Debbie Ann Powell/iStock Editorial via Getty Images

Despite some long-term bullish financial projections by a peer, Carnival Corp. (NYSE:CCL) still trades below $9. The cruise line stock is priced for a dire outcome while knowing the financial view is far more positive going forward. My investment thesis remains ultra Bullish on the cruise line stock with covid in the rear view mirror.

Limited Bulls

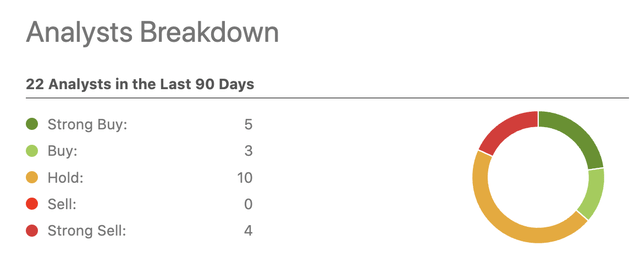

Whether talking Seeking Alpha contributors or Wall St. analysts, a lot of analysts aren’t bullish on Carnival. The average Wall St. analyst has a Hold rating on the stock.

The odd part of only 8 Buy ratings out of 22 analyst calls is that the average price target is still above $12. The average upside on these calls are 37%. Any move above 20% would typically warrant a Buy.

SA contributors are generally more Bearish. Only 1 article since the start of October is Bullish on Carnival with 4 Sell ratings. Not one of the 8 calls is a Strong Buy.

Business About To Top Normal

Royal Caribbean just outlined goals to top the ROIC peak from 2019 with a plan of achieving a $10+ EPS by 2025. The market basically ignored these goals as aggressive in a sign reality hasn’t returned to the sector following the covid destruction.

The airline and hotel stocks have already generated record revenues this year. These travel sectors weren’t restricted by covid vaccination and testing protocols like the cruise lines.

The cruise line sector began removing restrictions in August with most restrictions gone outside of some regions such as China. The sector has provided strong indications 2023 bookings are now easily matching 2019 levels at record prices.

Analysts now forecast Carnival to produce a record $21.4 billion in 2023 revenues with a further jump to $23.7 billion in 2024. The cruise line only had $20.8 billion in revenue back in 2019.

The disconnect should be clear here with Carnival forecasted to report record revenues, but the market can’t get excited about the stock below $9. Even Royal Caribbean forecasting a record EPS topping $10 can’t get analysts to increase 2025 EPS estimates above $8.

These conservative analysts have Carnival earning $1.30 per share in 2023 and boosting this amount to $1.62 in 2024. The stock isn’t accurately valued for a company earning this level of profits again, especially knowing the numbers are conservative.

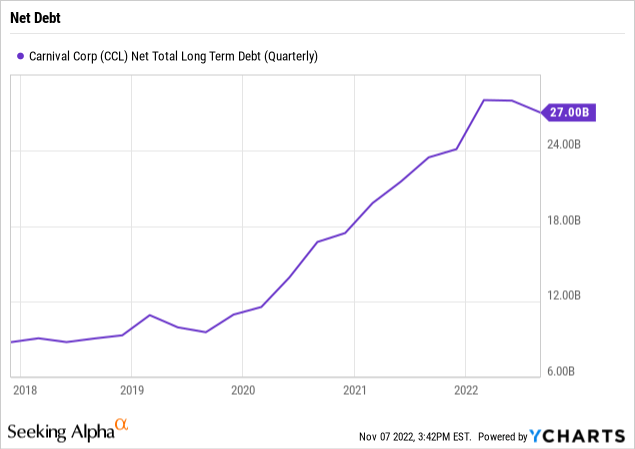

Carnival is definitely in a more precarious position with net debt up at $27 billion versus the 2019 level of ~$11 billion. The cruise line is paying $1.6 billion in interest expense now compared to annual levels below $200 million back in 2019.

These higher debt levels will impact earnings longer, but Carnival has an ability to generate boost to profits by cutting debt levels. The cruise line just raised $2 billion in debt at a 10.375% rate highlighting the need to eliminate covid restrictions and get back to full operations. Royal Caribbean provided all of the necessary details to support this very scenario.

Carnival has 1.2 billion shares outstanding now, but investors need to quit looking at the comparison to 2019. The higher share count shouldn’t contribute to any dire financial view. What Carnival had to do in order to survive covid is just a statistical number now. The profits will just be split amongst more outstanding shares. The higher debt is the only major concern and provide an opportunity to lower interest expenses with strong cash flows going forward.

Also, the market gets the inflationary picture wrong as well. The cruise line definitely has a lofty expense from fuel costs, but the cruise line only spends ~15% of revenues on fuel expenses and headed back downs towards 10% as fuel costs falls. The FQ3’22 fuel costs were $670 million and food costs were just $259 million while revenues were $4.3 billion and headed much higher.

All of the additional costs for employee wages and such are being absorbed via the record bookings. The cruise lines themselves haven’t generally highlighted the level of record bookings in comparison to 2019 as the difference between 10% and 30% would be massive, but some analysts have already given indications the industry booking levels are running at 30% above 2019 levels.

Carnival already listed customer deposits at $4.4 billion to end the August quarter, down slightly from the $4.7 billion levels from 2019. Investors should expect the cruise line to report record numbers when reporting year-end numbers.

As long forecasted, Carnival has the share impact for the $4.40 EPS levels of 2019 to end up with a $2 to $3 path going forward. The company has plans to expand capacity beyond 2019 levels leading to the comparisons to 2019 needing to be adjusted to a $5+ EPS stream now. In such a scenario, Carnival would generate a $2+ EPS with the current elevated interest expense and $3+ once those are normalized.

Takeaway

The key investor takeaway is that a lot of the bears on Carnival are still following the 2021 story not realizing the sector has seen a dramatic shift. The business is now set to recover to record levels, yet the market is generally very bearish on the stock. Investors should use this irrational pessimism to load on the stock.

Be the first to comment