AlbertPego/iStock via Getty Images

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are regulated by the Federal Housing Finance Agency (FHFA) who also serves as their conservator. Sandra Thompson was sworn in last week as Director of FHFA. She has been serving as an acting director since June 23. In that time, she has finalized modifications to the enterprise regulatory capital framework. Since being confirmed in May, she also finalized a rule requiring Fannie and Freddie to submit annual capital plans.

Investment Thesis

Fannie and Freddie currently are in conservatorship, retaining earnings since 2019. The government has $168B of liquidation preference in Fannie and $104B in Freddie Mac senior preferred stock, as well as 79% warrant coverage on both companies with basically a $0 exercise price. Given the Supreme Court ruling in Collin v. Yellen, I think the possibility of conversion of the liquidation preference makes common uninvestable, as there is no security in that share class in that outcome. Junior Preferred stock, however, continues to have strong legal challenges defending their share class rights, and it would take a vote for them to change their terms or convert into something else. Preferred stock currently trades at 10-15 cents on the dollar, and they need to be dealt with if Sandra Thompson’s Capital Planning Rule is to have any significance.

Will Sandra Thompson Testify This Next Week?

Patrick McHenry and French Hill wrote a letter to Maxine Waters asking to invite Sandra Thompson to testify on June 29th at their Housing Market committee hearing:

It is inconceivable to us that our Committee would have a conversation about the long-term impacts of the housing market without first hearing the Director’s plans to strengthen the safety and soundness of the GSEs in these turbulent times.

Patrick and French are both concerned about Fannie and Freddie being adequately capitalized ASAP:

Make no mistake that higher mortgage rates combined with sinking household incomes will place a significant strain on our housing markets. These changes also threaten to further erode the hard work of former FHFA Director Mark Calabria to strengthen capital reserves at Fannie Mae and Freddie Mac to avoid another costly taxpayer bailout once again. That work was already compromised by Director Thompson’s actions earlier this year to weaken those reserves, despite a 2020 unanimous vote by the Financial Stability Oversight Council (FSOC) that FHFA should ensure the GSEs be “sufficiently capitalized to remain viable as going concerns during and after a severe economic downturn.” The safety and soundness of the GSEs is an essential component to the long-term health of our mortgage markets, which is precisely why the Committee needs to hear Director Thompson’s plans for FHFA as the hot housing market rapidly cools over.

Republicans seem to want to encourage Sandra Thompson to push for a Fannie and Freddie balance sheet restructuring so that they can raise capital and be adequately capitalized. At the very least, it would seem to me that they would be curious what additional internal admin reforms would be left to be complete that would serve as prerequisites for such a restructuring that would lead to equity offerings. I am hopeful that Sandra Thompson is invited and does get a chance to testify regarding what she can do. Ironically, I think that if they really wanted answers they would need to get Sandra Thompson and Janet Yellen in the same room because the SPSPA is an agreement between FHFA and Treasury and as such, Sandra Thompson cannot unilaterally just restructure their balance sheets. The best she can do is point to the fact that Treasury isn’t getting any economic benefit from its equity stake as is, but stands to gain tens to hundreds of billions in a restructuring.

Fannie Mae And Freddie Mac Annual Capital Planning Rule Now Finalized

FHFA has not finalized the capital planning rule. This capital planning rule is designed around helping Fannie and Freddie raise capital to meet the ERCF:

The final rule’s requirement to develop capital plans will allow the Enterprises to identify the amount of capital they need to raise to meet the ERCF’s requirements, and to consider the timing of when to raise capital, and what types of capital to raise. The final rule, like the ERCF, is intended to provide a stable regulatory framework for the Enterprises for an extended period, including after they achieve adequate capitalization under the ERCF.

It is impossible for Fannie and Freddie to raise capital with Treasury still having their liquidation preference of their Senior Preferred Stock increasing at the rate Fannie and Freddie retain earnings (the economics of the net worth sweep are still in place). Treasury needs to restructure its equity position and the balance sheets of Fannie and Freddie in order for this capital planning rule to have any material significance whatsoever. As such, I see the finalization of this capital rule a green shoot indicating that because Biden nominated Sandra Thompson to run FHFA, that his administration is on board with following in Sandra Thompson’s footsteps and at some point will have to address the steps necessary to give this rule significance.

2022 EOY Litigation Calendar

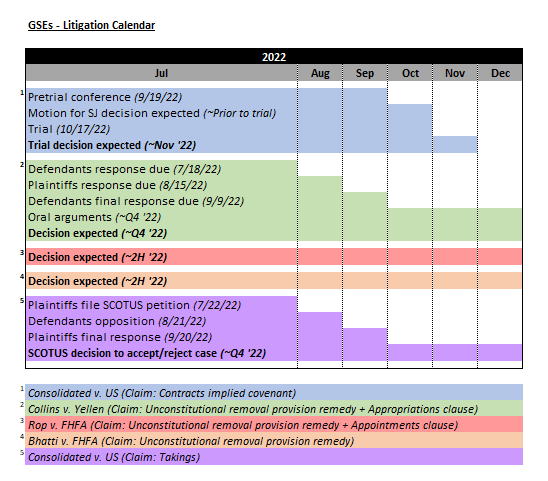

As you can see below, 5 major legal events are scheduled in the next 6 months:

2022 Litigation Calendar (2022 Litigation Calendar)

So, let’s take a look at a few of the more recent updates with respect to these cases.

DC District Contract Claims

Judge Lamberth issued a scheduling order for the contract claims lawsuit. Trial is set for October 17. Judge Lamberth has been correctly interpreting the breach of contract claims in favor of shareholder plaintiffs, but the government is trying to get him to re-evaluate his interpretation by pointing to the Supreme Court ruling that his interpretation of the law already aligns with. This is my favorite lawsuit, and for this reason alone I believe junior preferred shareholders are rewarded handsomely before the end of this year.

ROP Vs. FHFA

Plaintiffs pointed out that the government is relying on a dissent instead of the majority opinion to make their latest round of legal arguments:

Yet in a dissent issued the day after oral argument in this case, Judge Murphy suggested, without briefing by the parties (or amici) on the issue, that the de facto officer doctrine would generally bar federal courts from granting relief for actions by officials exercising executive power without a valid appointment.

…

Of course, only the majority opinion in Calcutt, which was recommended for publication, can control here

The fact that the government is sourcing dissents is indicative of the weakness of their legal arguments for this lawsuit.

Summary And Conclusion

Sandra Thompson, now that she serves as permanent director of FHFA, can work with Treasury to restructure its equity stake. This is especially true because she has finalized all of the rules that would need to be in place to chart a permanent course out of conservatorship and lock it in. Treasury currently gets no economic value of its equity stakes in Fannie and Freddie, but should it decide to work with Sandra Thompson, it could access $100B for affordable housing initiatives. These initiatives could help Americans who are currently being priced out from higher and rising interest rates get access to homeownership. This has been the direction of the Biden administration but so far Treasury has not said or done anything, it’s all been at FHFA — which makes sense because FHFA was working to get all the pieces in place.

Sandra Thompson being sworn in was the capstone on this, and now the ball is in Treasury’s court. Should it decide to wait, it would be actively risking the value of its restructured equity position to shareholder litigation, resulting in large cash payments to shareholders. Right now, the ball is in Treasury’s court and Republicans in congress appear to want to force this issue as early as next week. I am very optimistic about the rest of this year for junior preferred shareholders.

Be the first to comment