kmatija

REIT Rankings: Cannabis

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 22nd.

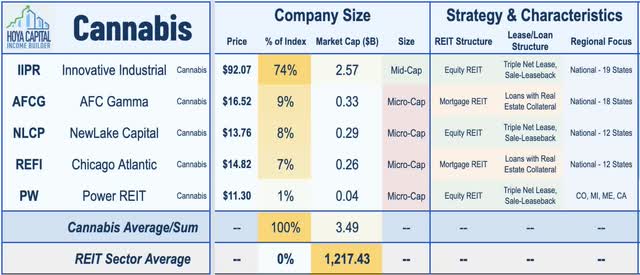

Getting high is getting cheaper. Coming down from a seemingly never-ending ‘high’ since emerging onto the scene in the mid-2010s, Cannabis REITs have been slammed in 2022 amid concerns over tenant financial health given the repricing of risk, tighter financial conditions, stalled progress on federal legalization, and challenging business conditions given a plunge in wholesale marijuana prices. Within the Hoya Capital Cannabis REIT Index, we track the three cannabis equity REITs – Innovative Industrial (IIPR), Power REIT (PW), and NewLake Capital (OTCQX:NLCP) – along with the two cannabis mortgage REITs – AFC Gamma (AFCG) and newly-listed Chicago Atlantic (REFI) – which together account for roughly $3.5 billion in market value.

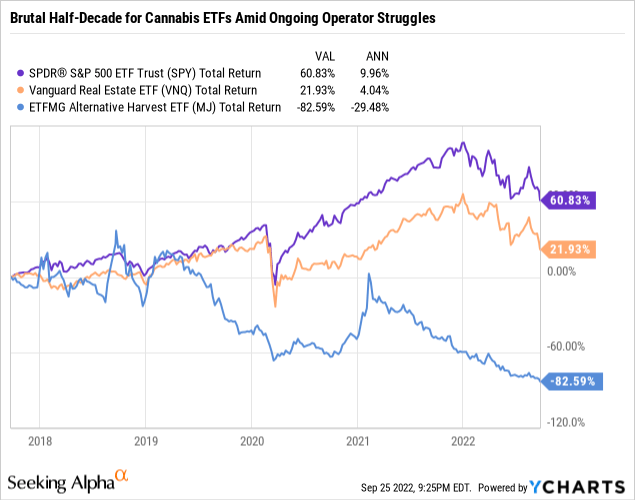

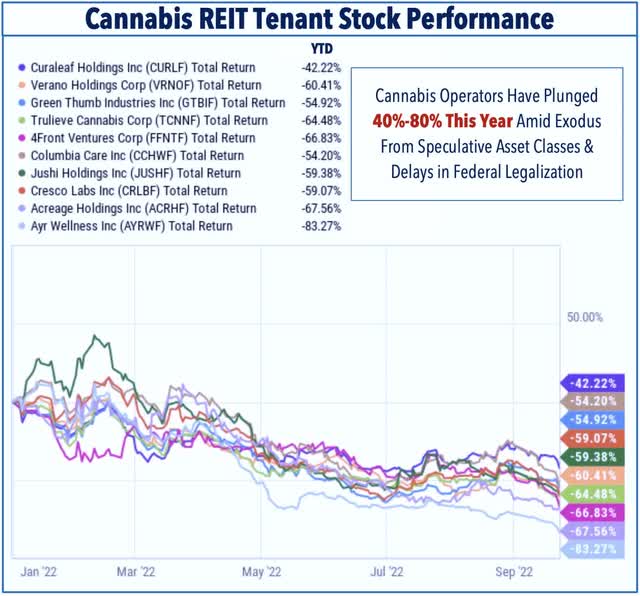

Owning the “Pharmland” – the physical real estate behind the cannabis cultivation industry – had been one of the few cannabis-related investments that was working amid a half-decade-long stretch of poor performance from the broader cannabis industry – reflected in the dismal five-year stretch for cannabis ETFs, which primarily hold cannabis operators and non-REIT companies along the cultivation-to-retail supply chain. Cannabis REITs – which entered 2022 with the strongest five-year total returns, dividend growth, and FFO growth of any property sector – have been unable to escape the cannabis industry’s downward pressure this year amid amplified concerns over tenant rent-paying capacity. The ten public-traded REIT tenants have plunged between 40-80% over the past year – a decline that roughly matches the dip among the three equity REITs in the sector.

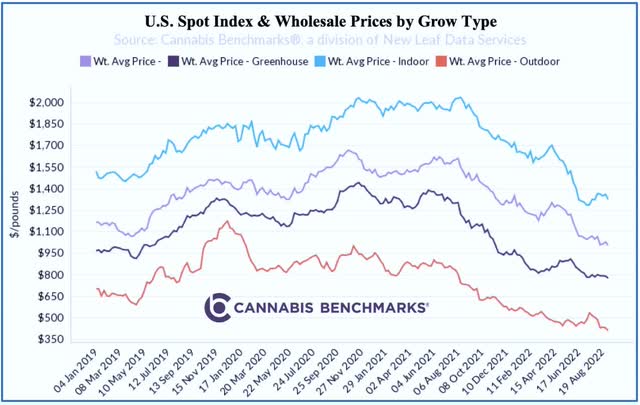

Aggravating the already-challenging macroeconomic environment, cannabis cultivators and retailers have been pressured by a weak pricing environment amid a flood of new entrants to the cannabis retail and cultivation industry and as institutional capital to multi-state operators has driven production efficiencies. Reflecting trends seen nationwide, data from the Colorado Department of Revenue showed that wholesale marijuana prices dipped to record lows this summer at just $658 per pound – down more than 50% from a year ago. The cost of production is estimated to be $800-$900 per pound in Colorado. The U.S. Cannabis Spot Index – the aggregate national price for the 18 legal cannabis markets covered by Cannabis Benchmarks – has also set a series of record lows this summer with the national average declining to $987 per pound last week – roughly 30% below the average price over the prior five years and more than 50% below the average price in 2015 amid the initial wave of state legalization.

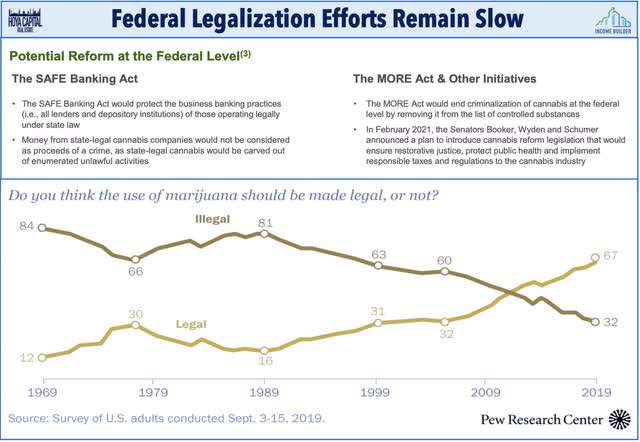

Adding insult to injury, stalled progress on federal legalization – which is typically the first investment case “bullet point” of cannabis businesses – has made a challenging fundraising environment enough tougher with IIPR estimating that total capital raising activity for the cannabis industry in the US is down over 60% in the first six months. Despite the trifecta of Democrat control in Washington, the once-ambitious legalization efforts have been defined by “broken promises” according to industry executives. Investors had widely expected the passage of several “low-hanging fruit” pieces of legislation that garner bipartisan support including the SAFE Banking Act, which would enable legally operating cannabis firms to use banking services and credit cards. Senate Democrats have reportedly been slow to move on targeted legislation to hold out for a more all-encompassing reform package despite longshot odds of full Senate passage. These challenging conditions have led to emerging pockets of stress across the industry including a handful of bankruptcies among smaller operators – including several REIT tenants.

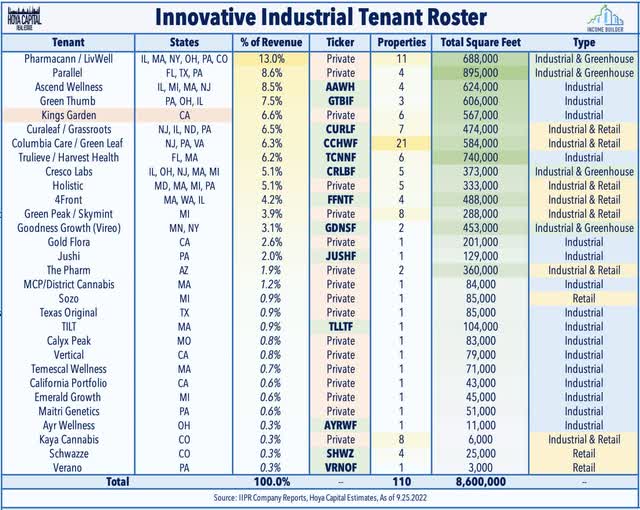

On that point, Innovative Industrial announced in July that one of its largest tenants – Kings Garden which accounts for roughly 6% of IIPR’s invested capital – defaulted on its rent obligations while another smaller tenant – Vertical – has made partial rent payments. IIPR announced in an 8-K last week that it reached a confidential settlement with Kings Garden, which no longer appears as a tenant on IIPR’s website. Kings Garden leased six properties – four in operation and two development properties – with total base rent of $5.5 million for the second quarter. IIPR noted in its Q2 earnings call that all other tenants are 100% on their rents as of July and August. IIPR reiterated in its discussion that it derives 80% of its revenues from Multi-State Operators (“MSOs”), and the handful of collection issues over the past five years have come from smaller single-state operators.

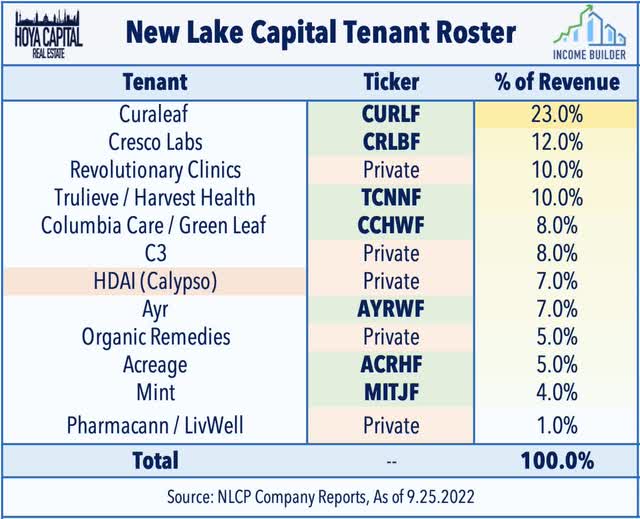

Meanwhile, NewLake Capital – which owns 31 properties across 12 states – noted in its earnings call that while it has collected 100% of its rents to date, that it’s “just a matter of time until we have a tenant issue to focus on” and highlighted potential issues with HDAI Calypso, which has seen a “deterioration in their sales over the past number of months.” Both IIPR and NLCP sounded confident in their ability to relet the space, and subsequent dividend increases over the past two weeks were positive indicators that tenant issues are contained. NLCP derives roughly 75% of its rental revenues from Multi-State operators including a handful of the same tenants as IIPR including Curaleaf (OTCPK:CURLF), Cresco Labs (OTCQX:CRLBF), Trulieve (OTCQX:TCNNF), and Columbia Care (OTCQX:CCHWF).

Given that there’s certainly no shortage of potential tenants in grow facilities – but there is a lack of ‘high-quality’ tenants with diversified business operations – we believe that the institutionalization of the cannabis cultivation industry is likely a net positive for these cannabis REITs over the long-term, which derive the majority of their revenues from multi-state operators (“MSO”) that in most cases are the lowest-cost producer. IIPR and NLCP have made concerted efforts in recent years to focus their leasing activity on these MSOs – and in industrial-like cultivation facilities rather than storefront retail space. Regardless of the status of federal legalization, we believe cannabis REITs can carve out a sustainable competitive niche if the state-level regulatory framework continues to evolve favorably as it has in recent years.

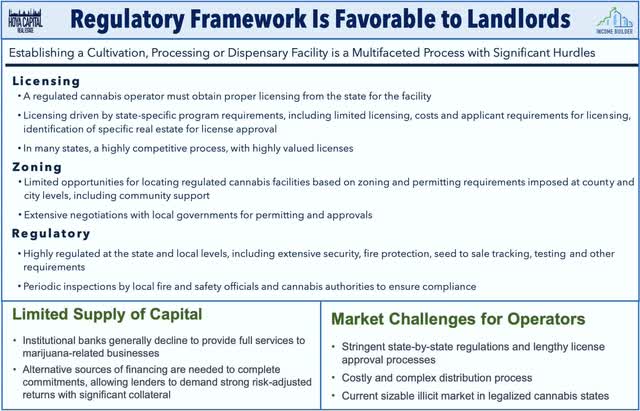

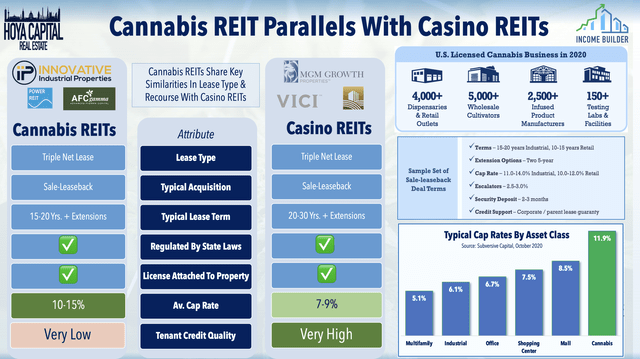

More states have adopted a limit-license framework in which licenses are effectively tied to the property – much like casino gaming licenses – which provides protection for real estate owners and the ability to quickly relet space. In a report on the linkage of cannabis businesses with an underlying real estate asset within state legal frameworks, Hoban Law Group notes, “In many cases, state marijuana statutes and regulations are closely tied to real estate laws.” In Colorado, for example, the marijuana license is attached to the physical premises and stays with the property in the event of default. This ideal legal framework effectively puts the real estate asset at the center of the business and grants the landlord significant protection from tenant non-payment while also serving as a barrier to entry to new supply growth.

Under this framework of limited licenses controlled by the state – which is increasingly the “default” structure of newly-legalized states – suggests that REITs could continue to be a primary capital provider even with expanded access to traditional financing sources in the event of full federal legalization. While still early in the evolution of the industry, we continue to see emerging parallels with the casino industry where REITs have carved out a profitable and attractive niche with a sustainable competitive advantage. Reflecting the effects of this legal framework – along with the lack of available capital sources – demand for suitable cannabis real estate properties has outstripped the supply, particularly for large cultivation facilities that are housed in industrial facilities, a property sector that is already in short supply.

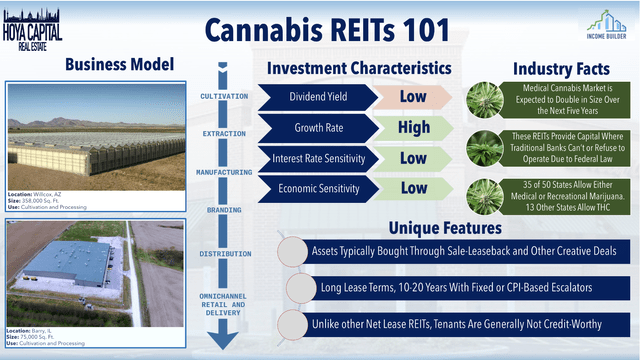

Cannabis Industry Overview

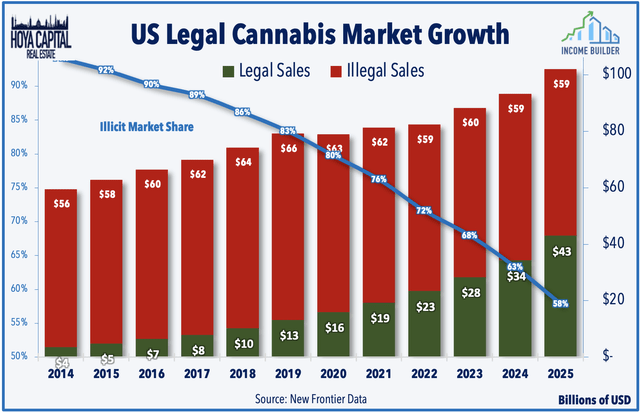

Cannabis is a genus of flowing plants – one species of which is marijuana – which has psychoactive properties that have been consumed via smoking, vaporizing, within food products, or via extract for medical or recreational purposes since at least 2500 BC. The psychoactive components in marijuana – primarily THC – can produce a mild sense of euphoria, while other cannabinoids in the plant such as CBD have been shown in studies to be effective in medical use for treatments of cancer, AIDS, and other illnesses. The legal cannabis market is expected to more than double in size over the next five years, from roughly $16 billion in 2020 to nearly $41 billion in 2025, representing a compound annual growth rate of 21%.

Existing in a legal “grey area” in which federal, state, and local laws often contradict, cannabis has been federally restricted since the 1930s, but medical usage is now legal in 38 states while recreational usage is legal in 18 states following a burst of activity last year which saw five additional states legalize weed: New Jersey, New York, Virginia, New Mexico, and Connecticut. Just four U.S. states currently maintain a full prohibition of any cannabis-based product – Idaho, Nebraska, Kansas, and South Carolina – but even within these states, cannabis usage has been incrementally decriminalized over the past decade.

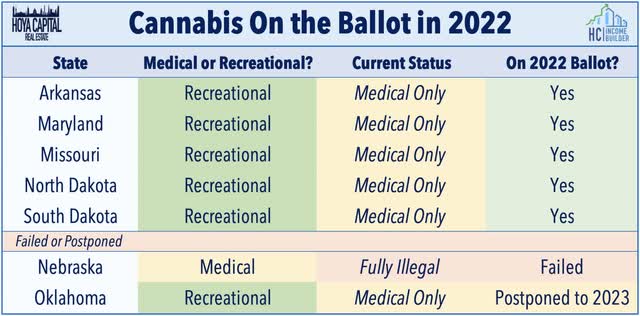

More than two-thirds of the U.S. population now support marijuana legalization, up from roughly 15% in the 1970s and 35% in the early 2000s while roughly 1-in-8 Americans consume cannabis regularly. In 2022, five more states will decide on marijuana legalization ballot measures. Voters in Arkansas, Missouri, North Dakota, and South Dakota will consider citizen-initiated measures to legalize marijuana. In Maryland, the state legislature voted to put the issue before voters.

The ongoing federal prohibition – and the resulting limit on access to traditional banking – has forced cultivators and retailers to turn to alternative sources for capital. These REITs effectively serve as “non-bank” lenders to state-licensed cannabis cultivators who often are shut out from access to traditional lending from federally-regulated banks. For equity REITs, assets are typically acquired through sale-leasebacks of cultivation, processing, and retail properties and lease are typically structured as triple-net leases with lease terms of 15-20 years. Cannabis mortgage REITs, on the other hand, typically originate 5-10 year loans collateralized by the underlying real estate, which stays on the balance sheet of the borrower. In either case, the capital provided by the REIT is typically then used by the operator to build-out a new facility or expand an existing cultivation facility, which are typically industrial-type facilities with specialized HVAC, lighting, and irrigation systems.

This sale-leaseback model has come under scrutiny recently with critiques outlined in several short-sale reports, but cannabis REIT leases are not unlike lease formats that are common across the triple-net-lease sector. Recent earnings calls have provided further color on the lease terms and underwriting process with IIPR detailing how leases are written such that investments are designed to result in dollar-for-dollar increases to replacement value that remain with the landlord in the event of tenant default. Leases are also generally subject to parent company guarantees covering operations throughout the United States and, critically, regulated cannabis operators typically must obtain licensing from the state for the facility which typically requires identification of specific real estate for license approval.

Cannabis REIT Stock Performance

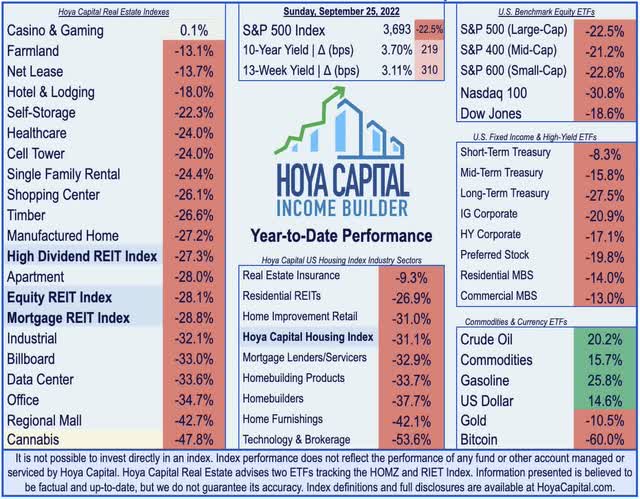

As noted above, cannabis REITs have been slammed in 2022, on concerns over rent payment from their cannabis cultivator tenants, which have been struggling amid a plunge in wholesale cannabis prices and challenging financing conditions. The Hoya Capital Cannabis REIT Index has declined by nearly 50% this year compared to the 28.1% decline on the broad-based Equity REIT Index and the 22.5% decline on the S&P 500 ETF (SPY). Remarkably. despite the sharp sell-off this year, Innovative Industrial is still the single-best-performing REIT since the start of 2017 with average annualized returns of over 40% compared to the roughly 6% annual returns on the broad-based Vanguard Real Estate ETF (VNQ) during this period.

Following two straight years of total returns of over 150%, micro-cap Power REIT has been hit especially hard with a decline of over 80% so far this year while industry leader Innovative Industrial is lower by nearly 60%. The declines among the cannabis mortgage REITs – each of which went public last year – have been more muted with AFC Gamma lower by about 30% while Chicago Atlantic has actually been one of the better-performing REITs this year with declines of only around 11%.

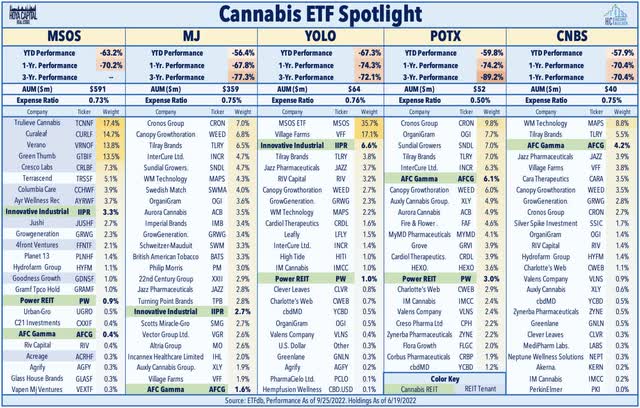

Cannabis REITs have delivered significant outperformance compared with broad-based cannabis ETFs over most recent and long-term measurement periods, a trend that we expect to continue if state regulatory frameworks continue to evolve in the “landlord-friendly” structure discussed previously. Underscoring the underperformance of many of these cannabis ETFs, since its launch in late 2015, the ETFMG Alternative Harvest ETF (MJ) – the oldest and largest cannabis ETF – has produced average annual total returns -29.48%, woefully underperforming the S&P 500’s 9.96% annual returns during this time, and being “left in the dust” by the two cannabis REITs.

Hoya Capital

The performance from newer cannabis ETFs – including MSOS, YOLO, CNBS, POTX, and TOKE – hasn’t been much prettier with 3-year average cumulative total returns of roughly -75%. Cannabis operators are the common top holdings among these ETFs include Canada-based Canopy Growth (CGC), Aurora Cannabis (ACB), Tilray Brands, Inc. (TLRY), Village Farms (VFF) and Cronos Group (CRON), U.K.-based GW Pharmaceuticals (GWPH), and U.S.-based GrowGeneration (GRWG), Hydrofarm (HYFM), Scotts Miracle-Gro (SMG), and Charlotte’s Web (CWEB:CA) (OTCQX:CWBHF).

Cannabis REIT Dividend Yield & Preferreds

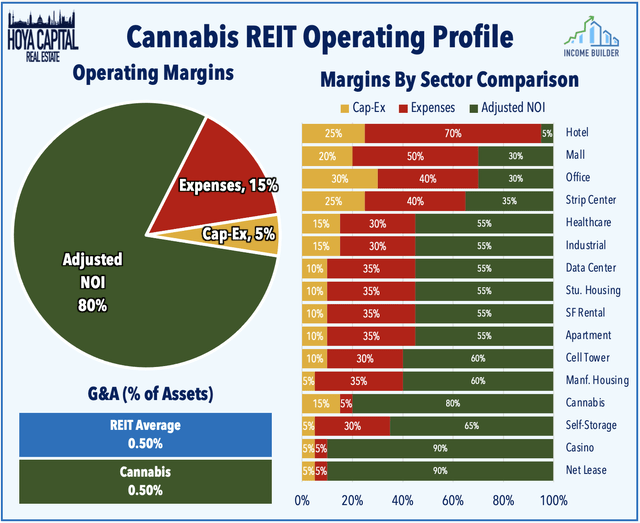

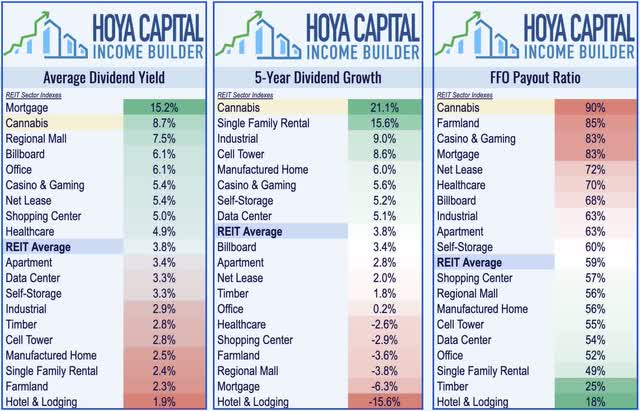

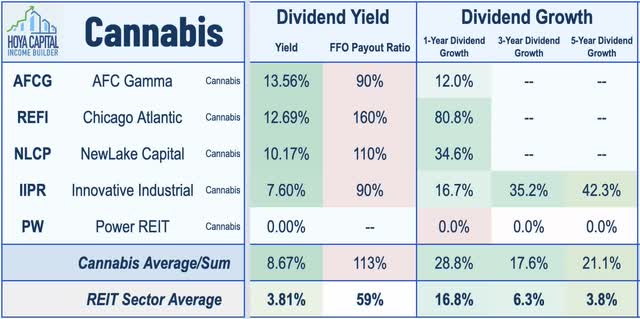

Buoyed by the two higher-yielding mortgage REITs and by another wave of dividend hikes this year, cannabis REITs pay an average dividend of 8.7%, which is well above the REIT market-cap-weighted average of 3.8%. Cannabis REITs have delivered the strongest dividend growth over the past five years, averaging more than 20% per year. Cannabis REITs pay out roughly 85% of their available FFO, however, higher than the REIT sector average.

Joining Innovative Industrial – which has now hiked its dividend twice this year, this month NewLake Capital hiked its quarterly dividend by another 6% – its third dividend increase this year. Chicago Atlantic Real Estate and AFC Gamma each held their dividend steady this month after dividend increases of 17.5% and 2%, respectively, earlier this year. After the hikes, IIPR and NLCP pay a dividend yield of 7.6% and 10.2%, respectively, while the two mortgage REITs currently have yields of roughly 13%. Power REIT has not paid a dividend since 2013.

Takeaways: Weeding Out The Weak

The previously-high-flying cannabis REITs have been slammed this year on concerns over rent payment from their cannabis cultivator tenants, which have been struggling amid a plunge in wholesale cannabis prices. The ‘institutionalization’ of the cannabis industry is likely a net positive for these cannabis REITs over the longer-term, but has come with bumps along the way including a recent rent payment default from Kings Garden – one of IIPR’s largest tenants. Volatility and tenant risk will persist – as will ever-present policy risk – but we continue to believe that cannabis REITs can carve out a sustainable competitive niche if the state-level regulatory framework continues to evolve favorably as it has in recent years.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment