bfk92

Investment thesis

In some of my earlier articles here on SA, I have proclaimed my bullish view on the product tanker segments due to the consolidation we are seeing from the oil companies of their refineries resulting in an increase in tons/miles for these vessels.

It was my interest in Frontline (FRO), with a mixed fleet of both crude oil tankers and product tankers that got me started. In search of a company that has pure product tanker exposure, I came across Ardmore Shipping (NYSE:ASC) which has such a fleet.

Ardmore Shipping logo (Ardmore Shipping homepage)

Company background

The company was established in 2010 and has its principal operating office in Ireland and its registered office in the Republic of the Marshall Islands.

Ardmore’s exposure to the oil product trade is somewhat different from that of Frontline, which focuses purely on the LR which is the Large Range vessels of about 115,000 deadweight. Ardmore’s fleet is in the MR, which is a Medium Range size vessel category of around 40,000 deadweight.

They own a fleet of 21 Medium Range product tankers that can also transport easy chemicals. In addition, they also own 6 slightly smaller vessels that are built with parcel trade in mind. These vessels have an average tank size of less than 3,000 cubic meter allowing them to carry a wider range of smaller parcels of chemicals.

Five MR tankers plus three 24,000 deadweight vessels are also chartered in on period charter.

Their fleet is modern with an average age of 7.9 years old. They have no newbuildings on order,

Financials

It has been a rather gloomy period when you look at their annual results for the last three years.

They delivered a loss of $22.6 million in 2019, followed by a loss of just $6 million in 2020 but another loss of $38.1 million last year.

The good news is that for the first half of 2022, they managed to deliver a GAAP profit of $21 million.

They have a fairly strong balance sheet and liquidity position Their liquidity of $57 million consisted of cash of $45 million plus a further $12 million available under existing undrawn credit facilities.

During the last quarter, they refinanced debt, which has been reduced by $97 million to $287 million. The loans are sustainability-linked, priced at Libor + 2.25%. The latest 6 months’ Libor is 4.49%. It is a good thing that they are reducing the debt, now that it costs 6.74% to service it.

The net leverage was 49% as of 30th June 2022.

Policy on returning capital to shareholders

It is perhaps somewhat futile to talk about returning capital when a company is not really making money.

But it would be good to know if it one day was in a position to do so. After all, why would you invest in a company unless you had some conviction that it would be profitable, and were in a position to share some of this with you as a part owner in it?

So far, Ardmore is not paying any dividends.

They also have stated their policy on the matter, which is a good thing, and here are their preference in this order.

- Maintain fleet over time

- Reduce leverage to below 40%

- Grow the fleet in an accretive way

- Return capital to shareholders

As of the second quarter of 2022, they have made good progress on this journey. Through higher time-charter equivalent earnings, they have been able to improve the balance sheet and will still prioritize further debt reduction.

During the conference call at the Q2 presentation, a few analysts did question what they plan to do once they hit the 40% leverage target they have set. Even though the management did answer that they could be in a position to return capital to shareholders in a couple of years, it was not clear if that would be taking place or if they would like to grow their fleet.

Business prospects

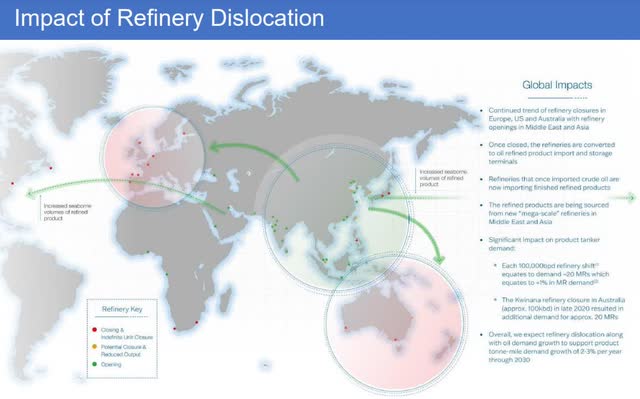

With oil majors closing down many refineries and new large clusters of chemicals and refineries being formed, there are changes in trading patterns taking place.

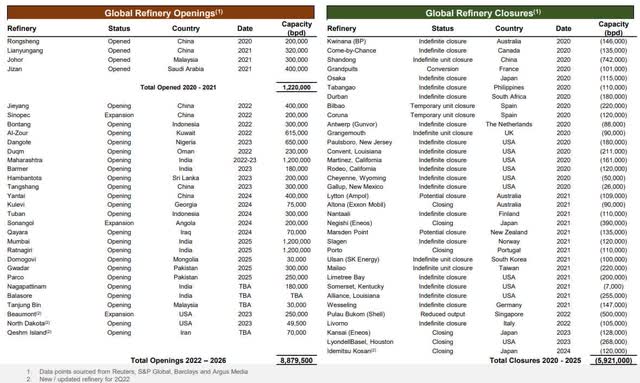

Dislocation in the Refinery Industry (Ardmore Shipping Q2 Presentation) Refineries opening and closing (Ardmore Shipping Q2 2022 Presentation)

All this adds up to more work for product tankers.

We can see this from Ardmore Shipping’s past and most recent average time-charter equivalent earnings per day for their MR tankers. It had been fairly stable, and as we saw from their losses, not particularly good in 2021. Earnings were around $ 11,500 per day.

In the first quarter of this year, it improved to $ 15,850 and subsequently doubled to $ 30,480 in the second quarter.

When publishing their Q2 results on the 27th of July, they had booked business giving them average earnings of $ 46,551 per day.

It might be too optimistic to count on such high rates going forward.

However, there are good signs that it is not quickly going down to what we saw in 2021.

The new trade routes are here to stay and the tonnage supply is favorable. The newbuilding order book is low at just 6.2% of the present fleet. Scrapping of tonnage also hit the highest number since 2012 last year with 68 product tankers taken out. This year is also on record to show a similar number of vessels being scrapped.

Conclusion

The fortunes are turning for this sector and Ardmore Shipping should benefit from it. As we all know, this is a very cyclical industry so it is difficult to predict how long the good days will last.

Pure supply and demand dynamics look attractive which means that the next two to three years should be good barring any unforeseen circumstances like a severe economic recession curtailing demand for refined oil products.

One problem I have with Ardmore is that here you really have to gamble purely on an increasing share price. You do not get paid to wait for this to possibly take place.

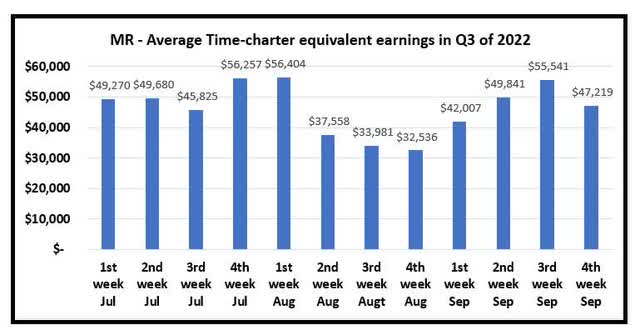

We did get a glimpse of what we can expect in terms of earnings in Q3 when management informed shareholders and investors of the bookings they had already secured for Q3 with average earnings of $ 46,551 per day.

Third quarter results are due to be released in about two weeks and I will be looking forward to seeing how they have done

The market has done well with only a short blip in earnings in August, as can be seen here:

MR – market average earnings in Q3 of 2022 (Data by Allied Shipbrokers. Graph by author)

It will also be interesting to hear if there are any changes to how they plan to allocate the free cash flow

My search for such exposure goes on. Perhaps some of the readers can give their opinion on a good candidate. Next up for me is to consider TORM (TRMD).

As such my stance would be that of a Hold.

Be the first to comment