OntheRunPhoto

It’s been a painful year for Carnival Corporation & plc (NYSE:CCL) with shares down more than 50%. Compared to some optimism last year that the cruise giant was set to sail away from pandemic disruptions, the latest storm is the threat of a looming recession, sending the stock back to near its Covid crash low. The story has been the impact of record fuel prices hitting margins, pushing back further any timetable for a return to sustainable profitability. A high debt position has also weighed on sentiment.

That being said, we like the stock heading into this week’s Q3 earnings. With expectations particularly low, there are a couple of reasons Carnival can deliver a strong report that sends shares higher.

- First, this quarter represented the peak of the summer cruise season which by all indications was exceptionally strong, capturing pent-up demand for leisure and entertainment. It’s also notable that this year did not feature any major gulf or Caribbean hurricanes during the summer months that historically lead to cancellations and earnings variability.

- We’ll highlight how falling energy prices during the quarter may likely provide some relief against the more significant cost headwinds in Q2.

- Finally, we also believe the booking trends remain strong despite the challenging macro environment. Pricing initiatives along with the impact of new ship launches may have added a boost to financial momentum.

CCL Q3 Earnings Preview

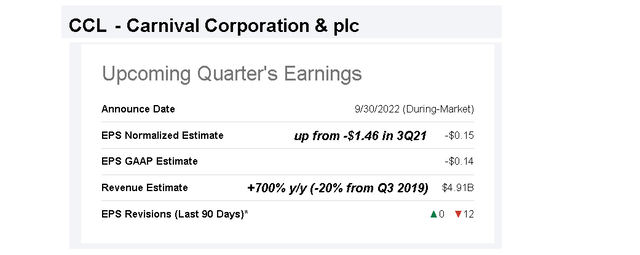

CCL is scheduled to report its Q3 earnings this Friday, September 30th. The consensus estimate for revenue at $4.9 billion represents an increase of 800% from Q3 2021 in the context of the period last year defined by the early post-pandemic startup with significant capacity constraints.

For reference, even with more improving operating trends this year, Covid restrictions have still been in place, which explains some of the spread compared to peak sales in Q3 2019 of $6.1 billion as a pre-pandemic benchmark. In other words, the theme with Carnival and other cruise lines is still an ongoing recovery with more gradual normalization compared to other industries.

The result has been depressed financials, with large losses in the recent quarter. This is expected to continue with the upcoming Q3 result as the forecast is looking for a loss of -$0.15. Again, an improvement compared to -$1.46 in Q3 2021 but still far off from positive earnings of $2.54 in Q3 2019.

The other important theme here for the company has been its increasing debt load, along with stock issuances utilized over the past year to support operations coming out of the pandemic. The company ended Q2 with $36 billion in total debt, a level nearly 3x more than the $11.5 billion at the end of fiscal 19. In July, Carnival issued $1 billion in stock at an offering price of $9.95 which further explains some of the weakness in the stock over the period.

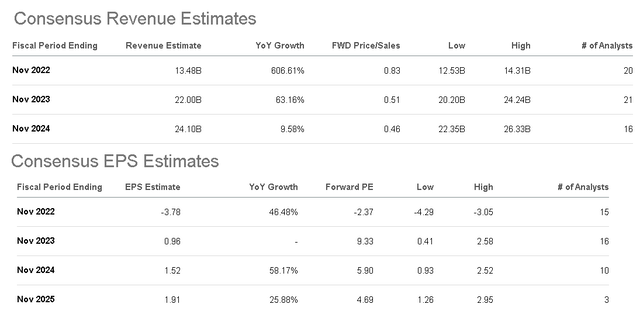

While Carnival’s balance sheet is indeed a weakness in the company’s investment profile, the understanding is that the debt level is manageable, at least with an outlook for more sustainable profitability going forward. According to consensus estimates, the forecast is that next year benefits from a full year of more normalized operations.

The market revenue of $13.5 billion this year climbed to $22 billion for fiscal 2023, which would be a new company top-line record. The market also expected earnings to turn positive in 2023 with EPS of $0.96 reversing the loss of -$3.78 expected for the full year 2022 result. We see room for Carnival to outperform through higher margins.

CCL Stock Price Forecast

As mentioned, the setup heading into this Q3 earnings report is deep pessimism against the difficult economic conditions. The combination of stubbornly high inflation and climbing interest rates means that consumers are getting pressured, which could translate into a slowdown of demand for cruises, hitting Carnival’s operating outlook.

As it relates to the stock, the question is how much of these factors have already been priced in, considering shares are already off nearly 20% from their September high of $11.19 just a few weeks ago.

The good news is that all the real-time updates from the cruise industry have been positive. During the last Q2 earnings conference call, CCL management noted occupancy rates have been climbing sequentially by month all year, with bookings into 2023 at the higher end of historical ranges.

The other important development in recent weeks is the news that Carnival is ending pre-cruise Covid testing requirements. For anyone potential customer that was avoiding booking a trip based on inconvenient restrictions, the “back to normal” protocols also remove a layer of extra expenses at the operating level. These are industry-wide trends, with a sense that cruises are in high demand given their relative affordability compared to other travel alternatives.

It’s worth noting that with the launch of the cruise line’s newest flagship “Mardi Gras” and the upcoming “Celebration” vessels, Carnival system capacity across all brands is on track to be 8% higher by next year compared to 2019. What’s interesting about these two ships as it relates to Carnival’s long-term outlook is that they represent a strategic shift toward a more premium product that is expected to support margins higher, with the impact possibly already having an effect in this upcoming Q3 earnings report.

We’re bullish on the stock and believe lower fuel costs during the quarter will be a big story when Carnival reports on Friday. In Q2, Carnival noted that its fuel cost at $545 million, representing nearly 20% of total expenses, was exceptionally high compared to an average of 12% in 2019. Favorably, the trend since July has been a sharp correction in energy prices including oil, and to a lesser extent diesel.

By this measure, the fuel cost trends have evolved better than expected, which should be positive for cash flow and margins this quarter. We’ll also look for other strong performance metrics like passenger cruise days and capacity levels.

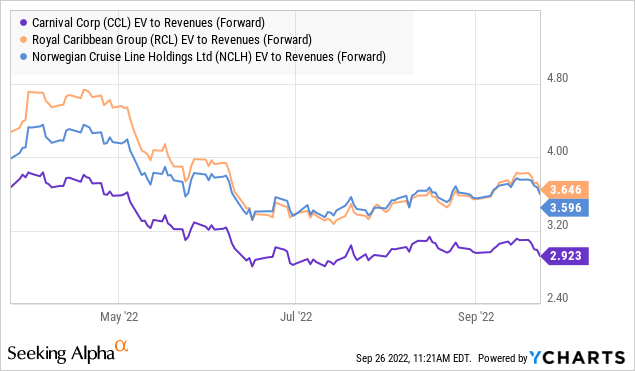

Compared to other cruise line stocks, like Royal Caribbean Cruises Ltd. (RCL) and Norwegian Cruise Line Holdings Ltd. (NCLH); CCL trades at a discount to the group in terms of its sales multiple, given its larger debt load and historically lower margins. CCL’s EV to forward revenue multiple at 2.9x is about 20% lower than RCL and NCLH, both closer to 3.6x. While some of that spread is warranted, we see room for CCL to converge higher as a bigger long-term turnaround story. While all cruise line stocks likely have an upside in a scenario where the operating conditions improve going forward, we make the case that CCL can outperform in percentage terms amid lower expectations.

Final Thoughts

We rate CCL as a buy into the Q3 earnings report. Beyond the headline numbers, we want to see management offer an upbeat take on the forward outlook in terms of trends in bookings and pricing efforts. The potential that guidance comes in strong and optimistic, brushing aside fears of a deteriorating economic environment, could be enough to lift shares higher as a catalyst for a more sustained rally.

As it relates to risks, the stock remains highly speculative amid negative free cash flow and otherwise challenged fundamentals. A deteriorating macro outlook beyond the baseline, further pressuring operating and financial trends, can open the door for a leg lower in the stock.

Be the first to comment