Chip Somodevilla/Getty Images News

Recap

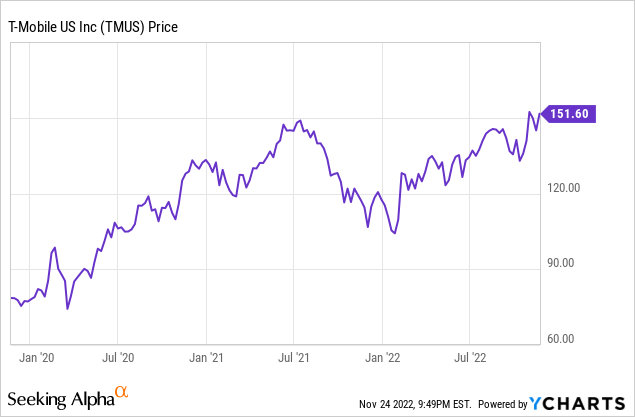

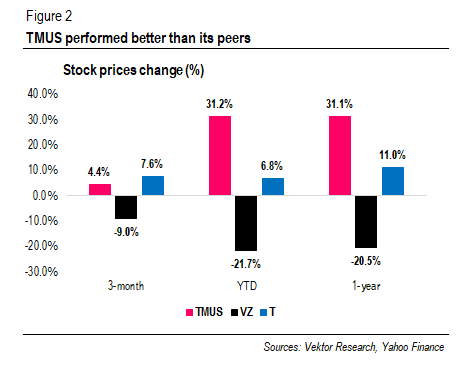

T-Mobile’s (NASDAQ:TMUS) stock has shown resilience during inflationary pressures and rising interest rates – prompting a major sell-off in the equity market. The stock performed better than the company’s peers (see Figure 2) and hit our 12-month target price of $151 per share.

Stock prices change (%) (Vektor Research, Yahoo Finance)

Leading The Race, But Its Lead Is Dissipating

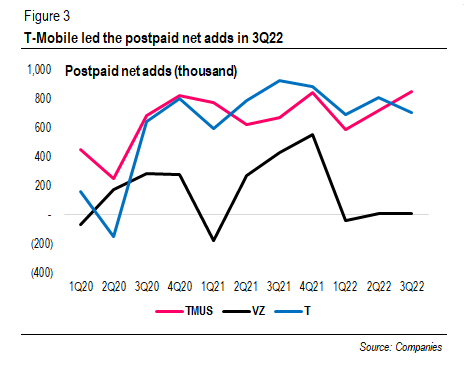

In 3Q22, T-Mobile once again overtook the number one spot in postpaid phone net adds with 854k, beating Verizon (NYSE:VZ) and AT&T (NYSE:T). Indeed, this has something to do with the price increase, as customers look for cheaper options amid inflationary pressures, in our view. Verizon made fee adjustments and, like AT&T, raised the older, shared plan offerings by $6 and $12 per month for single-line and multi-line phone accounts, respectively. Meanwhile, T-Mobile decided not to follow the same direction as its competitors, emphasizing its Price Lock commitment.

Postpaid phone net adds (thousand) (Companies)

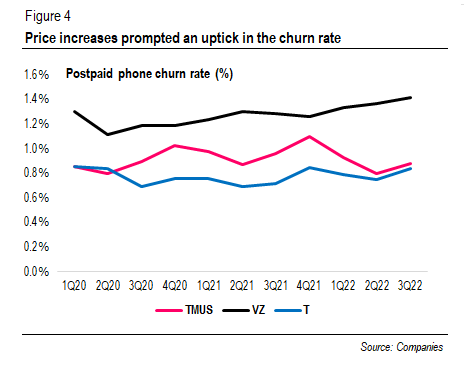

As a result, we saw a slight uptick in the churn rate, and the gap between T-Mobile and AT&T narrowed down.

Postpaid phone churn rate (%) (Companies)

Furthermore, T-Mobile continued its 5G leadership after announcing that it has covered 250 million in the mid-band and expects to increase to 260 million by the end of this year. In comparison, AT&T hit over 100 million POP, and Verizon claimed to have covered 160 million by 3Q22.

But T-Mobile still has something under its sleeve, as it picked up 30MHz of the C-band spectrum for $9.3 billion and spent $3 billion for an average of 21 MHz of the 3.45 GHz spectrum–likely to be deployed next year when its vendors offer dual-band radios. Moreover, the company scooped up 7,156 of 2.5GHz licenses, mostly in rural areas, for only $304 million in its effort to fill the coverage gaps. And competitors such as AT&T and DISH did not actively participate in the bid.

Nevertheless, competition intensifies among carriers and cables. First, Opensignal noted that Verizon and AT&T’s 5G customers saw an improvement in download speed as they were rolling out the C-band spectrum. Second, Verizon launched Welcome Unlimited charging a competitive $30 per line a month for four lines. The management said the plan is to attract new customers and eventually upsell them. DISH (NASDAQ:DISH) pushed its postpaid service, Boost Infinite, launch date to 1Q23.

Lastly, Cox Communications, the third-biggest cable company in the US, is likely to launch its mobile services with Verizon, just as Comcast and Charter do. Cox also unveiled two pricing options: $15 per 1GB per month and an unlimited data plan for $45 per month. Furthermore, cable companies are looking to build their small-scale 5G network using the 3.5 GHz band spectrum, Light Reading noted.

As competition from carriers and cable companies intensifies, we expect T-Mobile postpaid phone customer growth to slow down to 2.5% in the medium term, leaning toward the industry growth of ~2%. Still, we believe that T-Mobile still has growth drivers yet to unfold.

1. Mid-band spectrum activation on the 5G SA

T-Mobile recently announced that it was supporting the 2.5GHz band spectrum on the 5G standalone (SA) network. While the company is the first to bring in a nationwide standalone 5G network in the US, it was rolling out 5G SA in the 600MHz band.

Initially, Opensignal’s analysis shows that T-Mobile’s SA 5G running in low-band spectrum significantly increased availability and latency in rural areas. But its download speed was far slower than the non-standalone (NSA) counterpart running in the 2.5GHz band. Now, the situation could change with the 5G SA in the mid-band. On the other hand, Verizon announced last month that it was moving customers to its cloud-native, 5G SA core, while AT&T said it was still distributing the core software.

But a standalone 5G network offers much more than low latency and faster speed. Neville Ray said some opportunities from the enterprise market that come with the 5G standalone network:

And if you think about that standalone announcement that I just referenced, now we are in a position – not saying we are doing this today, but many customers in the business and enterprise space are coming to T-Mobile and saying, can you offer me enhanced SLAs, can you offer me a dimension service, maybe a slice of network capability, that will ensure that productivity for my workforce, the services and applications that we run, that’s going to be enhanced and be better and more committed rate and so on. And so you need an SA network.

We understand that network slicing and mobile edge computing (MEC) remain several years away from generating significant revenues. However, T-Mobile can utilize its 5G SA network for private networks, which can help the company increase its share in the enterprise market from 10% to 20% by 2025. Light Reading noted that T-Mobile is several years behind its competitors in the private 5G networking space–estimated to have a total addressable market of $7 billion-$8 billion by 2025.

Looking forward, we believe that T-Mobile is looking to utilize its mmWave spectrum to tap into the private wireless market. When asked about the millimeter wave use, Neville Ray said that it had to be economically “makes sense.” And the company cited “private and in-building networks” as one of the possible cases where mmWave deployments “will provide real benefits.”

2. Fixed-wireless’s Ample Room for Growth

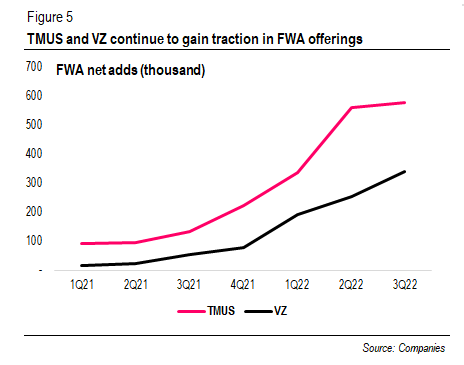

Fixed wireless access (FWA) has been one of the 5G’s success stories in 2022. For example, T-Mobile and Verizon added 578k and 342k subscribers in 3Q22, bringing the total customer base to 2.1 million and 1.1 million, respectively. AT&T has been relatively tight-lipped toward FWA offerings, but Fierce Wireless noted that the company had over 500,000 subscribers. Looking forward, T-Mobile set a target of 7-8 million subscribers by 2025, and Verizon expects to have 4-5 million subs.

FWA subs net adds (thousand) (Companies)

But not everyone is happy seeing the rise of FWA, as it is putting pressure on cable operators. For example, as noted by the Fierce Wireless, Comcast Chairman and CEO referred FWA as an “inferior product.” However, the management admitted during the 2Q22 earning call that the company’s flat broadband growth was partially due to FWA.

The question is that whether such growth will be sustainable in the long run. GlobalData predicts that FWA will continue to gain market share from cable, but the consultancy expects fixed-wireless to make up less than 10% share by 2027. One of the reasons is because carriers leverage their untapped capacity for FWA, and it will be available up to a certain point when mobile services demand more capacity. Analysys Mason estimated that fixed broadband required about 40 times, on average, higher than did mobile.

In addition to limited capacity, Recon Analytics founder Roger Entner mentioned multi-gig offerings as potential competitors in the broadband market, especially in the urban and suburban areas. Yet, Entner said that FWA offerings might still be around in rural areas where “it’s less economical to run fixed connections.”

Reports suggest that a significant bulk of T-Mobile’s FWA customer base came from rural areas–where “sufficient excess capacity” was likely present–while Verizon’s Ultra-Wideband FWA subs lean into the urban market. Interestingly, 2.5GHz licenses that T-Mobile recently picked up in Auction 108 are mainly in rural areas.

Looking forward, we believe that the ambition of 7-8 million FWA customers is achievable. T-Mobile added 190k subscribers per month, and its extensive spectrum holding in the rural areas might help the company ramp up its target beyond the 7-8 million figures.

Moreover, T-Mobile plans to expand its business to the fiber-to-the-home (FTTH) service, as it can open a new revenue source and offer a fixed-mobile convergence service. A converged bundle offering can reduce mobile churn and allow operators to upsell their customers as they demand higher data consumption.

Nevertheless, expanding to fiber will require billions of dollars of investment. T-Mobile’s management said it was still weighing up whether to invest, and further discussions about potential partnership remain to be seen.

Valuation

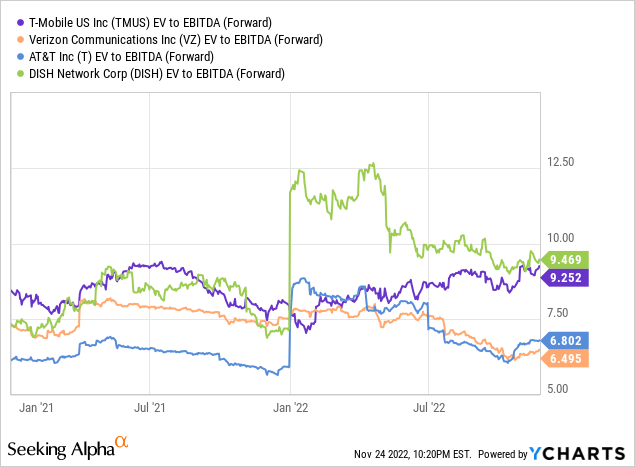

We downgrade our BUY call to HOLD, as the current price has reached our target price of $151 per share. Furthermore, T-Mobile is trading more than 9x of its forward EBITDA, far higher than Verizon and AT&T. Because we believe that the stock is fairly valued, Verizon might be a more attractive choice thanks to its cheaper valuation, a respectable ~24% ROE, and consistent dividends, in our view.

Final Thoughts

We like T-Mobile’s early mid-band spectrum deployment that enables the company to earn its 5G leadership position–going toe-to-toe with AT&T and even exceeding Verizon in postpaid phone net adds. In addition, price increases by the competitors to anticipate high inflation allow T-Mobile to lead the net adds in 3Q22.

However, the competitive landscape has since intensified. Verizon and AT&T are aggressively deploying their C-band spectrum to catch up with T-Mobile. Moreover, new players such as DISH and Cox are set to compete.

Indeed, T-Mobile’s FWA growth is incredible: it added more than half a million subscribers in just a quarter. However, the company’s target to reach the 7-8 million subs by 2025 has already been priced into the stock, in our view. The 5G SA network might help the company gain market share in the enterprise market, but it might be a couple of years away from generating significant revenues.

In conclusion, we downgrade our BUY call to HOLD, as the price has reached our 12-month target price of $151 per share. Furthermore, Verizon is a more attractive option than T-Mobile at the current valuation, trading ~7x of its forward EBITDA, a 30% discount over T-Mobile.

If you have any thoughts, please do not hesitate to comment below.

Be the first to comment