Investment Thesis

Amazon.com, Inc (NASDAQ:AMZN) is a company with 5 amazing businesses which span multiple industries.

AMZN’s AWS service dominates the cloud market by a wide margin compared to its competitors. It is also powering some of the highest quality companies which are unlikely to go out of business.

Sundry Photography/iStock Editorial via Getty Images

AMZN’s online retail business leads the online retail business by a double-digit market share. The next 11 competitors do not come close with a single-digit market share. Its online marketplace has the highest visits/month compared to other competitors. AMZN is able to increase its prime membership subscription fee, demonstrating its significant pricing power.

AMZN’s advertising revenue surpassed the most popular social media platforms of Facebook, Youtube, and Instagram and is largely unaffected by the privacy tweaks made to Apple’s operating system.

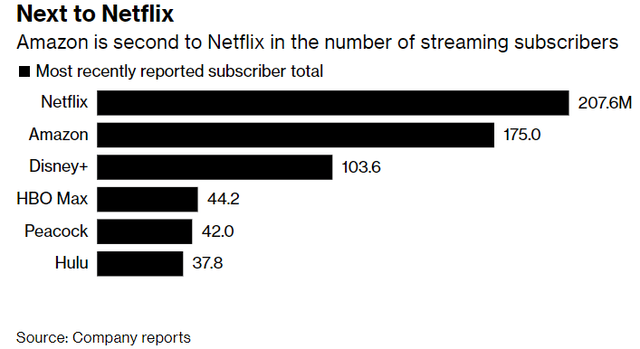

AMZN’s streaming subscriber volume is one of the largest, 2nd only to Netflix, Inc (NFLX). The acquisition of MGM studio is expected to boost its streaming business in terms of high-quality movie content.

AMZN already has an established logistic and delivery infrastructure. It is on track to surpass UPS in the U.S in terms of package delivery. Current sellers on the Amazon platform are already benefiting from the Fulfillment by Amazon (“FBA”) program. The recent launch of “Buy with Amazon” extends the FBA experience to the sellers’ own websites.

In my opinion, because of these 5 amazing businesses of Amazon, AMZN stock is a strong buy.

The Amazing Business of Cloud Infrastructure

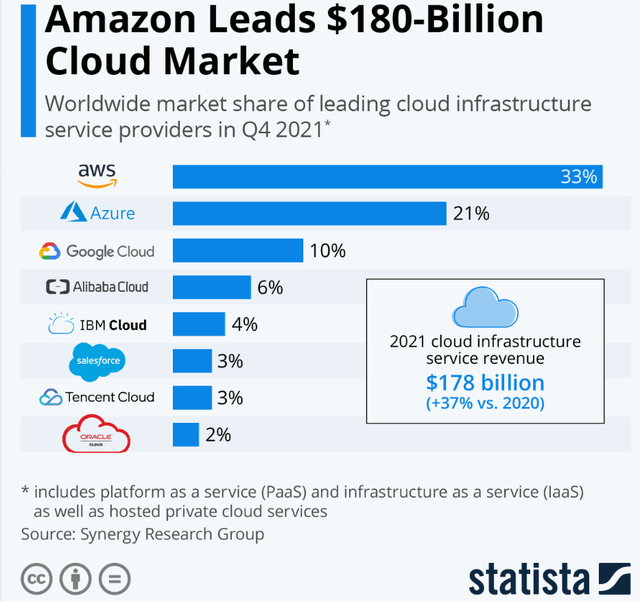

Amazon AWS is a leading cloud infrastructure provider. Based on Statista, we understand that:

Amazon’s market share in the worldwide cloud infrastructure market amounted to 33 percent in the fourth quarter of 2021, still exceeding the combined market share of its two largest competitors, Microsoft and Google.

Visually, this is how the different competitors fare in terms of market share:

Not only does AWS leads in terms of quantitative share of the market, but its cloud services are also used by some of the best quality companies in the world, in multiple industries. Here are some notable examples:

- Leading streaming services like Netflix, HBO, and Disney use AWS to power their highly popular streaming services.

- Salesforce uses AWS in areas where they do not have their own data centers to achieve cost savings.

- Adobe uses AWS to provide the infrastructure of ‘multi-terabyte operating environments for its customers to that it can ‘focus on deploying and operating its own software’.

With such a massive market share and having the support of market-leading companies relying on Amazon’s AWS, Amazon’s cloud infrastructure business shares some attributes of a defensive business providing ‘essential’ services for its most important customers.

As noted by Investopedia about Amazon AWS business:

Jeff Bezos has likened Amazon Web Services to the utility companies of the early 1900s. One hundred years ago, a factory needing electricity would build its own power plant but, once the factories were able to buy electricity from a public utility, the need for pricey private electric plants subsided. AWS is trying to move companies away from physical computing technology and onto the cloud.

The barriers to entry for a business to adopt a cloud solution from a provider may be low. But the cost of switching out of it can be substantial. This article illustrates how Amazon’s AWS long-term Glacier service maintains its high cost of switching out of its cloud service by:

- Making it easy to upload data by making the uploading of data free.

- And at the same time, it makes it more difficult to move it out by charging for transferring data above 1GB per month out of Glacier.

This creates a sticky relationship with Amazon’s cloud customers.

The Amazing Business of ECommerce

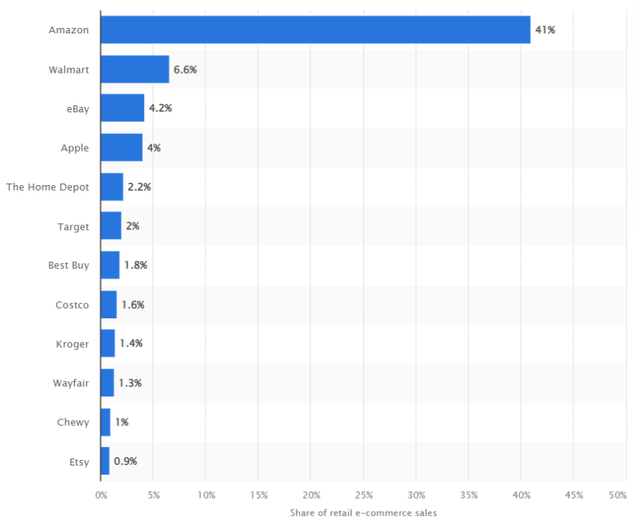

According to Statista Amazon’s E-commerce business leads the online retail market share by a wide margin of 41%. The next ‘largest’ 11 companies are all having market shares in the single digits.

Market Share of the Biggest eCommerce Companies in the World (Statista)

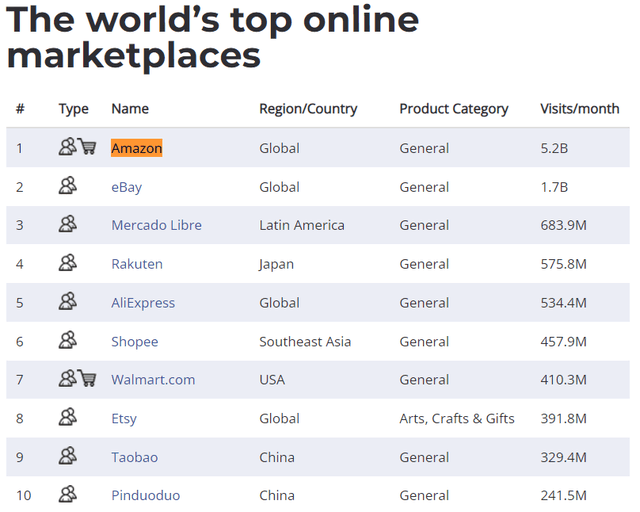

Amazon marketplace is also ranked top by Webretailer. It has the highest visits/month at 5.2B. This is more than twice that of the second most visited marketplace at just 1.7B visits/month.

The world’s top online marketplaces (Webretailer)

Amazon launched Amazon Prime in 2005. Since then, it has grown from strength to strength. Currently, it is one of the most popular retailer subscription services with a much larger subscriber base compared to some of its closest competitors.

According to Investopedia, these are the top 3 alternatives of Prime. I checked out their reported subscriber volume and list it below for comparison:

- Amazon Prime – According to Wikipedia cited earlier, “In April 2021, Amazon reported that Prime had more than 200 million subscribers worldwide. “

- Target Circle – According to ModernRetail, “Nearly two years after launching its Circle Rewards program, Target has hit 100 million members.”

- Walmart – According to RetailWire, ” Estimates have put the number of Walmart+ members between 11.5 million (Consumer Intelligence Research Partners) and 32 million (Deutsche Bank)”

- ShopRunner – According to an article by DigitalCommerce360 in 2019 “ShopRunner currently has 10 million members”.

We can easily see that the number of prime subscribers is overwhelmingly much larger than all these 3 alternative services combined. According to Wikipedia:

“In February 2022, Amazon announced its first increase in almost four years for the annual US Prime membership fee from $119 to $139.”

Not only is it having the largest volume of subscribers, but it is also able to charge the highest membership fees and increase them without fear of being overtaken by its competitors, suggesting a significant amount of pricing power in its retail subscription business.

The Amazing Business of Advertising

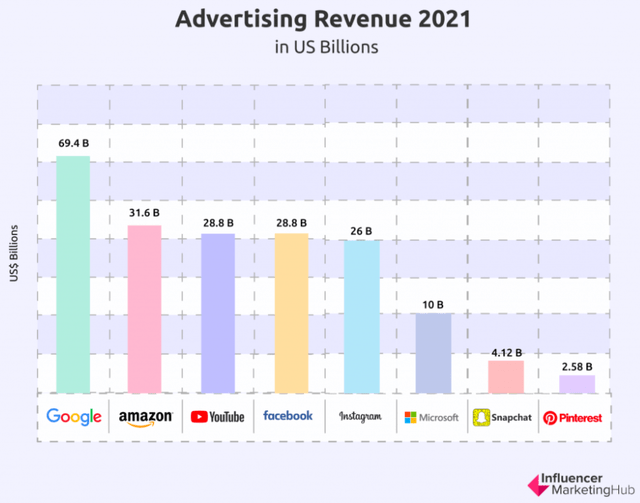

When we talk about the most successful platforms for advertising, what comes to mind is probably the biggest social media platforms like Facebook and Youtube (owned by Google). However, looking at the advertising revenue of some of the largest advertising platforms suggests a different perspective.

Advertising Revenue 2021 (Influencer Marketing Hub)

According to this chart from “Influencer Marketing Hub“:

- Amazon has the 2nd highest advertising revenue in the comparison list, dwarfed only by Google.

- Amazon’s advertising revenue is larger than even the most popular social media platforms of Youtube, Facebook, and Instagram in the comparison list.

- Amazon’s advertising revenue is also larger than that of Microsoft, Snapchat and Pinterest combined.

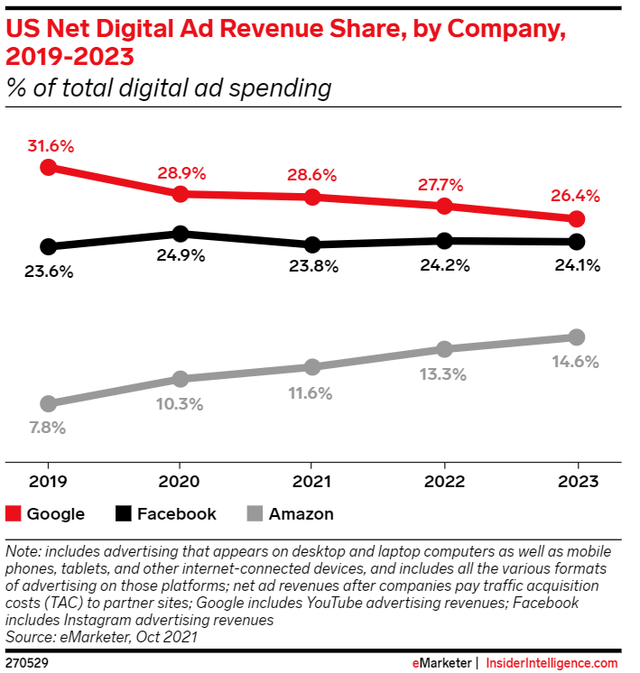

If we observe the advertising revenue by individual companies, Google and Facebook (currently ‘Meta Platforms’) still have the lion’s share of the total “Ad Revenue”, but Amazon’s share is rising consistently.

US Digital ad by Companies (emarketer)

Amazon has been mostly unaffected by the privacy tweaks made to Apple’s operating system. According to Reuters, “An Amazon official told reporters that the ability of brands to reach consumers across its ad properties was “largely unchanged” after Apple Inc’s privacy tweaks to its operating system “

This is in stark contrast to the impact of social media companies like Facebook, Snap, YouTube, and Twitter which have lost nearly $10 billion in revenue after Apple changes the privacy settings on its iPhone product. Google is also making changes to “Android, similar to the ones Apple made on iPhone” fueling the headwinds already faced by current social media companies.

These headwinds could prove to be a blessing for Amazon, as this CNBC article noted:

“As Apple’s App Tracking Transparency changes goes into effect, Amazon’s data will likely become a more rare and valuable commodity for marketers “

With such a flourishing advertising business driven by Amazon’s already available consumer data, in the long run, it should allow the company to offset whatever temporary losses sustained by the company on a quarterly basis.

The Amazing Business of Streaming

All Amazon Prime members automatically have access to Amazon Prime Video services by default. Hence the number of Prime Video membership subscribers is at least 200M, as discussed above. Here’s how it compares to other streaming alternatives:

- Disney has 129.8m subscribers, an addition of 11.8m new subscribers in the latest quarter of Q1 2022.

- Netflix reportedly has 221.64m subscribers as of 1 May 2022, according to DemandSurge.

According to Bloomberg, based on the estimations reported one year ago, Amazon’s streaming service was already leading by subscriber counts, 2nd only to Netflix and higher than Disney Plus.

streaming subscribers (Bloomberg)

Since we note earlier that ‘all Amazon Prime members automatically have access to Amazon Prime Video service’, it may not be so accurate to measure the popularity of streaming services by subscriber volume alone. An article by business insider analyzed the different streaming services and reported these conclusions:

Prime Video — 6,985 total movies (409 high-quality movies)

Netflix — 4,091 (447)

HBO Max — 2,586 (517)

A “high quality” movie is one that has a score of “7.5 or more on IMDb”. Based on this measurement, Prime Video may have the largest collection of total movies, but it trails HBO and Netflix in terms of high-quality movie content.

However, Amazon recently acquired MGM studio and this could prove to be a game-changer in terms of the provision of high-quality streaming content.

MGM owns some of the most popular franchises in its own rights. Some examples include “Rocky”, ‘James Bond’, “RoboCop”, and “G.I. Joe”, just to name a few. If Amazon can develop new sequels and reboots either in movies and/or television content from these franchises, Amazon prime video can prove to be a highly profitable business segment for the company in the long run.

The Amazing Business of Distribution and logistics

Amazon is one of the world’s largest online marketplaces that bring together both sellers and buyers. Anyone can list and sell on Amazon’s website, benefitting from its retail and logistical infrastructure, the ‘Amazon’ brand name, and network of customers. Nothing is free and certainly not if you signed up for the FBA plan and receive the following benefits:

- “24/7 Amazon customer service”

- “All fulfillment and shipping costs included (pick, pack, and ship)”

- “Access to one of the world’s most dynamic fulfillment networks”

Overall, the amount of fee charged to a seller for selling on Amazon varies depending on the plan selected.

On 21 Apr 2022, Amazon launches a new service “Buy with Prime” and this is a video to describe exactly how it works. This new offering allows “marketplace sellers that participate in the Fulfillment by Amazon program to extend that experience to their own websites”. When customers buy from Third-party sellers check out using the “Buy with Prime” feature, their payment and shipping information are already available from their Amazon accounts. This greatly enhances the checkout experience. Since the backend fulfillment of these orders is also done by Amazon, these sales made from the third-party website also benefit from the “world’s most dynamic fulfillment networks” of FBA as discussed above.

According to this article by TechXplore, “Amazon will surpass UPS in U.S. package volume in 2022—and in five years have a logistics network large enough that it won’t need to rely on UPS or the U.S. Postal Service”. From the same article, we understand that back in 2013, Amazon encountered a pitfall in delivery due to “a meltdown of the UPS shipping network”. If Amazon can totally detach itself from UPS’s delivery service, it effectively cuts away another middle-man in the shipping process to provide a more streamlined logistical and distribution experience.

Valuation

AMZN’s Free Cash Flow(“FCF”) has taken a beating due to “sharply higher costs: inflation in shipping, and logistics, as well as skyrocketing SG&A costs“. However, as discussed earlier, AMZN owns many successful businesses in multiple industries. As such, I believe these are short-term headwinds that will be resolved eventually, as this article pointed out:

2021 headline cash flow numbers look bad; however, when parsed for aggressive organic investment, the edge comes off. Aggressive growth in the AWS segment requires significant capital. Meanwhile, management is hardening the retail business. Senior leadership is laying up for the future.

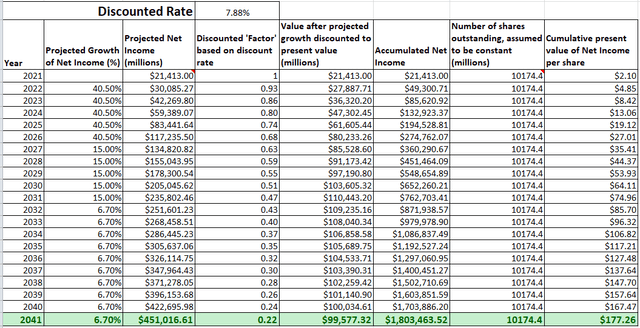

We will make the following assumptions in our valuation:

- AMZN is still positive in Net Income on an annualized basis. The Net income is $21,413.0M in the current TTM period. As such, we will use this figure in our calculation of intrinsic value using the Discounted Net Income model.

- AMZN grows at 40.5% for the next 5 years, as referenced from Finviz’s value of ‘EPS next 5Y’.

- AMZN matures in growth, growing at 15%, which is the average growth of the S&P 500 over the last decade (14.7%), rounded to a whole number.

- The discount rate is estimated to be 7.88%, taken from the WACC value.

Author’s Intrinsic Value Calculation (Seeking Alpha Data)

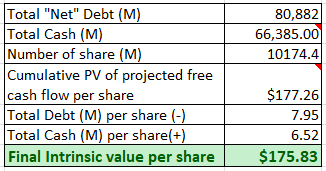

Based on the above inputs, the present value (“PV”) of projected Net Income per share for AMZN is $177.26.

Author’s Intrinsic Value Calculation (Seeking Alpha Data)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is about $176, rounded off to the whole number.

AMZN’s share price is currently undervalued and selling at a discount of -34% (116/176-1).

Investment Risk

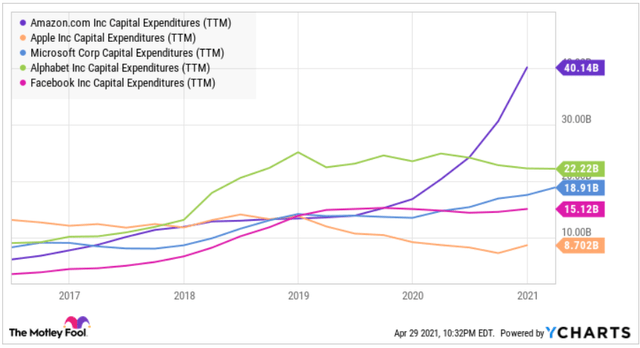

AMZN has been taking on much higher capital expenses as compared to its peers:

Capital Expenditure (Motley Fool)

These are long-term investments to build up infrastructures in multiple business segments like cloud and streaming. As the CEO remarked on CNBC, such investments are ‘still early days’ for AMZN, suggesting these high expenditure profile may persist for some time. Investors need to be patient and willing to hold the shares for a multi-year period.

Conclusion and Key Takeaway

If a fictitious retail stall tries to sell a hamper of 5 most popular ‘premium’ groceries for the price of just one of them, is this a good deal? What if the stall sweetens the deal further and sells you at a 34% discount? Is it a steal?

In my opinion, AMZN’s current price is analogous to that of the hamper I described. Holding AMZN’s share is like owning a ‘hamper’ of 5 amazing businesses that I described in earlier sections. And this hamper is now selling at a discount.

For this reason, AMZN is a strong buy for me.

Be the first to comment