Nikola Stojadinovic/E+ via Getty Images

Carriage Services, Inc. (NYSE:CSV), a provider of funeral and cemetery services in the United States, has taken a big hit after the rising number of deaths associated with COVID-19 caused the company to outperform, eventually leading to an all-time high share price of a little over $66.00 per share on December 27, 2021, before sharply pulling back at the beginning of 2022, ending up at a 52-week low of $22.71.

With tough comps and uncertainties surrounding what the new normal is in a post-COVID world, the stock has remained rangebound since the latter part of October 2022, as the company and market look for clarity on what the sector growth will look like in the quarters ahead.

While management reinforced the idea that there was simply no way of knowing how to offer guidance in the quarters ahead at this time, it also noted that over the long haul the business is positioned to return value to its shareholders.

In this article we’ll look at some of its recent earnings numbers, how the company differentiates itself, and what the long-term prognosis for the company looks like.

Some of the numbers

Revenue in the third quarter was $87.5 million, down $7.5 million or 7.9 percent from $95.04 million in the third quarter of 2021. Revenue in the first nine months of 2022 was $276.3 million, slightly down from the $280 million in the first nine months of 2021.

EBITDA in the reporting period was $35.3 million, down $9.4 million or 21 percent from the EBITDA of $44.6 million in the third quarter of 2021.

Net income in the quarter was $5.8 million, or $0.38 per share, significantly down from the net income of $13 million, or $0.71 per share of the third quarter of 2021.

Free cash flow in the third quarter was $16.5 million, down over $9 million from the free cash flow of $25.9 million in the third quarter of 2021.

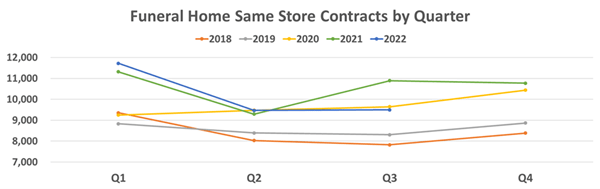

At first glance the quarter appears to be a disaster, but keep in mind this is in comparison to numbers while the pandemic was still raging, and when looking at the fourth quarter of 2021, the comps there are going to make the current performance of CSV look weak, even though it’s outperforming 2019 pre-COVID results.

Company Presentation

Another thing to take away from the earnings report is it points to the reason why management is holding back on guidance, and why investors are punishing or staying away from the company; there is simply no way of knowing when the market will provide visibility on what the new normal is going to be in a post-COVID world.

In all likelihood it’s probably going to come at the end of Q1 of 2023, but it could take another quarter before consistent results present themselves.

Business model and competitive advantage

The general business model of CSV is operating as a decentralized group of businesses while empowering managers to run the businesses in accordance with local needs and conditions.

The strength of that is quality managers are given more control of operations in alignment with the customer base, having the flexibility to respond to the changing local environment.

A challenge with the model is the company must keep tabs on performance across a growing number of businesses, providing different solutions while maintaining its decentralized business model.

As for its competitive advantage, CSV has a reputation that attracts independent owners to them when looking for solutions to their succession plans.

While that attracts businesses of various quality, it also in many cases brings the top companies as well, and with the strict measures in place to determine which companies will be a good fit for long-term performance, the company can acquire some great businesses that grow for many years.

Management compares itself to Berkshire Hathaway (BRK.A) (BRK.B) as a model to work from, in the sense of identifying companies with great value they can buy at a good price. While I understand why that comparison is made, I think a better comparison would be Canadian-based Constellation Software, which does business in the specialty software business.

The reason I suggest that is because Berkshire will buy or invest in quality companies across a number of sectors, while Constellation Software keeps within its area of expertise, as does CSV.

I bring that up to point out the way CSV is going to grow in the future; primarily via acquisitions and organic growth from those acquisitions because they’re part of a market that has a lot of growth ahead of it.

A major part of the criteria for acquisitions is they need to have significant market share in a growing area. With CSV being picky in that regard, it is setting it up for successful, long-term growth, even if at times it appears to be moving slowly.

Uncertainty and its share price movement

Since the share price of CSV plunged from about $32.00 per share starting in the latter part of October 2022, it has been trading rangebound, moving from a low of about $23.00 per share to a ceiling of approximately $26.00 per share.

With a company like CSV, it’s usually fairly easy to estimate near-term results because of easily available data on death rates and the percentage of people that choose cremation. But in a post-pandemic world that still has yet to go back to normal, the company can’t at this time confidently guide for what’s going to happen over the next couple of quarters, and even further out.

I think that’s why its share price has remained under pressure for a while.

The problem for investors is it’s impossible to know if the stock has found a bottom or if there’s more pain to come before the sector has more clarity.

For that reason, taking a new position now could result in an investor being underwater for a period of time, as the share price could easily drop in half from where it’s trading today if the numbers continue to fall as they have been; that’s especially true when comps are more favorable to measure the company’s current performance against its past performance.

Position sizing and dollar-cost averaging are a must in my opinion in order to have an acceptable cost basis in the company in preparation for its inevitable rebound.

Conclusion

CSV is a quality company operating in a sector that is going to continue to grow for many years, and once it discovers where the new normal is investors get more clarity on that, it’s going to give a better look into what a good entry point is.

Until then, it’s going to be hit and miss for the company in regard to its short-term performance. My thought is it’s going to take at least a couple of quarters before there is enough visibility to have confidence in what the new normal will be in the sector.

Longer term, I believe, because of the company’s business model and competitive advantage concerning independent owners, in many cases, approaching them first to sell their companies, it gives them the first look at quality companies it can acquire and add to their long-term growth.

With that in mind, I consider CSV a solid company to hold over the long term, with the caveat it’s hard to identify in the short term what a good entry point is.

Nonetheless, with its share price dropping so much, even now would probably be a good entry point, considering if it takes longer to discover the new normal, there’s a chance it could fall much further before it finds a bottom.

For long-term investors, this shouldn’t matter too much, but it is a psychological factor to take into account if considering taking a position in CSV.

Be the first to comment