GBP/USD – Prices, Charts, and Analysis

- UK economy contracts, is a recession already here?

- BoE – Will they end gilt buying on Friday?

Recommended by Nick Cawley

Get Your Free GBP Forecast

UK GDP contracted in August this year, missing market expectations and sparking fears that the economy is nearing, or has entered, a recession. In addition, industrial and manufacturing data for August missed expectations by a wide margin and paints a bleak picture of the UK economy at the present. This latest economic data will make the UK government’s job of slowing down rampant inflation via out-sized rate hikes even more difficult.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

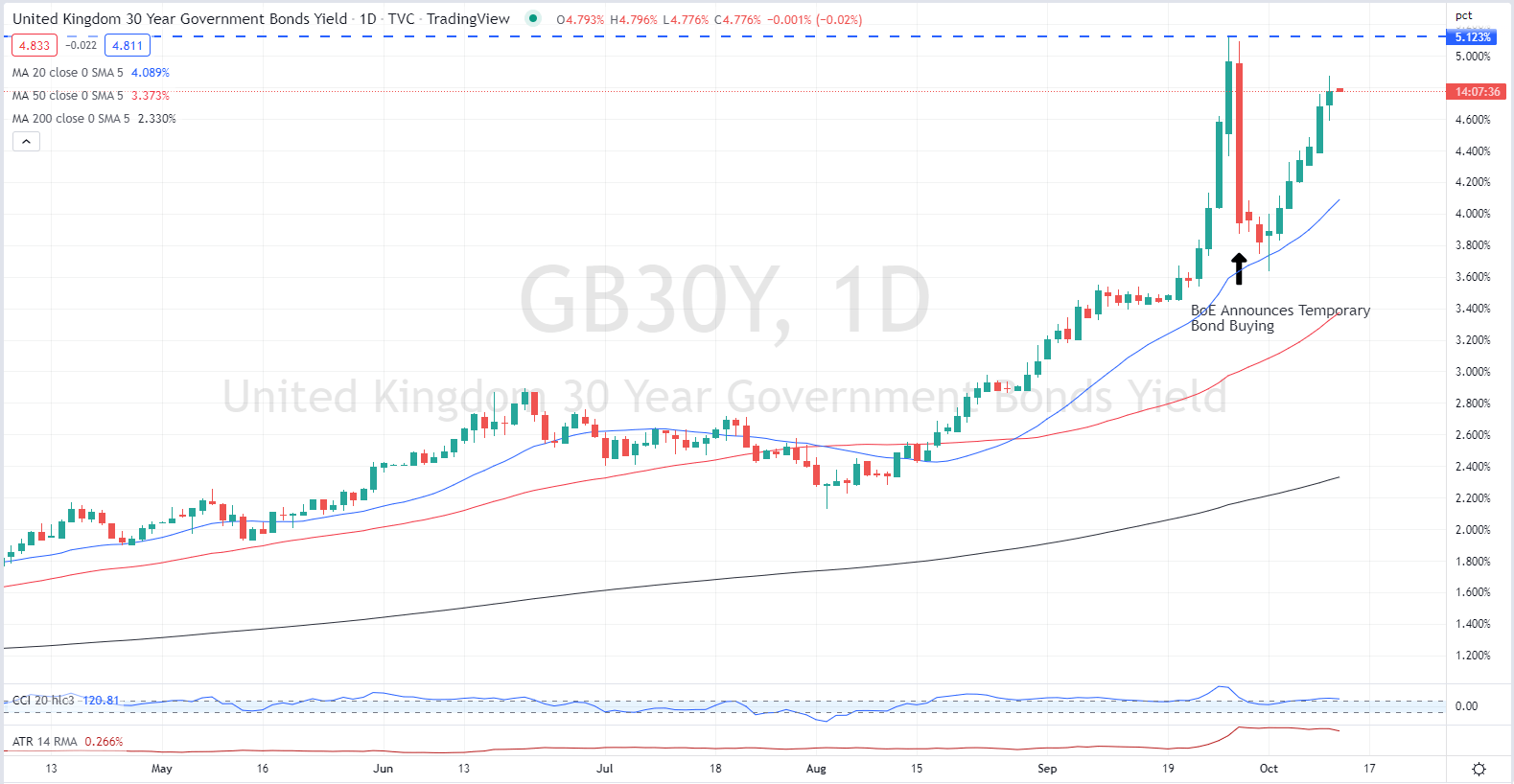

Sterling slipped lower against a range of currencies but the main story for the British Pound currently lies elsewhere. Late Tuesday, BoE governor Andrew Bailey warned that the temporary gilt-buying program would end on Friday as originally announced and suggested those that wanted to use this facility should saying ‘You’ve got three days left now and you’ve got to sort it out’. However, the latest market noise is that the BoE may well extend this program if needed, leaving the market once again wondering what is going on. This mooted flexibility may well be needed as aggressive traders are in their element when central banks set a timetable or a target. The delayed UK quantitative tightening program – bond selling – is likely to be put back further until the gilt market finds an area of equilibrium. The 30-year UK gilt currently trades with a yield of 4.82%.

UK 30-Year Gilt Yield October 12, 2022

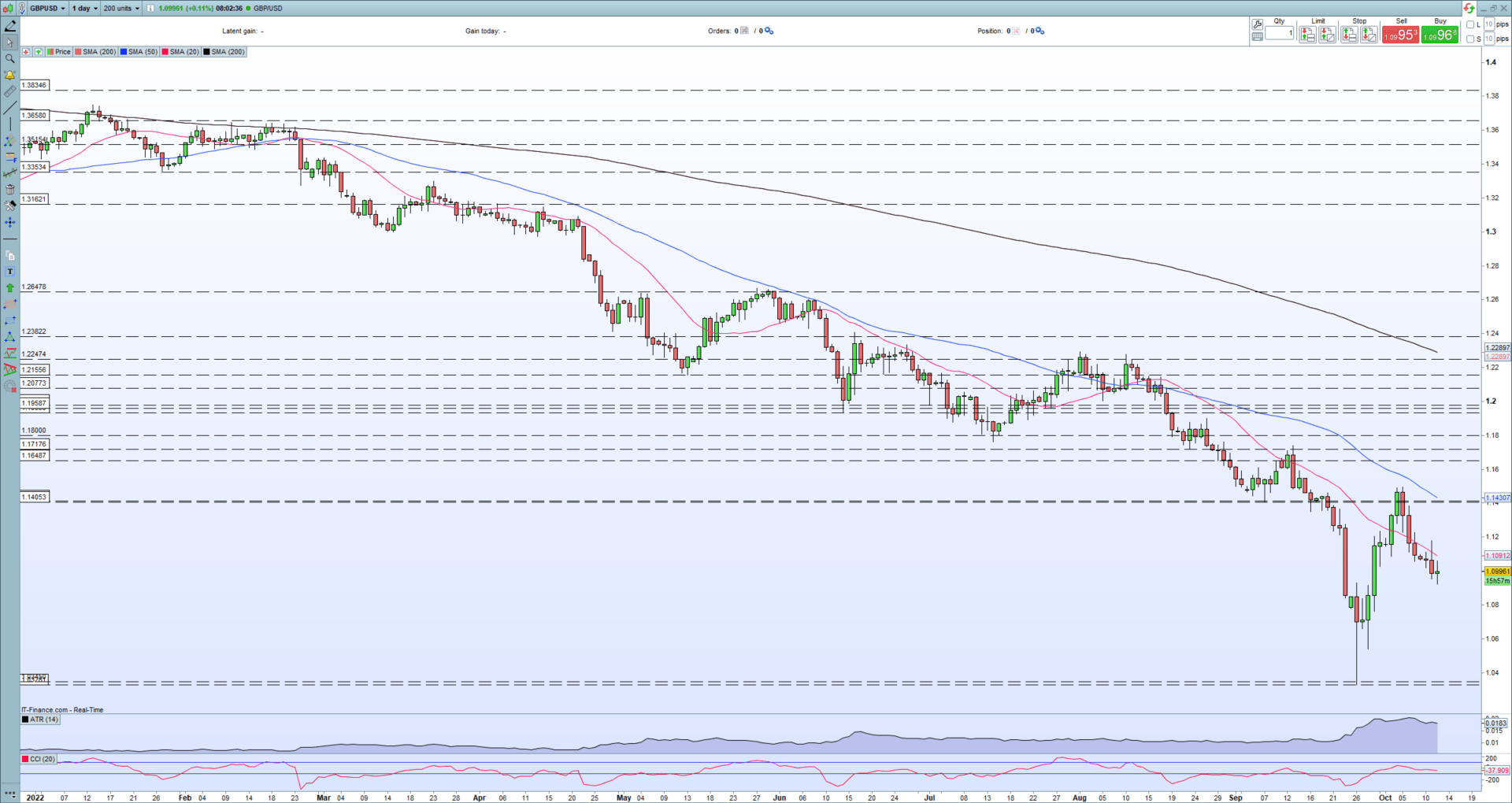

Cable is trading on either side of 1.1000 post-UK GDP release and is searching for a reason to make the next move. There are three Bank of England members speaking today, Jonathan Haskell at 09:00, Huw Pill at 12:35, and Catherine Mann at 18:00 – all times in BST – and their comments will need to be followed closely. There is also the latest look at US producer price inflation at 13:30, ahead of Thursday’s eagerly awaited US consumer price readings. The daily GBP/USD remains weak and volatile.

GBP/USD Daily Price Chart – October 12, 2022

Retail trader data show that 55.38% of traders are net-long with the ratio of traders long to short at 1.24 to 1.The number of traders net-long is 2.65% lower than yesterday and 17.80% higher from last week, while the number of traders net-short is 5.87% higher than yesterday and 7.84% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 0% | -3% |

| Weekly | 13% | -13% | 0% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment