vchal

When you think about waste services, odds are one of the major players in the space pops into your head. Regardless of which firm you think of first, the industry may not at first glance seem to be all that exciting. Having said that, there are some quality operators in this market, including some that are smaller and generally fall under the radar of many investors. One prospect to consider that fits this definition is Casella Waste Systems (NASDAQ:CWST). In recent years, this enterprise has done well to grow both its top and bottom lines. That fundamental performance continues into the current fiscal year. Long term, I suspect that the company will continue to create value for its investors. At the same time, however, I don’t view it as a particularly attractive prospect from a valuation perspective. This is due solely to the fact that shares of the enterprise do look a bit lofty at this point in time. But in the event that shares fall or the fundamental condition of the company drastically improves moving forward, this assessment could change.

Making money with trash

As I mentioned already, Casella Waste Systems operates in the waste services space. More specifically, the company serves as a regional, vertically integrated solid waste services firm. In addition to catering to residential customers, it also provides its services to commercial, municipal, institutional, and industrial customers, largely in areas of solid waste collection and disposal, transfer, recycling, and organic services. At present, the company has operations spread across seven different states. These are Vermont, New Hampshire, New York, Massachusetts, Connecticut, Maine, and Pennsylvania.

To best understand the company, we should touch on the three different segments that it has. The first of these is known as the Eastern Region segment. Through the 20 solid waste collection facilities, 29 transfer stations, three recycling and processing facilities, and two subtitle D landfills on its books, this segment provides solid waste solutions to its customers across Maine, northern, central, and southeastern New Hampshire, central and eastern Massachusetts, and northeastern Connecticut. During the company’s 2021 fiscal year, this segment accounted for 29.8% of the company’s revenue.

Next in line, we have the Western Region segment. Like the Eastern Region segment, this unit of the business provides waste services, but to customers in Vermont, southwestern New Hampshire, eastern, western, and upstate New York, northwestern Massachusetts, and Pennsylvania. This is the largest of the company’s segments, with 30 solid waste collection facilities, 36 transfer stations, six recycling and processing facilities, six subtitle D landfills, and a single construction and demolition landfill. Last year, this unit was responsible for 43.8% of the company’s sales. And finally, we have the Resource Solutions segment. Through the 14 recycling and processing facilities in its portfolio, this segment provides recycling and commodity brokerage operations, as well as organics services and large-scale commercial and industrial services, to its customer base. This segment accounted for 26.4% of the company’s revenue last year.

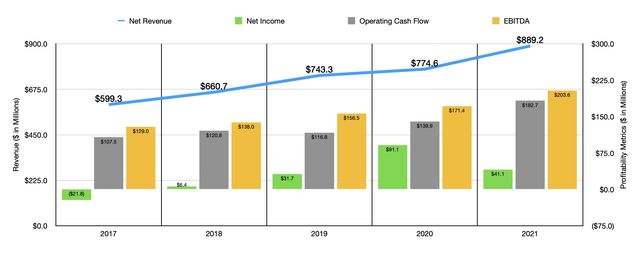

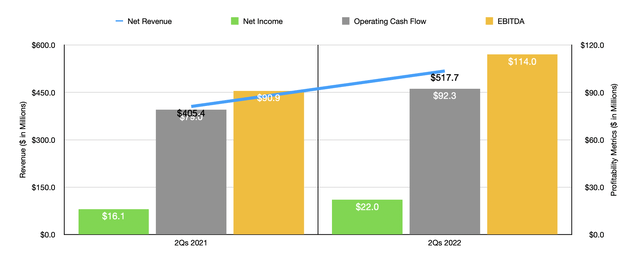

Over the past few years, the general trajectory for Casella Waste Systems has been quite positive. Between 2017 and 2020, sales rose consistently, climbing from $599.3 million to $774.6 million. In 2021, sales shot up to $889.2 million. This 14.8% rise was driven by a variety of factors. The biggest, by far, was a 7% increase caused by acquisitions the company made. However, the company also benefited from a 3.9% increase in pricing and a 2.2% rise in volume. Growth for the firm has continued into the current fiscal year. In the first half of 2022, revenue of $517.7 million beat out the $405.4 million generated the same time last year. This 27.7% increase year over year was driven largely by a 12.3% increase coming from acquisitions. Higher pricing pushed sales up by 6.3%, while volume added 1.1% to the company’s top line.

With revenue rising, profitability has generally improved. The company went from generating a net loss of $21.8 million in 2017 to generating a net profit of $41.1 million last year. Operating cash flow rose from $107.5 million to $182.7 million. Meanwhile, EBITDA for the company also improved, rising from $129 million to $203.6 million. Just as was the case with revenue, profitability growth has continued into the 2022 fiscal year. Net income in the first half of the year totaled $22 million. This stacks up favorably against the $16.1 million generated the same time one year earlier. Operating cash flow jumped from $79 million to $92.3 million, while EBITDA improved from $90.9 million to $114 million.

When it comes to the 2022 fiscal year as a whole, management expects revenue to be between $1.035 billion and $1.05 billion. Previously, revenue had been forecasted even lower at between $1.005 billion and $1.02 billion. Management now expects net income of between $50 million and $54 million. Operating cash flow should be between $208 million and $212 million. Meanwhile, EBITDA should come in at between $238 million and $242 million. All of these profitability figures are higher than what management previously guided for the year.

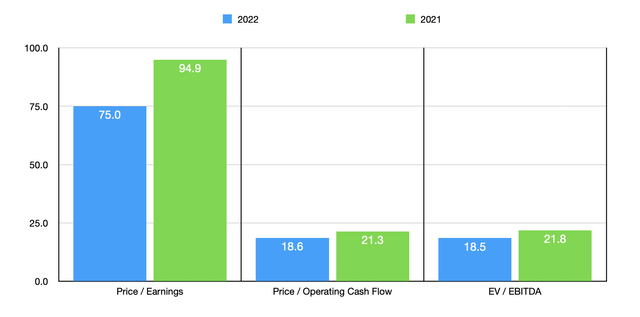

Using these figures, I valued the company on a forward basis. The price-to-earnings multiple would be a very lofty 75. But the price to operating cash flow multiple would be 18.6, while the EV to EBITDA multiple would come in at 18.5. As you can see in the chart above, these numbers are lower than what we get using data from 2021. Meanwhile, in the table below, you can see how the company is priced compared to four similar firms. On a price-to-earnings basis, three of the four companies had positive results, with multiples of between 22 and 145.2. Using the EV to EBITDA approach, the range for the four firms was between 11.5 and 55.4. In both cases, two of the companies were cheaper than Casella Waste Systems. Using the price to operating cash flow approach, the range was between 8.8 and 50.1. In this case, three of the four firms were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Casella Waste Systems | 94.9 | 21.3 | 21.8 |

| Stericycle (SRCL) | 145.2 | 18.1 | 23.7 |

| ABM Industries (ABM) | 22.0 | 8.8 | 12.0 |

| Clean Harbors (CLH) | 26.9 | 10.0 | 11.5 |

| Montrose Environmental Group (MEG) | N/A | 50.1 | 55.4 |

Takeaway

Based solely on fundamentals, I do believe that Casella Waste Systems is a quality company in a space that will likely continue to grow for the foreseeable future. This bodes well for shareholders. At the same time, however, shares do look a bit lofty, leading me to rate it a ‘hold’ for now.

Be the first to comment