Remember The Good Ol’ Days When You Thought It Was Cool To Pay 50X Sales? guruXOOX/iStock via Getty Images

When we last covered Canopy Growth Corporation (NASDAQ:CGC) we summed up the best case for investors assuming there were a few miracles along the way.

If CGC miraculously turned their negative gross margins to reach 3.63% and somehow wiped out most of its debt, a 0.1X sales multiple would look good on them. That gets us to about 10 cents a share.

Source: Bankruptcy Risks Are Growing Like A Weed

The stock dropped rather sharply just after that article as news of the debt swap hit. What is the debt swap and how does it impact you, the common shareholder? We examine that and give our opinion on where this is going.

The Swap

CGC announced that it had reached an agreement with a few noteholders and was going to issue common shares for those notes.

Canopy Growth has agreed to acquire the Notes from the Noteholders for an aggregate purchase price (excluding accrued and unpaid interest which will be paid in cash as part of the Cash Payment) of approximately C$252.8 million (approximately USD$196 million) (the “Purchase Price”), which will be payable in such number of Canopy Shares (the “Share Consideration”) as is equal to the Purchase Price divided by the volume-weighted average trading price (the “VWAP”) of the Canopy Shares on the Nasdaq Global Select Market (the “Nasdaq”) for the 10 consecutive trading days beginning on, and including, June 30, 2022 (the “Averaging Price” and such period of time being the “Averaging Period”), subject to a floor price of US$2.50 (the “Floor Price”) and a maximum price equal to US$3.50.

Source: Seeking Alpha

This was a win for the bearish thesis as CGC also saw those notes as a direct risk to bankruptcy in 12 months and was trying to desperately address the problem.

Price Extremely Distressed

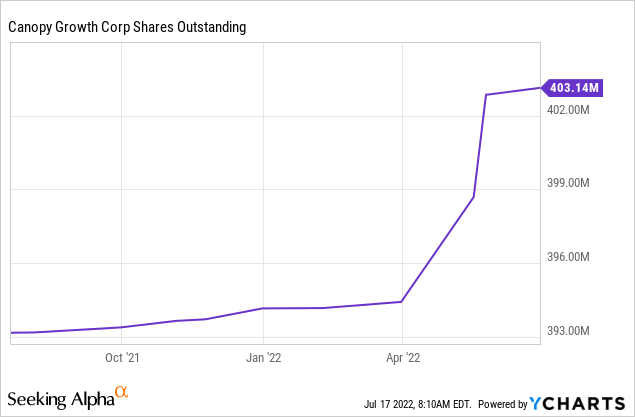

CGC noteholders have given little consideration to the price drop and the exchange will be happening at the extreme low end of the range. This will add about 80 million odd shares to the total, diluting shareholders to the tune of 20%.

On the other side of the equation, this only saves the company about $8.5 million in annual interest expenses.

$600 Million Maturity Looks Addressable

There was a second small tranche that negotiated the same terms for the notes. Cumulatively though, only one-third of the total notes have been addressed. That $400 million outstanding now is getting to a point where it has a higher probability of being paid off when the time comes. If investors recall, we had said that the terms of the credit facility limited the paydown of the debt. Those terms required over $200 million of liquidity to be met at all times. We thought that would be a difficult hurdle to meet, but now that the requirements have decreased by $200 million, this looks feasible.

In an ideal world though, CGC would pay down all of its $600 million via stock issuance. We know that investors might disagree and think that this would wipe out the bull case. We think that this would actually give CGC the best chance of actually dodging bankruptcy. 50% stock dilution is better than 99.99% dilution in bankruptcy.

Asset Sales Might Help More

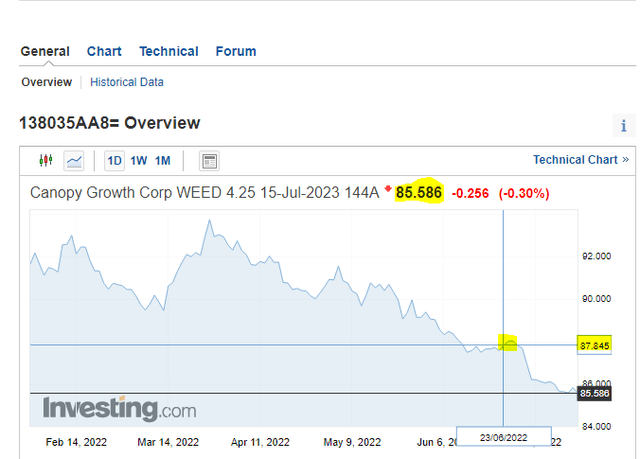

While the July 2023 note maturity is less of a threat, the credit facility banks will likely require a pound of flesh. What we mean is that those banks would likely have CGC retain the cash and increase the buffer on the secured debt. We will also note that the convertible notes have actually dropped since the debt exchange was announced.

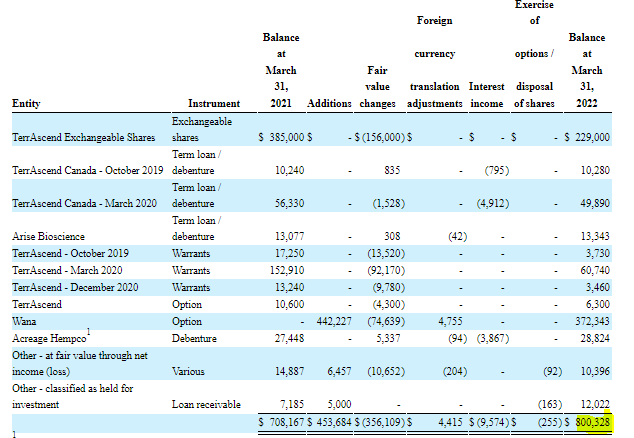

They now yield about 22% to maturity, suggesting again, that the market does not believe these can be paid off or refinanced. CGC will likely have to tender its equity stakes in Wana and TerrAscend.

CGC 10-K

Verdict

Bankruptcy remains a risk in 12 months, but there is no doubt that risk has reduced with this distressed debt exchange. Constellation Brands, Inc. (STZ) owns an overwhelming portion of the shares and before this exchange owned 142.25 million shares at a cost basis of $5.49 Billion CAD (about $4.25 billion USD) or $38.59 CAD per share (about $30 USD per share). They have also held the convertible debt and participated in this exchange subject to conditions that the remaining debt must be paid off in cash. Obviously, they don’t want to lose effective control here, which could happen if CGC paid off the debt with shares issued below a $1.00.

In the eggs and bacon breakfast, the chicken is involved but the pig is committed. STZ is clearly committed here and likely wants to avoid acknowledging the giant error in investing in CGC. This also makes a buyout possible, although we would assume it would come at a zero premium and likely at a price lower from here. That risk though makes us dial back the bearishness here and we are reluctantly upgrading this to a hold/neutral rating. We would look to move to the bear side if we get a strong rally back over $4.00.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment