MoMo Productions/DigitalVision via Getty Images

Investment thesis

Relo Group (OTCPK:RELOF) has embarked on an ambitious strategy to expand overseas with the SIRVAS BGRS transaction. Whilst the domestic business contributes steady earnings and the balance sheet remains sufficiently capitalized, we believe the company’s risk-reward profile is mixed given the challenges ahead. We rate the shares as neutral.

Quick primer

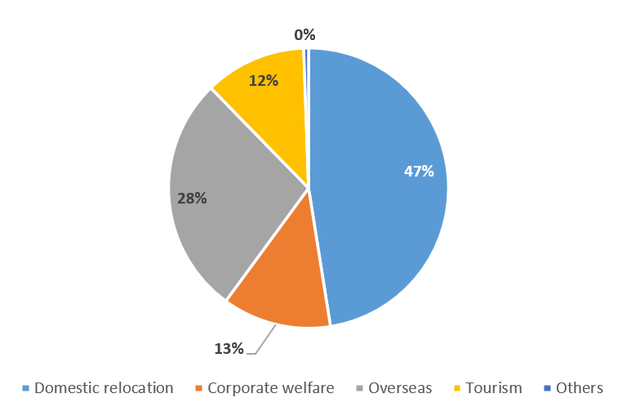

Established in 1967, Relo Group is a Japanese business specializing in outsourced corporate welfare services. The key business is Domestic relocation which covers corporate housing management, realtor activities, and global staff relocation support for Japanese enterprises. Growth via M&A is a core strategy, with the most recent deal in the Overseas business where de-consolidated group company BGRS merged with SIRVA to form SIRVA BGRS LLC; Relo Group has acquired preference shares that can be converted to a 23% equity stake of this newly created entity, as well as call options that would on exercise build a 100% holding by April 2025.

From FY3/2022 the company adapted IFRS reporting, resulting in net revenue recognition (with gross revenue recognition under Japanese GAAP to FY3/2021).

M&A activity has been funded historically by debt, although the most recent financing in December 2020 involved a USD244 million convertible bond raise maturing in December 2027. Currently, these bonds are trading at 66% parity.

Its key domestic peer is Benefit One (OTCPK:BNTOF).

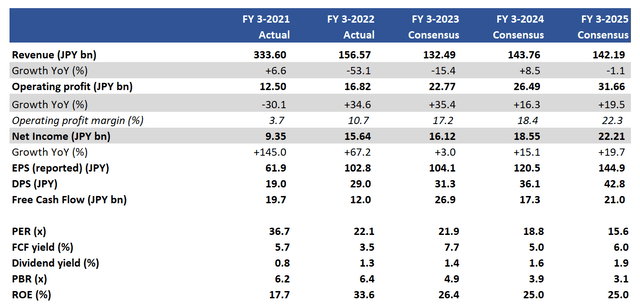

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

FY3/2022 revenue split by segment

FY3/2022 revenue split by segment (Company)

Our objectives

The shares in Relo Group have outperformed the TOPIX by 13% YTD, with its profile of high recurring cash flows (said to be around 80% – see page 2) in FY3/2021. The company aims to grow overseas with limited domestic growth prospects, we want to assess its medium-term outlook in relation to the SRIVA BGRS LLC deal and other organic growth opportunities.

Prospects for long term overseas growth

Whilst Relo Group has a strong market position at home with a stable earnings base, organic growth prospects are limited. The company has been building up its overseas presence with limited success to date, and both FY3/2021 and FY3/2022 saw operating losses in the Overseas business segment, particularly with softening realty activity. Although management has used its overseas operations as a way to demonstrate its global capabilities to large domestic enterprises, in the longer term the intention was to make a steady return.

In June 2022 the company structured a deal that would involve the following. Firstly, its own overseas business (labeled BGRS LLC) will exit the group via divestiture and be merged with SIRVAS, a US-based provider of human resources and executive search consulting services. With BGRS de-consolidating, this is raising the group’s profitability from Q2 FY3/2022 as it remained loss-making. Secondly, the Relo Group has the opportunity to tap into earnings at the merged SIRVAS BGRS by conversion of its preference shares to a 23% equity stake, and to fully acquire the company via call options by April 2025. This structure effectively allows the merged business to have a 2-year window to operate profitably before being effectively introduced back into the group’s financials.

SIRVA’s revenue was USD1.68 billion/JPY240 billion in FY12/2021, with an operating loss margin of 1.1%. In terms of revenue volume, the scale of SIRVAS’s operations is over 25 times larger than BGRS (and nearly twice as big as Relo Group currently). However, with a negative book value of USD8 million, SIRVA’s credit profile was weak and although deal terms have not been fully disclosed, the sale may have been a forced one. Relo Group will need to allocate more capital in the medium term in order to make this a successful transaction, although the path remains to walk away by not exercising the options.

Relo Group remains sufficiently capitalized on a debt-to-equity ratio of 2.74x, but investors must remain cautious about any future increase in gearing.

Outlook for the domestic business

The Domestic relocation business is based on winning new housing mandates from enterprises, by managing tenants as well as facilities maintenance. In Q1 FY3/2022 the business looked after 224,896 housing units (+10% growth YoY), as well as houses under management of 8,909 premises (+3% YoY). With long-term contracts in place, this yields attractive recurring income. Corporate overseas staff postings are gathering pace, resulting in double-digit sales growth of 23% YoY for this activity, but this made up only 10% of total Q1 FY3/2023 sales.

We like the domestic business as the core cash generator. Management appears to be adept at allocating this capital for future growth, but for the short term, there appears to be limited potential for earnings upside. Potential for future cost reductions is unlikely given management operating a pretty tight ship, and hence overseas expansion appears to be the only viable source of future expansion.

Valuation

On consensus forecasts, the shares are trading on PER FY3/2023 18.8x, on a free cash flow yield of 5.0%. These valuations on paper do not look hugely overvalued.

The key question appears to be whether the SIRVAS BGRS transaction will be a successful one. At present, it appears the market is happy to wait-and-see, valuing the shares as a primarily domestic concern with potentially high needs for capital in the next 2 years. With this transaction appearing to act as a headwind on the share price as opposed to a tailwind, for the time being, we feel the shares are fairly priced.

Risks

Upside risk comes from concrete improvements at SIRVAS BGRS, leading to an earlier-than-expected exercise of preference shares as well as options to fully consolidate the business.

Downside risk comes from the reverse of the above, where SIRVAS BGRS is seen as a huge liability for the company in terms of the resources it requires to operate. This could lead to major financing activity negatively impacting the credit profile. More excessive M&A activity by management before the business stabilizes may be seen as too much for the company to handle.

Conclusion

Relo Group has gone for the high-risk high-return strategy with the SIRVAS BGRS transaction. This may have been made possible with its steady domestic activities ensuring a sustainable flow of free cash flow. However, overseas M&A is not easy, particularly for a highly domestic-focused Japanese services company, and we believe the risk-reward profile for the shares is mixed. On relatively palatable valuations, we rate the shares as neutral.

Be the first to comment