion.

April Company Presentation

April Company Presentation

Cassava’s lead therapeutic product candidate is called Simufilam. This is a small molecule drug, which has completed a Phase 2b clinical trial.

April Company Presentation

Simufilam targets a scaffolding protein called Filamin-A or FLNA which is often found to be misfolded in the brains of Alzheimer’s patients. Management states Simufilam improves the function of multiple brain receptors and exerts powerful anti-neuroinflammatory effects.

April Company Presentation

The company currently has initiated two, placebo-controlled phase 3 trials evaluating simufilam, RETHINK-ALZ and REFOCUS-ALZ. The first to study the impacts after 52 weeks of daily dosing and the second evaluating impacts after a year and a half. The goal is to enroll 750 patients in these two trials and to the evaluate the safety and efficacy of oral simufilam 100 mg in enhancing cognition and slowing functional decline. REFOCUS-ALZ will also evaluate a 50mg dose of simufilam. As of early November, 650 patients in these trials had been enrolled.

April Company Presentation

The company is also developing an investigational diagnostic product candidate called SavaDx, which is a blood-based biomarker/diagnostic to detect Alzheimer’s disease. This is an early-stage effort as the company is working with third parties to evaluate the use of mass spectrometry to detect FLNA without the use of antibodies. The main focus of Cassava Sciences is on the development of simufilam.

Recent Developments:

In mid-November, the company took advantage of a big rally in its equity from early August to pull off an approximate $50 million capital raise. Earlier in that month, management filed a federal lawsuit against those who conducted a “short and distort” campaign targeting Cassava Sciences. They alleged that the defendants orchestrated a “disinformation campaign” that resulted in a pullback that destroyed millions of dollars of shareholder value. In October, leadership also filed motion to dismiss a shareholder class action that related to the trial data around Simufilam. An article this Fall on Seeking Alpha went into more detail around this saga.

Early this month, management stated that it had finished drug administration in the trial of 200 patients with mild-to-moderate Alzheimer’s. Participants in this open-label study have been given 100mg dosages of simufilam twice daily for 12 months. Data is currently being analyzed by independent biostatisticians. The company hopes to post study results by year-end 2022, pending completion of a study report by outside biostatisticians. The study started in early 2020 and is intended to monitor the long-term safety and tolerability of simufilam 100 mg twice daily for 12 or more months.

April Company Presentation

Analyst Commentary & Balance Sheet:

Not surprisingly, the analyst community has mixed views on Cassava’s prospects. JonesTrading ($100 price target) and H.C. Wainwright ($124 price target) both reissued Buy ratings on SAVA in early November following the company’s third quarter earnings report.

Two weeks later B. Riley Financial downgraded the name to a Neutral from Buy with a $44 price target and the following commentary.

While staying encouraged by SAVA’s steady pace of expanding patient enrollment in its ongoing Ph. III mild-to-moderate Alzheimer’s Disease [AD] REFOCUS-ALZ and RETHINK-ALZ trials, our thesis is adversely impacted by limited relevant data disclosures by the company from the ongoing Ph. II open-label (OL) study. this makes the “risk/reward profile” at present levels “more balanced.” Add in the distraction provided by the company’s recently filed defamation lawsuit against “certain individuals” Cassava claims have been running a “short and distort” campaign against the company over alleged misuse of data, and the analyst thinks it’s time to move to the sidelines.”

At the end of November, Univest Securities reissued their Sell rating and lowered their price target a buck a share to $11 after Cassava’s latest capital raise. In August, four insiders including the CFO added just over $3 million to their holdings in the low $20s. That has been the only insider activity so far in 2022.

The company ended the third quarter of this year with nearly $175 million worth of cash and marketable securities against no long-term debt. Management believes it will burn through between $80 million to $90 million worth of cash in FY2022. In mid-November, the company executed a capital raise of roughly $50 million via a registered direct offering, adding to its coffers.

Nearly one out of every four shares outstanding are currently held short.

Verdict:

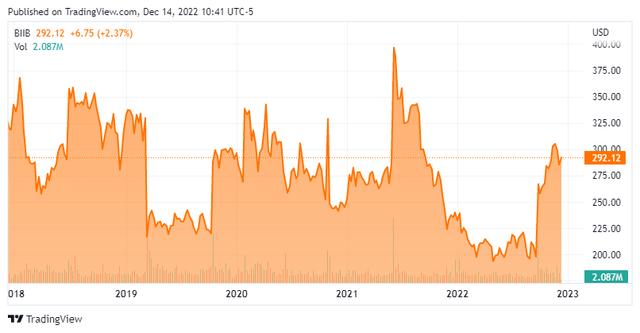

Obviously, Alzheimer’s is a massive potential market with over six million Americans impacted alone. There is only one new approved drug for this horrid disease in the past few decades. That is Aduhelm (aducanumab) from Biogen (BIIB). This drug was approved amidst major controversy a year and a half ago. Aduhelm revenue has been much, much lower than originally projected (the drug did $1.6 million worth of sales in the third quarter) and the stock of Biogen is down by a quarter from where the shares spiked right after FDA approval.

Tens of billions of R&D dollars have been spent trying to develop Alzheimer’s candidates by drug makers large and small. Very little progress to date has been made with Roche (OTCQX:RHHBF) being amongst the latest to post disappointing trial results. Biogen did recently disclosed lecanemab, which it is developing with Eisai (OTCPK:ESALY), met the primary endpoint in the late-stage study to treat memory loss.

One day, a biopharma firm will eventually come up with an effective treatment for Alzheimer’s. Hopefully, that will happen on the near-term horizon not decades out in the future given how many families are impacted by this dreaded disease.

April Company Presentation

The company that eventually lands that moon shot will create tens of billions of shareholder value. However, given Cassava’s colorful past and somewhat controversial present which includes litigation and a large short interest in its stock; I doubt this company will be the one to achieve what would be a historic event. Therefore, I am passing on any investment recommendation around Cassava Sciences.

The advantage of a bad memory is that one enjoys several times the same good things for the first time.” ― Friedrich Nietzsche

Be the first to comment