ayo888/iStock via Getty Images

Investment Thesis

Canadian Natural Resources (NYSE:CNQ) is a cheaply valued oil and gas stock. But there’s more to it than that.

It’s been a month since I wrote by bullish analysis on CNQ. Since that time, it appears that the energy trade is off.

However, I declare that this is categorically not the case. If anything, the prices of WTI are still in the triple digits. What’s more, if prices stay around the $100 marker, it’s actually a lot better than investors realize. Here I explain why.

What is more, not only does CNQ provide a strong dividend yield of 4.6%, but by my estimates, once we get into Q4 2022, I argue that CNQ will look to increase its capital allocation strategy.

Here’s why I rate this stock a buy.

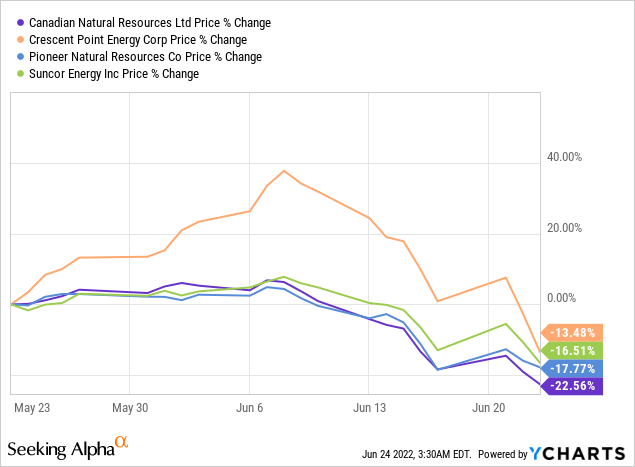

Recent Performance Of CNQ Stock

Canadian Natural Resources is an oil and natural gas production company. Like most of its peers, its share price has sunk in the past month.

The reason is that everyone is terrified about oil demand destruction. Indeed, as you know, WTI prices have fallen approximately 13% in the past week, from $119 to $103.

However, I declare that Canadian Natural Resources would actually be better positioned for WTI prices stably around $100 than it would be around $120. And that sounds counterintuitive. And the reason for this assertion is twofold.

In the first instance, with WTI around $100, there is a less near-term impetus to bring extra supply online.

Secondly, I believe that WTI around $100 is more likely to be a stable price than WTI around $120.

But this is the key, less WTI volatility brings less volatility to the equity too.

As a consequence of having less volatility in the equity or the share price, investors are more willing to overtime pay a higher multiple for the share price. Why?

Think of it in this manner. If share prices are all over the place, investors will demand a massive margin of safety before deploying capital to this sector. On the other hand, if oil prices are more stable, and predictable, investors will feel safer.

Goldman Sachs’ (GS) Jeff Currie has termed this concept a ”volatility trap”. And while that sounds like a catchy and esoteric term, it’s really quite straightforward.

The more investors worry the bigger the margin of safety investors demand. The more ”safe” the return is perceived the smaller the margin of safety required, and the higher the multiple investors will pay for an oil and gas stock.

Next, let’s dig further into why Canadian Natural Resources.

Canadian Natural Resources’ Capital Allocation Strategy

The one thing that attracts me to CNQ is clearcut capital allocation strategy.

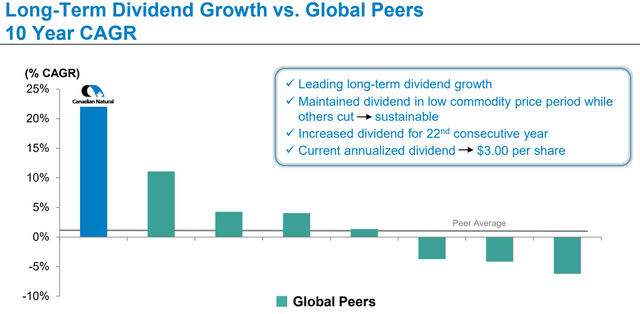

As you can see above, CNQ has a dividend that is growing at 22% CAGR. As the graphic shows, no other peer even comes to having such a strongly growing compounded annual growing dividend.

Incidentally, I should note that I follow many companies in the oil and gas industry and I can certainly back up that perspective. To the best of my knowledge, no other company in the oil and gas sector is compounding its dividend at just a fast clip.

Furthermore, CNQ’s recently announced a C$0.75 dividend, annualizes as C$3.00. This is a 4.6% dividend yield.

Accordingly, we can essentially declare that CNQ’s dividend is ”set in stone”. But there’s still more to get excited about CNQ.

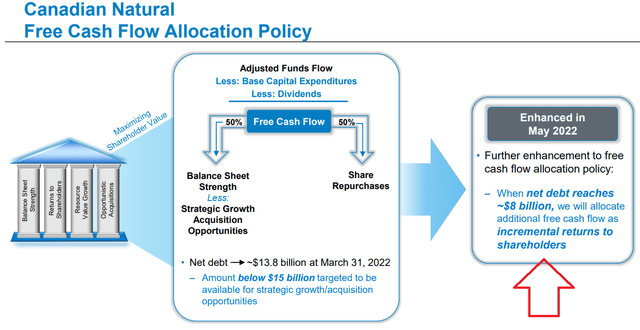

As long as CNQ’s net debt is below $15 billion, CNQ is committed to deploying 50% of free cash flow to share repurchases and 50% of free cash flow to the balance sheet.

However, once CNQ’s net debt falls below $8 billion, CNQ contends that it will increase its capital return to shareholders, see red arrow.

By my estimates, CNQ will see its adjusted free cash flow increase from C$3.4 billion in Q1 to at least C$4 billion in Q2. Realistically, given CNQ’s very strong operating leverage, I suspect that this free cash flow will actually be stronger than C$4 billion.

After all, during Q1 2022, WTI prices were approximately $85, while now I suspect that they have averaged $100 during Q2, an approximate 18% increase from WTI prices in Q1.

Nevertheless, let’s use the conservative C$4 billion adjusted free cash flow estimate for Q2.

Given that CNQ uses 50% of its free cash flow to pay down debt, that will mean that at some point in Q4 2022, CNQ could see its net debt fall below C$8 billion. Obviously, this makes the huge assumption that WTI prices stay around $100.

Yet, if we assume C$4 billion of free cash flow in Q2, that could see CNQ’s shareholder return amount to C$2 billion in Q2. That is a 2.7% combined yield to shareholders, that annualizes at 10.7%. All the while, paying down debt too.

CNQ Stock Valuation – Priced at 5x Free Cash Flow

Here are some back-of-the-envelope calculations. We know that in Q1 2022, CNQ reported C$3.4 billion. With Q2 nearly completed, I believe that Q2 2022 will see at least C$4 billion. That means that H1 2022 would see circa C$7.4 billion.

Now, if we assume current strip prices are sustainable, that means that CNQ could see approximately C$15 billion.

This means that CNQ is priced at slightly less than 5x free cash flow.

The Bottom Line

Canadian Natural Resources is an oil and natural gas production company with assets in Western Canada, the U.K. portion of the North Sea, and Offshore Africa.

The business is committed to returning capital to shareholders via dividends and buybacks. For now, CNQ is paying down debt alongside its capital return to shareholders.

But as noted in the analysis, I estimate that in Q4 2022, CNQ will have reached its $8 billion net debt target and will be in a position to meaningfully increase its capital return to shareholders.

As it stands now, CNQ provides an annualized combined yield of 10.6%. But at some point in Q4 2022, this is set to increase, provided that WTI prices stay around $100. Whatever you decide, good luck and happy investing.

Be the first to comment