Anton Skripachev/iStock via Getty Images

CarGurus (NASDAQ:CARG) has a mission to be the sole platform where automobile dealers can source, market, and sell autos and at the same time consumers can shop, finance, buy and sell. There is a lot of competition in the car space. There is also a lot going against the industry right now. CarGurus is one of the most visited car sites in America. Their online platform for buying and selling vehicles has many thousands of listings in their marketplace. The company has invested heavily in its technologies and offers digital retail solutions and the so-called ‘CarOffer’ online wholesale platform. The online market places allows people to purchase or sell a vehicle either online or in-person, and it gives car dealerships a platform to let them competitively price sales as well as acquire and sell vehicles in the U.S. All of this relies on A.I. and data analytics (e.g. algorithms) to improve the car buying experience, and maximize profits of its business/dealership customers. We like the operations, but the stock has been crushed. We think the economy gets worse before it gets better and this will definitely impact performance of this quality company. However, the market has priced a lot of this in, and we think you can start to buy on continued weakness. Let us discuss.

The macro backdrop is challenging of course

Make no mistake, inflation in general is hurting consumers’ budgets. Auto dealers are struggling with inventory, and the costs of manufacturers to produce vehicles has been elevated, meaning it costs more for dealers to acquire inventory. But car buying demand is in some trouble over the next few quarters in our opinion. This is the result of the Federal Reserve’s unrelenting battle to rein in inflation. The Fed is raising rates to slow the economy, with the goal of price stability. It is not easy on businesses that rely on consumers needing financing, and largely, the auto industry is one of them, both on the business end and on consumers. For the latter, a much higher monthly payment on any financed debt is a result of the rate hikes, and it is no surprise as to why sales of cars would be slowing. We are in a recession, in our opinion and according to GDP. The rate hikes are just taking effect, but we suspect CarGurus will start to feel this pressure when the company reports earnings next month. But if you look at the stock, a lot of this has been priced in and valuation has been drastically reduced.

Valuation looking attractive

The valuation of the stock has been crushed. Just crushed. Shareholders have been obliterated in the last few months. With it, the valuation of the name has improved, even if performance starts to slow as we come into the end of 2022. We do expect slowing and the market has walked this stock back. But the valuation is actually looking pretty attractive all things considered.

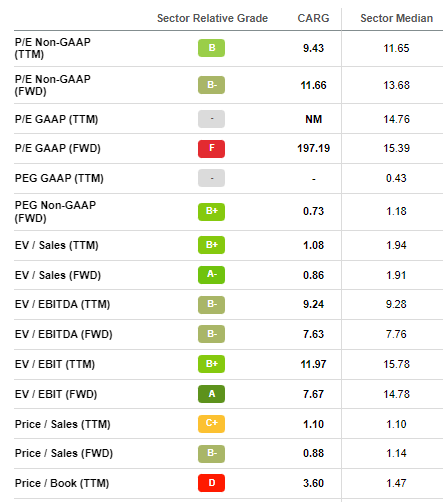

Seeking Alpha CARG valuation page

So the overall grade is about average valuation, but factoring in say a 15% decline in earnings, we are still trading at 12-13X FWD EPS, the cheapest the stock has been in some time. We love the enterprise value to sales, EBITDA, and EBIT values. The price to sales is also attractive.

Now, valuation has come down as expectations are dwindling, but folks, we are at all time lows here this month. And yet, there is still strong performance even in the summer when things started getting worse. We believe you see a decline in growth rate, but that the stock starts to recover with the market at the end of the year.

A lot of bad news is priced in.

Performance was strong, but started showing weakness

The thing is when Q2 was reported, the company beat on the top and bottom lines. Total revenue was $511.2 million, an increase of 135% compared to $217.7 million vs Q2 2021. That is huge growth and beat consensus by $4 million. So what went into this revenue figure? Well, the consumer Marketplace revenue was perhaps the weakest at $163.9 million, an increase of just 2% compared to $160.5 million in Q2 2021, reflecting a weakened consumer. However, wholesale revenue was $75.9 million, an increase of 42% compared to $53.5 million a year ago. The so-called product revenue was $271.4 million, rocketing higher from $4 million a year ago.

There was some mixed performance in operational metrics however. First, total paying dealers were 31,143 to end Q2, rising just 1% from a year ago. We would like to see the company do better here. International paying dealers actually fell to 6,655 from 6,777. That was a negative. But the quarterly average revenue per dealer in the U.S. rose to $5,771 versus $5,550 a year ago, and rose in international markets, despite the number of dealers falling. The revenue per international dealer was $1,533 versus $1,491 last year.

Making matters worse, website traffic was down across the board, suggesting heavily that consumers just are not in the market for a car as much as they were. This, we believe, is a direct impact of the high cost of cars right now, along with rising rates. U.S. average monthly unique users were 29.5 million, down 10% from last year. International average monthly unique users were 6.6 million, dropping 15%. This is a big reason the consumer revenue in marketplace was up just 2%.

Now despite higher revenues, expenses surged. This led to operating income falling 16% on an adjusted basis to $57.7 million, vs. $68.9 million last year. Ouch. Adjusted EBITDA, a non-GAAP metric, was $61.2 million compared to $71.2 million. Om the overall bottom line, adjusted income net income was $38.0 million, or $0.32 per share, down from $0.39 last year. This drop was of course expected by analysts and in management forecasts, and earnings beat by $0.01.

Looking ahead

Folks, while Q2 showed beats, the fact is that performance was slowing. This trend follows what we saw from other companies that have reported which operate in this space. This is why the market continues to push this lower, now a few cents above all-time lows. Perhaps the biggest issue was the decline in traffic. The company reduced its forecast for Q3, and the market has priced in much worse here. Oddly, despite walking into a recession, the company continues to be profitable. Cars are not going anywhere. People need and want to drive. Financing is just a problem, as is inflation causing car prices to rise. We think prices start to normalize. Once the recessionary impacts are complete next year, the stock will rally hard. The market will start pricing the stock higher well before this happens, and could happen into year end. The company expects revenue of $460 million to $490 million, and we see this coming toward the lower end for Q3. Adjusted EPS looks to be of $0.25 to $0.28, and we think that even at the low end of $0.25, the stock is still valued attractively. If annual EPS comes in at even just above $1.00, we are just 13X FWD EPS. We think this level of earnings could persist for a few quarters, but shares have priced in disaster here. We think it gets intriguing and would consider being buyers on the next big pullback.

Be the first to comment