ShaneQuentin/E+ via Getty Images

Introduction

While drinking some tea, an idea came to me: one can obtain a similar health benefit to their long term financial health as tea does for their physical health, all with just 3 holdings. Yes, I stole this idea from the commonly used FANG acronym: Facebook (FB), Apple (AAPL), Netflix (NFLX), and Google (GOOG) (GOOGL). I hope this pattern has not been worn out and overused in your eyes, as I find it is an easy way to group and remember strong assets.

People all over the world have been drinking tea for thousands of centuries, and for good reason. Numerous studies have shown that a variety of teas may boost your immune system, fight off inflammation, and even ward off cancer and heart disease (Penn Medicine).

Whether you are for it or against it, I would like to introduce you to TEA: Thermo Fisher (TMO), Edwards Lifesciences (EW), and Align Technology (ALGN). All three are pioneers or leaders in their respective industries, and offer rock solid fundamentals and significant growth prospects. While I was considering Teladoc (TDOC) for T, I found that hemorrhaging cash quarter after quarter to be slightly unhealthy (although TDOC is worth significant consideration due to the growth prospects for those with a long horizon). Perhaps like Align, the company will grow into their moat in the telehealth industry and offer a healthy financial foundation. In the end, I find that TMO, EW, and ALGN offer optimal fundamental health and significant moats. Take a look at the summaries below.

Thermo Fisher

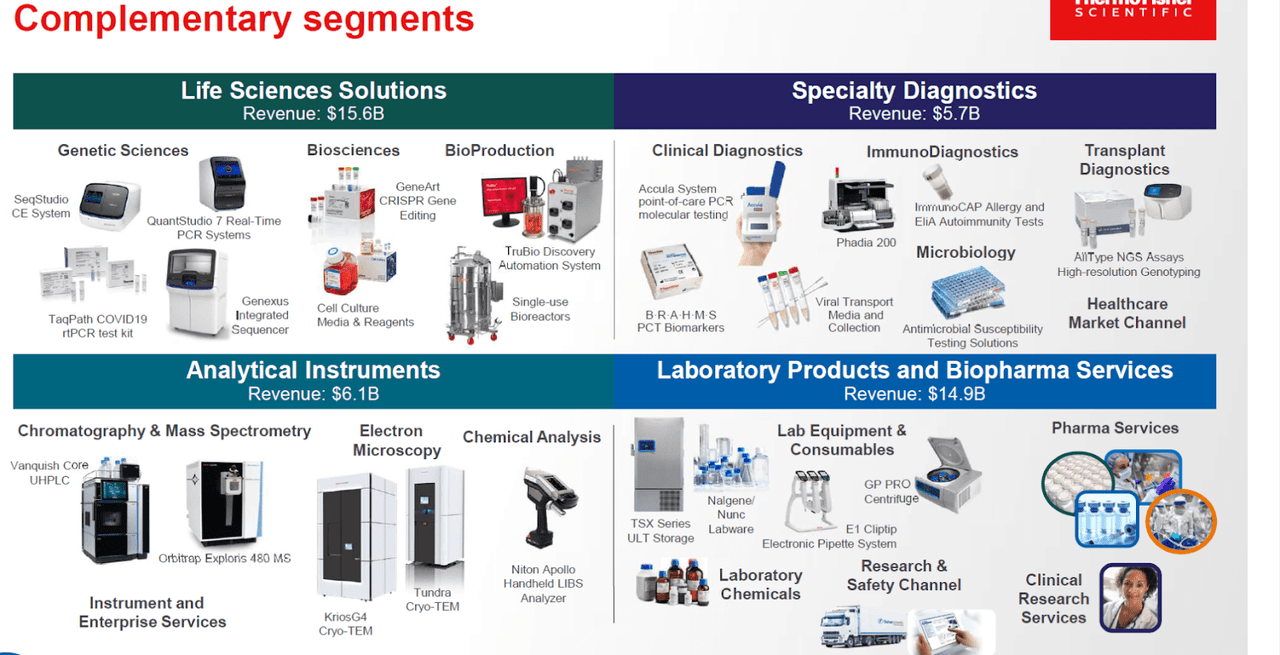

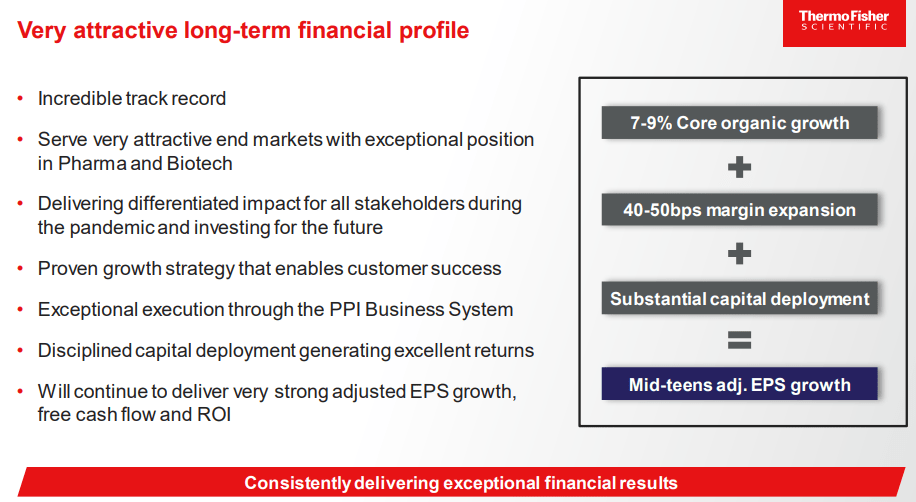

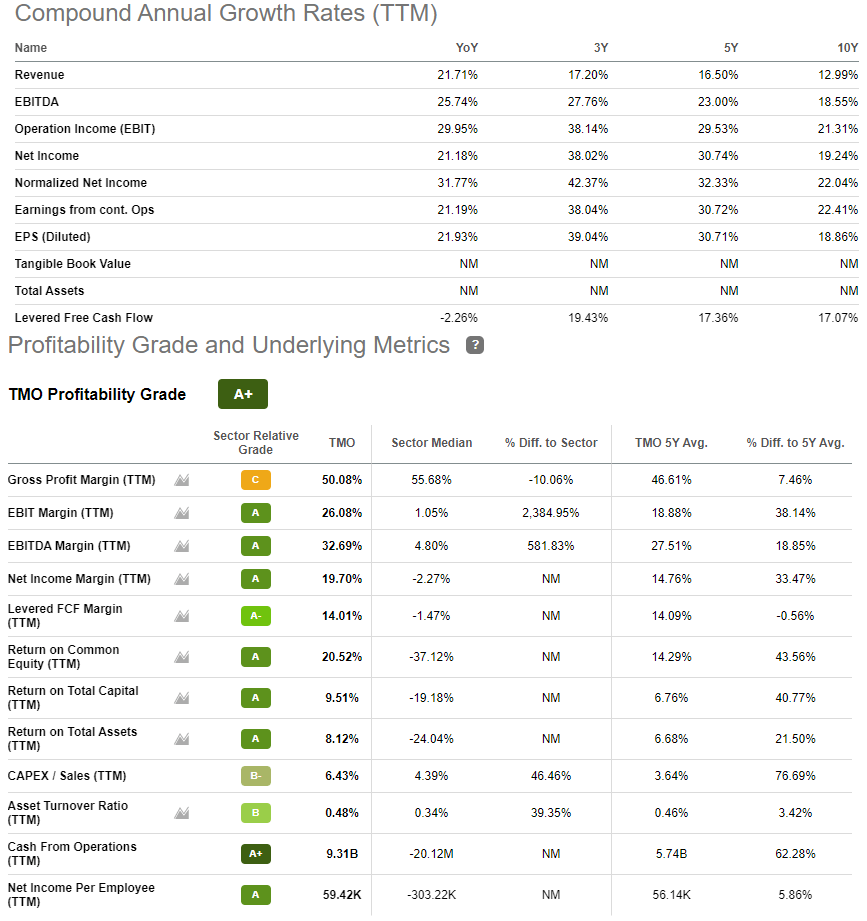

Thermo Fisher is a highly diversified healthcare tools and supplies company that offers a significant moat and exposure for the entire industry. Investing in TMO can be likened to investing in giants Honeywell (HON), Chevron (CVX) /Exxon (XOM), or Linde (LIN). The similarities involve the necessity of the majority of their products. Whether it is the production of mechanical equipment, procurement of the building blocks of chemicals and materials, or distribution of tools, consumables, and services required for the healthcare industry, Thermo has it covered. With this, I find the company offers a significant moat and is able to leverage growth segments in any part of the market. As an example, performance has been strong over the past year or so due to the pandemic. However, as seen in the first few years of the last decade, when healthcare is weak so is TMO. This inhibits the company from offer outstanding shareholder returns in terms of growth, but with careful acquisitions and financial planning, earnings per share have been more than sufficient for any type of investor over the past 10 years.

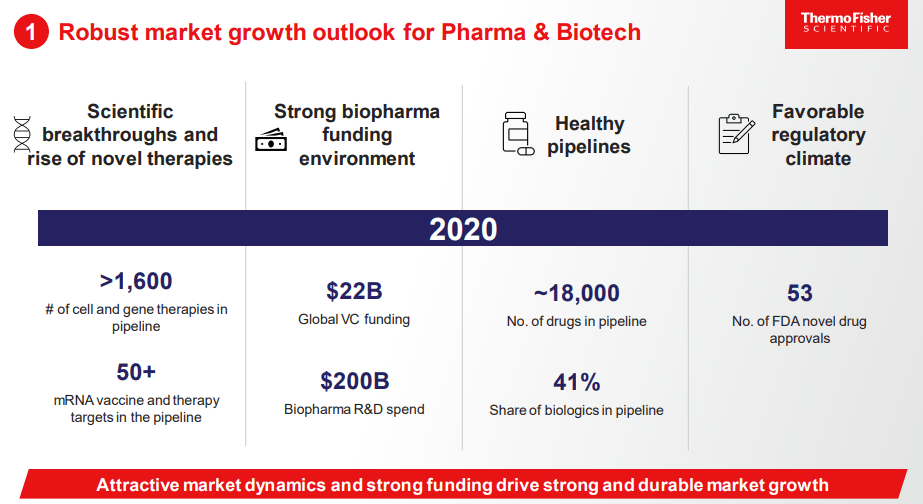

I also find that there is soon to be an upward cycle in the healthcare market as a large portion of the market has faced headwinds during the pandemic. As an example, FDA delays and lockdowns prevented clinical phase biotechnology companies from moving their work forward at a normal pace. Also, with hospitals inundated with those unfortunate COVID patients, less capital has been spent on elective or routine care and procedures. With a growing revenue segment based on the biotech and pharma industries, TMO is also able to grow along with all the new therapies that are continually being developed.

With COVID lingering in the background but the rest of the industry re-surging, I find that I only expect TMO to continue outperforming. This is one major reason to find immense safety in this company, although, I would say TMO offers the weakest moat of all three TEA stocks. Due to the wide range of proprietary technologies in healthcare, numerous other companies all own significant portions of each market segment TMO operates in. While the innovation and hype may lie with competitors, it is no issue for the growth potential in the industry as there are significant unmet needs to address, cost efficiencies to find, and basic components to supply. As such, I find that TMO remains a healthy bet on the entire industry as they continue to acquire and internally R&D their own growth path.

Thermo Fisher Thermo Fisher Thermo Fisher Growth and Profitability of Thermo Fisher (Seeking Alpha)

Edwards

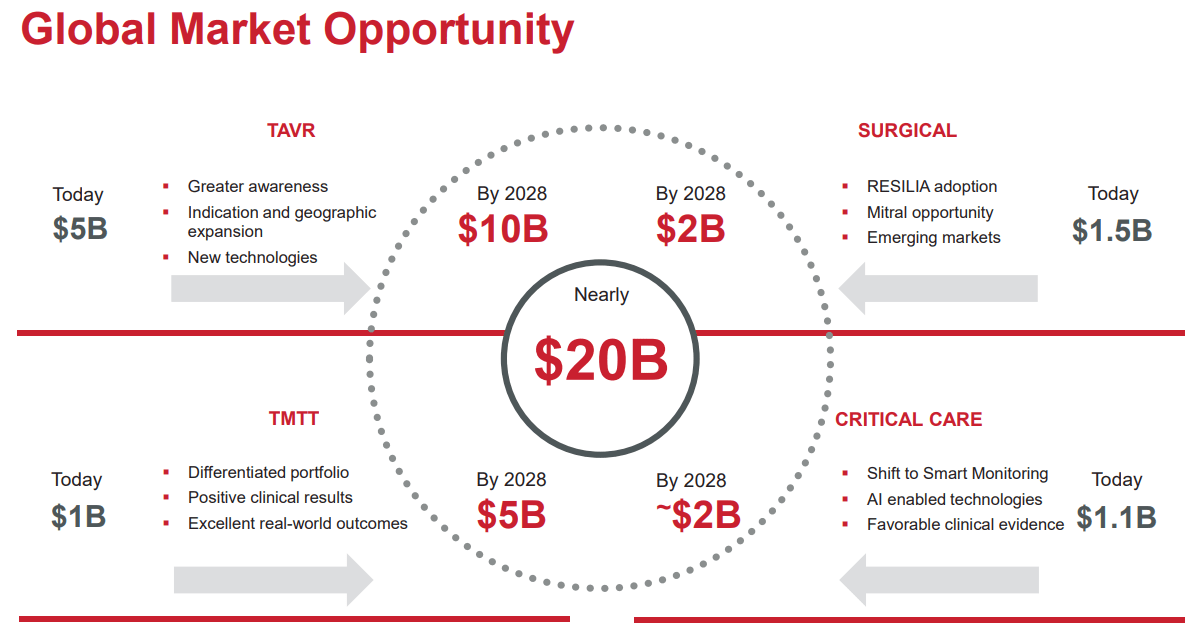

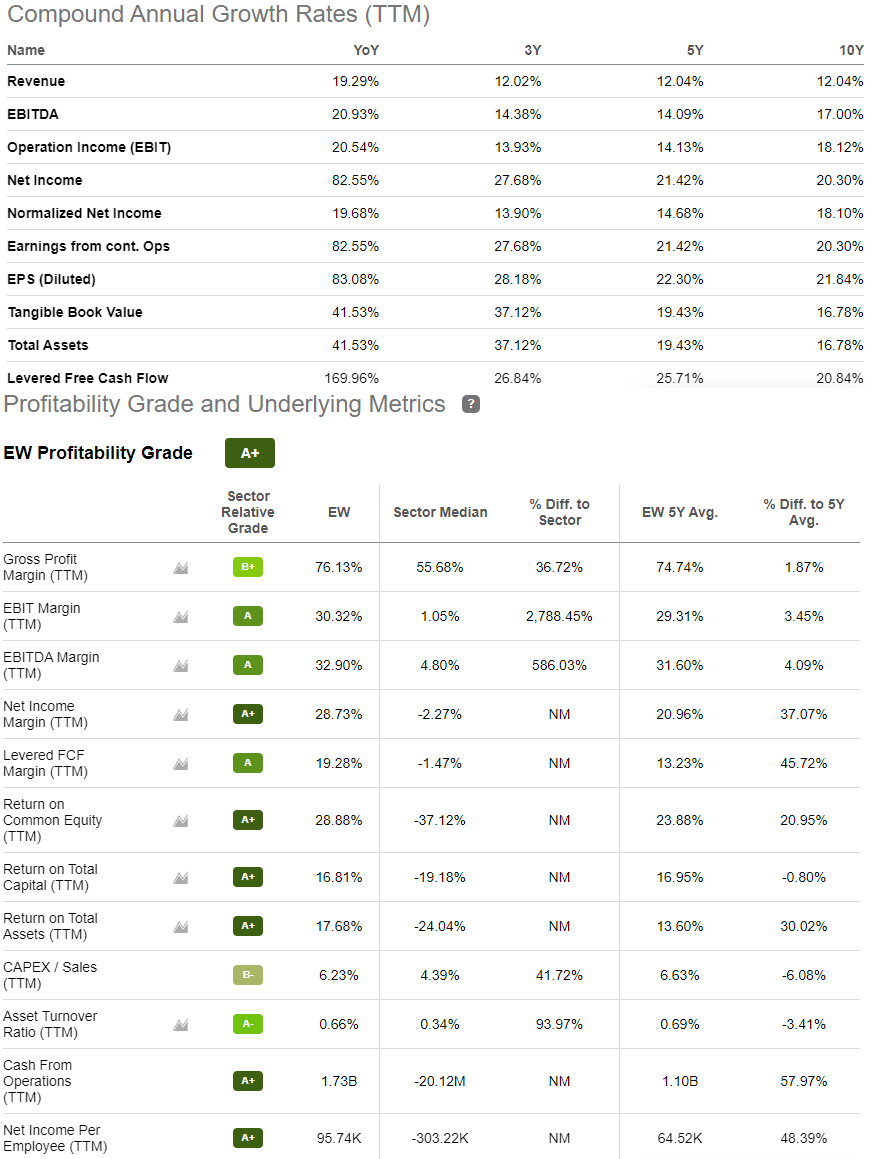

Edwards is a leading developer of cardiothoracic surgical technology, including the important non-open heart valve replacements. With the development of safer, longer lasting, and cost effective tech, EW has been able to grow into one of the largest medical supply companies in the market. With that, market leading profitability allows for both shareholder returns and reinvestment into novel technologies to perpetuate growth. Cardiovascular diseases are the leading cause of death globally, and the factors behind many of these issues are growing (diet, alcohol, inactivity, etc). With over 17.9 million people passing away from these issues worldwide, you can see how the beneficial products developed by EW are of significance. While your own financial health is possible due to revenue growth, your investment also supports R&D.

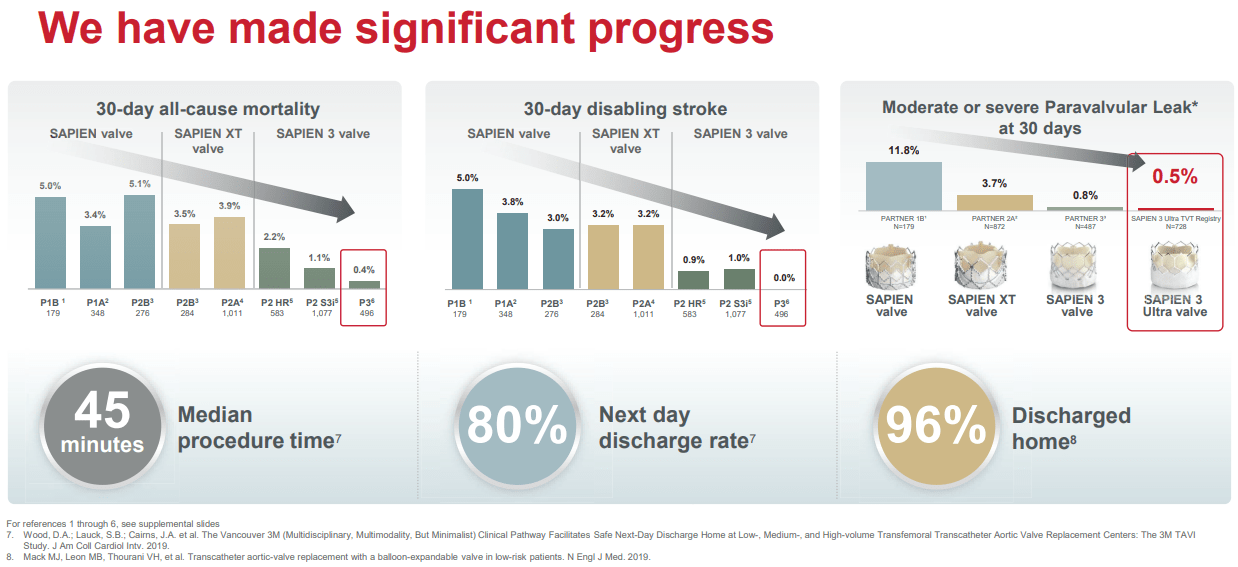

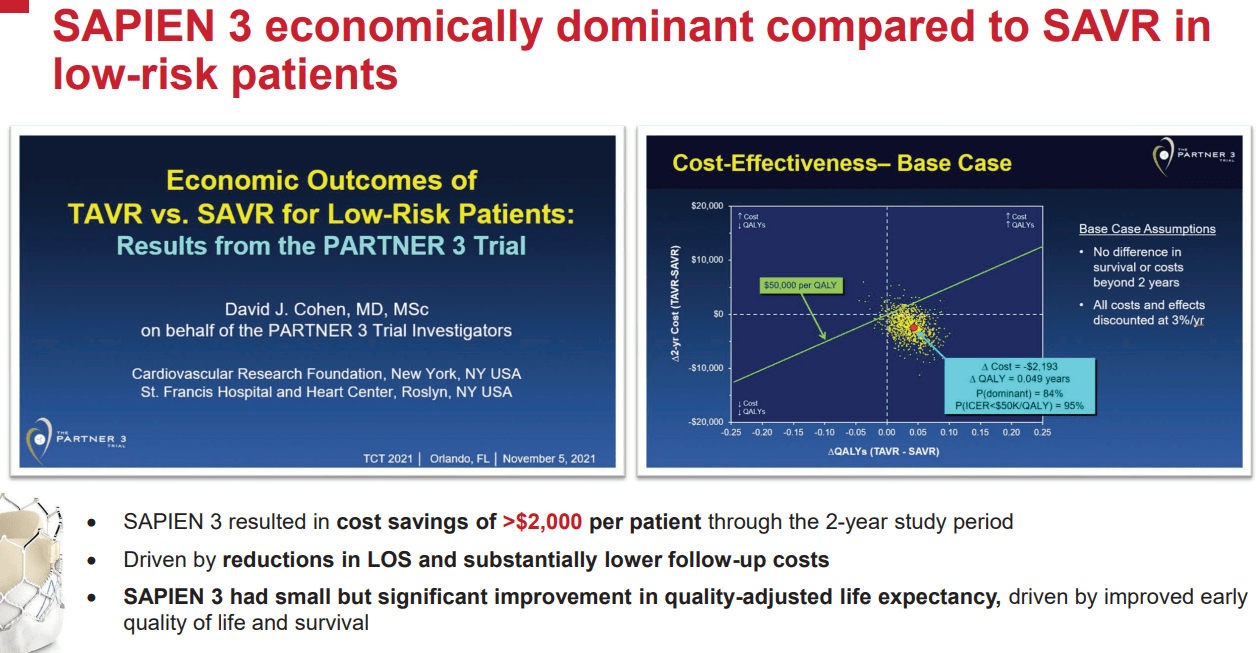

Edwards main growth driver over the past 10-20 years is their novel transcatheter aortic valve replacement (TAVR) which is the best in the market when compared to competitors from Boston Scientific (BSX), Abbott (ABT), Medtronic (MDT) and more. The slight advantage lies in the fact that EW TAVRs typically offer a safer profile due to their tech, especially for younger patients, and this is often a major consideration by physicians. EW currently has the largest market share of these devices, but there are plenty of competitors coming to market such as the Sept 2021 approval of Abbott’s product. However, I find that there is enough internal and external research that indicates EW superior safety profile that allows for the company to maintain their moat.

Many times, patients will come to us and they know the self-expanding valve has higher rates of [need for permanent] pacemaker and say, ‘I want the Edwards valve.’ Nowadays, patients are knowledgeable and the need for a pacemaker comes into the equation, certainly more so in the younger patients. Sometimes it does help us decide which valve to use (TCTMD Article).

Continued innovation is a pattern for the company which has been favorable to the financial foundation of the company. With negligible debt, diversification of revenue sources, and healthy profit margins, I find the investment is skewed significantly towards continued upside well into the future. Other considerations are the fact that growth was inhibited over the past year or so thanks to COVID and that the company has recently, or is about to, release multiple high growth products. As such, the company is a worthy member of TEA.

Continual TAVR optimization year after year. (Edwards)

Favorable price to efficacy profile. (Edwards)

Edwards

Growth and Profitability of Edwards (Seeking Alpha)

Align

Similarly to Edwards, Align is the pioneer and innovator of high quality orthodontic products, Invisalign to be particular. Invisalign has numerous moat like properties including an incredible first movers advantage, efficacy profile, and public image. Competitors such as SmileDirectClub (SDC) and ClearCorrect (OTCPK:SAUHY) offer a poorer investment vessel for invisible alignment technology when compared to Align. Considering that ALGN is also innovating new product lines including the tools and equipment necessary in the dental clinic, there remains significant value left in the company. While one may find an investment in Align to offer less ethical importance as orthodontics can be perceived as superficial as there are some potential periodontal health benefits to be considered.

Although, this investment offers the most consumer exposure out of the rest of the TEA names, and with expansion into the rest of the world well underway, offers an investment that grows with world wealth. This will allow Align to continue their upward revenue trajectory of 20%+ for the foreseeable future with high probability. While the stock has taken a hit as recessionary worries may inhibit growth, I find that long horizon investors who set recurring investments will end up quite satisfied with little stress over short horizon cyclicality. Market leading profitability and essentially no debt allows for incredible safety even if market outlook turns sour. If you would like another potential holding for the “A” position then there are plenty to choose such as AbbVie (ABBV) or Amgen (AMGN), both that would offer significant biotech and pharma exposure and safety at the expense of growth.

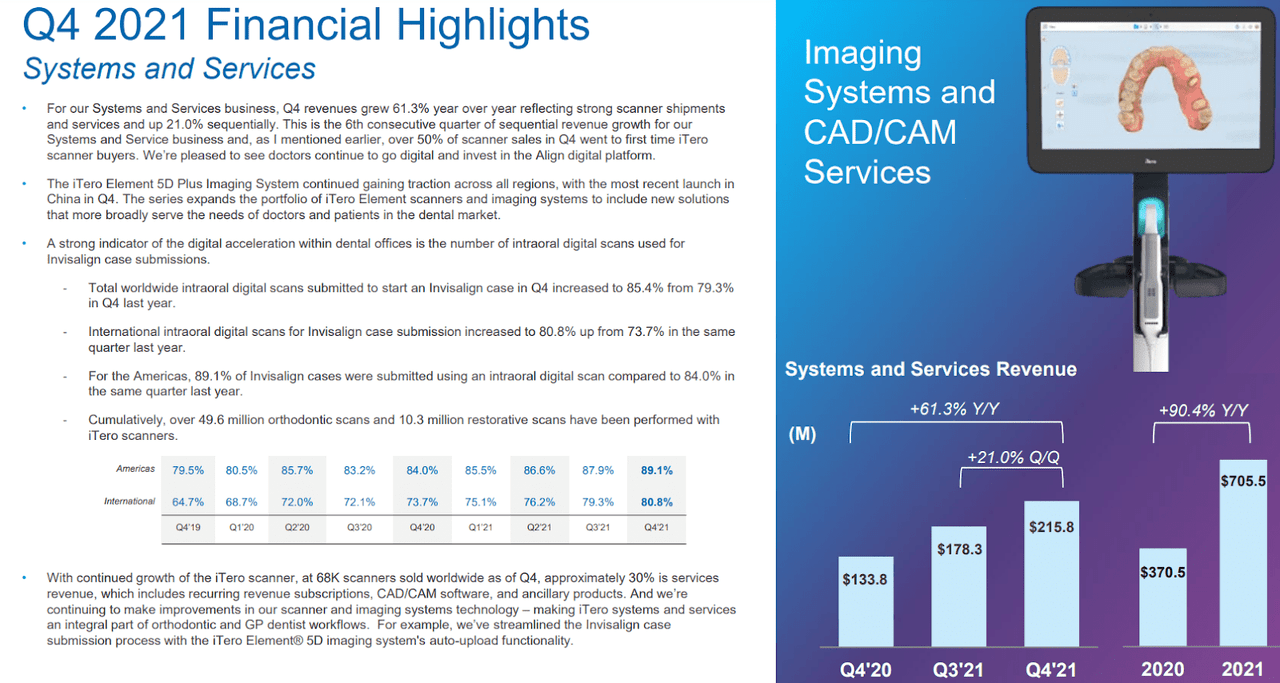

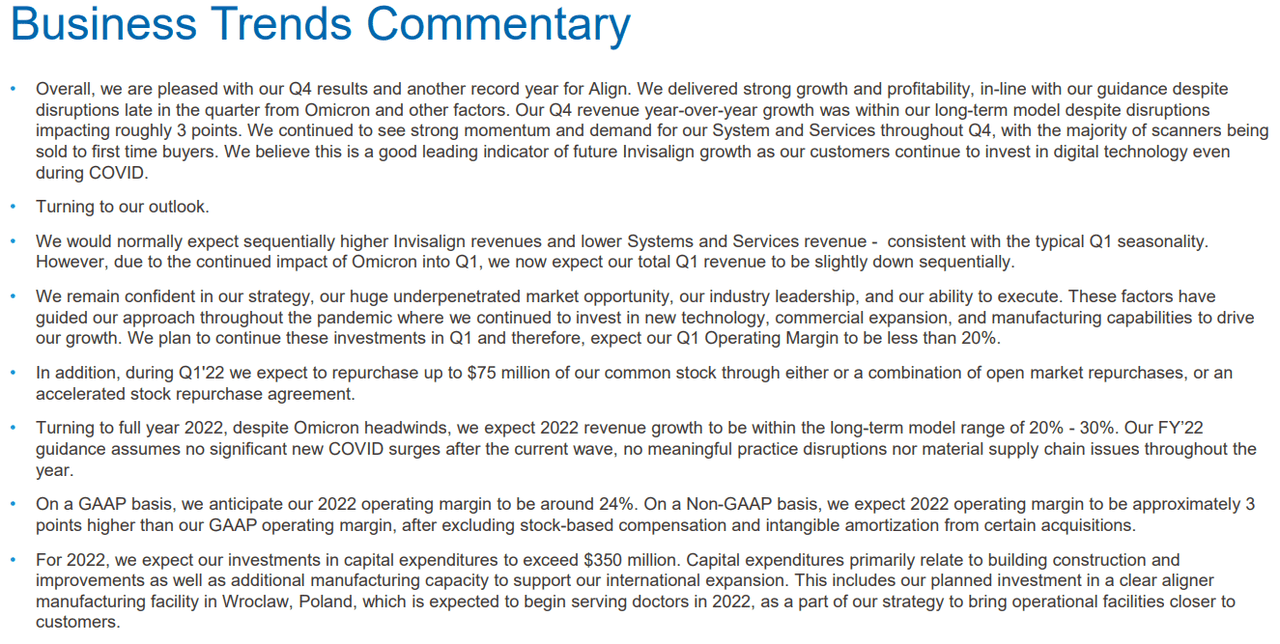

Align

Insights into business trends for Align (Align )

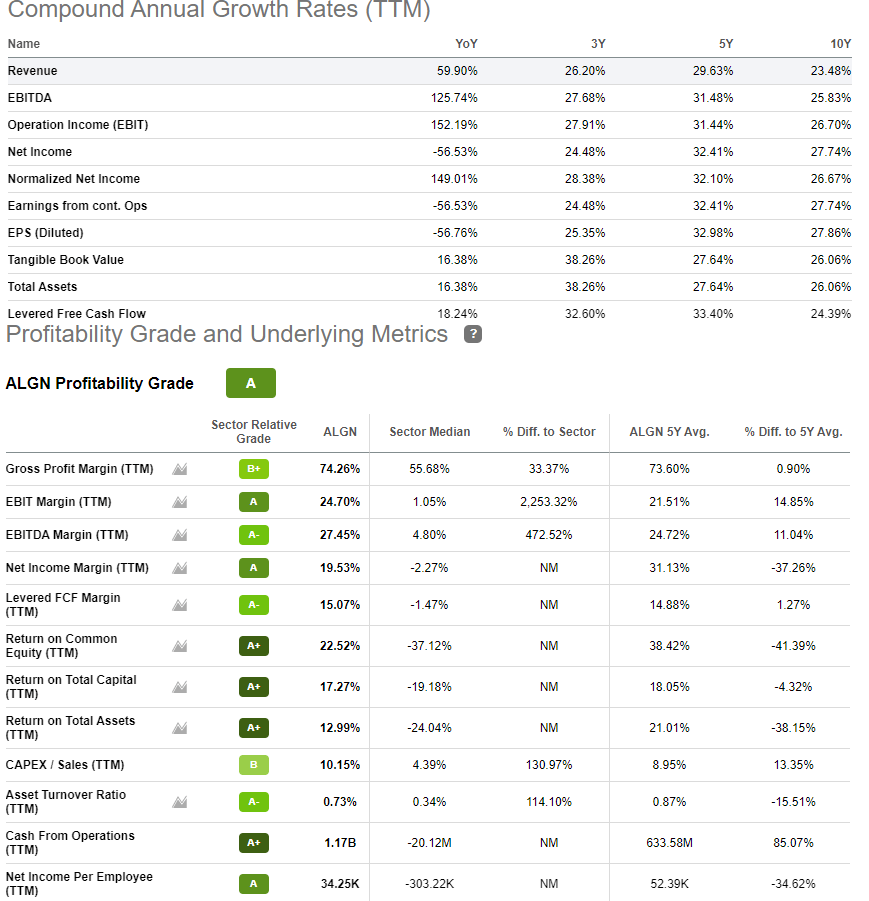

Growth and Profitability of Align (Seeking Alpha)

Conclusion

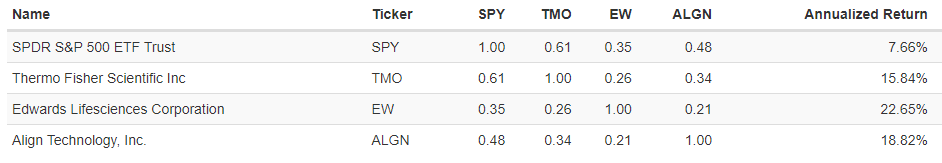

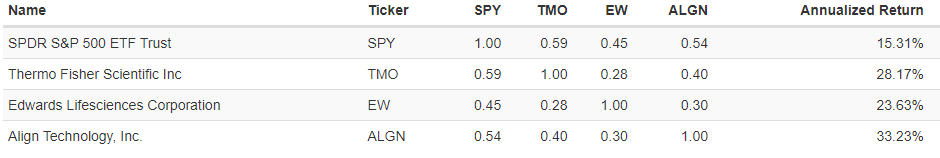

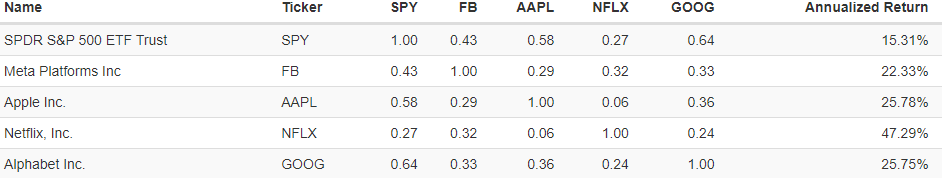

By following the TEA method, I find that investors will find significant outperformance in a manner similar to the FANG/FAANG ideology. I hope this quick summary of these names offers enough of an introduction to support consideration and further due diligence. I am sure many will think that valuation is an important factor to consider, and it is, but I often recommend recurring investments as a way to reduce valuation risk. Another consideration may be due to the correlation of the assets and whether they all offer similar returns. In this regard, I am happy to report that the names offer very little correlation to each other, and limited correlation to S&P 500 indices (SPY). TMO offers the most correlated return to the market, but this is mostly due to their large size and stability. EW and ALGN are far more volatile and fast growing, limiting correlations between themselves and the rest of the market.

Correlation Between TEA Stocks Since 2001 (Portfolio Visualizer)

Correlation Between TEA Stocks Past 10 Years (Portfolio Visualizer)

Correlation between FANG Stocks Past 10 Years (Portfolio Visualizer)

Looking back 20 years, and comparing that to a 10 year comparison to FANG offers unique insights into how different TEA are from each other (considering the significant rise and subsequent fall of NFLX). Anyways, I would like to use TEA as a way for more investors to enter into the healthcare industry and see healthy returns as a result. Let me know what you think about my acronym, and if you can come up with one or a few of your own!

Thanks for reading.

Be the first to comment