onurdongel

For those who follow us and read our articles periodically, it is no secret that we have been a buyer of energy equities over the last 6-9 months and utilized the options market to enter and exit positions. We like being able to predetermine when and where we would be buyers or sellers of certain names and, at times, manage cash flows in to and out of certain portfolios. While it does add a layer of complexity to portfolios, especially taxable accounts, we find it to be worth it over the long-run – especially when you can keep the portfolio’s overall ‘days-to-expiration’ low (as this usually allows one to avoid big discrepancies from where the equity position is either called from you or put to you and the stock price at that exercise date).

We utilize this strategy across portfolios, and today we had money coming in due to a call that occurred on one of our positions. We were a little overallocated to retail/apparel in this particular portfolio, and the stock had not gone much higher than the true cost of the transaction (option premium plus strike price), so we were not upset to see this call exercised against us. While we could have repurchased the call last week and worked it out on our own, we needed (and felt that we wanted to as well) to exit the position and build up some cash reserves and add to energy exposure.

So this morning we did a real money trade in one portfolio that involved Antero Resources (NYSE:AR), a name which we have been buyers of in the past.

So What Was The Trade?

This particular portfolio had a small inflow of cash from the previously mentioned call option being exercised again us. Our intention is to build up some cash in this portfolio, which is now currently margin free (which is a good place to be after the recent market run-up), but to also add some energy exposure which this portfolio is low on. With energy prices overall having come under pressure, we wanted to pick our spot carefully with where we would be placing these funds.

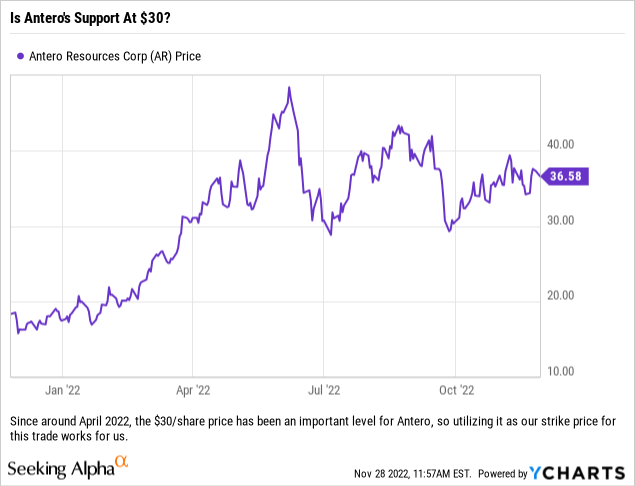

For reasons we will explain later, we are focused on adding exposure to Antero Resources around the $30/share level. The stock was trading at around $36.40/share this morning, so we could not currently purchase the stock at our desired level. This would qualify as a long-term holding if purchased, as we really do like what management is doing, so we decided to utilize the options market to write a put at a strike of $30/share. We initially focused on the January 20, 2023 puts, but those tightened up on us so we had to move out to the February 17, 2023 $30 puts. We were able to collect a premium of $1.65/share, or $165 per contract – which translates to a 5.50% yield on the cash we are tying up in this trade. This is an 81-day contract, so it is on the longer side, and Antero should report the day before this contract expires which could create additional volatility, but we do think that we have covered our downside with this trade.

Why Do We Like The Trade?

Well for starters, we do feel that we have covered a significant portion of our downside risk by utilizing the $30 strike price, which was about 17.60% below Antero’s stock price when we were able to execute the trade. The $1.65/share option premium also will reduce our cost basis (if the shares are assigned to us) to $28.35/share – meaning at the end of the day Antero’s stock price has to fall by more than 22.12% before we start to lose money on this trade. Yes, energy stocks can be volatile, but with winter months ahead, LNG demand remaining strong and over 20% downside protection, we like this trade – especially as it puts over 5% of our capital at risk back in our pocket to start.

Another reason we like this trade is that oil has come under pressure recently, and with China’s unrest and COVID outbreaks we do think that volatility could pick up (yes, there could be another leg downward, but it could also make a move back towards the $90/barrel area on reopening talk or speculation on an OPEC+ cut).

While oil seems to have some headwinds, natural gas seems like the friendlier place to be at this time, with further potential upside should we get some colder weather here in the US. We will point out that week-to-week data can be spotty sometimes (with weird, unexpected flows), but last week’s EIA Nat Gas Inventory data being down 80 bcf v the expected addition of 63 bcf was good news for the industry, and by extension Antero. Natural gas prices matter to Antero, not so much the oil, but we would point out that the swings in oil prices do dictate how some of the indices and ETFs trade, which does impact energy names in a general manner.

Oil prices have been under pressure lately, but Natural Gas prices have bene range-bound since early October. (Seeking Alpha)

Antero has had a lot of decent news lately as well. The company was added to the S&P MidCap 400 index, reported earnings which beat on revenues but missed on EPS, and increased its share buyback program by $1 billion to $2 billion. We think that these all create further tailwinds for us, which could also blunt any large move lower, especially if one reads the latest quarterly results conference call and believes that management can deliver on their 2023 guidance and capital allocation plans. The company is using 50% of their free cash flow to repurchase shares, and last quarter it resulted in $380 million worth of share repurchases with $400 million used to reduce debt. While that is good news, in the Q&A management basically said that while they previously looked to buy back the debt first and then repurchase shares, they are now comfortable to execute on share repurchases before retiring debt – meaning that one can put more faith in meeting the 50% CF target for share repurchases without any hiccups as that is a priority.

Closing Thoughts

While we would like to simply add exposure to Antero, right now the smart trade is to sit back and let the market come to us. A lot can happen between now and February, and while we have explained why we like the trade currently for a way to add exposure, we could also see investors using this as a way to generate yield if they do not think that Antero closes at, or below, the $30 strike price between now and February 17th. With the quality of this company’s management team, the balance sheet and share repurchases, there are a lot of reasons to like this trade from a downside management perspective, especially when looking at the strike price we utilized and the option premium generated.

For those who would argue that we laid out a bullish case for the stock which should lead us to the conclusion where we would outright purchase Antero shares, we would say that we cannot disagree. However, we are trying to add exposure in the face of what we expect to be a pullback in the market, so we do want to be smart about allocating capital right now.

Be the first to comment