Joe Raedle

Thesis – Don’t Buy Into The Noise

“All these noises and jumping up and down along the way are really just emotions that confuse you” – John Bogle

Carvana (NYSE:CVNA) surged during the past week after inflation numbers settled lower than anticipated, which followed a bullish argument from JPMorgan (JPM) as it dropped its bearish rating on the stock. Thus, it’s safe to say that Carvana’s traded price has been an event-driven vehicle of late.

If you’ve followed us for a while, you’d know that we’ve been relatively accurate with our Carvana ratings, achieving a 100% success rate. Our previous article called out Piper Sandler for its upgrade on the stock, proving to be successful as we locked in a profit of more than 65%.

Today’s article reiterates our strong sell outlook on the stock. Our analysis blocks out noise and relies on statistical inferences that combine macroeconomic and price action-related features to derive objective views.

Based on our judgement, Carvana remains a strong sell; here’s why.

Market-Based Activity

Carvana stock is what’s called a high-beta play on the market. This means its price action is highly sensitive to market cycles. Thus, you’d most likely always see wild price swings from the stock. Unless idiosyncratic risk plays a role, Carvana will almost always trade as a market-correlated high-beta play.

The data below shows the stock’s excess volatility with its Beta coefficient and standard deviation exceeding the broader stock market’s metrics (market beta, market standard deviation) by a substantial amount.

| Beta | 2.47 |

| Standard Deviation | 9.96 |

| Monthly VaR5% | 39.23% |

Source: Yahoo Finance; Macroaxis; YCharts

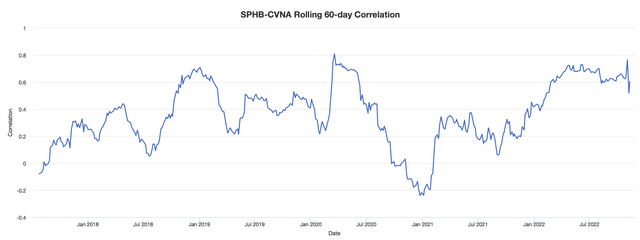

The chart below conveys Carvana’s growing correlation to the Invesco S&P 500 High Beta ETF (SPHB). The high beta ETF samples stocks from the S&P 500, and Carvana is known for trading as a “meme stock“; thus, you’d likely see an even higher correlation with small-cap high-beta assets.

CVNA Price Action (Portfolio Visualizer)

Understanding the market-based activity of stocks is fundamental to successful investing. You can analyze the commercial side of a stock’s underlying business all you want, but you first need to understand stock market segmentation and how each segment reacts to the bond market or investor psychology.

In our opinion, Carvana and most meme stocks spike during growth environments. Based on our anecdote, institutions and retail investors alike play the stock long whenever expansionary economic policy is anticipated, and they play the stock short whenever contractionary economic policy is expected.

Why does this happen?

Well, empirical evidence suggests that growth stocks outperform the broader market during early-stage bull markets and during economic expansions (or implied expansions). That’s because investors are willing to take on more risk whenever their future income certainty is in check (marginal utility theory).

The latest U.S. CPI report revealed lower-than-anticipated inflation, which indicates that less aggressive contractionary monetary policies might be in the offing. Thus, the broader market surged, and growth stocks (including Carvana) benefitted in particular.

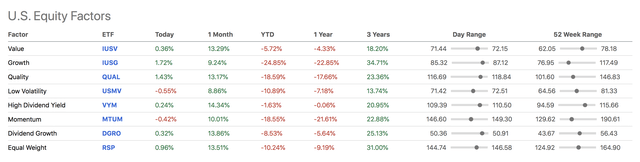

Stock Performance By Segment (Seeking Alpha) Carvana Price Action (Seeking Alpha)

We’ll get back to the macroeconomics of it all in the next section. However, based on our experience, the latest market surge and Carvana’s more than 50% 5-day gain is unjustified, we’ve seen plenty of wild price movements in the past, and this just doesn’t seem sustainable.

Fundamental Analysis

Macroeconomics

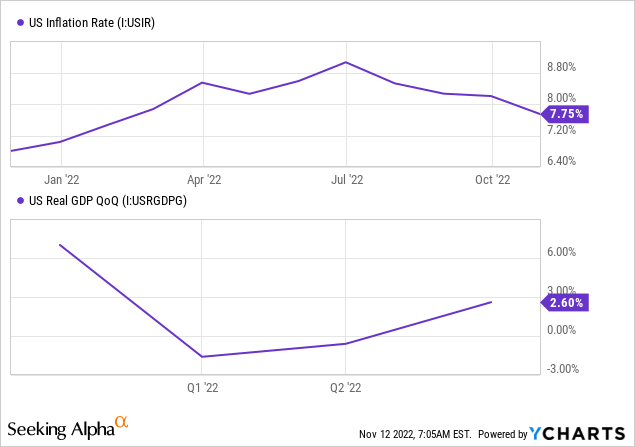

As previously mentioned, inflation settled lower than anticipated for October, only reaching a growth of 0.4%. Thus, the financial markets garnered a significant tailwind amid an implied slowdown in contractionary monetary policies.

We’re very confused about the market’s interpretation here. Firstly, inflation is still elevated beyond the normal realms of 2% to 3%, implying that there could a fair bit of contracting before expansionary policies are applied. Moreover, economic variables remain volatile, and inflation is seemingly unstable; thus, a slowdown in recent inflation doesn’t by any means imply a consistent bullish trend.

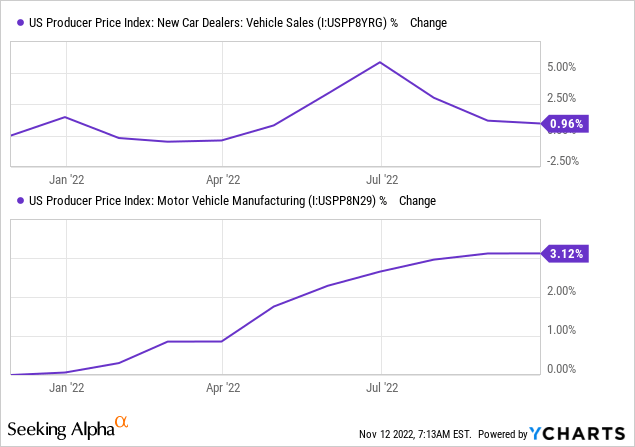

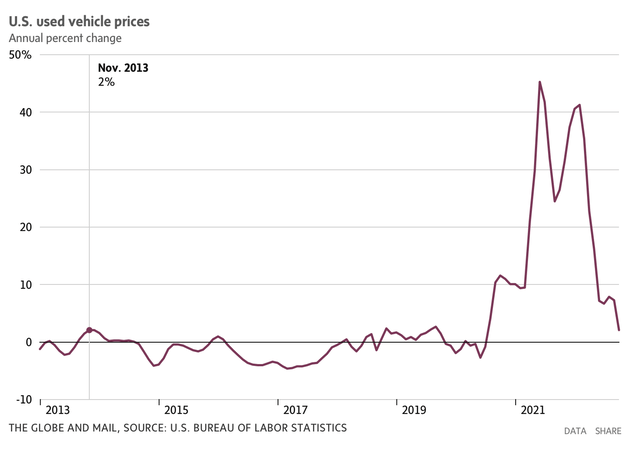

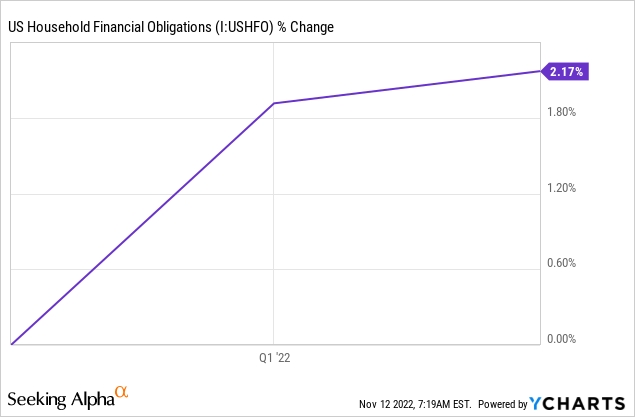

Furthermore, motor vehicle prices for new and second-hand vehicles are receding. It seems as though the market believes this could be a positive catalyst for consumers. However, we’d argue the contrary; it could be that receding vehicle prices are due to softening demand as interest rates remain high and household obligations have ticked up. Moreover, manufacturing costs remain resilient, and China’s consistent lockdowns mean supply-chain issues could persist.

Used Car Prices (The Globe and Mail)

Collectively, we can’t see many automotives rebounding for quite some time. Based on key metrics, it’s unlikely that auto sales will tick up anytime soon, nor will investors invest in cyclical stocks unless they’re “best-in-class”.

A counterargument would be that the stock market is often about perception and ignores the tangibles. Nevertheless, we don’t see investor and consumer participation rising in the coming quarters.

Operational Review

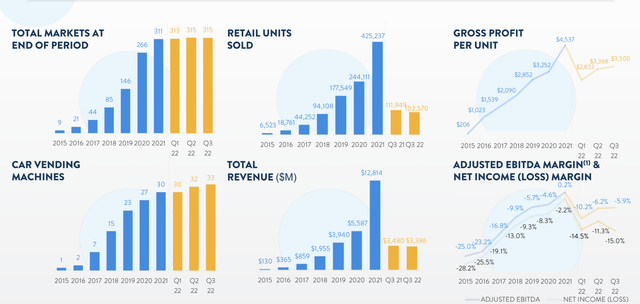

Carvana recently released its third-quarter earnings, unveiling a $300 million revenue target miss with a 2.6% decline in top-line sales. In addition, the company’s earnings-per-share is still in negative territory at -$2.67.

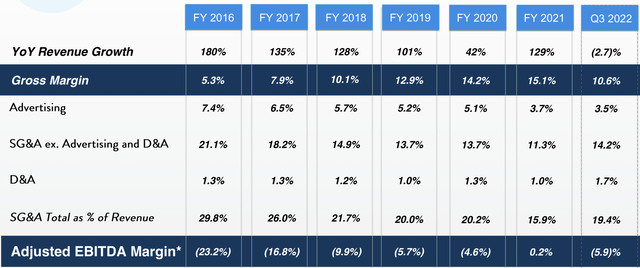

In its defense, Carvana is still an early-stage company, explaining its inconsistent growth. However, it doesn’t operate in an industry with high barriers to entry. Thus, the struggle for bottom-line profitability will likely persist for longer than investors initially anticipated. Moreover, cyclicality has clearly stunted the company’s progress as most of its key operating metrics are fading.

The company’s stalled gross margin isn’t a concern as it’s a uniform phenomenon among companies due to systemic inflation. However, tapering in sold units and stalling total revenue indicate slowing embedded growth.

Investor Presentation (Carvana)

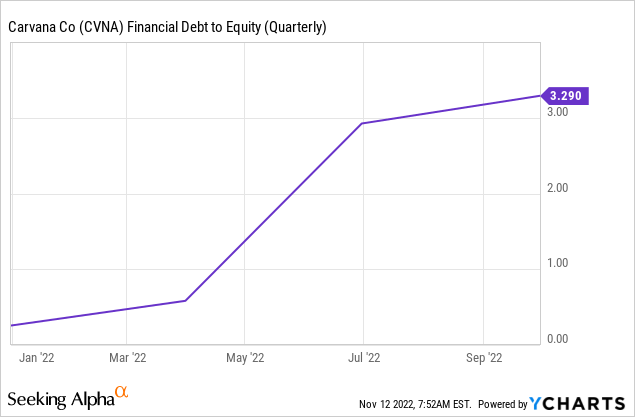

If the systemic risk is backed out, it has to be said that Carvana is actually scaling well. The company’s integrated business model is a big value-add in today’s market, where consumer-friendly platforms take preference among the general consumer. However, the company’s key systemic issues are within its capital structure. For example, its debt financing is expensive, with an effective interest rate of approximately 7.35%, which isn’t ideal in an environment where sales are receding. Therefore, it’s likely that we’ll experience much financial restructuring from this company (which is already leveraged by 3.29x), potentially harming its shareholders.

Investor Presentation (Carvana)

Relative Valuation

From a relative valuation vantage point, Carvana seems like a bargain as its pre-capital structure metrics like price-to-sales and EV/Sales are both likely in undervalued territory. However, these metrics shouldn’t be looked at in isolation, and a collective analysis is required to determine whether the stock is undervalued or not.

| Price-to-Sales | 0.08x |

| Enterprise Value/Sales | 0.59x |

Source: Seeking Alpha

Concluding Thoughts – Strong Sell Rating Reiterated

Macroeconomic analysis and market segmentation theory suggest that Carvana remains in poor shape. The company’s operational features have slowed, and its capital structure remains in a tizzy. Despite its more than 50% gain during the past week, we remain bearish on the stock and affirm our strong sell rating.

Be the first to comment