rlesyk

Introduction

This is the first episode of a series that I introduced in my previous article: “Learning From Buffett About Investing In Railroads: The BNSF Caste Study”.

I highly recommend to read it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire owns. I have outlined the general mind-frame of the Oracle of Omaha and what we can learn from him as we assess the publicly traded railroad companies.

This article and the following ones will try to look at the railroads exactly from the perspective of Warren Buffett.

Canadian National Railway

Before we start, keep in mind that the financial data are reported using the Canadian dollar.

Network and sources of revenues

Canadian National Railway (NYSE:CNI) owns a network of 19,500 route miles of track that spans Canada and the U.S. It is the only railroad connecting Canada’s Eastern and Western coasts with the U.S. South. This already checks one of the criteria we have to look at: the moat. Canadian National has a unique three-coastal network that is able to serve exporters, importers, retailers, farmers and manufacturers. However, the merger between Kansas City Southern and Canadian Pacific did create a true three-coastal competitor that actually is able to connect Mexico to Canada. So we are now before a duopoly on these routes. However, Canadian National owns and operated the fastest rail route in and around Chicago, which is the most important North American rail hub. The Company has also other strengths: an early mover advantage on sustainability, including fuel efficiency and environmental stewardship; an ability to innovate, including pioneering Precision Scheduled Railroading (PSR); and a focus on safety.

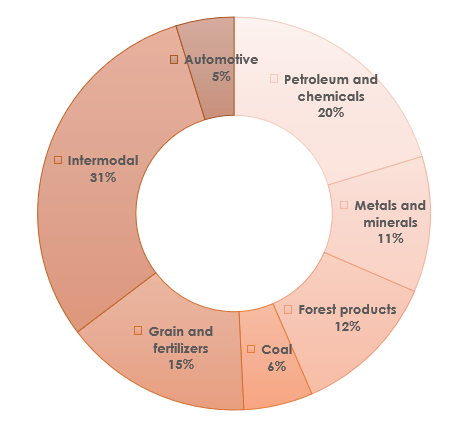

Canadian National Railway’s freight revenues are derived from seven commodity groups transported between a wide range of origins and destinations. This allows the company to have some product and geography diversification that helps it face economic fluctuations. In 2021, the railway’s largest commodity group was petroleum and chemicals which accounted for $2.8 billion of total revenues or 20% of total freight revenues. Grain and fertilizers hold the second spot with a $2.5 billion or 17.8% of total freight revenues.

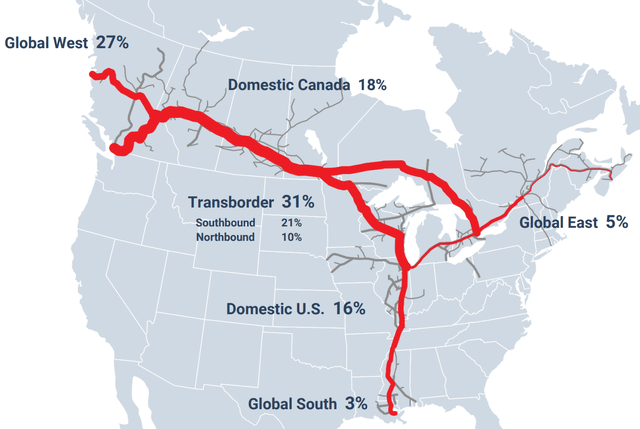

From a geographic standpoint, as we can see in the map below, 16% of revenues relate to U.S. domestic traffic, 31% transborder traffic, 18% Canadian domestic traffic and 35% overseas traffic. Canadian National also claims to be the originating carrier for over 85%, and the originating and terminating carrier for over 65%, of traffic moving along its network, which allows it both to capitalize on service advantages and build on opportunities to efficiently use assets.

Canadian National Q2 Results Presentation

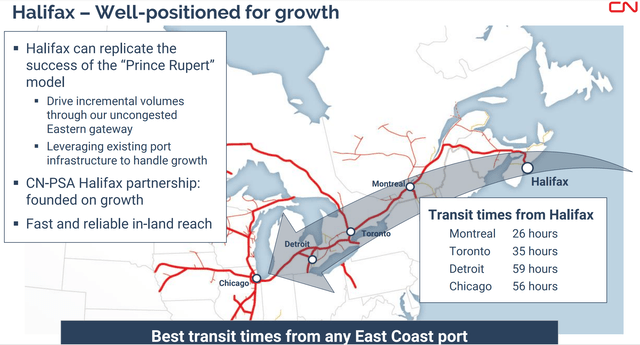

A key point for the company is the Halifax port which the company wants to replicate the success of its Western port of Prince Rupert. Here, too, the company plans on driving incremental volumes by offering an uncongested gateway and leveraging port infrastructure. Furthermore, the Halifax port can be really considered an Easter Gateway to move goods to the Great Lakes Waterway.

Canadian National Q2 2022 Results Presentation

As reported for the first half of the year, the freight revenues reached a total of $4,195. Below we can see how much each of the seven main sources, we see that petroleum and chemicals still hold the first place among commodities, though the total revenue is up 16% compared to 1H21 at constant currency ($1.59 billion in 1H22 compared to $1.35 in the same period last year) followed by grain and fertilizers whose revenue actually declined 10% from $1.32 in the first six months of 2021 to $1.2 this year. However, we know that this year’s harvest is surprisingly good in Canada, forecasted to be the third biggest one in more than a century. For sure, we will see the impact of this on the freight volumes and revenues of Canadian National Railways next quarterly reports.

Author with data from Canadian National

Earning power

Given the fact that railroads are capital intensive business, Buffett has made it clear that these companies need to be able to earn enough money to cover their interest requirements in any economic conditions. Interest coverages is calculated as pre-tax earnings/interest. In 2021, the company reported and EBT of $6.33 billion and an interest expense of $610 million. The ratio is 10.37, which is higher than Buffett’s BNSF.

Efficiency

One of the things we learned from Buffett is to look at railways over a long period of time, as they can be, if run efficiently, true compounders. If we go back ten years and look at the 2012 results to compared them with the FY 2021 we can see that the company steadily grew its revenues.

However, we have seen that this is not enough, as railways need to prove to be efficient. The operating ratio of Canadian National was 62.9% in 2012 and after ten years it was down to 61.2% meaning that the company has become a little more efficient. To state the truth, the operating ratio was as low as 59.8% in 2017, to then move back up and spike to 65.4% during the pandemic. Now it is once again heading south, which is a trend we want to see going on. In the first six months of 2022, this ratio was one again below 60% at 59.3%, which proves that the company has turned more efficient in the past decade.

Another key point, according to what we have learned from Buffett, is fuel efficiency. Canadian National improved it in the past six months by another 4% YoY to a record of 0.838 US gallons of fuel consumed per 1,000 gross ton miles (GTMs). In 2012, with the company consumed the same amount of fuel for 827 GTMS which means that in a decade the company has achieved to consume the same amount of fuel for a 20% GTM increase.

Use of capital: return on investments and shareholder return

As we have seen in the introductory article of this series, Warren Buffett is very aware that when a lot of capital is deployed, it becomes even more important to monitor the return on invested capital. Here we see that the company as a ROIC of 14.1% which is well above the current cost of capital for companies that is around 8%. This means that the company is not destroying value, but that it is actually creating it.

Furthermore, Canadian National has presented its strategy of growing volumes faster than the economy, but to achieve this it requires additional railcars (railway-owned or private) on the system. The company plans to spend $2.9 billion on capital investments to reach this goal which would increase the current ROIC.

Investments by CN and our customers are achieving synergies across the entire grain supply chain. Grain handling capacity in Western Canada is and the company reports that of the 42 new high‑throughput elevators on the Prairies, many with loop tracks enabling faster grain loading, 30 have been or are being built on CN lines (29 exclusively). This means that the company is investing to create a further operating advantage over competitors.

Another area of investments is Alberta, Canada’s largest hub for petrochemical production and refining. There are 36 petrochemical manufacturers currently operating in central Alberta, 85% of which are located on CN’s rail lines. Methane, ethane, ethylene and propane are some of the petrochemicals produced in Alberta that are used as building blocks for manufacturing. Canadian National’s capital investments in key natural gas liquids corridors coupled with customer investment in their facilities allow the company to provide a balanced flow of loads and empties for our customers. The two new propane export terminals at the Port of Prince Rupert are exclusively served by Canadian National, strengthening is control over this important manufacturing area. So far, the opening of these export facilities has been declared successful by the company, that states it is already exceeding targets.

As we said earlier, the company invests also a lot to enhance safety and integrity of track infrastructure. Canadian National is also investing in and deploying advanced technologies to automate labor-intensive tasks like track and railcar inspections, as well as to improve the customer experience through ‘track and trace’ functionality.

All said, the company wants to keep capex at 17% of revenues which, as far as I see, is a correct ratio that deploys enough capital to maintain and improve the business while delivering a careful cost management that doesn’t eat away a larger chunk of revenues. In addition, as far as the company is able to deliver a return on invested capital around 15%, investors should be glad to see such a use of capital.

Just to get an idea from Buffett of what he has spent for BNSF we can take a look at what he wrote in his 2014 shareholder letter:

We have a lot of work to do. We are wasting no time: As I also mentioned earlier, we will spend $6 billion in 2015 on improving our railroad’s operation. That will amount to about 26% of estimated revenues (a calculation that serves as the industry’s yardstick). Outlays of this magnitude are largely unheard of among railroads. For us, this percentage compares to our average of 18% in 2009-2013 and to Union Pacific’s projection for the near future of 16-17%. Our huge investments will soon lead to a system with greater capacity and much better service. Improved profits should follow.

It took just one year for Buffett to see some results, as he explained in his 2015 shareholder letter:

After a poor performance in 2014, our BNSF railroad dramatically improved its service to customers last year. To attain that result, we invested about $5.8 billion during the year in capital expenditures, a sum far and away the record for any American railroad and nearly three times our annual depreciation charge. It was money well spent. […] For most American railroads, 2015 was a disappointing year. Aggregate ton-miles fell, and earnings weakened as well. BNSF, however, maintained volume, and pre-tax income rose to a record $6.8 billion* (a gain of $606 million from 2014). […] At BNSF, price comparisons between major railroads are far more difficult to make because of significant differences in both their mix of cargo and the average distance it is carried. To supply a very crude measure, however, our revenue per ton-mile was just under 3¢ last year, while shipping costs for customers of the other four major U.S.-based railroads were at least 40% higher, ranging from 4.2¢ to 5.3¢.

I shared these paragraphs to prove once again what Buffett has come to realized after years he had shunned capital intensive businesses. It is not a bad position to own a capital intensive business that is able to provide a ROIC of 15% every year and where the capital investments produces in a year or two a difference that can be noticed regarding efficiency and shipping costs.

Canadian National has been one of the first railways to understand this and is now enjoying for some metrics a leadership position. Most importantly, it is among the first railways to spend on productivity and safety together in order to reduce injuries as much as possible.

What about the excess cash the company generates and that it doesn’t need for its investments? Well, we saw that Buffett, in this case, likes this cash to be returned to the shareholders through dividends or buybacks. As his first choice, he would not need a dividend, being the company able to have a 15% return on capital invested. But if the company does have excess cash, then Buffett will take it in order to deploy it at a decent rate of return (Berkshire’s average is about 20%). I think investors should ponder this point a bit, since railroads are becoming among the favorite stocks for dividend investors. I look for dividends, too, but I am becoming aware that I have to compare my ability to deploy the dividends I receive with the ROIC a company already achieves with the cash it has. If the company’s ROIC is higher than mine, then I prefer the company to pay as little of a dividend as possible, in order to enjoy better future returns.

Future cash flows

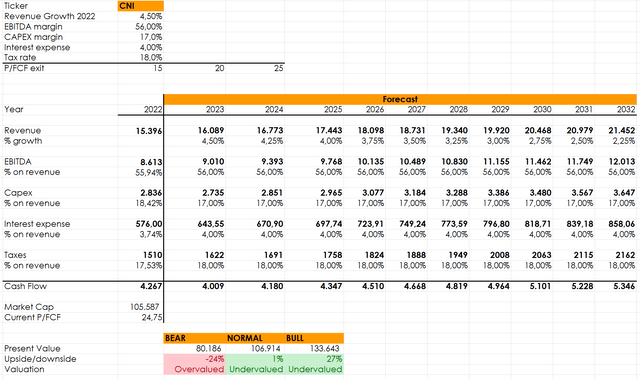

As we learned from Buffett, a business is worth what it is able to earn during its lifetime. So, here below is a simple discounted cash flow model that projects the future cash flows of the company and sets three possible scenarios based on price/free cash flow multiple exits. I plugged the numbers in Canadian Dollars. I am using the ratio between the free cash flow and the market cap to reach a valuation so that it is expressed in percentage points which can be applied both at the stock traded in Toronto and in New York.

I assumed that this year the company will grow its revenue by 4.5% which I actually think is low. I also assumed, in order to be conservative, a growth that slows down in the next decade by a quarter of a percentage point year after year. This is the assumption that I expect to be revised upwards as we see the company operating. The other data are pretty straight forward as they just replicate the current situation: EBITDA margin at 56%, interest expense around 4% of revenues and taxes around 18%.

The result is that the company is trading around fair value. However, these models don’t factor in any premium a company may deserve. For Canadian National, I see two reasons that make it more valuable that it seems. One is its three-coastal railroad which is still a unique property as long as Canadian Pacific and Kansas Southern still have to merge their operations and find new synergies. The second one is that Canadian National has been quite conservative with its balance sheet, favoring investments over dividends and obtaining a high return. Thought the company has underperformed all its major peers in the past decade, I would put in on a watchlist as the next ten years could see it catch up thanks to its efficiency and its ROIC.

Be the first to comment